12 Best Greenlight Alternatives (Cards For Kids & Teens)

Some products in this article are from our partners. Read our Advertiser Discloser.

Although Greenlight is a top choice for many parents looking for debit cards for kids, you have other options. Many Greenlight alternatives have most or all of the same features.

We’ve found the best Greenlight card alternatives to help you teach your kids money management habits that will set them up for financial success.

Editor’s Top Picks

Top Greenlight Alternatives

When it comes to kids’ debit cards, you should choose one that fits your family’s needs and budget.

In trustworthiness based on actual customer reviews, here are the best alternatives to the Greenlight debit card.

1. Copper Teen Banking

Apple Store: 4.8 out of 5

Copper Banking is a fintech company that has accounts for adults. However, each adult account holder can open up to five Copper Teen accounts.

You can fund your Copper account by transferring money from your bank or debit card. Then, you can transfer money to any Copper Teen account.

Other Copper Banking features include:

- $0 minimum balance requirement

- Automated allowance payments

- Direct Deposit capabilities

- Financial education tools

- Savings goals feature

Your teen does need to have their own cell phone to use Copper. That might be a downside for some parents.

Price: $0 per month

Learn More: Copper Banking Review: Is this Bank Account For Teens Worth It?

2. GoHenry

Trustpilot: 4.3 out of 5

GoHenry is one of the most popular Greenlight alternatives. It offers a debit card for kids ages six to 17. With GoHenry, you can establish weekly allowances or set up chore lists.

Your child’s earnings can stay in a spending account and be transferred to savings, or they can give some money to Boys & Girls Clubs of America.

Some features of the GoHenry debit card include:

- $0 minimum balance

- Real-time spending notifications

- Parental spending controls

- Direct Deposit capabilities

Note that GoHenry has a comprehensive learning center that is ideal for giving kids extra knowledge about money. Classes in the learning center are free.

Teens can also send and receive payments from other GoHenry members. This is a great feature to have if your teen wants to split a lunch bill or other expenditures with a friend.

Keep in mind that your teen cannot use the “pay at the pump” feature with GoHenry. However, they can pay for gasoline inside the gas station.

Price: Family plans are set at $9.98 per family (for up to 4 children), and the individual child is priced at $4.99.

Related: Greenlight Vs. GoHenry: Which is Better?

3. Mazoola

Apple Store: 4.3 out of 5

Mazoola is a family digital wallet that you can use to pay kids for chores. From there, you can help them manage their money, whether saving, spending, or setting financial goals.

Some features of Mazoola include:

- Parents can set limits on dollar amounts and approve retailers

- $0 minimum balance

- Chores feature

- Goals feature

- Charitable donations option

- Real-time activity notifications

Although the subscription cost is a bit high, Mazoola does offer a one-year free trial.

Price: $9.99 per month

4. Current

Trustpilot: 4.2 out 5

Current is a Greenlight alternative designed to help kids and teens learn about earning, spending, saving, and giving.

When you open a Current account, you can add a teen account for your child. Teen accounts through Current cost $36 per year.

As the parent, you control transfers to the account and can set spending and ATM limits.

Other features include:

- $0 opening deposit requirement

- $0 minimum balance

- Fee-free in-network ATM withdrawals

- Chore list capabilities

- One savings pod

- One giving pod

They also have Giving pods that allow your teen to donate money to a charity. You can set weekly allowances, make one-off transfers, or help your child earn via the chore list.

Price: $36 per year

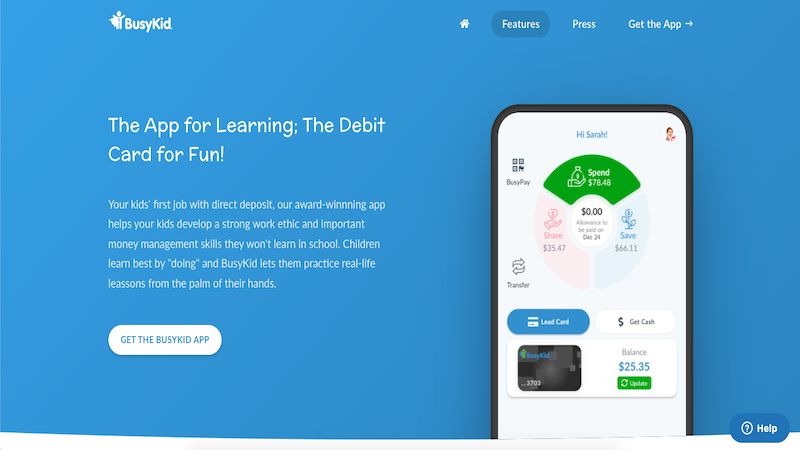

5. BusyKid

Trustpilot: 4.1 out of 5

BusyKid is a prepaid spend card that helps your kids earn money by doing assigned chores.

As a parent, you can use the app to assign preset chore choices or add your own to this Greenlight alternative. The money in your child’s BusyKid account can be spent anywhere Visa is accepted.

Alternatively, you can work with your child to save the money in a savings pod, invest it in fractional shares of stock, or donate it to a charitable organization.

Other features include:

- The option for parent-directed bonuses

- Friends and family can send money to the account via QR code

- Parental match feature on savings pods

- Multi-parent access

You can add up to five kids to your BusyKid account. Keep in mind that there is a $0.50 charge for each declined purchase (due to insufficient funds).

Also, it’s important to note that you will be charged $7.99 for each replacement card. You can load funds onto the card, which can be used anywhere you usually use a Visa debit card.

Read our full BusyKid review here.

Price: $3.99 per month or $38.99 per year

6. FamZoo

Apple Store: 3.0 / Google Play: 4.7

FamZoo is another great Greenlight alternative to help teach your kids about money. You can choose from two accounts: an IOU account or a prepaid one.

A prepaid account holds actual money, whether spending, saving, or giving. IOU accounts are accounts you’ll use to track the money you owe your child.

You can choose whether to use IOU accounts, prepaid accounts, or a combination of the two. Additionally, you can use the app to set up daily and weekly chores.

Kids earn their money (or you give them a weekly allowance), and then they work with you to decide how to spend, save, and give.

Other features of FamZoo include:

- Full parental controls

- Activity alerts

- Parent-paid interest option

- The ability to add rewards or penalties

The rewards and penalties option is a nice touch for parents who want to reward their children for going the extra mile or penalize them for not following the rules.

Note that you can save money on the monthly fee by paying semi-annually, annually, or bi-annually.

Price: $5.99 per month

Related Article: Greenlight Vs. Famzoo: Which Is Debit Card Better For Your Kids?

7. M1 Finance

Trustpilot: 2.3 out of 5

M1 Finance is a fintech company that allows adults to spend, save, borrow, and invest. Within M1 Finance, you can open a UTMA/UGMA custodial account for your child.

The company has a regular account that’s free. However, you must open the Plus account for $125 per year to create an account for your child.

If you use the debit card feature to spend some of the money from the custodial account, the money must be used for the direct benefit of the minor child.

The money will be transferred to the child’s ownership once they reach legal age. This varies based on the state you live in.

One nice thing about choosing M1 Finance over other options is that you can buy fractional shares of stocks and ETFs for your child.

Other features include:

- 1% cash back on debit card purchases

- Up to four monthly ATM fee reimbursements

- $0 minimum account balance

- No fees on international debit purchases

M1 Finance is geared specifically for parents interested in investing on their children’s behalf. The debit card is a secondary feature.

You can design your own portfolio or use one of M1 Finance’s custom portfolios.

Price: $125 per year

8. Acorns Family

Trustpilot: 2.3 out of 5

Acorns is best known for its adult accounts that allow you to invest in fractional shares of stock using roundups from connected debit and credit card purchases.

You can open an Acorns checking account and make purchases with your Acorns debit card. This costs just $3 per month.

What you might not know is that Acorns Family is available to families with kids. When you open an Acorns Family account for $5 per month, you get investment accounts for unlimited children.

Better yet, this account comes with investment, retirement, and checking accounts in addition to bonus investments, money-related advice, and much more.

Note that with Acorns, there’s no specific debit card for your child. However, you can allow your child to make purchases by setting up an Acorns checking account in your name.

Price: $5 per month

9. Axos First Checking

Trustpilot: 2.0 out of 5

The Axos First Checking account is designed for kids aged 13-17. Teen account owners must have a joint adult account owner.

The account comes with a fee-free debit card as long as you use in-network ATMs. You can also get up to $12 in ATM fee reimbursements each month.

Other features of the Axos First Checking account include:

- $0 minimum balance requirement

- $50 minimum opening deposit

- $0 monthly service fee

- $100 daily ATM limit/$500 daily purchase limit

- Real-time activity notifications

- Interest-bearing

Parents can control debit card access using the app or website. Kids can make peer-to-peer transfers and take advantage of Axos’ referral program.

Biometric identification and bill pay are also available with this account.

Price: $0 per month

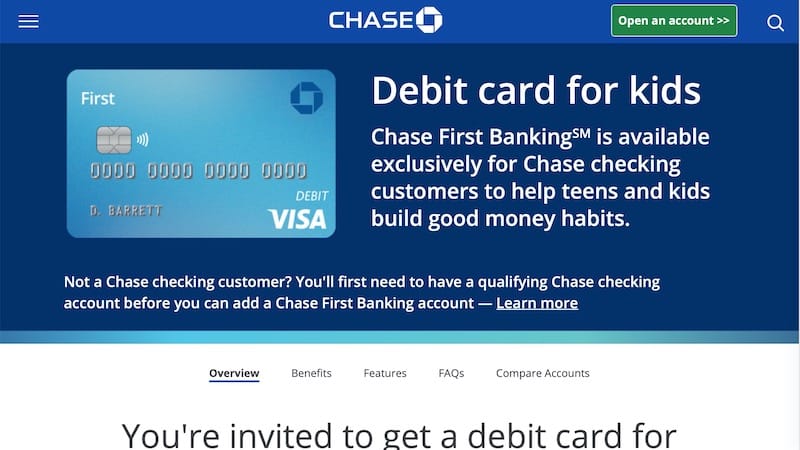

10. Chase First Banking

Trustpilot: 1.3 out of 5

The Chase First Banking account is for teens ages six to 17.

This account comes with a chore app as well as a savings feature.

Parents can choose how much a child can spend per transaction and where. For example, you could set a $10 limit at restaurants or a $20 limit across all categories.

Other features include:

- $0 monthly fee

- $0 minimum opening deposit

- Free ATM withdrawals at Chase ATMs

- Real-time spending alerts

Kids can even request money transfers through the app, which parents can choose to accept or decline.

As a parent, you must have or open a Chase checking account for your child to have a Chase First Banking account.

Up to five Chase First Banking accounts are allowed per parent or guardian.

Price: $0 per month

11. GravyStack

GravyStack is a great way for kids to save. Kids with banking privileges are provided with four bank accounts: Money Machine™, Save, Spend, and Share accounts. Income generated from Gigs is automatically transferred into your Money Machine™ and distributed among your designated Jars.

You can determine the allocation percentages for savings, spending, and charitable donations.

The GravyStack platform combines play and learning to impart important financial concepts to children and teenagers. Thus eliminating the need for nagging and encouraging financial education.

12. Fidelity Youth Account

The Fidelity Youth Account is a brokerage account specifically designed for teenagers. This account includes a debit card and is solely owned by the teen, meaning it is not a joint or custodial account. With the Fidelity Youth Account, teenagers can save, spend, and invest all in one convenient account.

Youth investment accounts are rare, and Fidelity has pioneered the path for teens to learn the art of investing. Fidelity offers a youth account that allows teenagers to make all of the investment decisions in the account. Most other brokerages must have parental oversight.

How Do These Greenlight Alternatives Compare?

| Company | Fees | Promotions |

| Acorns | $5/month | $10 Bonus After First Deposit |

| Axos | $0/month | Free |

| BusyKid | $3.99/month | 30 Day Money Back Guarantee |

| Chase | $0/month | Free |

| Copper | $0/month | Free |

| Current | $36/year | None |

| Famzoo | $5.99/month | 30 Day Free Trial |

| GoHenry | $3.99/month | 30 Day Free Trial |

| M1Finance | $125/year | $30 Bonus With $1,000 Deposit |

| Mazoola | $9.99/month | 12 Months Free |

| GravyStack | $7.00/month | $17/month family plan |

| Fidelity Youth Account | $0/month | Free |

Summary

The best Greenlight card alternatives will help your child learn to save, spend, invest and also find ways to make money as a teen. That way, they’ll be prepared when it comes time to leave the nest.

Take the time to understand which features are most important to you. Then, review the offerings and costs of each option to decide whether Greenlight or another card is best for you.