Is LifeLock Worth The Cost?

Some products in this article are from our partners. Read our Advertiser Discloser.

Cybercrime has become a regular occurrence. Whether it’s identity theft, credit card fraud or phishing, most people will deal with cybercrime at some point in their lives.

If you are looking for a company that can help keep your information safe, LifeLock is worth considering.

This LifeLock review will share what the company does to protect you from cybercrime, if it’s worth the cost, its features and more.

Overall Rating

Summary

LifeLock provides varying levels of identity theft protection for consumers. Features include credit monitoring, financial reimbursement and more.

-

Features

4

-

Cost

3

-

Security level

4

-

Customer service

2.5

Pros

- Plans to fit every budget

- Legal help to remedy breaches

- 14-day and 60-day money back guarantees

- 24/7 customer service

Cons

- Some plans can be costly

- Poor customer service reviews

- Service doesn’t monitor all transactions

What Is LifeLock?

LifeLock was founded by Robert J. Maynard (founder of the Internet Service Protocol) and Todd Davis. The company provides services to help alert members to potential identity theft.

If a threat is discovered, LifeLock can help resolve the problem and restore any financial losses resulting from the theft.

The company also helps stop hackers from accessing your personal information while using a VPN to make sure your online activity stays private.

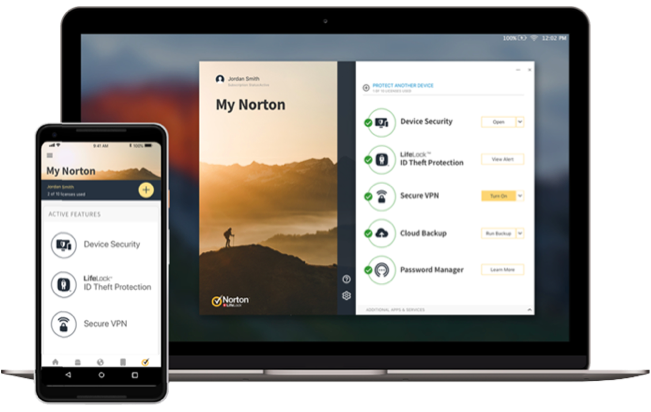

LifeLock was recently purchased by Symantec (parent company of Norton Antivirus) and now offers Norton Antivirus products along with its cyber protection packages.

How Much Does LifeLock Cost?

LifeLock has three different membership options, including Select, Advantage and Ultimate Plus.

The company offers individual plans within each membership tier, including a family plan for two adults and an additional family plan for two adults and up to five children.

Pricing ranges based on how many people are covered and which plan you choose. Keep in mind that all three plans offer a 15% discount if you pay annually instead of monthly.

Select

LifeLock’s Select membership costs up to $38.99 per month depending on your plan.

The pricing is as follows:

| Plan | Monthly Cost, First Year | Monthly Cost, After First Year |

| Individual | $9.99 | $14.99 |

| Individual + Spouse | $16.99 | $26.99 |

| Family | $23.99 | $38.99 |

Advantage

Monthly fees for LifeLock Advantage cost a maximum of $59.99 each month.

Depending on the plan you choose, the cost is:

| Plan | Monthly Cost, First Year | Monthly Cost, After First Year |

| Individual | $19.99 | $24.99 |

| Individual + Spouse | $29.99 | $47.99 |

| Family | $36.99 | $59.99 |

Ultimate Plus

LifeLock’s Ultimate Plus membership is the most expensive option, costing a maximum of $81.99 per month.

Here is the pricing breakdown for Ultimate Plus:

| Plan | Monthly Cost, First Year | Monthly Cost, After First Year |

| Individual | $29.99 | $34.99 |

| Individual + Spouse | $41.99 | $69.99 |

| Family | $48.99 | $81.99 |

LifeLock Features

The features LifeLock offers in each of its plans are meant to help you protect your digital life. They can also assist you in the event that identity theft occurs.

Alerts

The “Alerts” feature with LifeLock helps notify you about any potential identity theft early in the game.

LifeLock customer service will alert you by phone, email or text if there is:

- An application for new credit on your credit report

- A change in court records that appear on your record

- Any change of address appears on your credit record

- Alerts to any information found about you on the Dark Web

And more depending on which plan you have. Take a look at the website and the details for each plan to get more information.

Note that LifeLock does not monitor all the transactions on your credit report. However, if they see a suspicious transaction, they will alert you.

As a result, you’ll still want to monitor your credit report every few months so you can catch anything LifeLock may have missed.

Reports

If you have LifeLock’s Advantage plan or Ultimate Plus plan, you will have free access to both your credit report and your credit score anytime you want.

You can access your credit score on the Credit Score and Report tab using the mobile app or the website.

However, your credit report is only accessible via the website. Note that the Advantage plan just gives you your credit score and report from Equifax.

The Ultimate Plus plan provides you with your credit score and report from all three credit bureaus. Keep in mind that the credit score LifeLock shows is not your FICO score.

Instead, you’ll be able to access your VantageScore 3.0. While VantageScore is gaining popularity, most creditors still use the FICO score to make decisions about a client’s creditworthiness.

Reimbursement and Expense Compensation

LifeLock also offers Reimbursement and Expense Compensation. This is essentially an insurance benefit for added protection.

This feature covers costs for identity theft occurrences such as:

- Coverage of personal expenses

- Reimbursement of stolen funds

- Coverage of expenses for lawyers and experts

The coverage amounts for personal expenses and reimbursement of stolen funds vary based on which LifeLock plan you have.

Coverage amounts are as follows:

- Select members get $25,000 worth of coverage

- Advantage members get $100,000 worth of coverage

- Ultimate Plus members get $1 million worth of coverage

However, all plans come with up to $1 million of coverage for any necessary lawyers and other experts.

Is LifeLock Worth The Cost?

This depends on your unique situation.

If you end up having a serious security breach that results in tens of thousands of dollars in lost funds, you’ll probably find that LifeLock services are well worth the cost.

Since many people end up being victims of cybercrime on some level, there is a decent chance LifeLock could be worth it for you.

For example, I remember checking my credit card statement online one time only to find that someone had charged a $1,500 trip to the Bahamas on my card.

In my case, the resolution for this fraud was simple. I’d caught it early, so I called the credit card company.

After verifying that I hadn’t been out of the country, they removed the charge from my card.

Unfortunately, more experienced identity thieves can do more substantial damage to your credit report. This could end up costing you a lot of money.

The question you have to ask yourself is: How much am I willing to pay for peace of mind?

Some people feel comfortable monitoring their credit and taking care of any problems on their own.

However, others feel more comfortable having a safeguard such as LifeLock in place.

Ultimately, you have to make that decision for yourself.

Lifelock FAQs

Before you sign up for LifeLock, you may have some additional questions. Here are some answers that can help.

Signing up for LifeLock is easy. It takes just minutes to enroll in and install the service.

All you have to do is select the plan you want and follow the prompts. You’ll provide your email address, add family members and choose add-on features.

From there, you’ll enter payment information and choose whether you want to pay monthly or annually.

Norton offers 24/7 customer service via phone or via online chat. See the website for contact details.

Yes, LifeLock has an app. Members can download the mobile app (iOS or Android) free of charge once they sign up for the service.

The app is used for sending push notifications. If you respond to a notification concerning suspicious activity, you’ll have the option to be connected to a support specialist.

Yes. Monthly subscriptions are eligible for a full refund if they are canceled within 14 days of purchase. Annual subscriptions are eligible for a full refund when they are canceled within 60 days of purchase.

Yes, you can cancel your subscription or stop the auto-renew feature at any time. However, you won’t get a refund if you are outside the refund window.

What Customers Are Saying About Lifelock

Still on the fence about LifeLock? Here’s what others are saying about the service.

LifeLock received a strong rating from Consumer Affairs, earning 4 out of 5 stars. The platform cited plan variety and remediation options as the reason for LifeLock’s rating.

The main issue Consumer Affairs had with the service was that the price increased after one year.

The rating from the Better Business Bureau for LifeLock was A+. However, the customer reviews scored a 1.8 out of 5.

As of this writing, LifeLock has had 420 closed complaints in the last year and over 900 closed complaints in the last three years.

Most of the reviews centered around canceling and poor customer service issues.

LifeLock’s Trustpilot score is 4.5 out of 5. Some complaints were irrelevant, such as people getting spam emails from LifeLock imitators.

Most of the other complaints revolved around bad customer service. Several people noted that LifeLock had changed for the worse since Norton took over.

LifeLock Alternatives

What choices do you have if you’re searching for LifeLock alternatives? Here are some of the top options.

| Monthly Starting Price | Coverage | Monitoring Products | Trustpilot Star Rating | |

| LifeLock | $9.99 | Up to $1M | Identity theft | 4.0 out of 5 |

| IdentityForce | $14.99 | Up to $1M | Identity theft, credit card fraud and more | 4.4 out of 5 |

| Identity Guard | $8.99 | Up to $1M | Social Security, bank account, and more | 4.5 out of 5 |

| Credit Karma | Free | None | Credit | 1.7 out of 5 |

IdentityForce

From identity theft to credit card fraud and more, IdentityForce offers two different protection plans.

The plans are affordable at $14.99 and $19.99 per month, respectively. Both plans provide up to $1 million in identity theft insurance.

You can add on the ChildWatch feature to monitor your kids’ reports as well. IdentityForce comes with a host of features and is very competitive with LifeLock.

Additionally, IdentityForce gives you complimentary internet security software for both your mobile device and your PC.

This software helps prevent malware installation and keystroke tracking, which are common tools used by internet hackers.

Identity Guard

Identity Guard offers notifications for data breaches and identity theft. Like LifeLock, it has three different plans, and each one offers a variety of levels for individuals and families.

With Identity Guard, you can get a plan for as little as $8.99 per month.

Some of the features Identity Guard offers (based on the plan you get) include:

- Social Security number monitoring

- Health insurance monitoring

- Bank account monitoring

- Dark Web monitoring

Identity Guard also offers up $1 million in identity theft insurance coverage.

All plans come with a browser extension. They offer an anti-phishing mobile app as well. These features help protect your devices from unsafe websites.

Your Identity Guard membership can give you a monthly credit score update and credit reports from all three credit bureaus. However, this feature is only available with the top-tier plan.

Credit Karma

Credit Karma doesn’t offer all of the services that LifeLock does. Fortunately, it does provide credit monitoring services and will alert you if it detects suspicious activity on your credit report.

Credit Karma even monitors the Dark Web for information on you, gives you credit reports, and provides credit scores.

The cost of Credit Karma? Absolutely free. Think of it as a minimalist version of LifeLock.

Credit Karma might be a good choice for you if you’re not terribly concerned about identity theft.

Summary

Protecting your identity is becoming increasingly important, and an identity theft protection company like LifeLock can help.

As a consumer, only you can decide if you want or need identity theft protection and, if so, what level of coverage you want.

LifeLock can be a great solution if you want to make sure your information is being monitored.

Nevertheless, take the time to explore all your options and make the decision you feel will give you the most peace of mind.