Bright Money Review: Is The App Worth It To Pay Down Credit Card Debt?

Some products in this article are from our partners. Read our Advertiser Discloser.

If you’re struggling to pay off credit card debt, you might be looking for services that can simplify the process.

Bright Money (officially called “Bright”) is an app that can help you achieve your financial goals even if you’re living paycheck-to-paycheck.

Our Bright Money review will go over how the service works, its fees, features, and more to help you determine if the app is right for you.

Overall Rating

Summary

Bright Money was created to help you pay down debt faster, build savings and improve your credit score. The app automatically scans your checking account, adjusts to your spending habits day by day, and then transfers funds to help you meet your financial goals.

-

Set up

3.75

-

Ease of use

4

-

Features

4.5

-

Customer service

4.75

Pros

- Automated plan makes achieving goals easier

- Choose your debt payoff strategy

- Improve your credit score

- Free 10-day trial

Cons

- Monthly fee of $6.99 to $14.99

- Not ideal for users with low credit card debt

What is Bright Money?

Bright Money was founded with the goal of providing financial services anyone can use. In order to create personalized plans for its users, the app is driven by artificial intelligence (AI).

The company’s mission is to double the wealth of middle-income consumers by helping them make better financial decisions.

By combining data science and behavioral design, Bright Money’s artificial intelligence (AI) can help middle-income earners improve their financial picture.

The app accomplishes its goal by creating a trifecta of financial target goals you can implement. These include saving money, paying off debt and improving your credit score.

How Does Bright Money Work?

Bright was created for those who are struggling with credit card debt and paycheck-to-paycheck living. In fact, when you sign up for Bright Money, it will ask you what your top financial goal is.

Your choices are:

- Pay off credit card debt

- Improve your credit score

You can also choose savings goals at a later point, such as building an emergency fund or saving for a vacation.

Once you connect your checking account to Bright, it will analyze your income and spending habits.

From there, Bright will transfer small amounts of money from your checking account to your Bright account (called a Bright Stash account).

Then, it will systematically use that money to help you achieve your financial goals of paying off credit card debt and/or saving money.

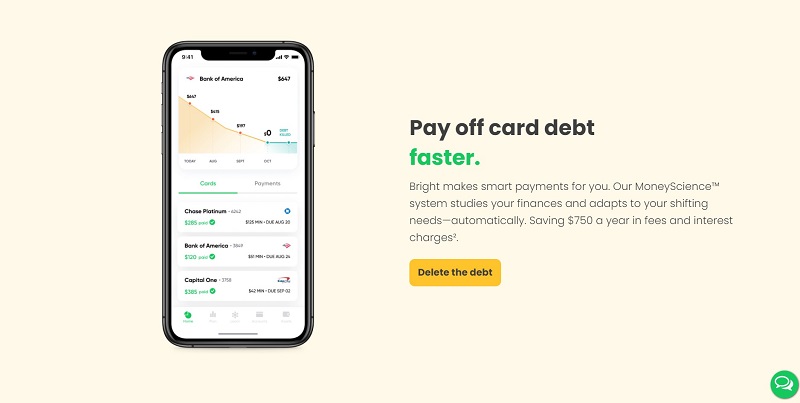

If you live with a low balance in your checking account, Bright has your back and uses its MoneyScience AI to automatically react. As your finances shift or if you have upcoming bills, Bright adjusts how much and when it withdraws money from your checking account.

These little steps will help you break the paycheck-to-paycheck lifestyle. In turn, you will improve your credit score as well as your overall financial situation.

Bright Stash

Your Bright Stash account is an interest-bearing account that stores the transfers made from your separate, current checking account.

From Bright Stash, the MoneyScience technology AI determines when to use your Bright Stash funds to make payments on your debt.

It will also determine when to make additions to your savings account goals or your investment funds.

If you are concerned about security, don’t worry. Bright Stash is FDIC insured.

Customized Funding

With Bright Money, you have complete control over how and when money is allocated to your Bright Stash account.

You can choose to fund your Bright Money account by:

- Allowing Bright Money’s AI to transfer money to Bright Stash as it sees fit

- Setting a regular transfer schedule into your Bright Stash account

- Having Bright Money transfer cash to your Bright Stash account on paydays

- Transferring money to your Bright Stash account manually as you see fit

You can use one of these allocation options. Alternatively, you can combine one or more as it fits your lifestyle.

How Much Does Bright Cost?

Bright has three membership plans, and each option has the same features. However, you can save money on membership fees by choosing longer plan terms.

Here are the membership plans and their prices:

- Monthly: $14.99 per month

- Semi-annual: $53.94 twice a year (averages out to $8.99 per month)

- Annual: $83.88 per year (averages out to $6.99 per month)

Each membership option comes with a free 10-day trial.

Additionally, all membership plans come with Bright’s money-back guarantee. This guarantee says that if you are not satisfied with your account, Bright will refund your membership charges.

Key Features of Bright Money

Bright Money has several features that can help you pay off credit card debt, save money and improve your credit score.

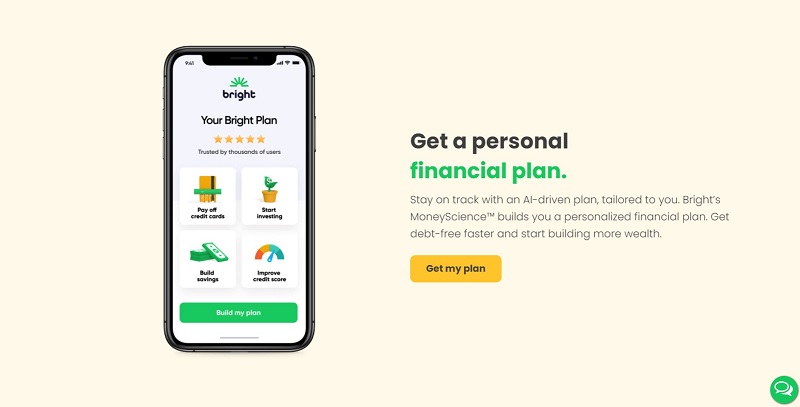

Personalized Financial Plan

Perhaps Bright Money’s most attractive feature is that it uses artificial intelligence to help you create a personalized financial plan using its patented MoneyScience technology.

MoneyScience was built on 34 algorithms with the help of over 120 financial experts. Plus, it’s been tested by over 60,000 users.

As mentioned, your MoneyScience plan can help you achieve three main goals, including paying off debt, improving your credit, and saving more money.

You decide which goals are most important to you and how those goals are achieved.

Bright Money’s AI algorithms help determine when you have extra money to spare to put toward your financial goals.

From there, it will put the extra money into your Bright Stash account, then allocate the money toward your financial goals.

Customizable Debt Payoff Strategies

You can choose from three different debt payoff strategies when you are customizing your Bright Plan.

These payoff strategies include:

- Debt snowball: Pays debt off in order from lowest balance to highest balance

- Debt avalanche: Pays debt off in order from highest to lowest interest charge

- Customizable payoff order: Pay off debt in the order you choose

The custom debt payoff option means that you can design the Bright Plan that best works for you.

Note that as of this writing, you can only pay off credit cards with Bright. You cannot pay off other types of debt, such as auto loans and mortgages.

Savings Goals

Bright lets you set a variety of savings goals. Then, it helps you to fund those goals by transferring money from your Bright Stash account to your savings pods when it sees fit.

Examples of savings goals you can set and achieve with Bright include:

- Rainy day funds

- Vacation funds

- New car funds

- House down payment funds

Or any other savings goal you may have. You get to choose your target goal date, and Bright does the rest.

Credit Score Improvement

Bright Money uses its MoneyScience technology to help you improve your credit score.

Your credit score is based on five main factors, including:

- Payment history

- Credit utilization ratio

- Length of time you’ve had your debts

- How much new credit you’re opening

- Type of debts you have

Bright Money’s MoneyScience technology knows which credit cards to pay down in what order if you are looking to increase your credit score as quickly as possible.

When you choose to let Bright Money decide how your credit cards are paid off, it will apply payments in a way that reduces your credit utilization ratio. In turn, that will help improve your credit score.

Keep in mind that if you choose your own method to pay off your credit cards, you may not see as fast of a rise in your credit score.

You can even view your credit score and monitor the improvement for yourself.

Bright Credit Builders

The platform also offers an easy credit boost with its Bright Credit Builder. It runs automatically, creating a new line of credit Bright uses to help pay off your credit cards and repays to the credit line automatically.

The result is an automatic positive payment history that boosts your credit score. It’s safe to use and risk-free. You’ll put down a $50 deposit for the line of credit and get it back in full when you’re done.

Bright Balance Transfers

Another facet of Bright Money is its Bright Balance Transfers. This is essentially a credit line that provides a lower interest rate than what you’re paying on your credit cards.

You can transfer your credit card balances to that credit line to help you pay less in interest and pay your debt off faster.

It’s possible to get lines of credit up to $10,000 with APRs as low as 9.95%. However, this will depend on your eligibility.

Bright Money Reviews

If you are trying to determine if Bright Money is right for you, knowing what other users think of the app might help.

Here is how Bright Money ranks on the various rating platforms:

| Platform | Rating | Number of Reviews |

| Trustpilot | 4.6 out of 5 | 639 |

| Apple App Store | 4.7 out of 5 | 2,700+ |

| Google Play | 4.7 out of 5 | 3,500+ |

These are a few reviews that customers shared across the rating websites:

“Bright Money is excellent! Amazing experience and Customer support are fantabulous! I love the way the app is designed!” – Jenny John

“I’m so glad I found Bright! It’s all I will ever need for credit card management. The algorithm is seamless. I never realize the money has been removed from my bank account. My cards are all paid on time or early.” – Chelzzz3

“I’ve only had this app for a few weeks and I’m already impressed. Text messages to keep you informed of your account statuses and quick customer service for your questions. I’d recommend.” – Katharine Brown

Alternative to Bright Money

Since Bright Money is a newer app, we’ve included an alternative for you to check out.

Tally

Tally works similarly to Bright Money, although it also doesn’t anticipate and adjust for other upcoming bills. The service helps you pay off your debt by letting you choose from three different membership options.

With Tally Membership, you link your credit cards. Then, Tally helps you pay them off in the smartest way possible. This option costs $4.99 per month.

Tally Basic includes all of the Tally Membership features. It also offers a lower-interest line of credit that you can use if you want to transfer your credit card balances so you can pay them off faster.

The Tally+ plan offers a larger line of credit at a steeper discount. Both the Basic and the Plus plan come with a $300 annual fee that is deducted from your available line of credit.

Frequently Asked Questions

If you are still on the fence about Bright Money, these questions might be able to help.

Yes. Bright Money uses 256-bit encryption bank-level security and partners with Plaid to keep your information secure. It doesn’t share data with third parties.

Additionally, Bright accounts are FDIC insured up to $250,000. This means you can rest easy knowing your money is safe

No. While it doesn’t work with everyone, Bright Money works with a wide range of banks. In total, the service works with over 14,000 banks.

Check the Bright Money website to see if your bank partners with Bright.

No. Bright Money works with most credit cards that have between 13 and 19 digits. If your credit card won’t sync with Bright Money, call Bright’s customer service number for assistance.

You can contact Bright Money via email at hello@brightmoney.co. You can also call Bright Money at 1-856-832-6419 or use their chat feature.

The company has customer service agents available 24/7.

Is Bright Money Worth It?

Bright Money is only worth it if you have the extra money to pay their monthly fee and you find value in the help of their services.

In most circumstances, you can pay off your debt without having to pay a monthly payment to a company like Bright.