Credible Review: Is it A Legit Way to Refinance Your Debt?

Some products in this article are from our partners. Read our Advertiser Discloser.

Years ago, I refinanced my hefty student loan balance for a lower interest rate. At the time, I was paying about 8 percent in interest. Looking back, I wish there were reviews like Credible Review to know all my options.

Refinancing helped bring the interest rate down to about 4 percent. Trust me when I say I was so ready to get out of student loan debt! I could spend less on interest and get out of debt faster.

Back then, I didn’t use Credible to help me find a lender. But to be fair, Credible wasn’t around yet.

Now, Credible can help you quickly see if you’ll save money by refinancing too. Continue reading our Credible Review so you don’t miss out like I did.

Overall Rating

Summary

Refinancing makes sense when you want a lower interest rate and have plans to pay it off quickly. Credible can help you do that easily.

-

Easy to use

4.5

-

Customer service

4.5

-

Offerings

4.5

Pros

- Free to use

- Personalized prequalified rates

- Competitive rates

Cons

- Refinancing costs

- Prequalified rates are not binding

What is Credible?

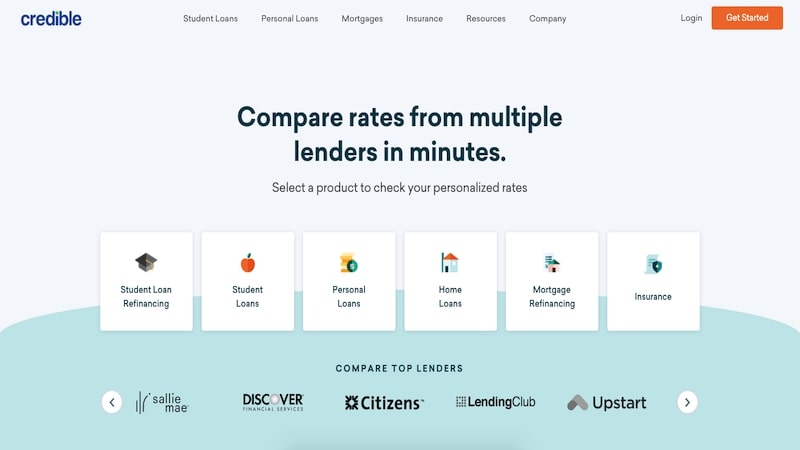

Credible is a loan marketplace that partners with multiple lenders. It’s free to use and compare personalized rates.

You may refinance student loans, a home mortgage or credit card debt. They also provide personalized rates for new private student loans.

Seeing all the personalized rates in one place lets you save time. Then you apply with the lender with the best offer. You are never required to apply for a loan from a lending partner.

You can get a personalized rate in two minutes. Plus, getting a rate doesn’t hurt your credit score. And if it doesn’t make sense to refinance, the only thing you lose is your time.

None of Credible’s student loan refinancing lenders charge the following fees:

- Application fees

- Origination fees

- Prepayment fees

- Service fees

Some of Credible’s personal loan lenders will charge an origination fee. You can see all the potential fees in the rate provided.

Credible has a 4.7 out of 5 Trustpilot score. This high score indicates that they have many happy users.

What Does Credible Offer?

Credible provides personalized rates from multiple lenders for these loans:

- Student loan refinancing

- Private student loans

- Personal loans

- Mortgage refinancing

Once again, getting a rate does not affect your credit score. Although, the lender will perform a “hard credit check” when you apply for a loan.

Student Loan Refinancing

You can refinance your federal, private and Parent PLUS loans. Both undergrad and graduate degree loans can be refinanced as well. Credible shows rates from ten lenders. Loan terms range between five and 20 years.

Getting rates from eight lenders should be enough to see if refinancing saves you money.

It takes several minutes to get a personalized rate. If you like the initial numbers, you can apply for a loan with a lender.

Saving thousands of dollars by refinancing can make Credible worth it. To clarify, you must also choose between a fixed or variable interest rate loan. But a

Keep in mind that you forfeit certain benefits if you refinance your federal or Parent Plus loans. These benefits can include forbearance and loan forgiveness. Most private lenders do not offer similar benefits.

Personal Loans

Refinancing high-interest debt is another way to pay less interest. You can get rates from multiple loan lenders. See Credible* for rates and terms.

One use of personal loans is to consolidate credit card debt. Medical debt is another common high-interest debt.

Credible clearly displays your interest rate, fees, monthly payment and total loan cost.

Unlike other loan marketplaces, Credible only lets lenders call you if you choose their offer. So you don’t have to worry about getting unwanted phone calls or spam email.

Once the lender disburses your funds, you can pay off your current loans. Then you send payment to the new lender at your new interest rate.

Mortgage Refinancing

Credible’s newest service is mortgage refinancing. Perhaps you got your current home mortgage when interest rates were higher. Or maybe you have better credit now, and qualify for a better rate.

Regardless, you can compare lender rates in a few minutes. You will see your estimated closing costs and lender fees. Take the time to compare rates for the 30-year and 15-year terms.

If you like a rate, you can upload your current mortgage documents. Credible manages the refinance process through closing.

Student Loans

Credible also partners with several lenders to offer private student loans. These loans are available for college, graduate and professional degrees.

When requesting a rate, specify if you are a student or a co-signer. None of the lending partners charge origination, prepayment or service fees.

These loans can help fund your remaining tuition costs. You may also work a college side hustle to borrow less money.

How to Get Rates from Credible

One nice thing about Credible is that it’s easy to use. Credible claims it only takes two minutes to get a personalized rate. After getting a personal rate for this review, I can say that the claim is valid.

If you haven’t already done so, make a list of your current loans. List the interest rate, current monthly payment and loan balance. Now you can quickly see if you can save money with Credible.

Step 1: Enter Loan Information

Estimated time to complete: 2 minutes

First, you need to prequalify for a loan. Then you answer a few personal credit questions so the lenders can give you a personalized rate. This process won’t impact your credit score because they’re not doing a hard pull.

However, the lender does a hard credit pull if you apply for their offer.

Step 2: Review Offers

Estimated time to complete: 5 minutes

The next step is comparing the personalized offers from each lender. You will see the interest rate, total loan costs and cost breakdown.

If you find a rate that you like, you apply on the lender’s website.

Step 3: Receive Final Offer

Estimated time to receive your finalized offer: 2 business days

The last step is applying for a loan. In this stage, the lender does a hard credit pull to make a final loan offer. It can take one or two business days to get an offer. Plus, you may have to answer additional questions to get an accurate rate.

This offer should be very similar to Credible’s initial rates. However, you can still decide to decline the loan offer during this step. For instance, you may find a better student loan company to refinance with.

Should You Refinance?

Refinancing makes sense when you want a lower interest rate and have plans to pay it off quickly.

Sometimes, you won’t get a lower interest rate. Or you have to pay added fees which offset any savings. In this case, you should try and make extra loan payments. Focus on your highest interest rate first.

You may need a side hustle to afford these extra payments. The extra effort now can help you save money by paying less interest

Also, Credible can help you decide if refinancing saves you money. You can contact their live customer support team if you have questions. Besides, they will even have a conference call with the lender and you.

Best Rate Guarantee

Credible offers a $200 best rate guarantee. You can file a claim if you find a better rate with a non-Credible partner.

Although you get rates from eight lending partners, Credible isn’t always the best option.

Is Credible Legit?

Yes, Credible is a legit company that has a Trustpilot score of 4.7 out of 5. There are many positive reviews. Some of the most liked features include comparison tools and good customer service.

“Great way to have several lenders provide options on loans. I was able to view terms and rates easily.”

– Mariana L

” I received very fast service. Customer service was phenomenal. I was in touch with a very knowledgeable rep. “

– M. Harrington

Also, Credible only gets paid if you finish the loan process and the lender disburses funds. Credible doesn’t sell your information to other parties. This policy helps reaffirm that Credible is legit.

Positives and Negatives

Here is a quick summary of the positives and negatives of Credible.

Pros

- Free to use

- Personalized rates in minutes

- Easy-to-read rates from multiple lenders

- Won’t get annoying emails or calls from lenders you don’t choose

Cons

- Refinancing doesn’t always save you money

- Other lenders may still offer better rates

Summary

Credible lets you quickly see if refinancing saves you money. And saving money on interest for the life of your loans is an easy way to put more money into your pockets. Plus, a smaller monthly payment also means you can get out of debt sooner.

Credible NMLS ID# 1681276 110 Corcoran Street, 5th Floor, Suite 151 Durham, NC 27701

*“Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.”

I don’t have anything to refinance. And I’m a pensioner and only have a car as insurance . We have lived in a car for 6months have have a flat @700$ a fortnight. Wondering your thoughts of me getting a loan. Im in Australia.

Sorry, I don’t know anything about getting a loan in Australia. I would recommend finding a side hustle to increase your income instead of a loan. That way it is more sustainable and you don’t have to pay interest.

Hi I’m from Pakistan, is there any possibility to give loan online?

I would check their website and see if they are available in your country.