Robinhood Review: Is This Free Trading App Worth It?

Some products in this article are from our partners. Read our Advertiser Discloser.

Investing is important, but it can be complicated. You need to open a brokerage account, choose stocks to invest in and place buy and sell orders. Many brokerages make it more difficult by adding commission fees to trades or minimum account balances.

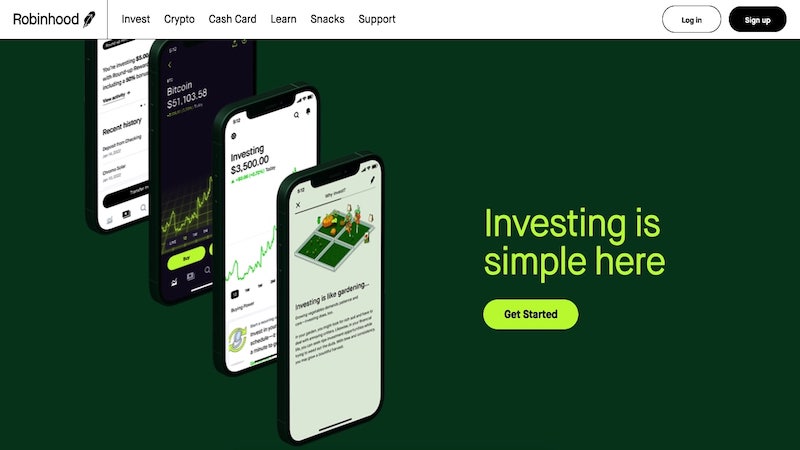

Robinhood is a phone-based brokerage that streamlines the trading experience. You can easily buy and sell stocks, ETFs and options through the app. It also offers some useful features to help you manage and protect your cash reserves.

Overall Rating

Summary

Robinhood is a good way for new investors to learn the market at a low cost. It’s suitable for people who want a cheap way to trade regularly.

-

Ease of use

5

-

Minimums

5

-

Retirement Accounts

3

-

Data streams

4.5

Pros

- Easy to use

- Real-time data

- No minimums

Cons

- No retirement accounts

- No mutual funds or bonds

- Limited customer service

What is Robinhood?

Robinhood is a mobile-based brokerage company that aims to make it easy for anyone to invest for free.

How Does Robinhood Work?

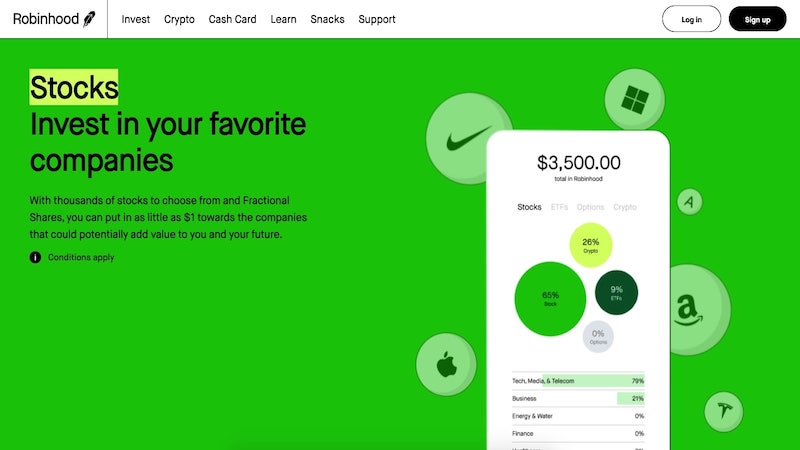

Robinhood is a brokerage, which means that you can use the service to invest in securities. In particular, Robinhood enables you to invest in stocks, Exchange Traded Funds and options.

Unlike some other brokerages, Robinhood does not charge commissions with each trade that you make.

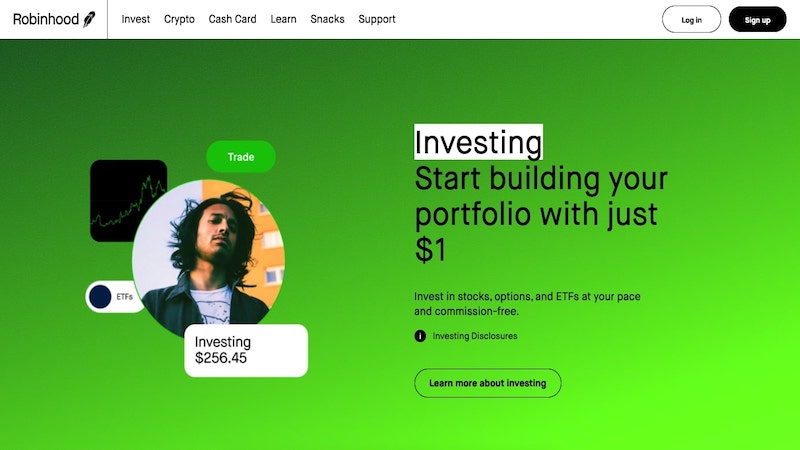

Also, Robinhood lets you purchase fractional shares in businesses. To explain, each company’s share has a price. For example, a share of Coca-Cola cost about $45 when this article was written. With most brokerages, you have to have at least $45 to buy shares in Coke, and you can only invest in $45 increments.

However, with Robinhood, you can invest any amount in the company and buy less than a full share at a time.

Like other brokerage companies, once you purchase shares in a business, you can hold those shares for as long as you’d like. You can sell the share for a profit or a loss if it changes in value.

You’ll also receive dividends from businesses that pay dividends to shareholders.

What Can You Invest In With Robinhood?

Robinhood is a cost-conscious brokerage company that keeps the investing process streamlined. That means there are some restrictions on the investments you can buy through Robinhood.

Specifically, Robinhood lets investors buy stocks, ETFs and options through their accounts. You cannot purchase bonds, mutual funds or other types of securities.

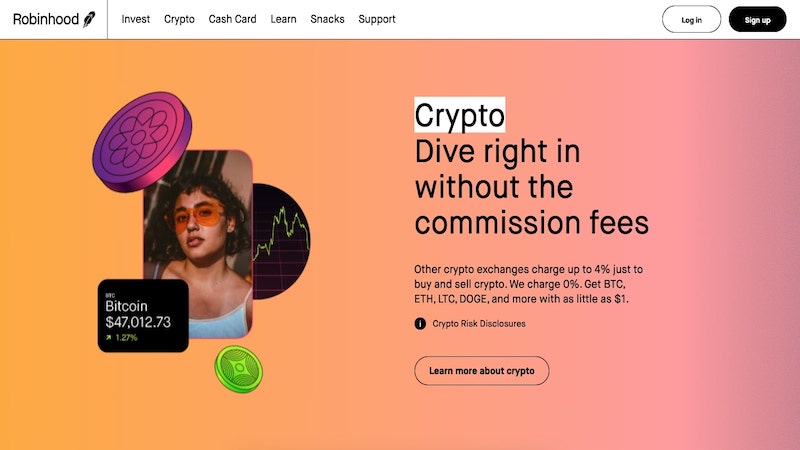

Robinhood also offers cryptocurrency trading for people who want to trade crypto. Robinhood supports more than a dozen cryptocurrencies, including Bitcoin, Ethereum, Litecoin and Dogecoin.

How Does Robinhood Make Money?

Robinhood doesn’t charge a commission when you make a trade, but that doesn’t mean that its services are too good to be true. The company can make money in other ways.

Robinhood does charge for a service it calls Robinhood Gold. A $5 per month subscription gets you access to additional features and the option to invest on margin (borrowed money). Robinhood also charges interest when you use margin.

Robinhood Features

Customers can take advantage of many features that Robinhood offers.

No Minimums and Commission-Free Trading

Cost is one of Robinhood’s biggest value propositions. You can open a Robinhood account regardless of the amount of money you’re able to deposit.

Also, you can invest in any stock you want without having enough to purchase a full share. You can put as little as $1 into a security, even if a full share costs thousands.

Options

Robinhood lets its customers trade options without paying a commission.

Options are volatile, complex securities. They can experience broader, swifter price changes than stocks, making them appealing to people who want to earn big returns. Options can also be far riskier than investing in stocks, so it’s essential to understand how they work before trading them.

When you sell a call option, you give the buyer the right, but not the obligation, to buy shares in a company at a set price. If the actual cost of a stock rises above that fixed price, the option buyer can exercise the option. That lets them buy shares at a discount, which they could immediately sell for a profit.

When you sell a put option, you promise the buyer that you’ll buy shares in a company at a set price. If those shares fall below the value set in the option, the buyer of the put could buy those shares and immediately sell them to you for a profit. Buying a put gives you the right to sell shares at a set price.

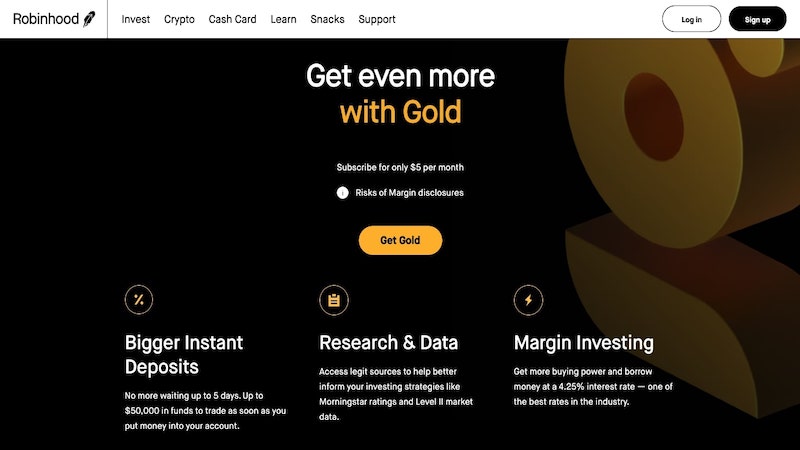

Robinhood Gold

You can sign up for a subscription service that Robinhood offers called Robinhood Gold. The service costs $5 and offers four perks.

First, subscribers get access to professional research from Morningstar. The research can help you find good investment opportunities or learn about market trends.

This is one of the most popular brokerages with instant deposit but there is a limit.

Second, Robinhood Gold increases subscribers’ instant deposit limit to $5,000. Typically, when you add funds to your account, you need to wait for the transaction to complete before you can use that money for trades.

The $5,000 instant deposit limit means you can start trading with up to $5,000 immediately when you make a deposit.

Third, Robinhood Gold gives you access to level two market data, which includes information on the bid and ask spread for securities. This data can help you see the level of demand to buy and sell shares in a company.

Finally, Robinhood Gold subscribers who have at least $2,000 in their account can trade on margin. This lets them borrow money from Robinhood to buy shares and options. Margin costs money because you have to pay interest on the money you borrow.

Margin also greatly increases your risk by amplifying your losses. With margin, you could lose more than 100% of the money you put into an investment. If that happens, you have to cover the losses from another source.

Cryptocurrency

On top of trading traditional securities, Robinhood lets you buy and sell popular cryptocurrencies.

Cryptocurrencies are digital tokens that people can exchange like currency. No specific government issues them. Instead, the creation and distribution of cryptocurrencies are handled by the code written by the person or group that developed the currency.

Some cryptocurrencies have gained wider acceptance and high values than others. Still, they tend to be very volatile and unpredictable.

Robinhood supports trading in more than a dozen cryptocurrencies, including Bitcoin, Ethereum and Litecoin.

Cash Management

Robinhood’s cash management account allows its customers to earn interest on uninvested cash and keep the money protected.

When you sign up for the cash management account, you receive a debit card that works like any other. You can use the card to make purchases using uninvested cash in your Robinhood account. Also, you can withdraw money from ATMs.

When you sell shares through Robinhood, the proceeds automatically go to your cash management account. When you place buy orders, Robinhood deducts the funds from your cash management account.

Money in the account earns .30% APY. It also provides up to $1.25 million in FDIC insurance, equivalent to the protection offered by five separate accounts.

Is Investing with Robinhood a Good Idea?

Whether investing with Robinhood is a good idea or not depends on your investing needs and goals.

If you’re looking for an easy way to start investing, with no minimums or costs, Robinhood is a good option. There are few easier ways to start putting money in the market.

The interface is easy to use, and the account is very flexible, letting you choose your own investments. That also makes it a reasonable choice for people who want to learn about investing in individual stocks.

If you’re a hands-off investor, Robinhood might not be the best choice. The lack of trade commissions means that the company expects its customers to trade regularly.

The fact that you can’t purchase shares in mutual funds also makes it harder to use as a passive index fund-based strategy.

Another drawback of Robinhood is that you can only open a taxable brokerage account with the company. If you want to save for retirement, you’ll be better off with another company.

The tax benefits offered by Individual Retirement Accounts are well worth the effort of opening one.

Keep in mind that all investing is subject to risk. There’s no guarantee that the money you invest will earn a return. You could lose some or all of your investment’s value.

So ensure you have an emergency fund and extra money that you can risk losing before you start investing.

Positives and Negatives

Robinhood has both benefits and drawbacks to consider.

Pros

No Fees or Minimums

Fee-free trades are Robinhood’s calling card. If you’re looking for the cheapest way to start investing, it’s hard to beat Robinhood.

All you need is a phone to download the app and a bank account to link. Once you’ve done that, you can get started with as little as you’d like. You don’t even have to save up enough to purchase a full share in a company.

Easy to Use Interface

Robinhood’s mobile-first design means that the app’s interface is sleek and easy to use. You can search for stocks quickly and get a clear view of their past performance. The app also includes useful visuals showing changes in your portfolio over time.

It is simple to execute trades, and you can access market news and research easily through the app.

Protect Your Uninvested Cash

Robinhood’s cash management account is a good place to store extra money, even if you already have a checking account. It lacks some checking account features like a checkbook or online bill pay, but you will get a debit card. That makes it easy to access your money.

The money you keep in the cash management receives FDIC protection, and you’ll earn interest. It’s a suitable place to keep an emergency fund or just some extra money you’re not ready to invest.

Cons

Here are the downsides to using Robinhood.

No Retirement Accounts

A major drawback of Robinhood is that the company only offers taxable brokerage accounts. Saving for retirement is important, and using a tax-advantaged account such as an IRA offers significant benefits. If you want to open an IRA, you’ll have to use another brokerage to do so.

Can’t Invest in Mutual Funds

Robinhood focuses on investing in stocks and ETFs. You can’t purchase shares in mutual funds, which are some of the easiest ways for hands-off investors to build a nest egg. So if you want to get around the investment restrictions, you’ll have to use another brokerage.

Alternatives to Robinhood

Robinhood isn’t the only way to invest; there are other options available.

Traditional Brokerages

Many traditional brokerages have followed in Robinhood’s footsteps, cutting commissions, minimums and fees for investors.

Big players like Vanguard and Fidelity have removed commissions for stock trades, letting you get the full brokerage experience at a low cost.

Most traditional brokerage companies allow you to invest in mutual funds and open different accounts like IRAs. They might not have the sleek interface that Robinhood has, but they’re more fully-featured, which is valuable for more sophisticated investors.

Robo-advisors

Robinhood is designed for active investors. But if you want a more hands-off approach, you might want to consider a robo-advisor.

Robo-advisory firms ask you questions to assess your investing goals and risk tolerance. Once the robo-advisor knows these details, all you have to do is add money to your account.

The robo-advisor software takes your funds and invests them automatically, designing a diversified portfolio for you. It’s completely hands-off beyond adding or withdrawing money.

Most robo-advisors charge a fee, typically a percentage of your invested assets each year. They argue that their services, such as automatic rebalancing and tax-loss harvesting, increase returns enough to offset the fee. Even if they don’t, some people find the ease of using a robo-advisor worth the cost.

Summary

Robinhood is a mobile-focused, discount brokerage. It’s suitable for people who want a cheap way to trade regularly. However, those looking for hands-off investment options or more types of accounts should consider an alternative.

Yet, traditional brokerage companies have started cutting their fees and minimums, which may reduce Robinhood’s value proposition significantly.