7 Best Stock Market Simulators

Some products in this article are from our partners. Read our Advertiser Discloser.

For most people, investing in the stock market is both exciting and nerve-wracking. Luckily, the best stock market simulators can help reduce investing-related stress.

Stock market simulators (also called trading simulators) give you a chance to test your investment strategies without risking the loss of any real money.

If you are intrigued, read on to learn how trading simulators can help you develop the best investing strategy for your needs.

*Please note that these recommendations are listed in random order, not by recommendation. The simulator you use should be based on personal experience and other factors.

What is a Stock Market Simulator?

In short, a stock market simulator is a computer program that mimics the stock market’s performance.

When you sign on to use a stock market simulator, you receive virtual cash to invest as you please. These simulators typically let you start with $100,000 in virtual cash.

You can purchase and sell investments such as stocks, bonds, ETFs and commodities. As you make your investment decisions, you watch your virtual portfolio balance go up or down.

Many stock market simulators are set up to mimic the actual stock market. They often share real-time pricing, charge brokerage fees and commissions and give you opportunities to dabble in options.

As a trading simulator user, you can practice buying, selling and holding various investments. The longer you use the simulator program, the better your feel for how the market could work.

Working with your virtual portfolio can teach you a lot about how varying investments may perform and what you may stand to gain or lose from the investment strategy you’ve designed.

If your virtual strategy does well over time, you may want to design a similar portfolio in real life. Otherwise, you can revamp your portfolio and try again.

For new investors or investors with a low risk tolerance, a stock market simulator can be a great tool for safely testing investment opportunities.

Keep in mind that while many stock market simulators are free and can be downloaded for instant use, others are tied to brokerage firms that require you to have a real brokerage account.

Top Stock Market Simulators

Each of these stock market simulators is set up to closely resemble the real stock market. This gives you investing experiences that closely mimic actual results.

1. Ziggma

Ziggma was created to help investors manage their investment portfolios. Within Ziggma’s set of management tools is a stock market simulator.

The platform offers both a free account and a premium option. However, the free account doesn’t include the portfolio simulator.

A premium account costs $9.90 per month or $89 per year. To use this simulator, you must open an account and link it to your investment portfolio.

Think of Ziggma as sort of the Empower of investing.

The simulator helps you see the potential impacts of your investment choices. It also has a backtesting feature that lets you create “what if I had” scenarios.

Best for: Investors interested in portfolio management features

Pros

- Affordable for almost any income level

- Multiple features, including backtesting

- Portfolio management tools included

Cons

- No free simulator access

- Need to link your investment account

2. Warrior Trading

Warrior Trading is primarily geared toward day traders. If you’re new to investing, you can check out their Trading Terminology page.

The platform has two paid subscription plans, including Warrior Starter and Warrior Pro. Warrior Starter is a 30-day membership that is meant to help you learn and transition into a Warrior Pro membership.

If you want to determine if day trading is for you, the Warrior Starter plan is the way to go. It is advertised as an “essential trading education program for beginners” and costs $997.

The Warrior Pro program includes unlimited access to Warrior Pro Masterclass courses, live trading room chat access, mentor sessions and more. It costs $5,997 annually.

Warrior Trading’s stock market simulator can be purchased as an add-on to either of these two programs. You’ll pay $99 per month for the simulator and start with $200,000 of virtual cash to trade with.

As a bonus, Warrior Trading also has a free online trading course and a free e-book.

Best for: Investors interested in day trading who can pay the course fees

Pros

- Includes comprehensive training programs and courses

- Stock market simulator partnered directly with NYSE and NASDAQ

- Real-time Level 2 quotes and instant order execution

- Advanced performance reports

Cons

- Expensive

- Training is focused on day trading, a higher-risk form of investing

3. MarketWatch Virtual Stock Exchange (VSE)

The MarketWatch VSE is a free stock simulator that allows you to build your portfolio and watch the markets react in real-time.

It’s a customizable game that allows you to set your budget and perform a variety of market moves. You can allow or disallow short selling, margin trading, and more.

When you register to use MarketWatch’s VSE, you can either join a game or create your own. You can also invite others to compete against you to see whose strategy comes out on top.

One of the great things about the platform is that you can use MarketWatch’s extensive educational library to learn about the market as you make your investment choices.

MarketWatch VSE also has a community where you can discuss investments and see how others are investing.

Pros

- Suitable for any type of investor

- Free to use

- Allows you to join an existing game or create your own

- Option to compete with family and friends

Cons

- No trading of options

- Registration required

Best for: Investors who love a little competition

4. Thinkorswim by TD Ameritrade

Thinkorswim is a trading platform owned by TD Ameritrade. Along with many real-life trading options, Thinkorswim also includes a simulator as a part of its trading platform.

If you are a current TD Ameritrade customer or you open an account to become one, you can use the Thinkorswim simulator.

You’ll get $100,000 in virtual cash to use with your Thinkorswim simulator. It’s easy to use the “add simulated trades” button to test out as many strategies as you want.

With Thinkorswim, you can practice trading in stocks and commodities. Options and futures contracts are available as well, while real-time quotes are available upon request.

Thinkorswim covers all of the simulator bases, from educating clients to giving them access to life-like experiences with its simulator. As a result, it is great for all levels of investors.

Pros

- Allows virtual investing for everything from stocks to forex

- Free to use for TD Ameritrade customers

- 60-day trial for non-customers

- Caters to beginning and experienced investors

Cons

- Must have a TD Ameritrade account to use long-term

Best for: Any investor, but is especially beneficial for new investors

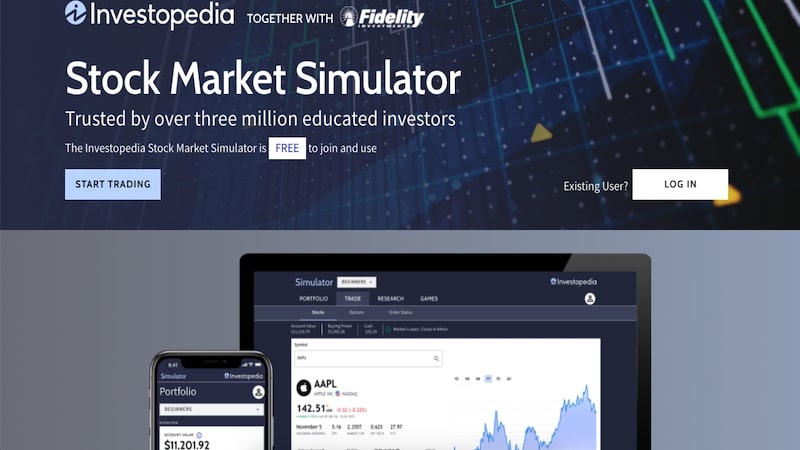

5. Investopedia Stock Simulator

The Investopedia stock simulator is free to use and gives you $100,000 in virtual cash to play with on the stock market.

It has a great community component where you can connect with over 700,000 other investors to share ideas and glean information.

Investopedia’s simulator lets you trade U.S. listed stocks and ETFs. It also gives you the ability to buy options.

This simulator offers a delayed data feed and is off from the real market by about 20 minutes. However, it’s one of the easiest simulators to use and can be a great choice for new investors.

Pros

- Wide range of educational articles available

- Free to use

- Easy to use for new investors

Cons

- Delayed data feed instead of real-time

- No charting

Best for: Those looking for a community of investors to learn from

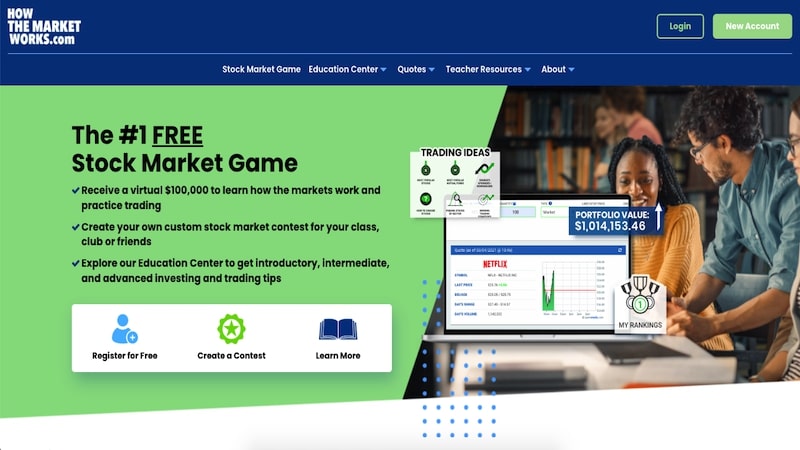

6. HowTheMarketWorks

HowTheMarketWorks was one of the first stock market simulators invented. Users can open a free account and start with $100,000 in virtual cash.

There is an education section on this simulator with various articles geared toward both beginner and advanced investors.

Some stock and ETF quotes are real-time on the game, but others have a 15-20 minute delay. You can join an existing game or create your own and invite family and friends.

Furthermore, there is a Teacher Tools section that allows you to create accounts for your class and work on investment education together if you are an educator.

Pros

- Comprehensive educational tools

- Free to use with registration

- Real-time trading simulation in most cases

- Teacher/classroom tools

Cons

- No options, futures or commodities trading

Trustpilot score: N/A

Best for: New traders who are just getting involved in investing

7. TradeStation

TradeStation’s simulator is free to use when you open a TradeStation brokerage account or purchase a TradeStation Analytics Software subscription.

If you open a brokerage account, you can choose between the TS Go account and the TS Select account. Each account has different features and benefits.

TradeStation Analytics Software subscriptions start at $99 per month.

Keep in mind that the TradeStation simulator is more geared toward day traders than long-term investors.

Newer investors will enjoy the learning tools but need to be prepared to put in some study time.

Pros

- Several community forums

- Intuitive mobile app available

- Real-time numbers

Cons

- No free account options

- Might be too costly for many investors

- Geared toward day traders

Best for: Day traders and experienced investors

Key Features of Stock Trading Simulators

When you’re searching for a stock simulator to use, it’s important that the simulator contain key features that will give you the best user experience.

Here are some features to look for when you’re searching for a stock simulator.

Real-Time Market Resemblance

The stock market simulator you use should resemble the actual stock market very closely. Testing investment strategies on simulators that don’t closely resemble the real market will result in skewed returns.

Educational Tools

The best stock market simulators have a host of educational tools available to users. This feature is especially vital if you’re new to investing.

Consequently, you should look for simulators that focus heavily on education, especially if you are a newer investor.

Multiple Investing Options

Unless you’re testing one or two specific strategies, your stock market simulator should offer a wide variety of investing options.

It’s beneficial to use simulators that will allow you to test investing in everything from stocks to forex to commodities and more.

FAQ

Before you choose a stock market simulator, it’s important to get all your questions answered. Here are some commonly asked questions about this type of investing tool.

Stock market simulators range in price from free to quite expensive. Look at plans and prices to help determine the right simulator for your needs and your budget.

This depends on each individual user. Every simulator is unique, and each user has different likes, dislikes and goals.

Fortunately, there are simulators that cater to investors of all experience levels and that offer all types of investments. One great option is Thinkorswim.

The stock market simulators we mention here are safe to use. They use fictitious funds.

While some will cost you real money in the form of fees, you won’t use real money to invest.

If you decide to invest money in the stock market using the strategies you tried with the simulator, do exercise caution. There is no guarantee you will have the same results.

How Do The Stock Market Simulators Compare?

| Company | Trustpilot |

| Warrior Trading | 4.9 |

| MarketWatch Virtual Stock Exchange | N/A |

| Thinkorswim | 3.4 |

| Investopedia Stock Simulator | 4.0 |

| HowTheMarketWorks | N/A |

| TradeStation | 1.6 |

| Ziggma | N/A |

Summary

Using a stock market simulator can be a great way to learn more about investing if you are a beginner. It can also be an excellent way to test your personal investment strategies or ones recommended by others.

Trying investment strategies using a stock market simulator before you invest your real hard-earned cash in the stock market can be a wise decision.

Choose the best simulator for you by evaluating your needs and budget, then start practicing to increase your confidence when it comes to investing.