FreeTaxUSA Review: Is it Legit?

Some products in this article are from our partners. Read our Advertiser Discloser.

Can you really file your taxes for free? It’s possible to file any federal tax return for free. Learn how with our FreeTaxUSA Review.

Note that you will need to pay to file your state tax return. The good news is that filing fees are significantly lower than competing software.

This software might be the best way to file your taxes this year to get the same results at a crazy low price.

Overall Rating

Summary

All federal tax returns cost $0, and state tax returns cost $14.99 with FreeTaxUSA. This option is one of your most affordable if you’re comfortable preparing your own taxes. However, there isn’t an option for one-on-one tax advice.

-

Ease of use

4.5

-

Reputable

4.5

-

Tax advice

3.5

-

Fees

4.5

Pros

- Affordable

- Free Fed tax returns

- Easy to use

Cons

- No personal tax advice

- No free state returns

- Limited customer service

What is FreeTaxUSA?

FreeTaxUSA has been offering online tax filing since 2001. In fact, this platform is one of the first IRS Free File Alliance members.

Since launching, FreeTaxUSA states it’s filed over 50 million federal tax returns.

The primary appeal of this tax software is the ability to file complex tax returns for free. While you will need to pay $14.99 per state return, you can easily save at least $100 in comparison to the most expensive DIY software.

You may consider using this service if you’re confident in preparing your taxes by yourself and tire of paying high tax preparation fees.

How Does FreeTaxUSA Work

You can file your federal return for free and state tax returns for $14.99.

FreeTaxUSA can even be free for these advanced tax situations:

- Earning self-employment income

- Selling stock investments in a taxable account

- Earning rental property income

- Filing an itemized return

It’s also possible to file business taxes that report on a Schedule K-1.

However, this platform is barebones and lacks advanced features like syncing to your bank and investment accounts. This service doesn’t offer a tax expert review option either.

You can import last year’s tax return but must manually input the box data from each end-of-year tax form. It can take a long time to prepare your taxes if you have a lot of tax documents that won’t upload automatically.

Advanced support features like priority customer support and audit assistance are available if you upgrade to the “Deluxe Edition” that costs $6.99.

These advanced features can help prevent tax prep errors and provide peace of mind.

Non-Supported Tax Items

Certain complex tax situations are not compatible with FreeTaxUSA.

Some non-qualifying tax situations include:

- Foreign employment income (Form 2555)

- Customers living outside the United States when they file their return

- Archer Medical Savings Account MSAs (Form 8853)

- Donations of tangible items exceeding $5,000

- TaxFreeUSA supports publicly-traded security donations above $5,000

Receiving Your Tax Refund

If you get a tax refund this year, congrats. FreeTaxUSA lets you receive your refund via direct deposit into a checking account or savings account.

Most federal refunds process within 21 days of the IRS accepting your e-file return.

You can also request the IRS to mail a check or debit card. However, it can take up to one month to receive your refund.

Either option is free when you pay your FreeTaxUSA fees upfront with a credit or debit card.

Otherwise, you will pay an extra $19.99 if you have FreeTaxUSA withhold your tax prep fees from your refund.

How Much Does FreeTaxUSA Cost?

FreeTaxUSA is 100% free for all federal tax returns. However, you must pay up to $14.99 for each state return.

All filers pay the same fee amount no matter how complex their federal tax return is.

Since you must pay to file state returns, this service may not be the best if you qualify for a free federal and state return.

There a couple of different add-ons you can pay for:

- Deluxe Plan: $6.99

- Tax extension (Form 4868): $0

- Pay filing fees with your tax refund: $19.99

- Pay filing fees with a debit or credit card: $0

- Unlimited amended returns: $14.98 ($0 with Deluxe)

- Mailed Printed Return: $7.99

- Professionally Bound Tax Return: $15.99

You will need to decide if you want to stick with the free version or upgrade to the Deluxe edition. The Deluxe plan has a one-time $6.99 fee.

Here is a closer look at the Free and Deluxe editions of this tax software.

Free Edition

The free version gives you full access to platform. You can claim advanced tax credits and deductions that other software charges an upgrade fee.

FreeTaxUSA charges the same price for all tax returns:

- Federal: $0

- State: $14.99 per state

Note: Filing your state return late may result in higher fees for some services.

If your state has no state income tax, you can very likely pay $0 to file your taxes. Assuming you have a simple tax return, other software like TurboTax waive the state filing fee.

FreeTaxUSA is one of the most affordable options in these situations:

- If you can itemize

- You sold investments

- If you earned self-employment or freelance income

- You own a rental property

For example, a self-employed person can pay as much as $168 to file their federal and state return using TurboTax. Or they can pay $14.99 with FreeTaxUSA.

Downsides to the free plan include a lack of live technical support and IRS audit assistance. You will need to upgrade to the deluxe edition to access these amenities.

Deluxe Edition

As mentioned earlier, for $6.99 you can upgrade to the FreeTaxUSA Deluxe Edition.

Premium benefits include:

- Priority support with live chat

- Unlimited tax return amendments (i.e., Form 1040-X)

- IRS audit assistance

You may consider upgrading to this service as you will pay less than choosing it after you file.

Key Features

Here are some of the benefits of a using FreeTaxUSA to file your taxes for free.

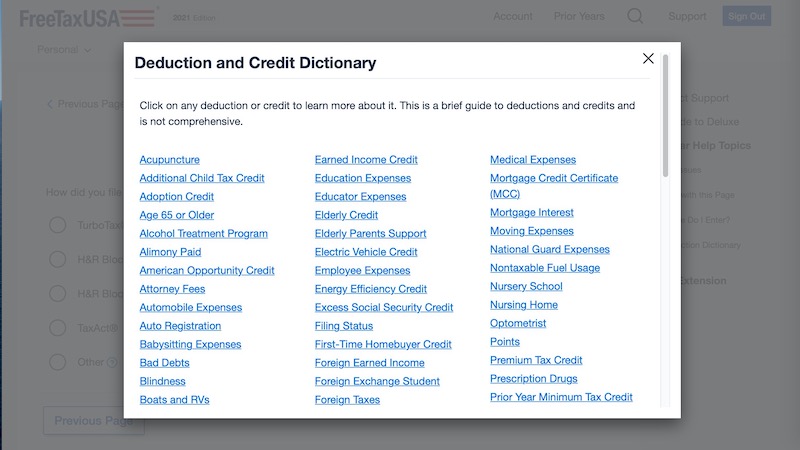

Advanced Tax Deductions and Credits

The free version offers advanced tax deductions and credits that other software may require you to upgrade to claim.

Two examples include home mortgage interest and health savings account deductions.

Basic tax benefits like the Child Tax Credit, Earned Income Credit, and student loan interest are also supported.

There is an online tax deduction library that can help you claim applicable tax savings.

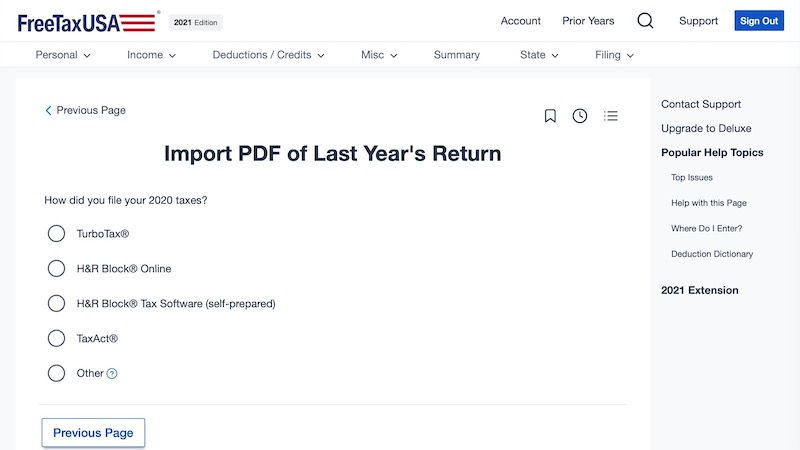

Free Import of Last Year’s Return

You can import last year’s return for free from TurboTax, H&R Block and TaxAct. All other tax documents will need to be manually entered.

The lack of auto-import tools is a nuisance, but it’s a tradeoff for cheap tax software.

Live Chat Support

You may need to wait several hours–or even the next day–to finish your return.

Premium members get live chat technical support Monday through Saturday, 8 am to 11 pm Eastern Standard Time.

You can resolve any technical errors in real-time to complete your return in one session.

Once again, live chat is only for technical support and not tax advice.

Unfortunately, free members can only send an email or an online message if they have trouble preparing their return.

Neither the free nor deluxe plan offers one-on-one tax guidance. FreeTaxUSA does provide answers to common tax questions that are accessible online 24/7.

Unlimited Tax Amendments

If you forget to report a tax form or mistype a number, you will need to file an amended tax return with accurate results.

On the federal level, this is Form 1040-X. All legit tax software lets you file amended returns for an additional fee.

FreeTaxUSA charges $14.98 for unlimited returns if you file under the free edition. With the Deluxe version you don’t pay for amended returns.

Most people may never file an amended return in their life. But perhaps you might need to.

For example, maybe you didn’t know your college side hustle is taxable income.

Or maybe you forgot about some side hustle work you did early in the year.

Audit Assist

If your tax return is subject to an IRS audit, FreeTaxUSA provides complimentary assistance to Deluxe users.

However, this doesn’t mean in-person representation with the IRS agent.

Instead, the company’s audit specialist will guide you through the audit prep process. You can have the necessary information to answer the auditor’s questions.

These benefits do not appear to extend to a state tax return audit.

As you complete your return, FreeTaxUSA’s software looks for audit red flags. For example, maybe you forgot to include all the boxes from a form 1099.

Or you accidentally claim an irrelevant tax deduction.

Fixing these errors won’t prevent a tax audit. But the verification is part of TaxFreeUSA’s 100% accuracy guarantee.

Tax Extensions

It’s free to file a federal tax extension with FreeTaxUSA. You have an additional six months to file your federal return.

This feature is handy if you don’t have all of your necessary tax documents yet.

If you owe the IRS money this year, those taxes are still due on the federal tax deadline. It’s April 18, 2022, for your 2021 tax year return.

After the federal tax deadline passes, any unpaid balance is subject to interest and penalties.

Prior Year Tax Returns

If you haven’t filed the tax return for a previous year (and need to), TaxFreeUSA can be your cheapest option. Your federal return costs $0, and each state return costs $17.99.

As of February 2022, you can file prior year returns for tax years 2014 through 2020. You’re responsible for unpaid taxes at the federal and state level.

For example, you might file a return for tax year 2019 or 2020, to receive stimulus benefits in 2020 or 2021.

The IRS only issues tax refunds within three years of the original tax deadline. This three-year limit also applies to amended returns using tax form 1040-X.

For the 2022 tax filing season, you can receive a prior-year refund for your 2019, 2020, or 2021 returns.

Printed Tax Returns

All users receive a printable PDF copy of your federal and state tax returns.

For an additional fee, you can request a mailed printed return or one that’s professionally bound.

This optional fee is one of the few you might pay with FreeTaxUSA. Note that these fee amounts may change over time.

Customer Support

One downside of using cheap tax software is the lack of in-depth customer service.

To be more specific, TaxFreeUSA doesn’t offer one-on-one tax advice from an Enrolled Agent (EA) or a Certified Public Accountant (CPA).

This expert access can cost an extra $80 with other online tax software. The few platforms offering personal tax advice have different prices and service levels.

You most likely won’t need personal advice if you have a simple return, such as W-2 earning and bank account interest only.

Most seasoned tax filers familiar with the tax code can probably file without hands-on help.

Paying for a second opinion might be worth it if you have a complicated return. For instance, you have a multi-state return or are self-employed.

Online Questions and Answers

To be fair, FreeTaxUSA has a rather in-depth digital tax topic library. You can enter questions and topics into a search box and see relevant articles.

Even advanced topics like the “safe harbor rule” have a general overview.

If you need help, you will likely find the information you need on the IRS website or other online outlets. You will need to decide if the lack of in-depth support is worth saving money.

Email and Online Support

Free edition members have unlimited email and online technical support. The only “catch” is that free filers don’t get real-time assistance.

Response times can depend on the current number of support tickets. You might receive a response in minutes, or it could be the next day.

It’s best to see if the online FAQs can answer your tech support questions first.

Live Chat Support

FreeTaxUSA responds to deluxe edition customer support tickets first. You also get live chat support, which can be easier and quicker than sending multiple emails.

Live chat support is available during tax filing season from 8 am until 12 am Eastern time, Monday through Saturday.

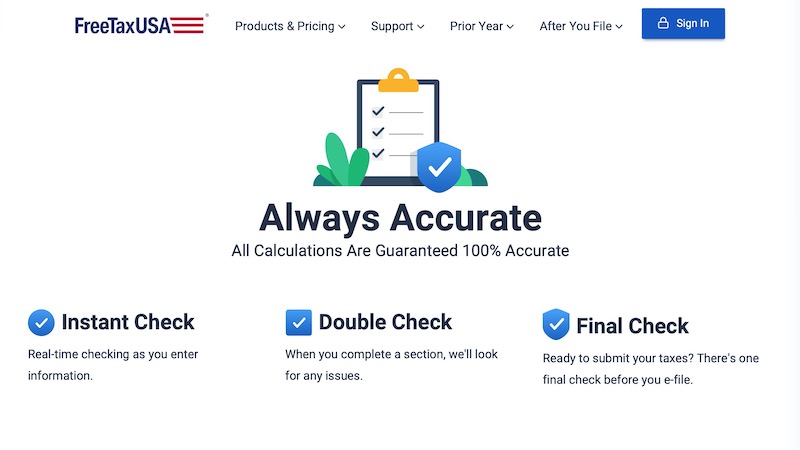

100% Accuracy Guarantee

Your return is eligible for the 100% calculation accuracy guarantee.

If the IRS or your state tax agency finds an error, FreeTaxUSA reimburses the penalties and interest.

Each year, FreeTaxUSA tests lots of different tax situations to look for calculation errors. This beta testing reduces the likelihood you will get an error.

Still, this guarantee doesn’t cover user-input errors like spelling mishaps or data entry mistakes.

You have 45 days to notify FreeTaxUSA to claim reimbursement for applicable fees and penalties.

In addition, the software guarantees they will calculate a similar tax refund (or tax liability) when you submit the same information into a competing platform.

FreeTaxUSA Reviews

FreeTaxUSA is a legit way to file your taxes online and these customer reviews can preview what to expect.

Trustpilot

The service has a 3.4 out of 5 Trustpilot score with 29 ratings.

“I’ve been using Free Tax USA for years. Simple, easy, accurate software. I recommend them highly. The only thing I don’t like is that I don’t file state taxes and it’s hell to try to get around that to the end of your federal return. I forget how to do it every year and usually end up emailing them. They have an outstanding customer service email system.” — Barb

“I don’t have a very complex return, some investments and interest. But it did everything I needed and more. I filed my federal and state return through them and the fees for e filing were reasonable and I look forward to using it again next year.” — Thomas U.

Better Business Bureau

Also, FreeTaxUSA’s parent company, TaxHawk, has had Better Business Bureau accreditation since 2005. However, it’s BBB rating is only 2.25 out of 5 with 16 reviews.

“I have no complaints about this company. I am an older disabled senior citizen.” — John S.

“Paid for an amended return assuming they’d be doing all the work. After I already pay their system then explains that I have to print and mail the ammendment.” — John M.

Alternatives to FreeTaxUSA

These tax prep programs can be more user-friendly if you desire more hands-on help. It’s also possible to file a basic state return for free along with your federal return.

TaxSlayer

If you prefer the affordability of discount tax software, TaxSlayer has one of the highest customer satisfaction ratings. Its pricing is also low and there is a free federal and state option too.

It’s possible to ask a tax pro your financial questions and get IRS audit assistance for three years.

Read our TaxSlayer review to find out more.

Trustpilot score: 4.3 out of 5

TurboTax

Many consider TurboTax to be the “gold standard” of online tax prep software. This service can be the easiest to use as they can automatically upload most tax documents.

You can also opt for a TurboTax Live plan where a tax expert can review your return and look for additional credits and deductions. They can also answer your personalized tax questions.

Whether you file yourself or upgrade to a guided approach, your prep fees will be higher than FreeTaxUSA.

Simple tax returns are eligible for $0 federal and $0 state filing. However, the entry-level pricing for advanced returns starts at $59 federal and $49 per state.

Read our TurboTax review to learn more.

Trustpilot score: 1.4 out of 5 (due to pricing complaints)

H&R Block

H&R Block offers online and in-person tax filing services. Its online filing features are competitive with TurboTax but your fees can be lower. Their Deluxe plan starts at $29.99 at the federal level and $36.99 per state.

In addition, more returns qualify for the free federal and state filing plan. For example, you can file for free if you received unemployment benefits or paid student loan interest.

Read our H&R Block review to find out more.

Trustpilot score: 1.2 out of 5 (due to customer service complaints)

FreeTaxUSA FAQ’s

These questions can help you decide if FreeTaxUSA is legit.

FreeTaxUSA is easy to navigate but requires you to manually input each box of your W-2 and 1099 tax forms. You also won’t have access to a tax expert if you need individual tax guidance like an Enrolled Agent or CPA can provide.

Free Edition users have e-mail support and access to an online library. Deluxe users can get live chat support from 8 am to 11 pm Eastern Monday-Saturday.

FreeTaxUSA currently doesn’t offer a mobile app, yet its website is mobile-friendly. A mobile app is a nice touch in today’s world.

Since the service doesn’t support W-2 snapshot uploads, it may only be an inconvenience if you want live chat support.

FreeTaxUSA encrypts your data and provides time-sensitive passwords. You can also receive alerts when the software detects changes to your account details.

You may consider using FreeTaxUSA if you’re comfortable preparing your tax return by yourself. Being knowledgeable about tax credits and deductions can also be helpful.

Hiring a tax preparer can be better if you need hands-on help or are a small business owner needing a CPA.

Summary

FreeTaxUSA is a reputable online tax software with some of the lowest filing fees. It’s worth trying FreeTaxUSA if you want to get the same results as the most expensive programs.

It can take several extra minutes to prepare your federal and states taxes. However, the extra work can be an easy way to save money.