How to Get Rid of Credit Card Debt Quickly

Some products in this article are from our partners. Read our Advertiser Discloser.

If you have credit card debt, know that you are not alone. The average household has over $15,000 in credit card debt, and the average interest rate is over 16% according to Bankrate.

If you are paying only the minimum payment, you’ll likely be carrying that debt for over twenty years. If that plan doesn’t sound good to you, there are ways you can get rid of your credit card debt fast.

My wife Kim and I paid off $52,000 in debt in just eighteen months. It wasn’t always easy. But everything we sacrificed was worth the result.

We’re now consumer debt-free and well on our way to having our mortgage paid off too.

There’s something about being debt-free that changes your outlook on life. My wife and I have no stress about money now. We have an emergency fund and plenty of extra cash to travel and do fun stuff with.

Life without consumer debt is just…better.

If that sounds like a life you want to live then here are seven things you can do to help pay off your credit card debt really fast. But first, you need to find out “why” you want to be debt-free.

How to Pay Off Credit Card Debt Fast

After you’ve figured out why being debt

1. Use the Debt Snowball

The debt snowball is the method that we used to pay off our debt quickly.

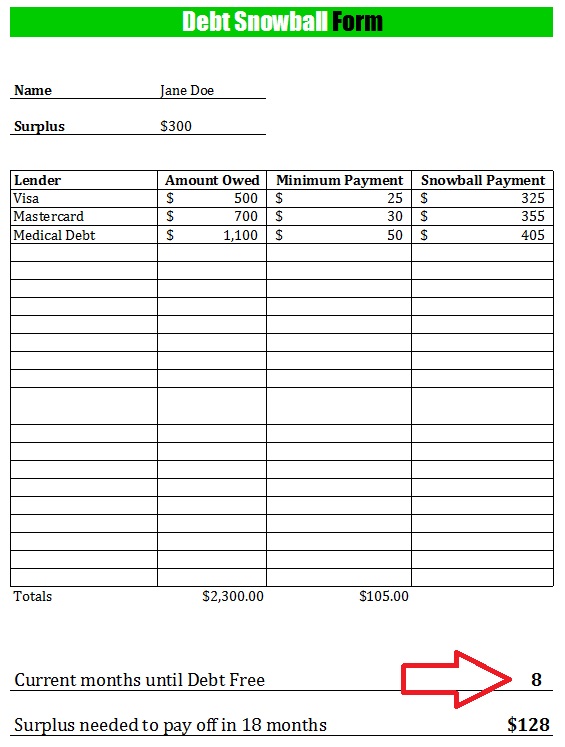

We listed our debts in order from smallest to largest and then listed the minimum payments alongside them. We focused on paying off the smallest debt first while we made minimum payments on everything else.

Any extra money we got throughout the month from working more hours or selling items went toward that smallest debt. When that debt was paid off, we’d put extra money toward the next smallest debt, and so on.

It might save you more money to pay off the highest interest cards first, but I found it incredibly motivating to see each debt get paid off, and that happened quickly for us by using the debt snowball spreadsheet.

Well Kept Wallet also offers a free debt snowball calculator where you can find out how many months until your debt is completely paid off.

Sample Debt Snowball form

2. Refinance High-Interest Debt

Another thing you can do is to look at refinancing higher interest credit cards so that you can get a lower interest rate.

Companies like Credible* specialize in helping you refinance higher balance credit cards so that you don’t pay the ridiculous interest rates that credit cards tend to have. Some of the lender’s interest rates are as low as 3.79%!

Regardless, it will be a lot less than you are paying now.

The more you can lower your interest rates on the money you owe, the faster you’ll be able to pay those balances off.

3. Make Extra Money with a Side Hustle

Taking advantage of side hustles was another strategy we used to eliminate our debt so quickly. I worked multiple side hustles the whole time we were paying off our debt.

For example, I delivered pizzas, sold stuff and I also did some freelance writing. There are hundreds of side hustles that you can do that will help you bring in extra cash to get that debt paid off fast.

You can work a second job, put in overtime hours at work, start a small business such as a landscaping business or do freelance work in an area that you are knowledgeable.

To get ideas for side hustles, start by making a list of what you like to do and what you’re good at doing. Then think of ways you can use those talents to make money.

For instance, if you are great at math and like kids, you could be a math tutor on nights and weekends. You can shovel snow in the winter or mow lawns in the summer.

If you’re good at technical stuff, you can work online designing websites for people. Or be a brand ambassador in grocery stores.

Since all of the money you earn through side hustles will be money you wouldn’t normally have, you can put it all toward debt and kick those balances to the curb in no time.

4. Pay Off Higher Interest Rate Credit Cards First

I’m a big fan of the debt snowball method I talked about earlier. I think it provides huge psychological wins in debt payoff. It helps to see line items on your debt list disappear quickly.

However, from a mathematical standpoint, you’ll pay off your debt faster if you pay off your highest interest cards first.

Simply put, the higher interest rate cards you have are costing you more money in interest payments each month. The less you owe on them, the less interest you’ll pay and the faster you’ll get your debt paid off.

Related Post: Bright Money Review: Is The App Worth It To Pay Down Credit Card Debt?

5. Slash Your Monthly Expenses

Another way to pay your debt off faster is to start living more frugally. Cut costs in every area you can. Start finding free stuff to do for entertainment.

Learn to save money on groceries. Cancel unnecessary subscriptions and memberships like cable TV and gym memberships.

Look through every line item on your budget and get rid of the expenses you don’t absolutely need. Then take all of the money you save and put it toward credit card debt.

6. Sell Your Stuff

Another way to get more money to pay off your debt quickly is to sell your stuff. There are dozens of apps you can use to sell your stuff online and locally.

Go through every closet, drawer, storage area, and pile up things you don’t need to sell them however you can.

Take your cash proceeds and make a massive extra payment on your debt.

7. Call Your Credit Card Companies

Consider calling your credit card companies. You may be able to negotiate a lower interest rate on your credit cards. Tell them you’re going to switch to a lower rate card if they don’t reduce your interest rate.

If the company refuses to lower your rate, consider shopping around for a no-interest or low-interest credit card where you can transfer the balance.

Summary

The faster you get your credit card debt paid off, the faster you can focus on your next financial goal of paying off your mortgage, saving to buy a house or investing money so that you can retire early.

Set your plan in action and see how fast you can reach your goal of becoming debt

*“Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.”

Good Job.

Would you recommend using an IRA to pay off credit card debt?

That definitely depends on your situation! For the most part, if you have an account that is growing and gaining interest, it is highly recommended not to touch that money, even for debt. It just depends on the amount of debt and income you have! It definitely depends on your personal situation, but the majority of the time, you shouldn’t draw from a retirement account.

In my opinion, when you make any purchase with your credit card, think if you can actually afford the purchase. Many times credit cards are used on impulse without keeping in mind the budget or family finances. You can also try and talk to your credit card companies. Many can lower your interest rate to give you an opportunity to catch up. Thanks for sharing, Deacon.

That is a great point about calling the credit card companies to ask for a better interest rate. I have done that before. However, the interest rate was never as good as just refinancing the credit cards altogether.

This is a nice post, Deacon!! In my opinion, anyone’s credit score will suffer if they don’t pay their debts. But, if they don’t need to buy anything on credit then it may not matter to them. The bad accounts will fall off sooner or later, and anyone can start to rebuild when that happens.

I agree that people’s credit would suffer if they don’t pay off their credit card debt. That is one reason why I think they need to pay it off quickly. It is much better to pay your debts than let them go to collections.

I try to focus on paying off the debt that accrues the highest interest (in terms of overall dollar amount accrued, not necessarily the rate as you can have low balance high rate debt, for example) each month. My strategy is to limit the total amount I have to pay out to satisfy the debt.

For those that are successful in paying off their debt, always remember to continue saving the amount you would have been paying for the debt. It’s time to get ahead financially! Try to avoid viewing this money as extra money each month by adding it to a discretionary spending account.

This is a good article. My husband and I were never big on credit card debt. But, when our children were young and we were not making much money, we had to use our credit card to pay for emergency car repairs and a few other unplanned expenses.

My rule of thumb was to pay off the debts that had the highest interest rates. But I get your plan as well. When you see the balance at zero it is a motivator.

That is great to hear that you are not a big fan of credit card debt. Yeah, both methods work, it is just that the Debt Snowball seems to be more effective at keeping people motivated while paying off their debt. I’m glad to hear that credit card debt is no longer an issue for you anymore ,though.

We are huge advocates of side hustles, and so many people are doing it today! It is a great and easy way to make some extra money during your off hours. Not to mention, there are hundreds of different side hustles. Also, if you can’t find a side hustle you like, then you can just make your own up (as long as it’s legal, haha)!

We wish you a happy and successful new year from the Centsai team!

I’m glad to hear you are an advocate of side hustles as well. It is super helpful to make as much money as you can to pay credit card debt off early. Thanks!