How to Save Money for a House: Step-by-Step Guide

Some products in this article are from our partners. Read our Advertiser Discloser.

Let’s be real, saving for a house is hard. Saving money, in general, is hard.

Besides the actual budgeting of how much you need to put away in addition to your other financial obligations and bills each month, there’s rising mortgage rates, which change frequently.

Buying a House Will Only Get More Expensive

It never ceases to amaze me when someone tells me they just bought a home simply because of how crazy expensive it is.

I live in the San Francisco Bay Area, which is one of the priciest places to buy a home in the U.S. Year after year, it tops the list for expensive places to live.

A report from CNBC said that higher mortgage rates and the loss of homeowner tax breaks in the priciest parts of the country are making homes less affordable.

Will You Remain a Renter For Life?

Before you can even get into a home, you’d have to save for a down payment, and according to a Zillow survey, 68 percent of renters find that saving for a down payment is the biggest obstacle when purchasing a home.

What does this all mean for you, the potential homebuyer? It means that saving for your new home is becoming increasingly difficult and more expensive.

Do You Fall In the I-Don’t-Know-Camp?

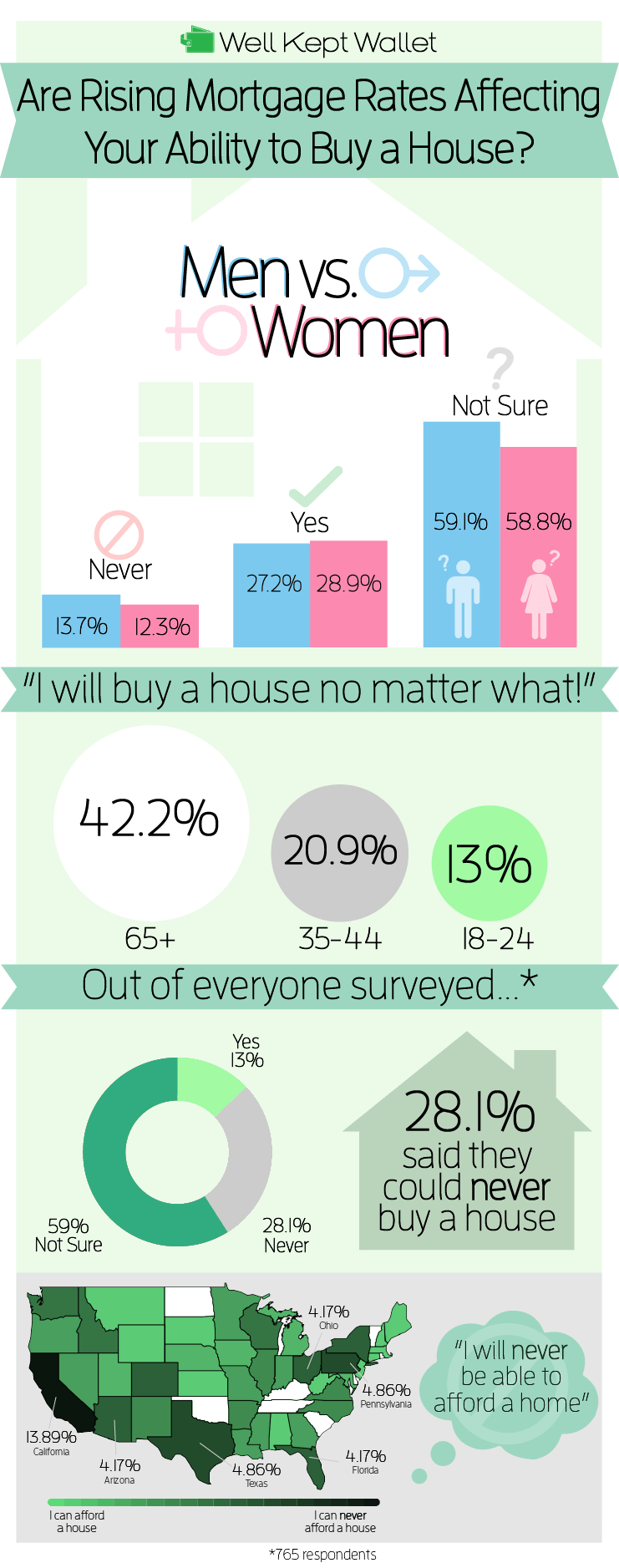

Well Kept Wallet’s survey results

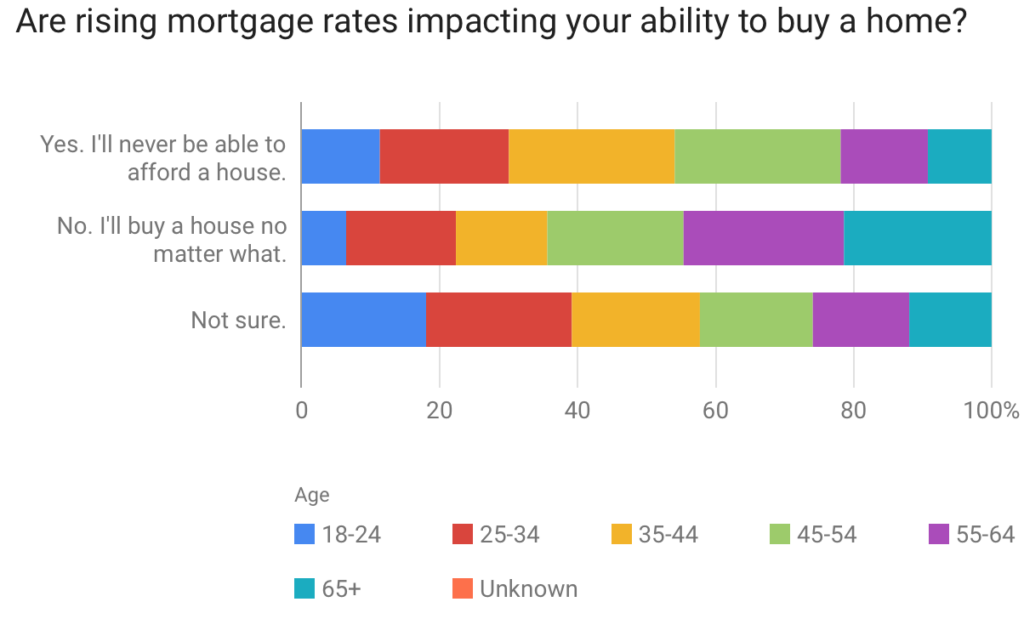

Given these future predictions, Well Kept Wallet asked 1,000 consumers how these rates affect their ability to buy a home.

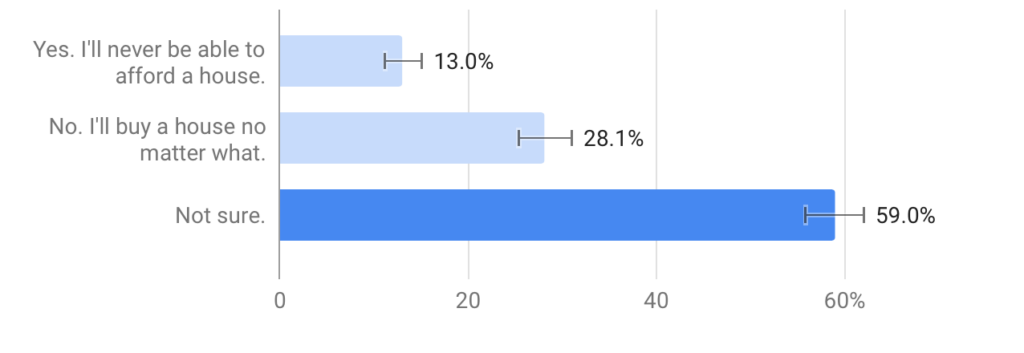

Here are the overall results:

- 28 percent said rising mortgage rates won’t stop them from buying a home

- 13 percent said they’d never be able to buy a home

- 59 percent said they weren’t sure

The overwhelming response was uncertainty, which indicates that people don’t fully understand their money situation. This includes assessing their current finances and how much to budget so they can save money, save for retirement, and build wealth.

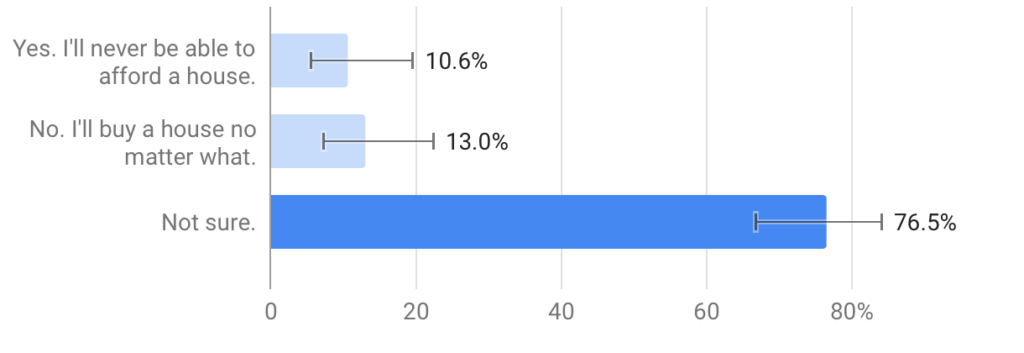

Well Kept Wallet survey results from the 18-24 age group

This uncertainty is even higher for 18-24-year-olds, with 77 percent saying they aren’t sure if they’ll ever be able to afford a home. This is the group that has the most amount of time to save for a home, but will also end up in a future market of the most expensive homes with rising mortgage rates and inflation.

Don’t fall into the uncertain category. Have a plan and set actionable steps to start putting away money each month for a down payment.

Here’s a step-by-step guide for how to save for a home.

How Much Do You Need For Down Payment?

Traditionally, home buyers have come up with 20 percent of the home’s price for down payment.

However, home prices have become quite expensive, so not everyone is able to easily save up 20 percent of a home. A Zillow report showed that 55 percent of home buyers were putting less than 20 percent down on a new home.

You don’t have to come up with a 20 percent down payment.

This 20 percent number makes lenders feel comfortable that you won’t have trouble paying off the home. It also helps you avoid paying for PMI, or private mortgage insurance and helps you qualify for a lower interest rate mortgage. This means your monthly mortgage will ideally be at a manageable number.

Tip: For housing (mortgage payments or rent), try not to go over 25 percent of your total take-home pay. If you make $3,000 a month after taxes, you should aim for your housing cost to be no more than $750.

FHA Loan May Be an Option If You’re a First-time Homebuyer

Before diving in about budgeting and how to save diligently for your down payment, I wanted to throw in the FHA loan option if you’re a first-time homebuyer.

FHA stands for Federal Housing Administration and is a loan issued by federally qualified lenders.

These loans are geared to potential homebuyers who aren’t able to make a big down payment. You’re only required to put down a 3.5 percent down payment which means you can borrow up to 96.5 percent of the value of the home.

While borrowing almost 100 percent sounds scary, it can realistically get you into your first home without a huge down payment.

If you wanted to buy a home that was $500,000 and qualified for a 3.5 percent down payment on an FHA loan, you’d only need to put down $17,500. If you wanted to put down the traditional 20 percent down, you’d need $100,000. Big difference.

If you choose this route, the time it takes you to save for a down payment may be drastically shorter, but be sure to continue saving for other costs related to purchasing a home, like closing costs.

If you’re curious about what your monthly mortgage payment may look like with an FHA loan, check out this FHA loan calculator from the Mortgage Reports.

Budget and Calculate Your Monthly Savings

I’m going to guess that budgeting is not on the top of your favorite things to do in your spare time, but there’s no way around it if you want to set a plan to buy a house.

At the very least, you should figure out how much is coming in vs going out each month. If you normally use your debit or credit card to make purchases, look through your online statements to see what your spending looks like in the last three months. If you mainly use cash, this might be harder to track, so you’ll just have to give estimates to your best knowledge.

Categorize Spending

Depending on how detailed you want to go with your budget, you can break down and categorize your spending.

Example categories include:

- Restaurants/eating out

- Travel

- Uber/Lyfts

- Groceries

The purpose of looking through categories is to see where you can scale back. Restaurants and eating out definitely falls into this category.

Cook at home more often. I used to batch cook all my meals on Sunday and freeze it for the week (lunches and dinners). This helped save time and money during the weekday when things got busy and it was easy to fall into the trap of eating out.

See what you else you can cut out or reduce from your monthly expenses each month.

Here’s a checklist to give you an idea of what to look for:

- Cable TV

- Cell phone bill: FreedomPop offers cheap, no-contract phone plans

- Lower your credit card interest rate: call your credit card company and ask

- Reshop your insurance plans

What to Budget For While Saving For a House

While you’re saving for a down payment on a house, don’t lose sight of the other things you should continue putting away money for. These include your 401(k), IRA, and emergency fund.

Here’s a budgeting checklist:

- Monthly income – if your income varies from month to month, average out the last three months and use that number.

- Monthly expenses, including paying off debt (credit card, student loans, etc.)

- Emergency fund – aim to save 6 months’ worth of living expenses.

- 401(k) – continue automatically putting money aside from your paychecks.

- IRA – automate this process from your checking to IRA account.

- Down payment fund

- Other savings goals (a car, vacation)

- Spending money each month

There’s an App for That

There are a number of free websites you can use to keep track of your budget. Keep in mind you have to sync your bank accounts, credit card accounts, and investment accounts in order to see all of your finances aggregated into one place.

Here are some resources you can use to help you with budgeting:

- Mint: free

- Empower: free

- You Need a Budget, also known as YNAB: Free trial

Unless you like creating spreadsheets or would rather pay for a robust budgeting tool, like Quickbooks, online tools like Mint have been a godsend for people like me.

The benefits of an app

I’ve been a Mint user for years now, and while I think some of the categories need improvement (expenses get categorized incorrectly all the time), I use it mostly to track how much is coming and going, from my accounts.

There are downfalls to using Mint, such as accounts not connecting correctly or at all, and you can’t connect an employer’s 401(k) either. (Tip: If you’re interested in opening an investment account with Betterment or Empower, you can easily track your 401(k) through these platforms.)

My main gripe about Mint is how terrible it is at categorizing. I used to manually correct the categories for spending, but eventually I gave up. It doesn’t bother me if categories are wrong because all I really need it for is to see an overview of my money.

It also tells you your net worth which isn’t super accurate but that’s okay because it’s free.

If you’re the type of person who needs to see the finer details of where your money is going and want accurate categorizing, Mint probably isn’t the best tool for you to use.

If you want something that will help give you budgeting advice and is more thorough than Mint, I hear great things about YNAB, which costs $6.99 a month but you can get the first two months for free.

YNAB takes budgeting to a whole new level and gives you advice based on your situation, plus cool features like color coding your spending to quickly visualize where your money is going.

Saving Money on Bills Each Month

If sifting through your bills to see where you can cut corners doesn’t really appeal to you, there are lots of apps that can help you, for free. My favorite app, which is actually a personal finance “assistant,” is Trim.

It looks at your subscriptions and receipts and will cancel unwanted subscriptions for you, text you when you’re spending too much on something, and negotiate your cable bill.

Since it’s free, I decided to use it and within the first few months, I got a text message that said they were able to save me $25 on my internet bill that month. Score!

Include These in Your Budget Too

When you’re calculating the cost of the home, be sure to include add some cushion for things like closing costs and home inspections. Estimate that your closing costs will be about 2 to 5 percent of the price of the home.

While you’re focus will be on saving for a downpayment, you should also calculate how much you would be able to afford after you purchase your home, as maintaining a home is a lot more expensive than renting.

Factors to consider and add to your budget:

- Rising interest rates

- Home repairs

- Landscaping

- HOA fees

- Taxes

- Insurance

Create a Savings Plan

As part of your action plan, automate your savings. Each time you get paid, automatically move money directly to your online savings account.

If you don’t have an online savings account, open one. It earns you roughly 18-22X more than a big-bank savings account.

Currently, these are some of the best savings accounts, as they offer high interest and are completely free to open.

- Aspiration Bank

- Synchrony Bank

- Barclays Online Savings

- Discover Bank

- 360 Savings By Capital One

Here is our complete list of the best savings accounts.

Keep in mind that with any savings account, at big bank or online bank, you may get charged a fee if you withdraw money more than six times each month.

Open a CD

Another type of account that might be a great place to house your savings is a CD, or certificate of deposit. CDs earn slightly more than an online savings account but the only catch is that you can’t pull out your money any time you want.

When you save money through a CD, you agree that it will stay in the bank for a certain amount of time. You also get a fixed interest rate for the length of the term, and the longer the term, the higher the interest rate.

With CDs, there is usually a minimum required deposit of $500 to $1,000.

Just to give you an idea of what kind of interest rate you can expect with a CD, Marcus By Goldman Sachs is offering a 2.35 percent APY on a 3-year CD and Synchrony Bank is offering a 2.6 percent APY on a 5-year CD.

There are also options for a shorter term, including one year.

Set Your Goal and How Much Time It Will Take

After you figure out your budget, the next step is to set a timeline for how long it will take you to save that money.

If you are saving $1,500 each month and you’re trying to reach a goal of $50,000, it will take you approximately three years to save, assuming things go according to plan.

While you’re saving, check in every quarter and make sure you’re hitting your targets. If you find yourself falling behind, consider picking up a side hustle to make up for it.

It’s a good idea to pick up a side hustle anyway, to pay off debt or put away extra money.

Increase Your Income Through Side Hustles to Save More Aggressively

Get a side hustle going to reach your savings goal faster. Technology, apps, and companies like Amazon, Uber and Airbnb are making the extra income streams more readily available to people.

Here are tips and resources for how to do this.

Rent Out a Spare Room

If you have space to spare in your house, take some clear photos and post it on Airbnb with a detailed description. Consider yourself lucky if you live in a big, touristy city like New York City, San Francisco or Los Angeles.

These areas might also have higher competition, so one tip is to lower the price. Airbnb has smart pricing and makes suggestions based on what other similar homes in your area are going for.

Price it slightly lower and you may be able to get customers faster this way. This is the exact strategy I used when I first listed my apartment and it worked like a charm. Within a few short months, I got nine bookings!

Airbnb Tip: I know a couple who regularly lists their entire apartment on Airbnb for $275 a night, and then book another Airbnb room nearby for a much cheaper price. This is a hack that earns them $1,000 a month, and even more over the summer.

Sell Your Gently Used, Designer Clothes

Spring cleaning doesn’t always have to happen in spring. Use Poshmark and eBay to sell your items. Designer items are most in-demand. I have personal experience selling on both Poshmark and ebay, and if it’s not brand name, it usually doesn’t sell.

The rule from professional organizers is if you haven’t used it or have worn it in the last year, it needs to go.

Here are some examples of top designer brands that are high in demand on eBay and Poshmark:

- Louis Vuitton

- Alexander Wang

- The North Face

- Lululemon

- James Pearse

- Vince

- Madewell

Sell Your CDs and DVDs

Everything is digital now, do you really need to hold on to your collection of CDs and DVDs? A company called Decluttr was created just so you can sell them your old CDs, DVDs, games, books, game consoles, and phones.

You ship your used stuff to Decluttr for free and you can get paid by check, PayPal or direct deposit.

Use Your Driving Skills for Rideshare

Uber currently has 2 million drivers and serves 65 million people in the U.S.

The nice thing about ridesharing is the flexibility. All you have to do is turn the app on and off, depending on how much time you have to work.

Uber allows drivers to pick up passengers along the way based on the direction they plan on traveling.

Let’s say you’re driving home from work and you need to head east. You can select to only pick up passengers going eastbound.

The only caveat is that you can only turn on this feature two times during your shift.

Check Your Credit 6 Months to 1 Year Before You Reach Your Goal

While you’re diligently saving for your house, check your credit score along the way to make sure it hasn’t dipped or your identity has been stolen.

If you think a stolen identity doesn’t apply to you, think again. CBS News said almost 145 million people were affected in 2017. There’s a good chance your personal information is floating out in cyber space.

It’s a good idea to check it regularly in general, but stay extra vigilant within six months to a year of purchasing and shopping around for your future house.

That way, if you need to improve your score, you have plenty of time to do it.

You get three free credit reports each year from the big bureaus at AnnualCreditReport.com.

Tip: Set alerts on your Google Calendar every three to four months and stagger your reports, rather than looking at them all at once. That way you can closely monitor any changes within the year from report to report.

You can also use sites like Credit Karma and Credit Sesame to monitor your credit score, but keep in mind you won’t get your full credit report history.

Once You Know Your Credit Is Solid, Get PreApproved for a Mortgage

I know the word “preapproved” may conjure cheesy, late night TV mortgage commercials, but hear me out. Getting preapproved for a mortgage allows you to understand what kind of home you could reasonably afford and compare offers and interest rates with other lenders.

When you’re preapproved, it means you can technically “lock in” that loan interest rate if you’re ready to move forward.

The beauty of getting preapproved is that it doesn’t cost you anything and you’re not obligated to sign anything with a particular bank.

Is it a crucial step as you save for a down payment? No. But, it may save you time, effort, and money when you start shopping for a house because you’ll know how much of a loan you qualify for and at what interest rate.

Stay Motivated to Achieve Your Goal

Create quarterly check-ins while you’re saving, and reward yourself with something fun (and inexpensive) to keep you motivated and emotionally engaged.

A few ideas include:

- Making a vision board of what kind of homes you’d like to live in. Look at it every day.

- A friend of mine who was saving for a house would periodically check out an open house (or five) in the area she wanted to live in. As she walked through the house, she visualized what it would be like to live there.

Do whatever works for you and don’t lose sight of keeping your finances in order and saving.