TurboTax Review

Some products in this article are from our partners. Read our Advertiser Discloser.

Filing your taxes online is becoming easier, faster and more affordable each year. In this TurboTax Review for 2023 we’ll outline the tax software’s latest programs, pricing and share what else is new.

If you’re considering filing your tax return online this year, check out the details of TurboTax.

Overall Rating

Summary

If you like the idea of filing your taxes online, using TurboTax is a great option. With a history of tax preparation going back 40+ years, TurboTax has plenty of experience in the tax filing arena.

-

Ease of use

4.5

-

Online support

4

-

Features

4.5

-

Price

3.5

Pros

- Easy to use

- Quickbooks integration

- Free for basic 1040

Cons

- Pricing

- No in-person support

What is TurboTax?

TurboTax is an online tax prep program that has been helping people file taxes by themselves since the mid-1980s.

This platform continues to be one of the most popular as it has many features that discount tax software doesn’t offer like downloading your tax details from your bank or investment account.

If they offer them, the tools might be harder to use or have reduced capabilities.

It’s possible to file your taxes for free at the federal and state level when you have a simple tax situation.

In addition to filing by yourself, you can also get help from tax experts who can review your return for potential mistakes and overlooked tax deductions.

How TurboTax Works

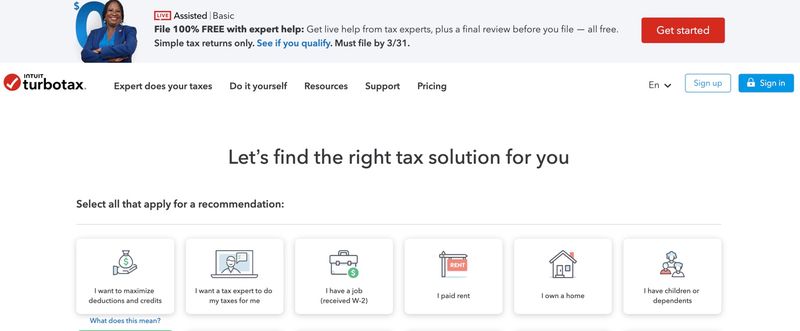

TurboTax makes online filing of your tax return super easy. Your job is to fill out the online questions they ask during the tax filing process. Their job is to put the numbers together.

You’ll start by answering basic questions such as your name, address and Social Security number.

From there, you’ll be asked specific questions about your income and the type of job you work. TurboTax can work for you whether you have a W-2 job or are self-employed.

The system will also ask you questions about dependents you might have, charitable deductions or any other tax-related information.

When you finish answering all of the items, TurboTax will review it just to double-check for accuracy.

TurboTax will give you information on how to fix items or what it thinks might be wrong if there are any perceived errors or potential errors.

Also, the program provides you with suggestions on how to lower your tax burden further.

For instance, it might suggest opening or adding to an IRA, or increasing charitable deductions.

TurboTax has programs that allow you to fill out your tax return entirely on your own. Or they’ve staff standing by to help you.

After you finish filling out your return using the TurboTax system, TurboTax sends it to the IRS or your state’s Department of Revenue.

And it will give you instructions as to waiting for your return or paying if you own additional tax monies.

How Much Does TurboTax Cost?

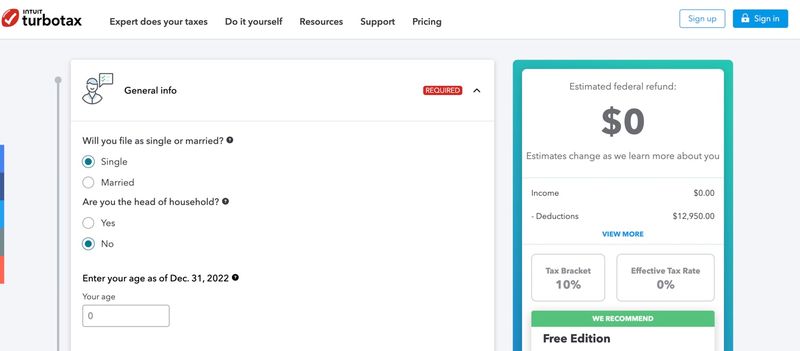

TurboTax offers several different pricing plans from self-service to a full hands-on approach. Your pricing depends on the complexity of your return and which filing option you choose.

Here’s a summary of what each one contains.

TurboTax Free Edition

TurboTax has a great new feature where the Free edition is concerned. This year, the TurboTax Free Edition is free for both state and federal return filing. Note: For simple tax returns only” AND “not all taxpayers qualify“.

You can use this program if you’re filing with a basic 1040 form.

You can only use this edition if you earn W-2 income and limited bank interest or stock dividends. Earned income credit and child tax credits will work with this edition too.

However, you can’t use this edition if you have any type of itemized deductions, receive unemployment income or need to add a Schedule A to your return.

TurboTax Deluxe

TurboTax Deluxe is TurboTax’s most popular edition as it handles itemized returns and rather complex deductions. It costs $129 ($89 on sale) to file your federal taxes and an additional $49 to file your state taxes.

However, this version comes with many additional features. For instance, you can include mortgage and property deductions with this version.

And it comes with on-demand help from a tax specialist. Besides, the Deluxe version searches over 350 available deductions to help minimize your tax burden.

Know that if you have self-employed income, sell investments or if you own rental real estate, you’ll have to use one of the next two versions we talk about here.

TurboTax Premier

TurboTax Premier costs $179 ($139 on sale) to file your federal taxes and an additional $49 to file your state taxes. With this version, you can auto-import your investment income and tax data.

You can include investment data from stocks, bonds and ESPPs as well. Plus, you can allow for rental property income and deductions with this version.

And that also includes depreciation schedules and fair market rental value estimation.

In addition, the Premier version will help you accurately account for cryptocurrency gains and losses.

This version is likely best for those who own rental properties but don’t have other self-employment income. And it comes with on-demand tax expert help too.

You will also need to upgrade to this package if you sold any investments in a taxable non-retirement brokerage account.

TurboTax Self-Employed

TurboTax Self-Employed is meant for anyone with 1099 or other self-employed business income. If you have a business you run from home, this is the version for you.

The Self-Employed plan costs $209 ($169 on sale) to file federal taxes and an additional $49 to file your state taxes.

It searches for more than 350 tax deductions and credits to make sure you don’t miss important deductions.

You can use it for investment income and deductions, and real estate income and deductions as well.

And it allows for easy 1099-MISC income import with your smartphone. This version has a host of industry-specific deductions meant for the self-employed and contractors.

And like the Deluxe and Premier versions, it comes with on-demand tax expert help.

TurboTax Live

TurboTax Live is an optional service where a tax expert reviews your return before you file. It’s also possible to have the expert prepare your return after you upload your documents.

Your filing fees for TurboTax Live are as follows:

- Basic: $0 Federal and $0 State (limited time offer, then $89)

- Deluxe: $129 ($89 when on sale) Federal and $49 State

- Premier: $179 ($139 when on sale) Federal and $49 State

- Self-Employed: $209 ($169 when on sale) Federal and $49 State

You might consider one of these packages when you have a complex situation and need hands-on help. It can also be more convenient that hiring a local tax preparer as you can file from home.

The Live packages have the same benefits and tiers as the DIY plans but you can receive unlimited tax advice with on-screen support from a tax expert. You also get a final expert review before filing your return.

Every TurboTax live support specialist is standing by ready to help.

And TurboTax Live experts have an average of 15 years of tax help experience, meaning you can be assured they know current tax laws.

When you use Live Assisted, you can get answers to specific questions or help with certain sections of your return. Or you can have a TurboTax Live specialist look at your entire return.

TurboTax Live is available from 8 a.m. to 5 p.m. Pacific Time. In addition, you can submit a question in writing and get an answer within 24 hours.

TurboTax Live Guarantee

TurboTax Live also comes with its own guarantee.

If the IRS charges you a penalty because of an error a TurboTax Live agent made, TurboTax will reimburse you the cost of the penalty, along with any interest you have to pay.

TurboTax Live is available with all TurboTax versions. However, the plan prices are different if you want to include TurboTax Live.

TurboTax Live Full Service

You can also hire a tax expert to complete your tax return on your behalf.

First, the service matches your situation with a relevant tax expert. Then, you upload your documents and the tax expert prepares your tax return.

Your tax prep fees can be the following:

- Basic: $209 ($169 on sale) Federal and $39 State

- Deluxe: $259 ($219 on sale) Federal and $49 State

- Premier: $369 ($329 on sale) Federal and $49 State

- Self-Employed: $399 ($359 on sale) Federal and $49 State

Key Features

There are several features and benefits to the Turbotax software program. Here are some of the most popular features and benefits of Turbotax.

TurboTax Guarantees

TurboTax comes with program guarantees to ensure you get accurate help.

The 100% Accurate Calculations Guarantee ensures that if you pay a state or federal penalty due to a TurboTax calculation error, the company will reimburse you for the penalty plus interest due.

The Maximum Refund Guarantee promises that if you receive a larger refund or smaller tax due from another tax preparation method, you’ll get a refund of what you paid for TurboTax.

If you use TurboTax Free, you’ll get a $30 refund. TurboTax has other guarantees as well. See the TurboTax website for more information.

Audit Support and Representation

TurboTax has two levels of audit support with their services:

- Audit Support (Free): Receive free one-on-one guidance and year-round answers. This level doesn’t offer in-person representation.

- Audit Defense ($49.99): A tax expert will provide in-person representation with the IRS and state tax agencies. This benefit is part of the TurboTax MAX add-on package.

Note that you do need to purchase this add-on before you file your return. However, the service remains available for the entire length of time your return is eligible for audit.

MAX Add-On Program

The MAX add-on program I mentioned above offers four benefits.

Lifetime Full Audit Representation

When you purchase the MAX add-on, TurboTax gives you a lifetime promise to defend you for the length of time your return is eligible for audit.

You need to purchase the MAX add-on each year that you file.

Full Identity Restoration

MAX includes expert restoration services if you are ever a victim of identity theft. This service works to recover both your identity and the identity of any joint filers on your returns.

Identity Theft Monitoring

MAX also provides for identity theft monitoring. Identity theft experts keep an eye on your online identity and notify you quickly if any suspicious activity occurs.

Identity Loss Insurance

The TurboTax MAX feature provides insurance coverage due to losses related to identity theft.

That includes legal fees and any other financial harm you might experience in the case of identity theft.

Priority Care

This feature puts you in place for a shorter wait time should you need help while filing your taxes.

MAX is the ultimate add-on for tax filing and identity protection, should you feel you need it.

Tax Calculators

There are several free online tax calculators at your disposal that you can use during the year to optimize your tax situation.

Some of the calculators include:

- Estimated tax refund

- W-4 witholdings

- Tax brackets

- ItsDeductible donation tracker

- Self-employment expenses

Multi-State Filing Option

All TurboTax plans come with a multi-state filing option. This feature can be great if you have multiple states you need to file taxes in.

You might need to file in multiple states because you’re working in several states or have rental properties in various states.

You can add the multi-state filing option to any TurboTax package. See the website for specific prices.

Mobile App Feature

TurboTax has apps for both Android and Apple, meaning you can use the program along with your mobile devices.

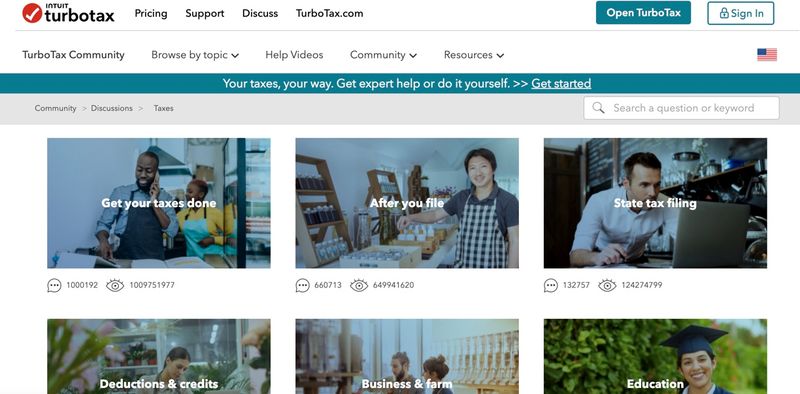

Online Community Support

TurboTax has a healthy online forum community where you can ask questions of other TurboTax users. Also, they’ve got a blog that shares articles on a variety of tax subjects.

These resources are free and may answer your tax questions so you don’t have to pay for live support.

Data Imports

The tax software integrates with most banks and stock brokerages to download your year-end tax documents. This feature can save a significant amount of time if you use several platforms, sold several investments or have lengthy documents.

Even if you didn’t use TurboTax last year, you can upload a PDF of last year’s tax return to quickly start this year’s process.

Other tax software may have you manually input all of these details. In addition to the extra time commitment, you’re more likely to make a reporting error.

Quickbooks Interface

If you use Quickbooks to manage your money or your business, you’ll find it extra easy to do your taxes with TurboTax.

Quickbooks software information can be directly imported into your TurboTax filing program since Intuit owns both programs.

Pay Via Your Refund

TurboTax also has a feature that lets you pay for your TurboTax filing plan with proceeds from your refund. However, there is a $39.99 fee for using this feature.

TurboTax Reviews

Here are some testimonials from others who used TurboTax to file a recent tax return.

Trustpilot

TurboTax currently has a 1.3 out of 5 Trustpilot score with 171 reviews. Many complaints revolve around the fees this platform charges for optional features that other tax software may offer for free.

This service can be more expensive than its competitors but it can also be easier to use. Some of the balanced reviews are below:

“I have used Turbo Tax for years. Have always been satisfied. I have very simple taxes and always choose the basic package. I noticed this year (2021) more than ever, Turbo Tax kept trying to up-sell to a more expensive package while I was imputing data.” — Diane Wing

“Turbotax is actually very easy to use. I used to wonder if it missed anything every year, but I compared it to what an accountant did with deductions and it was on target.” — Wesley

Apple App Store

The iOS mobile app has a 4.8 out of 5 rating with over 848,000 reviews:

“This app is great for standard working income and I have used it for years for that purpose, but very quickly the app falls short if you are trading often in stocks or other forms of frequent trade investment.

“There is an extra charge for filing with trading income that you then have to painstakingly manually enter, despite the data being very clear and concise on all tax documentation.” — Ario52

Google Play Store

This software has a 4.7 out of 5 rating with over 280,000 reviews on Google Play.

“Great software & cheaper than any tax service out there. I’ve used TurboRax for 5+ years & it never disappoints. Of course they are going to try to sell you their service, it’s a business, but they never force you, as long as you qualify for the free file option.” — Sascha Napier

“Very Easy to navigate and helps you with everything you need to know for your tax situation. I have been a customer for many years and will continue to do so. I also recommend friends and family to Turbo Tax and HIGHLY recommend this app to others.” — Lily Brock

“I really really like this app because how it goes through everything finally whether you pay for deluxe or not. The only thing though I don’t really agree with is how expensive it is.” — Ashley Miller

Summary

TurboTax offers many features that make it one of the easiest tax software to use. However, their prep fees for advanced returns can be expensive and a cheaper service can produce similar results if you’re willing to put in a more effort.

That said, they do offer completely free filing for both state and federal if you’ve got a simple tax situation and only need to file the 1040 basic form.

If you like the idea of filing your taxes online, using TurboTax is a great option and a loyal customer community.