Modiv Review: Invest in Real Estate Affordably

Some products in this article are from our partners. Read our Advertiser Discloser.

One way that many experts suggest investing is through real estate. It can potentially be a great way to diversify your investments.

However, real estate investing can be tough work. And it can require a lot of capital. Not everyone has the financial ability or the knowledge to purchase and manage rental properties. And not everyone wants to learn.

Investing through crowdfunding real estate sites has become a popular choice for investors who don’t want to own real estate investment properties outright. It allows more people to have a chance to profit from real estate investments — even without a lot of cash.

One such crowdfunding real estate investment firm is called Modiv. In this review, we’ll share what Modiv is all about so you can decide if it’s a smart investment move for you.

Overall Rating

Summary

Modiv is a solid choice as a real estate crowdfunding option.

-

Ease of use

4.5

-

Customer service

4.5

-

Earning potential

4

Pros

- Investment options

- Web navigation

- Easy to use

Cons

- No guarantees

What is Crowdfunded Real Estate Investing?

Let’s start with a brief summary of what crowdfunding real estate investing is. Traditional real estate investing involves purchasing rental properties outright.

As an investor, you’re responsible for buying the properties, paying the mortgage, etc. You either manage the properties yourself or hire a management company to find and manage tenants.

You can also buy properties in order to flip them. Buy, rehab, and sell for a profit.

Both of these types of real estate investing can be a lot of work — and cost a lot of money.

With crowdfunding, a real estate investment firm collects money from thousands of people wanting to invest in real estate.

The firm uses the money to invest in properties. Some crowdfunded real estate firms offers for people to invest in REIT portfolios. A REIT is kind of like a mutual fund of investment properties.

Other firms help investors crowdfund to invest directly in an individual commercial or residential property. When the profits come, the company splits the designated profits with all of the people who contributed to (invested in) the purchase of the properties.

There are many crowdfunding real estate investing companies. Many allow you to invest in real estate for as little as $500 or $1000. This Modiv review will tell you about one of these real estate investing opportunities.

What is Modiv?

Modiv is a crowdfunding real estate company that was formed from by a group of investment professionals involved in other real estate investment companies.

CEO Aaron Halfacre has over 25 years of real estate investing experience, including a stint as President of RealtyMogul.

The rest of the staff, as well as Modiv’s Board of Directors, have extensive experience in the area of real estate investing too.

Modiv was created as a way to give individual investors a chance to invest in commercial real estate–and to do so at an affordable entry level.

How Does Modiv Work?

Modiv uses funds invested in REITs to purchase various properties. As properties produce rental income, Modiv REIT investors get dividends from any profits.

Modiv REITs are publicly non-traded REITs. This means that as public REITs, they are registered with the Securities and Exchange Commission and open for public viewing.

However, they are non-traded, which means you can’t buy and sell shares of the REITs on the open market. This is different from the publicly traded REITs you can get from an investment broker.

Instead, Modiv relies on crowdfunding to buy real estate. And if you want to sell, you’ll have to sell your shares back to Modiv.

With Modiv, you can earn monthly dividends via the rent collected from tenants. This makes Modiv a great potential source of monthly income.

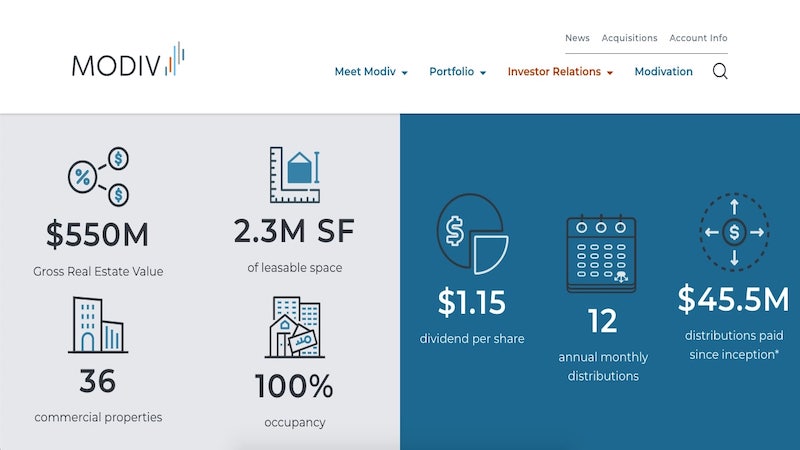

Modiv has one REIT you can invest in at this time.

Modiv REIT

The Modiv REIT has a minimum investment requirement of $1000. You’re not required to invest any additional money into the Modiv REIT after this initial $1000.

However, if you do invest additional money into the Modiv REIT, you need to invest a minimum amount of $100 at a time. This additional investment can be done on an automatic monthly basis or occasionally as you choose.

The Modiv REIT focuses on single-tenant commercial properties.

Some of the features of this REIT include:

- Tenants have strong financial statements.

- All Tenants sign long-term leases.

- Tenants include blue chip companies and the federal government

- Properties are located in primary, secondary and some tertiary markets where construction is substantially complete.

The reason Modiv chooses properties in areas where construction is substantially complete is to avoid the risk that can come with new construction. The company seeks out properties that come with reduced risk in order to help maximize profits.

Note that the Modiv REIT is currently available only in certain U.S. states. Modiv is in the process of getting approval to offer the Modiv REIT in the remaining U.S. states. Contact Modiv directly for more information.

Investment dividends can be a great way to make passive income. Bonus: shares in the National REIT are available to accredited and non-accredited investors. More about this in a minute.

What Fees Does Modiv Charge?

One thing that stands out about Modiv is that it doesn’t charge any annual transaction fees. In addition, it won’t charge you any fees to manage your account.

The fees come in the form of returns. 97% of investment returns go directly to investors.

3% of returns are used to cover miscellaneous expenses the company has, such as organizational costs.

And there are repurchase fees we’ll talk about in a bit.

Modiv doesn’t use brokers to find investors. Instead, it focuses on the crowdfunding platform to find investors.

This is how the company keeps overhead costs low and can pass those savings onto investors.

What About Liquidity?

The REIT Modiv offers are long-term (over three years) investments. The company does have a share repurchase program in which it will buy back your shares if you need to cash out early.

However, it charges fees for repurchasing your shares. You can plan on paying up to 3% in fees if you cash your shares in early through the repurchase program.

Note that the website says the company will only repurchase shares if its advisors say they have enough liquid cash to do so safely.

However, the site also says it’s never denied a share repurchase request.

Pros and Cons

Now let’s use this Modiv review to go over a summarized list of their pros and cons.

Pros

Modiv has a lot of great features to talk about. Here’s a summary.

Low Minimum Investment Requirement

Possibly one of the best pros about Modiv is the low minimum investment requirement. Just about anybody can come up with $1,000 to invest if they work at it.

Attractive Target ROI Rate

Modiv’s target rate of return for their investments is 7% to 12%. This is an attractive target rate for many investors.

Although it’s not a risk-free investment, real estate investing is often less risky than other investments with similar returns.

No Annual Fees

Another attractive feature is the fact that there are zero annual management fees and broker commission fees. Typical REITs have annual management fees and broker commission fees.

It Pays Monthly Dividends

As I mentioned earlier, Modiv pays monthly dividends on its REIT profits. You can choose to take the dividend payments as cash or have them reinvested.

It’s a True Passive Income Source

Modiv REITs are a true source of passive income. You can literally set it and forget it. Just set up the monthly amount you want withdrawn from your bank account and deposited into your Modiv REIT.

Then let the property purchase and management team do the rest.

Modiv Works to Minimize Risk

Modiv focuses on purchasing properties intended to minimize risk for investors. It buys properties in well-established areas with high occupancy rates.

This is a great feature if you are an investor with a low risk tolerance.

It’s a Hands-Off Way to Invest in Real Estate

Possibly one of the biggest pros of Modiv and crowdfunded real estate investing in general is that it’s largely hands off.

When you invest in real estate yourself, you’re looking at some cumbersome investment factors. You’ll need to:

- Come up with a large down payment to buy a property.

- Make monthly mortgage payments.

- Find and screen tenants — or you’ll need to pay a management company to do this.

- Maintain the property and make repairs as needed. Again, you can instead pay a management company to handle this.

I’ve always loved the idea of investing in real estate. However, financial and fear factors have kept me from buying a rental property on my own.

Modiv allows people to reap the benefits of real estate investing in a hands-off manner.

Cons

First, though, let’s talk about potential cons of investing with Modiv

Modiv REITs Are Only Available to Accredited Investors

Modiv only allows accredited investors. That means you qualify to participate if you have a sole annual income of $200,000 or a joint-with-spouse annual income of $300,000 (for the past two years and expected to continue).

You are also considered an accredited investor if you have a net worth of at least $1 million, either solely or jointly with a spouse.

Modiv does not allow non-accredited investors to participate.

There’s No Guarantee of a Profit

As with any investment, Modiv can’t guarantee it’ll have dividend payments for you each month. There is a risk you’ll lose your investment monies as well.

The company does work to minimize risk by investing in properties with a down payment of 50% or more. In addition, it works to choose properties in established areas. However, this process doesn’t eliminate your investment risk entirely.

This is a Long-Term Investment

As I mentioned earlier, the Modiv REITs are a long-term investment. Plan on five to seven years or more for a term. If you’re interested in sticking with short-term investments, this probably isn’t the best investment choice for you.

There are Early Liquidation Fees

Also as mentioned earlier, you can sell your shares through the Modiv share repurchase program. However, you will pay administrative fees of up to 3% for doing so.

Keep this in mind as you decide whether Modiv is for you. Next, let’s talk about what the Better Business Bureau has to say about Modiv.

Modiv Better Business Bureau Rating

Whenever we do review posts on Well Kept Wallet, we try to find independent sources of review. One source we use — if available — is the Better Business Bureau (BBB).

However, Modiv doesn’t have any ratings on the BBB website at this time. Being a newer company, Modiv doesn’t have a Trustpilot score as of this writing either.

The previous company, Rich Uncles had an A rating with BBB.

Note that we will monitor these sources for Modiv ratings and add them when available.

Summary

If you’re considering investing in real estate, consider a crowdfunding platform. It’s a way for you to potentially profit from real estate without all of the hassles of owning rental properties outright.

You won’t have to deal with saving for a large down payment and working to find the right property to buy. In addition, you won’t have to deal with tenant issues, repair and maintenance, and a large mortgage payment.

Crowdfunded real estate investing means that experienced real estate investors do the heavy lifting for you. They do the work of finding and managing the property, and of making the mortgage payment.

As an investor, you simply back their work with your money and collect any profits. Modiv seems to be a solid choice as a real estate crowdfunding option.

It works to minimize risk to investors by purchasing lower risk properties. And it doesn’t charge any annual management fees or broker fees.

However, it is important to remember that all investing comes with risk of loss of your investment.

In addition, you just can’t beat the $1000 minimum investment requirement. If you’re thinking about dabbling in real estate investing, Modiv can be a great way to start with minimal risk.

Thanks a lot for this great review, Laurie. I just started investing in BRIX REIT as a European investor. I am looking forward to my first dividend payment and also the tax withholdings. I am invested in a lot of European crowd investing companies giving an annual return of 5% to 15%.

That’s great that you are investing! Thanks for sharing.