9 Best Crypto Platforms

Some products in this article are from our partners. Read our Advertiser Discloser.

Many people are looking for an efficient and secure place to buy cryptocurrency. The best crypto exchanges have low fees, multiple investment options and easy access to your holdings.

These platforms let you trade Bitcoin, Etherum and many altcoins. It’s even possible to earn interest on your cryptocurrency holdings.

Top Cryptocurrency Platforms

Each cryptocurrency trading platform has different benefits and fees. If altcoin investing interests you, make sure to compare the investment options as well.

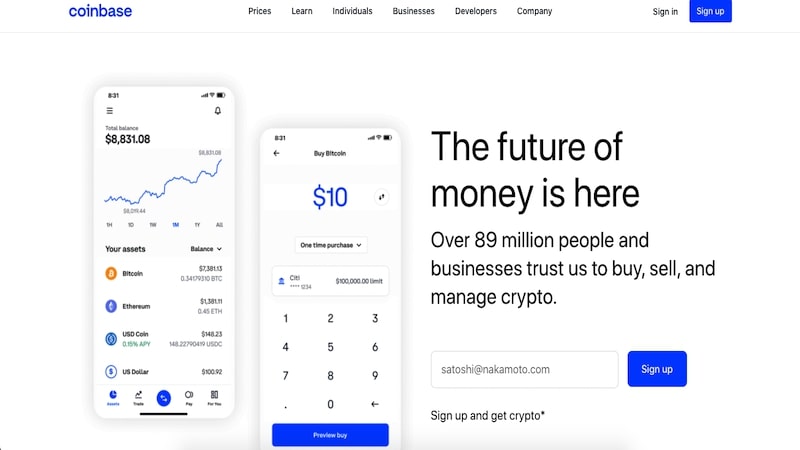

1. Coinbase

Coinbase is the largest crypto exchange in the United States. It’s easy to use for first-time buyers and has many investment options.

With Coinbase, you can earn free cryptocurrency rewards for select coins by watching short videos and answering quiz questions with the Coinbase Earn feature.

Buyers can fund trades with fiat currency from a linked bank account, debit card or PayPal.

In addition, the platform executes trades in real-time. This means that you don’t have to wait for the fund transfer to complete and potentially miss the perfect buy-in price.

While you are less likely to find newer altcoins that have a small market cap on Coinbase, you can easily find many of the most popular cryptocurrencies.

The trading fees for the standard Coinbase platform can be higher than the competition. Instead, consider using the Coinbase Pro platform with lower trading fees similar to competing services.

Here are a few other Coinbase Pro benefits:

- Use candlestick price charts to find price trends

- Place limit-type orders to buy or sell crypto at a specific price

- Use the order book to see transaction prices and amounts of recent orders

Digital vault storage is free for long-term offline storage. However, users cannot see their private storage keys to easily transfer coins to another wallet.

Pros

- Easy to use

- Many account funding options

- Can earn free cryptocurrency with short quizzes

- Coinbase Pro has reduced fees and technical analysis tools

Cons

- High transaction fees for the standard platform

- Fewer investment options than other exchanges

- Users may not have private key access

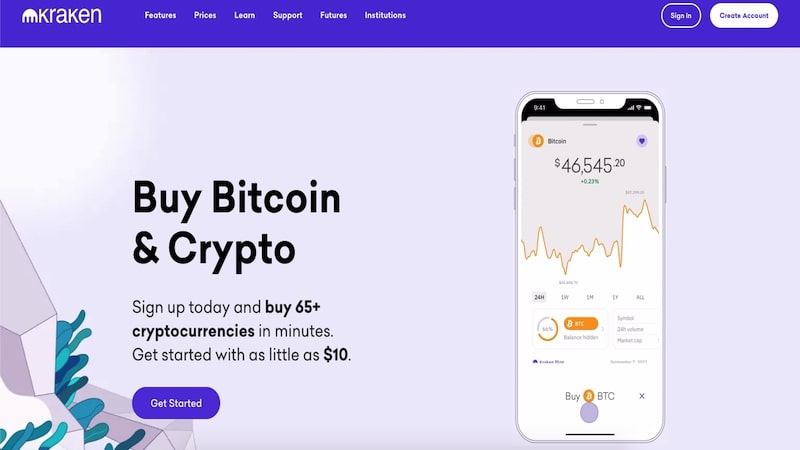

2. Kraken

Kraken is another popular exchange that offers low fees and many crypto trading options.

The platform can be a little harder to use than Coinbase because it’s built for technical traders. If you already use the Coinbase Pro platform for the reduced fees, the experience is similar.

Users can access technical analysis price charts and the real-time order book.

Funding your account with cash can be more complex than other exchanges. You may need to wire transfer funds from your checking account instead of linking a bank account with standard ACH transfers.

Existing cryptocurrency holders can transfer their crypto positions to fund a Kraken account and exchange them for other coins.

Investors can also stake participating coins and earn interest. Staking rewards can be earned twice a week.

Aggressive traders who are comfortable using leverage can open margin accounts and also trade futures. Keep in mind that this feature is too risky for most investors.

Pros

- Over 50 investment options

- Low trading fees

- Technical charting tools

- Can stake cryptos and earn interest

Cons

- Must wire transfer cash deposits

- Harder-to-use platform for new investors

- No basic web layout like Coinbase or Gemini

3. Gemini

Gemini offers a standard platform that’s easy to use and has a similar feel to most investing apps. Advanced traders wanting technical analysis tools can use the ActiveTrader platform.

Like other exchanges, the ActiveTrader platform may charge lower transaction fees. Overall, this service has competitively low fees if you use the beginner-friendly standard web or mobile platform.

The exchange has a wide variety of cryptocurrencies you can trade. Other platforms may have more options, but you will find well-known and newer coins here.

It’s also easy to fund your trading account with ACH transfers from a linked bank account. Wire transfers and cryptocurrency transfers are available as well.

Some unique Gemini features include:

- Gemini dollar, an interest-earning stablecoin with a 1:1 backing to the U.S. dollar

- The ability to stake select cryptocurrencies and earn interest

- A Gemini wallet to pay for purchases with crypto at participating merchants

Users that want extra security layers may also prefer Gemini for its offline cold storage feature.

You can make instant withdrawals from the offline wallet instead of waiting several days like similar alternatives. However, you pay a $125 fee per withdrawal for the convenience.

Pros

- Low trading fees

- Basic and advanced trading platforms

- Can stake and earn interest

- Available in every U.S. state

Cons

- Fees are higher for the basic platform than ActiveTrader

- High offline storage withdrawal fee

4. Binance

Consider Binance if you want an advanced trading platform with over 50 cryptocurrency options. You can also swap your fiat and existing crypto positions for the BNB stablecoin.

The platform may also provide exposure to altcoins other exchanges don’t offer.

It’s important to note that the United States version (Binance.US) has fewer investment options than the international Binance.com which can restrict U.S. residents due to industry regulations.

Trading fees are competitive. You will pay a little higher fee for instant buy orders and pay the mid-market range between the current buy and sell price.

To secure a lower price, consider placing limit-type orders with a maximum trade price.

There is a basic platform built for beginner investors and an Advanced Trading platform for technical traders. The trading fees can be lower for the active trading level.

Experienced investors can trade over 100 cryptocurrency pairs instead of funding buy orders with fiat currency. You can also fund your account by linking to a bank account or via wire transfer.

Like other exchanges, you can stake crypto positions and earn interest. Unfortunately, the platform doesn’t offer staking rewards on as many tickers as other exchanges.

Pros

- Many investment options

- Basic and advanced platforms

- Several account funding options

Cons

- Few staking rewards

- No offline storage option

5. eToro

If you want to trade stocks and crypto on the same platform, eToro is worth a look. You can either buy the actual cryptocurrency or derivatives plus stocks.

Cryptocurrency derivatives are the same investment product that investing apps like Robinhood, Public, or Webull offer and trade like stocks.

You can’t spend derivatives or access the private keys, but you can have a similar performance to the actual cryptocurrency.

eToro doesn’t charge any transaction fees to buy or sell crypto and stocks since it’s a free investing app. However, you will pay $5 per account withdrawal, and the minimum withdrawal amount is $50.

You might like the investment product flexibility if you prefer holding real cryptocurrency and dollar-based crypto derivatives.

The platform has approximately 15 cryptocurrencies you can trade. While you can invest in the most-traded coins, other exchanges offer at least 30 to 50 tickers.

New investors may also like the CopyTrader portfolio option. If you’re unsure which cryptos or stocks to invest in, you can buy into a managed portfolio that mimics the buy-and-sell actions of experienced traders.

All users also get a $100,000 paper trading account to practice investing before committing real money.

Pros

- No trading fees

- Copytrading portfolios

- Can trade cryptocurrency and crypto derivatives

- $100,000 paper trading account

Cons

- Limited investment options

- Not available in every U.S. state

- $5 account withdrawal fee

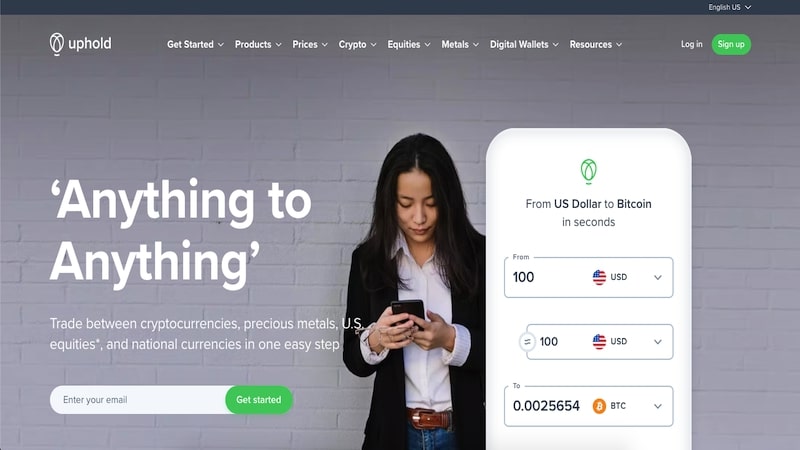

6. Uphold

Uphold is one of the best cryptocurrency exchanges for altcoins that may not be available on other platforms. You can fund your account with U.S. dollars from a linked bank account or trade pairs from your existing crypto position.

International investors may prefer Uphold since they can send money overseas on the platform. You can use crypto or fiat currency to fund remittances.

The platform fees for cryptocurrency trading and money transfers can be lower than other exchanges.

You won’t pay trading fees when you buy or sell crypto. A few other platforms have a similar policy. However, you pay a spread fee that can vary.

Pros

- No trading commissions

- Can send cryptocurrency and funds overseas

- Many investment options

Cons

- Spread fees on trades can be high

- The unique features can make the platform confusing

Best for: International investors

7. Crypto.com

Crypto.com offers more investment options than most exchanges because you can trade as many as 90 cryptocurrencies. Most of the largest platforms offer approximately 50 trading options.

Users who sign up at Crypto.com can earn an extra USD$10 Sign-Up Bonus when they stake in 1000CRO as first stake.

You can fund your account with linked bank transfers, payment cards or existing crypto balances.

The fees can be lower or competitive with exchanges that have an active trading platform. You will either pay a maker fee or taker fee depending on how quickly your order fills.

The platform offers technical analysis research tools that can benefit new and experienced investors.

It is important to note that this service can be harder for beginner investors because it doesn’t offer a basic platform like Coinbase or Gemini.

Several notable Crypto.com features include:

- Earn interest on 35+ tokens

- Private keys access

- Pay for purchases with crypto

- Trade NFTs (non-fungible tokens)

Investors can earn a higher interest rate on this platform than the competition. Having immediate access to the private keys is also convenient.

Pros

- Many investment options

- Earn up to 14% interest on tokens

- Competitive fees

Cons

- No basic platform for new investors

- No educational resources

- High staking rewards require a large balance

8. Bitcoin IRA

Bitcoin IRA is one of the few platforms that lets you trade cryptocurrency in a tax-advantaged account. Many exchanges only allow you to buy cryptocurrency in taxable accounts.

You can transfer an existing IRA or 401k if you’re willing to swap your stock market investments for a more volatile asset.

This self-directed IRA holds alternative assets and charges several service fees your stock market retirement account most likely doesn’t.

Some of the Bitcoin IRA fees include:

- Annual custodian fee: $240

- Selling transaction fee: 1%

- Buying transaction fee: 5%

These fees are higher than other exchanges, but the tax benefits can be worth it if you have a high cryptocurrency balance.

One potential downside of this platform is the narrow list of investment options. You can hold legacy coins like Bitcoin and Ether, but Stellar Lumens (XLM) is one of the only altcoins Bitcoin IRA currently supports.

Unfortunately, the platform currently doesn’t support next-generation altcoins like Cardano or PolkaDot which are popular but not as widely traded.

The good news is that you can earn interest on your crypto holdings. This passive income can also grow tax-advantaged.

Pros

- Tax-advantaged retirement account

- Can earn interest on holdings

Cons

- High fees

- Limited investment options

9. Hodlnaut

Hodlnaut is an excellent option for long-term investors who want to earn interest on their cryptocurrency holdings.

You will need to transfer your balance from an existing wallet as there isn’t an exchange to buy or sell. But, you can trade for another cryptocurrency the platform supports.

Currently, the platform supports these tokens:

- Bitcoin (BTC)

- Ether (ETH)

- Tether (USDT)

- USD Coin (USDC)

- DAI (DAI)

- Wrapped Bitcoin (WBTC)

You can earn weekly interest payments on your deposits. The current interest yields are at least 6% APY.

To convert your interest income to cash, you will need to transfer the balance to another exchange supporting fiat currency.

There are zero deposit fees or token swap fees, but you pay a fee on the withdrawal amount. The withdrawal fee varies by token and can be reasonable as most platforms charge transfer-out fees.

Some of the current withdrawal fees are:

- 0.0004 BTC

- 0.005 ETH

- 18 USDC

There are no account fees, and the withdrawal fee is the only platform cost.

Pros

- Earn interest on cryptocurrency deposits

- Weekly interest payments

- No deposit or exchange fees

Cons

- Cannot deposit cash

- Withdrawal fees apply

- Limited investment options

Best for: Earning interest on cryptocurrency and stablecoins

Frequently Asked Questions

While any cryptocurrency exchange can help you buy or sell your desired cryptocurrencies, there are several factors to consider to choose the best platform for your goals.

Most cryptocurrencies are easy to use and have similar investment options.

When considering your investment options, ease of use, trading fees and storage fees are factors to evaluate.

Additionally, any cryptocurrency exchange should let you invest in well-known tokens like Bitcoin. If you want to buy altcoins like Dogecoin, you should verify the platform offers it before funding your account.

Most crypto exchanges are safe and have extensive security procedures to prevent account breaches. Two-factor authentication (2FA) and strong passwords are common security practices.

However, cryptocurrency doesn’t have the same financial protections as an FDIC-insured bank account or an SIPC-insured stock brokerage account.

Consider storing cryptocurrency you plan on holding long-time in an offline crypto wallet.

Most cryptocurrency exchanges charge transaction fees, which are a fixed dollar amount ($0.99 to $2.99) or a percentage of the transaction amount (0.01% to 0.50%).

Exchanges may also charge account funding fees and withdrawal fees.

A few exchanges don’t charge transaction fees but charge a spread fee they include in the purchase price or sell price instead.

Crypto exchanges let you buy, sell or trade cryptocurrencies with fiat money or another token. You can store your holdings in an online “hot wallet,” but it’s more susceptible to hackers.

Crypto wallets may let you store your cryptocurrency private keys on a secure online server or an offline device like a USB device. Several wallets will let you pay for purchases with your current balance.

Summary

A cryptocurrency exchange can be the best way to buy this digital asset since you can access your private keys and purchase more altcoins than stock investing apps offer.

Some platforms offer cold storage, interest rewards and payment capability for extra flexibility. You may need to join several platforms if you want to invest in various altcoins beyond the most popular cryptocurrencies.

Consider the investment options, platform fees and research tools as you identify the best crypto exchange for your investment strategy.