Liberty HealthShare Review

Some products in this article are from our partners. Read our Advertiser Discloser.

Healthcare is one of the most expensive budget items for many American families. Most people have access to health insurance through an employer, but others do not. What’s worse, sometimes people cannot afford traditional health insurance.

That’s where Liberty HealthShare comes in. This organization allows members to share medical expenses with a community of like-minded people. Its services help reduce the cost of healthcare for families in a nontraditional way.

Our Liberty HealthShare Review can help you determine if the provider is the right option for your healthcare needs.

Overall Rating

Summary

Liberty HealthShare is a healthcare-sharing organization that allows families of Christian faith to receive financial support for medical bills without enrolling in traditional health insurance. The organization has a variety of plans to choose from at affordable rates.

-

Services Coverage

2

-

Customer Service

1.5

-

Monthly Contributions

2

-

Additional Services

2

Pros

- Multiple plans to choose from

- Low starting rates

- Coverage for dental, vision and prescription drugs

- Not limited to specific doctors or a specific network

Cons

- Strict membership requirements

- Sharing amounts are capped

- No coverage of pre-existing conditions in the first year

What is Liberty HealthShare?

Liberty HealthShare is a healthcare-sharing community. This means it’s a community of people who have come together to share healthcare costs.

It works similarly to health insurance, where the monthly contributions from members are pooled and used to cover each other’s medical expenses.

As a Christian organization, Liberty HealthShare requires its members to meet specific requirements.

To join, you’ll need to fulfill the following qualifications:

- Observe Christian standards

- Accept the organization’s shared beliefs

- Maintain a Christian lifestyle

Maintaining a Christian lifestyle includes things like not using tobacco products and following scriptural teachings on alcohol use.

How Does Liberty HealthShare Work?

When registering for Liberty HealthShare, you can select from five plans. Each plan has members pay a monthly share amount.

After choosing your plan, you can see any doctor of your choosing, identify yourself as a self-pay patient and submit your bills to have eligible expenses covered.

Here are the five available plans.

Liberty Assist

Liberty Assist is a healthcare-sharing program designed specifically for seniors 65 and older. This program is created for Medicare Part A and B enrollees. Its purpose is to fill in any coverage gaps while allowing members to control their medical care.

Current members of a different Liberty HealthShare program can transition to Liberty Assist when they turn 65.

New members can sign up upon termination of their employer-provided health insurance or during the three months before and after the month they turn 65.

Liberty Rise

Liberty Rise is a healthcare-sharing program designed for people ages 18 through 29. Since people within this age group often have lower incomes and fewer health costs, Liberty Rise is a budget-friendly program for young adults who don’t have children.

For married couples, each spouse must have their own membership.

This plan covers expenses like primary physician care, specialists, hospital stays, urgent and emergency care, surgeon fees and CT or MRI scans.

Liberty Essential

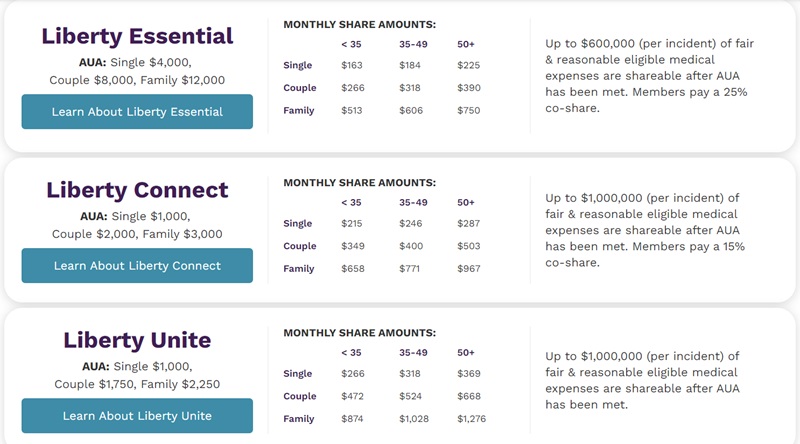

The Liberty Essential plan is one of Liberty Healthshare’s three primary plans available to families. Members can enroll in this plan as a single person, a couple, or a family with children.

This plan is the most affordable of the three primary options. Members must meet an annual unshared amount (AUA). This is similar to a deductible in traditional health insurance.

Liberty Essential’s AUA is $4,000 for a single person, $8,000 for couples or $12,000 for families.

The plan covers up to $600,000 per incident of fair and reasonable eligible medical expenses after the AUA, with an additional 25% co-share.

Liberty Connect

Liberty Connect is the second of the organization’s three primary plans. Like the Essential plan, this option is available to single people, couples and families.

This plan has an AUA of $1,000 for single people, $2,000 for couples and $3,000 for families. After the AUA is met, the plan covers up to $1,000,000 per incident of fair and reasonable eligible medical expenses, with a 15% co-share.

Liberty Unite

Liberty Unite is the top-tier healthcare sharing plan from Liberty HealthShare. It is also available to single people, couples, and families.

This plan has an AUA of $1,000 for single members, $1,750 for couples and $2,250 for families. Once the AUA has been met, the plan covers up to $1,000,000 per incident of fair and reasonably eligible medical expenses.

Better yet, this plan doesn’t require a co-share.

How Much Does Liberty HealthShare Cost?

The cost of Liberty HealthShare is different for each plan option. Liberty Assist charges a different rate depending on your age.

On the other hand, Liberty Rise has a flat rate that all enrollees pay. At the time of writing this, the plan charges a monthly contribution of $119.

Finally, Liberty Essential, Connect, and Unite each charge different amounts depending on your age and whether you’re enrolling as a single person, a couple, or a family.

The tables below from Liberty HealthShare’s site show the price for each of the different options.

Key Features

In addition to its healthcare sharing plans, Liberty HealthShare offers some extra services to help its members save money.

Healthcare Bluebook

Healthcare Bluebook is available to Liberty HealthShare members to help them find the best healthcare. Using the Bluebook, members can see the amount they should pay for a medical service based on an independent nationwide database.

The tool adds transparency to medical care. It also encourages members to consider the cost of services and shop around for a better rate. This price transparency benefits all of the members of the healthshare.

DialCare Mental Wellness

DialCare Mental Wellness is a telehealth program that provides mental health services. Liberty HealthShare members can access safe, secure, and private mental health services virtually or by telephone.

DialCare Physician Access

DialCare Physician Access works similarly to its mental health counterpart but is for general medical care. Members can speak with doctors via phone or video chat to receive diagnoses, treatment and more.

Careington Dental

Careington Dental is a dental network that allows Liberty HealthShare members to get the dental coverage they need. Most health insurance plans don’t cover dental care, but Careington helps people to find discounted services with transparent pricing.

EyeMed Vision

EyeMed Vision helps Liberty HealthShare members access affordable vision care by offering 20% to 40% savings on the retail price of eyewear. Members can get discounts on exams, eyeglasses, and lenses from thousands of providers nationwide.

QualSight LASIK

QualSight Lasik allows Liberty HealthShare members to get 20% to 30% savings on the cost of LASIK surgery at one of more than 1,000 participating locations.

Elixir Prescription Drugs

Elixir Prescription Drugs helps Liberty HealthShare members access affordable prescription drugs.

Members can save between 50% and 95% on generic drugs and 10% and 45% on name-brand medications at more than 60,000 pharmacies nationwide.

Customer Reviews

While Liberty HealthShare’s website contains many positive reviews, the provider has below-average reviews overall.

Here’s how it stacks up on the rating sites:

| Site | Rating | Number of Reviews |

| Better Business Bureau | 1.97 | 145 |

| Trustpilot | 1.9 | 114 |

These are a few reviews members have left online:

“Believe all the negative reviews. After more than two years since we left the program we still have approved claims that remain unpaid. And that’s two years plus past the approved date.” – Brad

“My experience with re-enrolling was phenomenal. Incredibly patient people, willing to walk me through and re-explain as many times as needed. Every time I’ve called, there has always been a human being to answer the phone!” – Felecia

“They are great as long as you don’t have any health bills. Nothing is covered, even what is pure authorized takes 1+ years to be paid— if ever. Do not even think about it!” – Ryder

“I think more people should look at these plans. Very reasonable cost, great customer service and benefits.” – Margaret

Alternatives To Liberty HealthShare

Liberty HealthShare is one of the top health-share organizations on the market, but there are also plenty of other options. Here are the top alternatives to consider.

Altrua

Altrua HealthShare is an organization that connects thousands of families, churches and organizations in a health-sharing program. There are four plans to choose from, starting at $136 per month.

Altrua doesn’t boast all of the extra member services that Liberty HealthShare does, and its starting price is higher. However, it does accommodate churches and organizations.

Medi-Share

Medi-Share is a Christian health-sharing organization that’s been in operation for roughly three decades. Like Liberty HealthShare, Medi-Share has plans for individuals, families and seniors.

It also offers a plan for employers to provide to their employees and a plan for missionaries.

Learn More: Medi-Share Review: A Cheap Alternative to Health Insurance

Solidarity

Solidarity HealthShare is a health-sharing organization that helps to fund its members’ healthcare costs while protecting and practicing its Catholic beliefs.

This organization provides coverage for various services, including general care, dental, vision, prescription drugs, fertility, mental health, hospice, and more.

Summary

Liberty HealthShare can be an excellent replacement for traditional health insurance. It includes many of the services that would be covered by another plan, often at a significantly lower rate.

Of course, Liberty HealthShare lacks some of what you’d find with traditional health insurance. It’s also only available to like-minded individuals of the Christian faith.

Nevertheless, it could be a great option to cover your healthcare needs if you qualify.