What Should Your Budget Percentages Be?

Some products in this article are from our partners. Read our Advertiser Discloser.

One of the best ways to be successful with your money is to know where your money goes each month. Many people fall into financial trouble but don’t understand why.

According to CNBC, the average person spends about $164.55 per day when accounting for expenses like housing, food, cell phone bills, etc.

Making a budget and tracking your spending can help you get a better handle on your finances and give you more confidence in your financial situation.

Creating a budget actually gives you freedom. A budget gives you the freedom to tailor your current spending practices as you see fit. It helps you adjust them in a way that ensures you are managing your money in line with your financial goals.

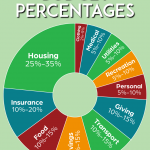

Monthly Budget Percentages by Category

Here are some guidelines that will help you to make your budget. Your budgeting percentages may vary from these suggestions due to the size of your family.

The area you live in (cost of living varies from city to city) and what your financial goals are will have an impact too.

Remember that it’s important to tailor your budget to fit you/your family’s personal needs and lifestyle.

| Category | % of Take-Home Pay |

|---|---|

| Giving | 10 – 15% |

| Medical | 5 – 10% |

| Housing | 25 – 35% |

| Transportation | 10 – 15% |

| Savings | 10 – 15% |

| Food | 10 – 15% |

| Utilities | 5 – 10% |

| Insurance | 10 – 20% |

| Recreation | 5 – 10% |

| Clothing | 2 – 5% |

| Personal | 5 – 10% |

Why Following These Percentages Can Help

My family and I used to be saddled with over $60,000 in consumer debt. In our particular case, it was a simple lack of budgeting and not tracking spending that got us into that debt. We couldn’t figure out why we were in the hole each month.

After all, we weren’t making large purchases. We were only buying small daily items.

The problem was that I wasn’t tracking our spending. Instead, I made an estimated budget each month and assumed we followed the numbers.

When we decided to go back and add up our previous annual spending, we were floored at what we found.

We assumed we were spending $600 a month or so on groceries. In reality, we were spending about $900 a month. We assumed we were spending about $100 a month on eating out.

In reality, were spending $275 a month. So a lack of budgeting and not tracking our spending had a huge impact on our financial situation. And it wasn’t a good one.

The reality of it hit us hard. I know money is important but because of that mistake, we’re still working to pay off the debt we accrued from not budgeting.

Track Household Spending as a Team

It’s important to use a budget and track spending together as a team. As you plan your monthly spending, don’t just use one or the other.

If you create a budget without tracking spending, you’ll have no idea if you’re staying within the budget you’ve allotted for each category.

This can be especially challenging in certain spending areas. Groceries, entertainment and restaurant expenses are the three areas we struggled with the most.

What if you track your spending without first setting a dollar amount goal for each category? If so, you can easily spend more than you would like to in one or several categories.

With a pre-set budget, you have a number to aim for that will help ensure you’re making efforts to control spending.

With controlled spending, you have more money to put toward your financial goals. It will work for you whether those goals are saving money for a house, paying off debt or working toward financial freedom.

Working on and living within a budget and tracking your spending may seem restrictive at first. However, I’d be willing to bet that the excitement over the savings you gain by having a plan for your money will set in fast.

And it will far outweigh any pre-budget sense of restriction you might feel before you start using these powerful financial tools. So are you ready to give it a try?

Feel free to tweak the percentages we suggest to fit your particular spending goals. Just make sure that your percentages add up to 100% each month.

A “zero-based” budget” ensures that every dollar has a “job” and that no money is left unaccounted for. Why? Because unaccounted money often means wasted money.

Consider Using Cash For Monthly Spending

Another personal finance tool that may help you stick to your budget is the cash envelope system. Money is easy to waste, especially in today’s plastic-driven, app-driven virtual banking society.

When using credit or debit cards, you don’t actually see the money leave your hand as you make your purchase. So it’s very easy to forget that it’s the same money that you work so hard for each week. Instead, it’s only a line on your digital bank statement.

Today’s banking technology means that it’s a whole lot easier to spend a little bit of money each day. However, at the end of the month that “little bit” adds up to a whole lot of your paycheck.

This reality leaves a large percentage of people wondering where their money disappears to each month. In the process, they incorrectly assume that they simply don’t earn enough to “make it.”

Try using a cash envelope system for fluid expenses. Use it for groceries, entertainment, meals out and other flexible spending categories. This will help you ensure you’re not spending over the allotted amount in your budget.

Why? Because you commit to only using the money in the envelope for those expenses. Once the money is gone, you’re finished spending in that category for the month.

Setting New Monthly Budget Percentages

One way to avoid the pitfalls of “disappearing” money is to set new monthly budget percentages each month. Do this for each category of your spending. Different months often bring different budgeting needs.

For instance, you might have a special trip to the opera one month that you wouldn’t normally take.

Work to determine at the start of each month how much money you’ll spend in each spending category.

After that, track your spending to be sure you stick to your budget. By doing so, you stand a much better chance of ensuring that your earnings go where you truly want them to go each month.

You also help eliminate the amount of money that “disappears” into the black hole of spending. As you get accustomed to using percentages to plan your budget, know that your numbers might change. You’ll likely find yourself tweaking your percentage amounts to fit your particular monetary needs and goals.

Tweak Your Budget on a Regular Basis

Keep tweaking your budget each month until you find a system that works well for you or your family. Doing so is a vital part of a successful financial plan. No person/family is the same as another.

This means your budget will not work well if you base it on someone else’s budgeting plan. Also, it’s probable that your spending in each category may change from month to month depending on what bills are due.

For example, car tabs are only due one time during the year. This means you’ll likely have a month when you spend more on auto maintenance to cover auto tab costs. Dave Ramsey recommends calculating your annual costs in certain fluid budget categories.

Do this for categories such as auto maintenance, and divide that number by twelve. Then save the necessary amount of cash each month.

Save the money either in your cash envelope for that category or in a separate savings account. That way, when the bigger expense months arrive, you’ve already got the cash set aside.

It doesn’t matter which method you choose but choose something. It’s vital to budgeting success to analyze your spending and budgeting categories each month. You’ll want to see if you need to make changes that will better suit your financial situation.

Summary

Learning to use budget percentages to maximize the success of your financial budget is an important step. It’s a vital part of successful money management and wealth-building.

Use this powerful tool to help ensure that you do indeed reach your financial dreams and goals.

Awesome! Thank you.

I would love to find a single person who can keep their utilities at 5-10%! If we are including electricity, cable, internet, trash, water, and cell phone, etc., it simply isn’t possible unless you are very wealthy and living significantly below your means.

First off, this is budget is not necessarily going to work for everyone. This is not a one budget fits all model because everyone’s situation is different. However, it can be a starting point for those who have no budget at all. Then, tweak the categories that need tweaking and continue to fine tune your budget until you have one that works for you. I wish you luck.

In addition to college debt, mentioned by other people posting, I would like to see how the percentages change if you live in an area where you feel that you should send your child to a private/religious elementary and high school.

Keep in mind these budget percentages are not going to work for everyone exactly as they are listed. Each person’s situation and needs are different. The budget can certainly be used as a starting point and then adjusted to fit your own needs, such as schooling for your children. Thanks for your comments.

So, one question I have with these percentage guides is that even if you follow the “lower bound” recommendation on most of the items, you still can’t stay under 100% if you use the upper bound on any of them. I’d love to be able to budget 130% of my income, but that’s just not possible. The lower bounded recommendation shouldn’t add up to 97%.

Evan – it’s up to you to adjust where needed. These are just suggestions based on averages. Your budget should always equal 100% of your income. f you choose to spend a little more in one category…then you must spend a little less in another.

Hi,

I love the concept. But what about debts?

Should there be a category for that?

There isn’t a recommended percentage for debt. So, if you are over 0%, I would work on getting that down to zero. 🙂

Ideally there would be no debt, Deacon, but about 70 percent of four-year university graduates leave with student loan debt. With a standard repayment plan, it will be part of a budget for 10 years. It is currently about 20% of my monthly net income after taxes and health care benefits are deducted. With a graduated or income-based repayment plan, it would be in my budget for longer, albeit at a lower rate. Such a significant budget expenditure should be included in an article such as this. Young people like me are still refining our budget management skills, and people older than me may return to school for continuing education or to advance their careers and want to plan their education and budgets accordingly.

Well, as mentioned in the post, you need to “tweak these percentages to fit your particular spending goals. Just make sure that your percentages add up to 100% each month.”

The thing is, everyone’s needs are different. My budget won’t be the same as my best friend’s or my neighbor’s or your’s. Budgets are not cut and dry but tailored to each individual person to suit their needs. I wish you luck in setting your’s up to include everything you need it to. It sounds like you are on the right track.

There is and it’s 0-10%.

Laurie, I’ve seen these proportions touted several times; each time I thought that these are debatable. There are two ways to come up with such proportions: average (what is the average that people pay on…) or normative assumptions (earning so much you should…). In both cases, these proportion will be very different (realistically) depending on income or age and stage of life. I’d be very seriously worried about someone in their 60s who still spends 35% of their income on housing. Similarly, people on small incomes usually end up paying higher proportions of the income to live in places that won’t count as luxury even in your wildest dreams. I’m with Daniel on this one: throw this stuff away and think about the life with which you are happy (or content) and how to make sure your money matches it.

I think Daniel’s point was in favor of budgeting and spend tracking, but emphasized the importance of personalizing it. These numbers are an average, but it’s important to pick numbers that fit in with an individual’s needs or wants. Just make sure you are picking numbers and not being flippant or unaware of what you spend.

Hi, Laurie!

I know some successful people who takes these numbers and just toss them in the trash can. I know people who spend way more than 35% with housing and they are fine. Like you said, “Because no person/family is the same as another, no budget will work well if it is based off of someone else’s budgeting plan”.

What I say is: do what you feel it’s right for you and your family, track it, adjust, tweak it, and be happy. It’s what matters the most, after all.

Thanks for sharing!

That’s a great comment, Daniel!!! We’ve had huge success with budgeting and spend tracking. It’s really changed our lives for the better.

I think the housing bucket is one of the biggest keys to having a successful budget. If you own a home and can stick to the 25-30% guide line it leaves you room for other things. Often, we over purchase a home and struggle to pay for other things. This leads to relying on credit cards to cover gaps which is never a good idea.

One of the things that I think is so dangerous about the mortgage lending community is that they allow for a 45% DTI when approving for a mortgage. This DTI is based off of gross income, and can include OT if there’s a 2 year history of it. This is a recipe for disaster for borrowers, and one we fell into ourselves! You’re right, Brian, that 25-30% number is a MUCH safer way to go. Or, no mortgage at all. 🙂