7 Top Free Software Picks to Maximize Your Refund

Some products in this article are from our partners. Read our Advertiser Discloser.

Many people may not realize that you can file your taxes for free. Several online tax software companies provide certain filers with no-fee federal tax filing. Some offer free state filing as well.

All the tax software options below offer free filing, but qualifications vary. To minimize unpleasant surprises come tax time, we’ll share what it takes to qualify for the free version and what bumps you into a paid tier.

Top Free Tax Software

Not all tax filing software is created equal. Some offer more robust free federal filing options, while others nickel and dime you once you cross a certain threshold.

Many free tax filing options are only available early during tax season. However, with the 2024 filing tax deadline being April 15th, free filing may still be accessible.

Before filling out your tax return, check with the software you are using to make sure free filing is available.

Here is a list of the best free tax filing options.

1. Cash App Taxes

Cash App Taxes is the only 100 percent free tax filing software that allows you to take deductions and credits without an upcharge. This means all users get free federal and state tax filing.

It’s important to note that not every situation is covered. Cash App Taxes does not have a paid option for more complicated returns.

For the average user who has a straightforward tax return, Cash App Taxes is a great option. The software will guide you through the filing process, only showing you the sections you need to complete based on your situation.

You can even import last year’s tax return from other tax software such as H&R Block and TurboTax.

The software supports the most common tax forms, including:

- 1099s

- Itemized deductions (Schedule A)

- Business profits or losses (Schedule C)

- Child tax credit (Schedule 8812)

- Earned Income Credit (Schedule EIC).

Some situations that are not supported include multiple state returns and nonresident state returns.

Best for: Those who want free tax prep and filing that may not qualify for other free offers

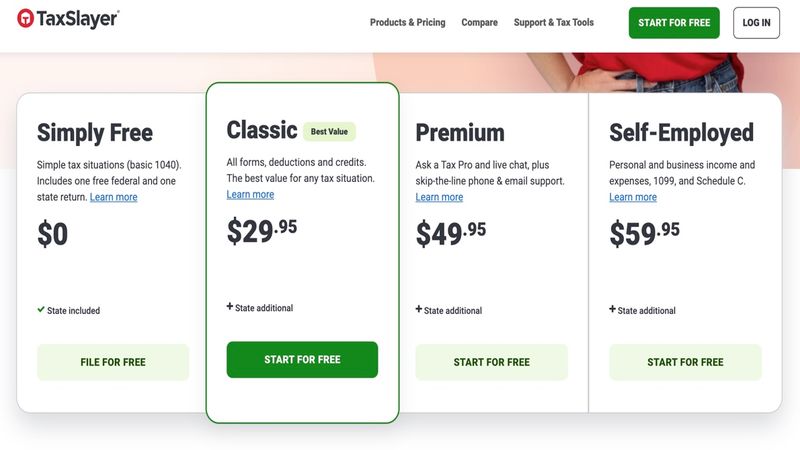

2. TaxSlayer

TaxSlayer has a free option for those who have a simple tax situation and need to use the basic 1040 tax form. It’s called Simply Free, and it includes one free federal and one free state return.

The free return is limited, but it covers education expenses such as student loan interest deductions and education credits.

More complicated situations, such as HSA contributions or claiming the Child Tax Credit, will bump you into a paying tier.

The software allows you to upload your previous tax return, making it easier to switch from another tax prep service. It also includes unlimited email and phone customer service support at no extra charge.

Best for: Filers who have a simple tax situation using the basic 1040 tax form

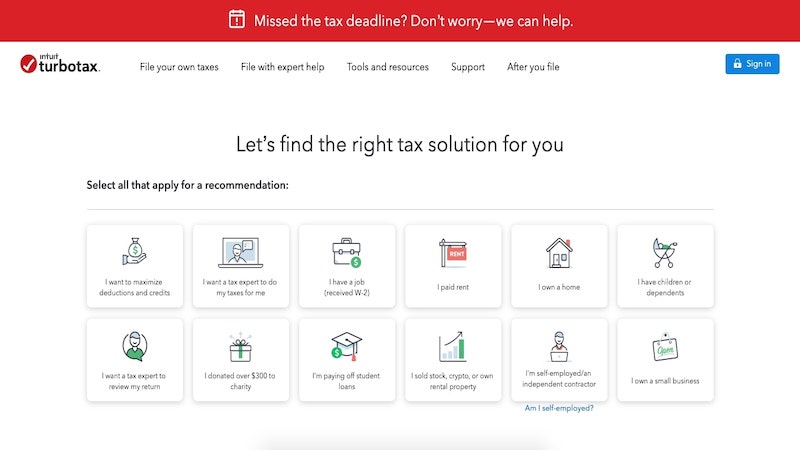

3. TurboTax

TurboTax is one of the most well-known names in tax preparation and filing.

Similar to other software companies, they offer a free option for simple tax returns. The free version covers Form 1040 or Form 1040 plus unemployment income.

Other situations covered by the free edition include:

- W-2 income

- Limited interest and dividend income

- Standard deduction

- Earned Income Tax Credit

- Child tax credits.

If you meet the criteria, you can use TurboTax to file free federal and state tax returns.

Best for: Filers with simple tax returns and those taxpayers with W-2s

4. H&R Block

Another solution is H&R Block. It has a free option that allows users to file their federal and state taxes at no cost. However, the free version has many limitations.

The free filing version supports W-2 income, unemployment income and student loan interest. If you want to claim deductions and credits or have HSA contributions, you will have to pay to file your taxes.

For filers with straightforward returns, H&R Block offers a good value from a known industry brand. The software will also make sure you receive the right credits, including the Earned Income Credit, for free.

H&R Block offers a price preview feature that shows you the price for your return, so you always know if you get bumped into a paid tier. If you qualify for a tax refund, you will get real-time updates on what to expect.

Additionally, if you used another tax prep service to file last year’s taxes, you can import that tax return into H&R Block.

Best for: Filers with simple W-2 or unemployment income only claiming student loan interest

5. TaxAct

TaxAct is an IRS Free File partner. This is a public-private partnership between the IRS and several tax preparation and filing software companies.

The company offers free federal and state tax return filing if you meet certain criteria. To qualify, you must have an adjusted gross income of $63,000 or less and be age 56 or younger or eligible for the Earned Income Tax Credit.

Alternatively, you can file for free if you’re active duty military with an adjusted gross income of $72,000 or less.

If you meet the above criteria, your federal tax return filing will be free. State tax return filings are only free for select states, with the complete list shown on their site. Other users will pay $19.95 for state tax return filing.

The free tier allows filers to report W-2, retirement and unemployment income. It also supports claiming credits and deductions.

Users can import prior-year tax returns to make the process easier. The software has paid tiers and can bump you into those for things like student loan interest or HSA contributions.

Best for: Filers who aren’t claiming student loan interest or HSA contributions

Learn More: TaxAct Review

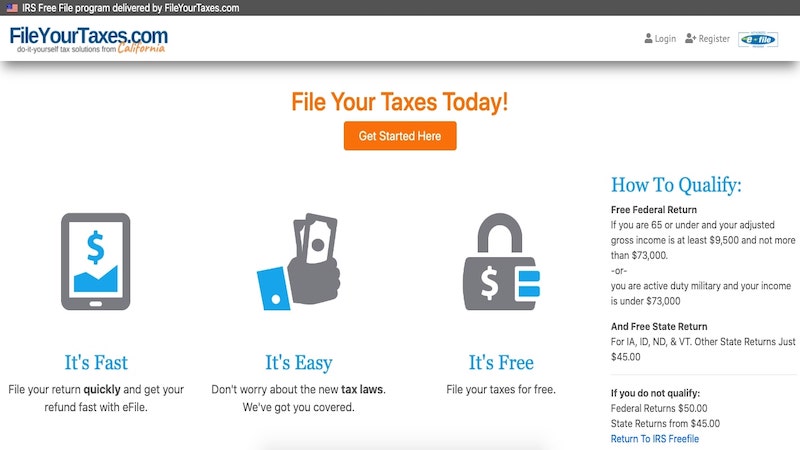

6. FileYourTaxes

FileYourTaxes is another IRS Free File partner. You can file your federal tax return for free if you are 65 or younger with an adjusted gross income between $9,500 and $72,000.

It’s also available to active duty military members with incomes under $72,000.

Filers in Iowa, Idaho, North Dakota, and Vermont can get free state returns. Those in other states will be charged $37.95 for the state tax filing.

If you do not meet the qualification criteria, you will be charged $44.75 to file your federal taxes and $37.95 to file your state taxes.

Best for: Filers who meet specific qualification criteria and active duty military members

7. FreeTaxUSA

FreeTaxUSA is another IRS Free File partner offering free federal tax returns depending on your situation. The tax prep software offers different levels depending on your income, credits and deductions.

It supports many credits and deductions, including:

- Homeownership

- HSA contributions

- Earned Income Credit.

Besides W-2 income, you can report income from investments, a small business or Schedule K-1. You can also import prior year returns from TurboTax, H&R Block or TaxAct to make switching easier.

While federal tax filing is free, state returns are $14.99. Pricing is transparent and displayed on the landing page.

You have the option to upgrade to a deluxe version for $6.99, which includes priority live chat support, unlimited amended returns, and audit assistance.

Best for: Filers with no state tax filing requirement

Learn More: FreeTaxUSA Review

Frequently Asked Questions

Here are answers to some common questions about the best free tax software for filing your tax return.

It depends. There are several tax filing software companies that offer a free filing option if you meet certain criteria. Some offers only cover free federal tax filing and charge you to file state taxes.

In 2024, only Cash App Taxes offers free tax filing for all users for both federal and state taxes. However, it doesn’t cover all tax situations.

Yes, most of the tax prep companies with free filing have restrictions on who qualifies. Criteria will vary from software to software, so make sure you meet the guidelines before starting your return.

Many companies have paid tiers and will charge you if you don’t meet the free filing criteria. Check what the free version covers so you don’t end up with a pricey surprise after spending hours entering your information.

It depends. Some tax prep software companies only offer free federal tax returns, while others also extend the free offer to state filings. Always check the price for both before getting started.

In 2024, Cash App Taxes, H&R Block, TaxSlayer, and TurboTax all offer both free federal and state tax filings if you meet certain criteria.

Even if you have a basic tax return, you may not qualify for free tax filing. If you want to deduct student loan interest, HSA contributions or claim tax credits, you may have to pay to file your taxes.

Many tax prep software companies will bump you into a higher tier and require that you pay before filing your return.

Summary

Free tax filing exists for those who meet certain criteria. However, most tax software options have a paid tier, and many credits and deductions could make you ineligible to file for free.

However, paying for your tax return may be a good option if it means you get tax deductions and credits that result in a higher refund.

Don’t opt for a free version if it means you’ll have a smaller tax return. Choose the option that is right for your situation.