5 Steps to Save Over $1,000 in a Year

Some products in this article are from our partners. Read our Advertiser Discloser.

Are you looking for a creative way to save more money each week? My family likes participating in the 52-week savings challenge to save over $1,000 a year.

You might save money in a Mason jar like my family or track your savings digitally. The important thing is to start saving your extra cash and maximize your income.

How to Save $1000 in a Year

Being able to save an extra $1,000 a year may seem difficult but practicing these tips can make it easy.

1. Make a Savings Goal

The first thing we do to motivate ourselves to save money in our jar is to make a goal for the money we save.

Some of our recent savings goals include:

- Taking a smallish vacation

- Buying something new that we all want

- Paying off debt

Each person in our family has a different list of goals for their change jar savings. We find it important to write down what we plan to do with the money each year.

Writing our goals down can motivate us to keep our goals and continue saving. If you only make a mental goal and don’t write it down, you can be more likely to forget your savings purpose.

2. Track Monthly Savings

Tracking your weekly and monthly savings is essential to knowing how much money you save.

How do you know if your savings goals are on track?

Here are some of the ways to track your savings progress:

- Write weekly savings totals on a piece of paper

- Create savings goals in your online bank or budgeting app

- Make electronic bank transfers to a “sinking fund“

We like to save money in our family by using a Mason jar to keep our spare change. Actually seeing the cash build up in the jar can motivate the whole family to add more.

Choose a tracking method that works best for your household and savings habits. Your method doesn’t have to be complex.

If you don’t use cash, making a weekly cash transfer between your bank accounts can be the easiest way to track your savings progress.

3. Save Spare Change

Living cheaply is one way to meet your savings goals. But you can also save money each time you spend money.

Spending Roundups

Several online banks and money apps offer “spending roundups.” This savings tool rounds up your debit card and credit card purchases to the nearest dollar and saves the spare change.

Chime is a financial technology company that can automatically transfer your spending roundups into an interest-bearing savings account. Other apps may invest your round-ups instead.

As more people and stores prefer card payments to cash these days, savings round-ups can make achieving your savings goals easier.

Automatic spending roundups also let you maximize online purchases.

Pay With Cash When Possible

If you pay for purchases with cash, you might use our spending strategy and save your spare change for a year.

Keeping our savings goal in mind, we find ourselves using bigger bills such as tens and twenties. Next, we put the one-dollar bills into the jar plus any coins.

That spare change can easily add up to a few hundred dollars a year.

We then give some extra “oomph” to our Mason jar by using it to do the 52-week savings challenge as well.

4. The $1,000 Savings Challenge

Trying to save money for one year may seem challenging even after you cancel subscriptions and reduce recurring expenses.

It’s easy, really.

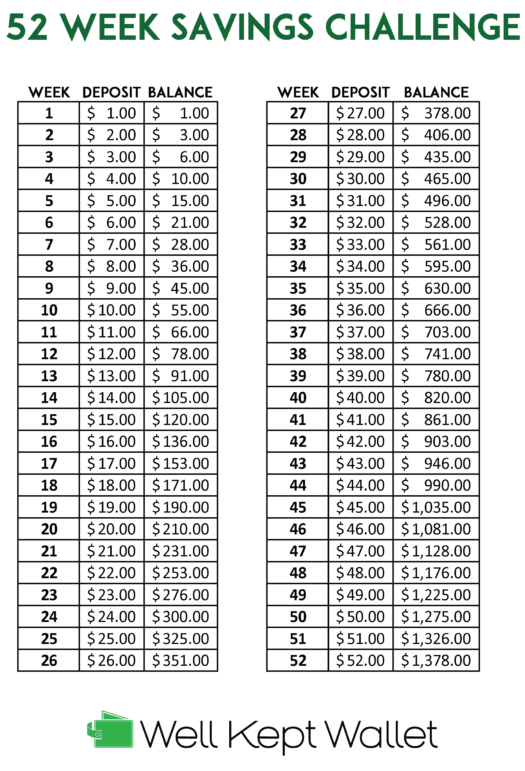

During week one you put $1 into savings, week 2 = $2 into savings, week 3 = $3 into savings, and so on and so forth.

Each week, you save one extra dollar than the week before.

By the end of the year, you’ll have saved $1,377 dollars with the 52-week savings challenge.

Any extra spare change you add to the jar or your spending round-up account is in addition to this annual savings challenge.

5. Motivate Yourself to Save Money

You may need some help motivating yourself to save money each day. One suggestion is to start dreaming big as you save small amounts.

Some motivation suggestions include:

- Imagine a vacation in the Bahamas

- Paying off a credit card

- Building an emergency fund to epic proportions

If you’re doing the Mason Jar Challenge, then set that Mason jar in a prominent place and start saving. The visual reminder can help you continue savings.

What if I Can’t Save the Bigger Amounts Each Month?

Being able to save $50 a week as the challenge ends might be difficult for you. Saving large amounts of money has been a problem for us too.

In the last four weeks of the 52-week challenge, you’ll need to put $202 into savings.

Since our debt-to-income ratio (DTI) is pretty high as we work to pay off our debt, saving $200 a month just isn’t feasible for us sometimes.

In your case, your income may be steady but your monthly expenses fluctuate.

Make a Weekly Savings Checklist

Our family can still meet the savings goal by saving larger amounts in earlier weeks.

We make a chart listing each dollar amount that needs to be saved. As you accomplish a goal, you can “check” a weekly box even if it’s further down the list.

We don’t always go in order with our weekly savings amounts. Instead, we base our weekly savings amounts on what our expenses are during the month.

For instance, let’s say we’re on weeks 5, 6, 7 and 8. The total dollar amount to be saved that month would be $26.

If it’s a good month for us with not a lot of extra expenses, we might use the $52 week in place of the $5 week.

That way the total monthly savings amount is manageable and we’ve got one of the bigger weeks out of the way. We also have the $5 savings week ready and available to save for a month when money is tighter.

It doesn’t really matter so much that you go in numerical order when you save.

What matters is that you meet each of the weekly savings amounts at some point during the year. Meeting each weekly goal once means you accomplish the yearly savings goal.

The discipline is still there yet you’re working the chart in a way that fits in with your particular budget needs.

Switching weeks around also means you’re more likely to keep your motivation levels high.

How Can I Get Extra Money to Save?

If money is super tight, making more money and cutting expenses can meet your goals.

Cut Expenses

Reducing your monthly spending can be the quickest way to reach your savings goals. You don’t have to use your free time to work an extra job and save money immediately.

Consider canceling recurring bills, delaying purchases and choosing cheaper alternatives.

Are there line items in your budget that can be reduced or eliminated so that you have more money to put into savings?

Here are some ideas to spend less money:

- Cancel cable or satellite TV

- Cut out the daily latte’

- Lunch at work – can you brown bag it a few days a week?

- Cut back on entertainment expenses by doing cheap or free stuff

- Cancel magazine subscriptions

- Ladies, do your manicures and pedicures at home

- Decrease alcohol purchases

- Cut back on clothing purchases

- Shop around for lower life insurance rates with Policy Genius

- Work to save money on groceries

- Use coupons apps for online purchases

Most people can find at least one or two areas in which they can cut expenses. You can have more cash to complete the savings challenge as a result.

Increase Earnings

You can also increase your income to find more money to save for the challenge.

Making more money can have more results as you can only reduce expenses by so much.

Here are some ideas to earn more money:

- Ask for more hours at work if you’re paid hourly

- Get a second job for a short time

- Sell unwanted items around the house

- Pick up a side hustle or start your own business doing something you love

- Take surveys online with Survey Junkie

There are many ways to make money locally and online. You can set your own schedule which is great if you work full-time or have a family to raise.

Check out this post on more ways to make money for more ideas on how you can increase your income.

How Can I Save More Money?

In addition the the 52-week savings challenge, there are several ways to save money every day of the year.

You might use some of these savings hacks to initially meet your weekly savings goals.

Pay Off High-Interest Debt

One of the quickest ways to save extra money is paying off high-interest debt.

Some examples include credit card debt and personal loans. Most of these balances have interest rates above 10% APR.

Instead of spending your interest savings, you can transfer the amount into your savings account. Then, you can count the savings amount toward a weekly savings goal.

Delay Purchases

Delaying purchases is another way to reduce your annual spending.

For instance, instead of upgrading to the latest iPhone model, you might skip an upgrade cycle. Replacing your battery can be cheaper and extend your phone life by several years.

If you absolutely need a new phone, consider buying a used phone first.

Automate Savings

Another effortless way to save money is to schedule automatic bank transfers. On a weekly or monthly basis, have your bank transfer a fixed dollar amount into your savings account.

Depositing your cash into a high-yield savings account lets you earn more interest on your idle cash.

Save Tax Refunds

Try saving your tax refund instead of spending it on items or experiences. This financial windfall can help you achieve the larger weekly savings goals in the 52-week savings challenge.

Your tax refund can also be an effortless way to save $1,000 in a year–or more.

To keep more of your tax refund, also use an app to file your taxes for free.

Get Free Money

Another option is to find free money such as matching 401k contributions. You may also qualify for unclaimed property like a long-lost security deposit.

There are other apps and websites that can help you effortlessly get money.

Summary

If you’re looking for a way to really ramp up your savings, consider giving the Mason Jar Challenge a try. The total dollar amount you’ll save might seem daunting at first, but the truth of the matter is that most people easily waste $1,300 a year on little stuff.

Putting the money into savings can easily help you save $1,000 a year or more. You may hardly miss the cash once you perfect your savings habits.

I LOVE this! We do the same thing. We recently just took our change to a CoinStar and cashed it in to cash instead of coins. We were surprised that it was almost $100 just hanging out on the shelf– we even blogged about it! It really takes no effort to toss that change into a jar and it obviously pays off.

I did the 52 week challenge last year made it to the end. I’m doing it again this year. I have been saving spare change for years.

This sounds like such a fun idea…it would definitely be motivating for younger children.