Vaulted Review: An Easy Way To Invest In Gold

Some products in this article are from our partners. Read our Advertiser Discloser.

Many people view gold as the money of kings since it has been used for thousands of years. However, gold is expensive to purchase by the ounce. Plus, gold coins and bullion can be risky and expensive to store by yourself.

If you want to buy physical gold with small amounts of money, Vaulted can help. This gold-buying service lets you purchase fractional pieces of gold that are stored in a secure vault, and you can request physical delivery.

Our Vaulted review can help you decide if this is the best way for you to invest in gold. I also share my experience of using this platform to own gold.

Overall Rating

Summary

Vaulted lets you buy physical gold and physical silver without a minimum investment and affordable fees. Your portfolio is stored in trusted physical vaults, and you can request physical delivery.

-

Minimums to invest

5

-

Fees

4

-

Investment Options

3.8

-

Additional Features

4

-

Ease of use

4.5

Pros

- No minimum investment

- Transparent fees

- Open to international investors

- FedEx delivery is available

Cons

- Silver fees higher than gold fees

- Semi-annual maintenance fees

- Expensive shipping fees

- Taxable accounts only

What is Vaulted?

Vaulted is an online-only precious metals trading platform that lets you buy fractional shares of physical gold and silver. Assets are held at the Royal Canadian Mint or HSBC London, and you can request physical delivery.

The platform allows you to trade gold and silver through its website and mobile app.

Its fees are competitive with gold funds you purchase through a stock investing app. However, these funds are better for short-term trades or investing through a retirement account since minimum holding periods and transaction fees apply.

Vaulted offers investors the convenience of investing in gold-linked ETFs (fractional investing and off-site storage). It even supports physical redemptions, which many gold funds don’t provide.

I personally have been using Vaulted since 2019 as I can buy gold in small increments and it’s stored securely in off-site vaults. Additionally, I appreciate the flexibility of being able to request physical delivery.

Being able to request delivery by mail verifies that this investment platform is legit instead of only building wealth when a gold fund’s share price increases. However, many investors use the standard storage to get exposure to gold and minimize fees.

You can also talk with an advisor to answer your questions about investing in gold and get help building a precious metals portfolio. It’s important to note that Vaulted doesn’t offer managed portfolios, so you must decide when to buy or sell gold.

Is Vaulted Legit?

Yes, Vaulted is a legit, scam-free way to buy investment gold or silver. It has been around for roughly 50 years and is best for investors who cannot purchase an entire coin or bar at once.

Better yet, it’s an excellent platform for dollar cost averaging since you can schedule recurring investments.

Your investment is stored as conflict-free bars with a 99.99% purity level. The primary difference from getting gold from a precious metals dealer is that there isn’t a minimum investment, which means more investors can participate.

You may still prefer owning real gold or silver that you can hold in your hand, but these two metals are expensive when you have a tight budget. This platform helps you safely start investing in precious metals and diversify your portfolio.

Verified Assets

All gold deposits are stored at the Royal Canadian Mint in Ottawa. This precious metals depository is owned by the Government of Canada and insured against theft, damage or other losses.

To prevent spoofing scams where there’s not enough gold to cover customer redemptions, the vault’s inventory is counted quarterly and audited annually.

Importantly, your gold investment isn’t mixed with another investor’s position or leased by Vaulted or the Royal Canadian Mint.

As an additional safeguard, Vaulted maintains paper records of your purchase history and the current size of your holdings. This redundancy protects you during an extended power outage or if a portfolio dispute arises.

The same protocols are in place for silver deposits which remain in the vault at HSBC Bank in London. For peace of mind, other gold-backed ETFs store their deposits with this bank.

What Happens if Vaulted Goes Out of Business?

You own the metals in your portfolio, even if it’s not enough to request physical delivery. If Vaulted, its parent company (McAlvany), the Royal Canadian Mint or HSBC Bank closes, you can sell your shares for the current market value minus transaction fees.

How Does Vaulted Work?

The registration process and making your first gold purchase with Vaulted can be more straightforward than buying physical gold from a precious metals dealer.

Create an Account

You will start by providing your contact information and email address to open an account. It’s possible to apply online or through the Vaulted app. The enrollment process takes a few minutes, and it’s free to join.

To protect your privacy, this platform doesn’t require your Social Security number (SSN) until you sell gold.

It’s easiest to join from within the United States, but international investors are also welcome. One primary difference is that non-U.S. investors must fund their purchases with wire transfers and cannot link a bank account.

Fund Your Account

You can connect a checking account to schedule ACH transfers or send a wire transfer to fund your account. The service uses Plaid to connect to your account and avoid storing your banking details on their servers.

For many investors, ACH transfers are the best funding method as they don’t incur any fees. Many banks charge the customer for outgoing wires, so this is a nice perk.

Furthermore, you won’t need to make a minimum deposit or maintain an ongoing balance to keep your account active.

It’s possible to schedule one-time and recurring transfers. When scheduling a transaction, you can invest in gold or add to your cash balance for a future purchase.

Buy Gold

You can buy gold shares in real time when the stock market is open (9:30 a.m. to 4 p.m. EST). There isn’t an investment minimum, but your investment cost is the current price of gold plus a 1.8% transaction fee.

After entering your investment amount, you will see the estimated purchase price and quantity. Upon submitting the order, it executes at the current spot price.

While there isn’t a minimum investment amount, a holding period applies. Federal regulations require that gold purchased through ACH transfers be held for 60 days, while wire transfers have a maximum three-day wait.

Like all physical gold holdings, your investment won’t earn royalties. Instead, you will only make money if the spot price increases above your original purchase price.

Sell Gold

You can also sell gold on demand with a simple click of a button during the New York Stock Exchange (NYSE) market hours at the current spot rate. Similar to buying gold on Vaulted, a flat 1.8% transaction fee applies to all sales.

It’s possible to sell a full or partial position, and you will see an estimate of how much gold you’re exchanging for cash.

Before selling, you must provide your individual taxpayer identification number (ITIN) or Social Security number to receive a year-end 1099 tax form. Your proceeds are subject to taxes.

Since transaction fees and capital gains taxes apply, you may want to speak with a Vaulted advisor before selling to see if you can minimize your tax burden.

The dealer states that customers can potentially reduce their tax liability from 30% to 50% versus the standard 28% long-term capital gains tax rate for precious metals.

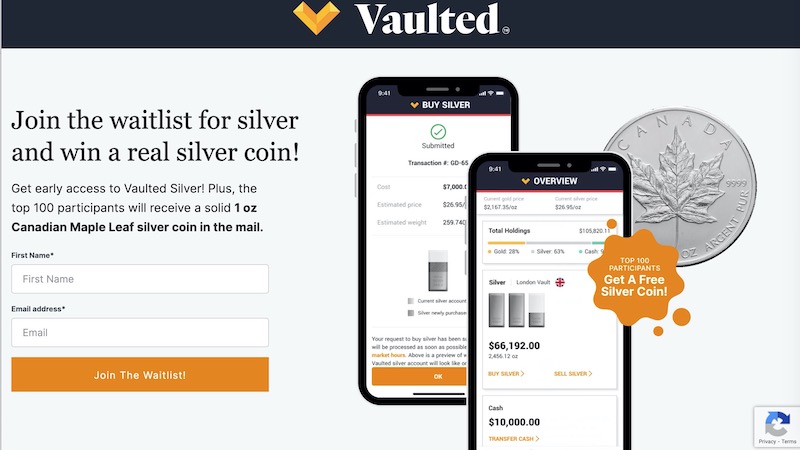

Trade Silver

The Vaulted Silver platform launched in mid-2023 and lets you buy physical silver with fractional shares. Each investment applies toward a 1,000-ounce bar stored at HSBC Bank in London.

The quality is 99.9% pure silver (0.999) and is a London Good Delivery Bar. All silver is sustainably sourced and conflict-free.

Orders are processed when the New York Stock Exchange is open on normal business days from Monday to Friday. When buying your selling silver, you will see the current spot price plus the buyer’s premium or seller’s premium.

How Much Does Vaulted Cost?

Vaulted has transparent fees that can provide peace of mind to investors.

You will encounter these two mandatory expenses:

- Transaction fee: 0.8% for gold transactions and 2.0% for silver transactions

- Annual maintenance fee: 0.4% of your gold portfolio value and 0.6% of your silver portfolio (collected semi-annually)

The silver trading fees are higher than gold as it’s more expensive to store silver because of its lower asset price.

There are no fees to join or maintain your account. A downside is that your uninvested cash doesn’t earn interest.

Shipping Fees

If you have a sufficient balance, you can request physical delivery to your home, office or local storage facility using FedEx. Delivery is only available within the United States and Canada.

This redemption option isn’t treated as a sale, so it’s non-taxable. However, shipping and insurance costs apply.

You’ll incur the following shipping fees:

- Royal Canadian Mint handling costs: $50 per bar

- Shipping costs: Varies by carrier and delivery location

- Insurance: $75 per bar

These shipping and insurance fees are high. If you plan on self-storing your investments, there are other places to buy gold at a competitive cost.

Vaulted Key Features

In addition to buying gold or silver with as little as $1, here are some of the other tools and membership benefits that can make precious metals investing with Vaulted stress-free.

Educational Resources

If you’re new to gold investing or are an experienced but curious investor, you can read educational articles and investment insights within the Golden Nuggets library. The topics include gold investing and the economics of gold.

In addition, members can check out Vaulted’s blog or subscribe to a free weekly newsletter that provides a brief commentary on gold’s price performance and other notable events in the investment markets.

Advisors

Vaulted customers can speak with an advisor free of charge by phone or email for basic help with gold investments. According to the site, the average advisor you’ll work with has over 20 years of experience with precious metals investing.

These conversations can help you navigate the ins and outs of investment gold, which can differ from stocks and bonds since it’s a physical asset. This support person can answer basic investment questions and provide technical support.

Consider working with a fiduciary financial advisor to review your financial situation for additional support.

Mobile App

The fully functional mobile app for Apple and Android devices lets you trade gold and read educational articles in the Golden Nuggets section.

Physical Delivery

All gold purchases are in the form of a kilo bar (32.1507 troy ounces). This can cost approximately $61,086, with a gold spot price of $1,900 per ounce.

You can also request delivery in smaller denominations, such as:

- American Eagle coins (1/10 ounce)

- Canadian Maple Leaf coins (1 ounce)

- Bullion bars (10 ounces)

You will work with a Vaulted advisor to exchange your partial kilo bars for these gold coins and bullion. A transaction fee applies to exchange products similar to your initial purchase of fractional precious metals.

Being able to request physical delivery lets you buy physical gold in increments, but the transaction and delivery fees may not be worth it for some customers. As a result, you might be better off buying gold coins and bars directly from a dealer.

VaultPlan

The easiest way to gradually build your gold portfolio is through recurring investments. The VaultPlan feature lets you schedule recurring investments from a linked account on a monthly or biweekly basis.

I like the VaultPlan as you can effortlessly buy gold or silver in increments without timing the market. You can choose a budget-friendly amount to purchase regularly. Then, you can make one-time purchases when you have extra money to invest.

Customer Reviews

Before using any investing platform, it can be wise to understand the experience current customers have had.

Here’s how Vaulted ranks on the different rating websites:

| Website | Rating | Number of Reviews |

| Apple App Store | High | 335+ |

| Google Play | High | 220+ |

Here are some Vaulted Review excerpts from customers:

“Vaulted is a service that I have been using to buy gold for the past two years or so. [It] has been flawless in its ease of use for a guy who doesn’t transact normally via iphone. Vaulted is a great alternative to normal bank savings.” — Khaki M.

“A lot of fees when you’re already buying gold from them at a higher rate.” —Milli M.

“Best way to own gold. The company is 50 years old but Vaulted is their sleek new offering. My advisor is very helpful (been in the business for decades!) Highly recommend.” —Meika M.

“Though I wish we also had access to silver, this app makes it easy to invest in gold, real gold, not paper, without having to run out and buy gold bullion or coins that can be stolen or lost.” — Dra G.

Frequently Asked Questions

These are some questions potential Vaulted customers tend to have about the platform.

Summary

Gold is one of the best alternative investments because it’s among the most valuable precious metals. Many people invest in gold or silver to diversify their portfolio, but minimum investment and dealer premiums are expensive for coins and bars.

Vaulted makes it easy for anyone to start investing in gold and silver. If you are thinking about adding this asset to your portfolio, the platform is worth considering.