FarmTogether Review: Is This Farmland Investment Worth it?

Some products in this article are from our partners. Read our Advertiser Discloser.

Interested in investing in farmland? FarmTogether is a way to invest in farming operations without the hassle of owning a farm.

But is this the right investment opportunity for you? This review can help you decide if it’s a good investment choice for your portfolio.

Overall Rating

Summary

FarmTogether is a real estate crowdfunding platform with a twist. Instead of investing in commercial or residential buildings, you invest in farming operations. The platform is open to accredited investors only.

-

Cost

4.5

-

Investment Options

5

-

Investment Minimums

4.5

-

Fees

4

Pros

- Annual returns favorable

- Open to global investors

- Lower risk

- Taxable & non-taxable accounts

Cons

- Accredited investors only

- Long holding periods

- High minimums

- Limited customer service

What Is FarmTogether?

FarmTogether is a real estate crowdfunding platform with a twist. Instead of investing in commercial or residential buildings, you invest in farming operations.

The company was founded in 2017 by Artem Milichuk, who has over a decade of experience in agricultural finance. Investors who take part in FarmTogether’s mission can own shares of varying types of farms.

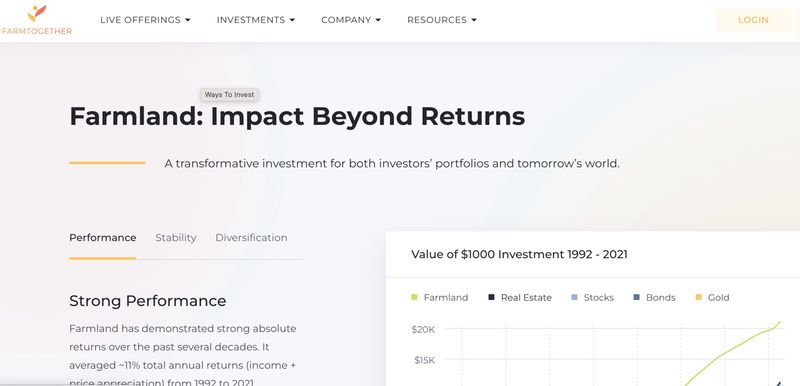

Although a smaller percentage of investors choose farmland as an investment, it is a logical investment since food is an everyday necessity. Additionally, agricultural assets have a long history of steady returns.

FarmTogether backs farming investment opportunities that have a return rate of between 7% and 13% and generate a cash yield of between 3% and 9%.

A history of steady returns, along with the fact that farming is a critical part of life worldwide, makes agricultural investing attractive.

With FarmTogether, you get a truly passive income investment. Property management and other decisions are made by FarmTogether or its management partners.

Their goal is to purchase farmland that is priced below value. Then they work to improve the land and lease it out on a long-term lease, ultimately selling it for a profit at the end of the investment term.

All farming operations that FarmTogether takes part in have been meticulously reviewed for stability and healthy operational functions.

Farmtogether Quick Summary

| Product | Farmtogether |

| Minimum Investment | $10,000 |

| Fees | Varies |

| Account Types | IRA, Taxable |

Who is FarmTogether For?

FarmTogether is for any accredited investor looking to add asset classes in agriculture to their portfolio.

An accredited investor is someone who meets one of two financial criteria:

- An income of over $200,000 per year for a single person

- An income of over $300,000 per year for a married couple

Your income has to be at that level for the last two years and be expected to remain at that level for the coming year.

Alternately, you can qualify as an accredited investor if you have a net worth of at least one million dollars. This net worth applies either individually or jointly with a spouse.

If you don’t meet one of these two requirements, you can’t invest with FarmTogether.

Investing with FarmTogether

How does investing with FarmTogether work? Here’s a rundown.

Investment Types

With FarmTogether, you own fractional shares of individual farms. You’re not taking part in a REIT. Instead, you own shares of an entity, typically an LLC, that owns farmland property.

You can own a fractional share of a farm, or you can back the entire farm on your own.

The shares you own have the potential to earn money in two different ways:

- Earning income via land lease

- Through profit that is made when the land is sold

Each farm leases its land to farmers who manage and sell the crops. They then invest in both row crops, such as corn and soybeans, and permanent crops, such as nut and fruit trees.

As an investor, you get to choose which types of farms you invest in. Each of the farms that FarmTogether invests in has been thoroughly vetted.

Additionally, FarmTogether invests some of its money in each farm. They’re putting their money where their mouth is by joining investors in holding fractional shares of each farm they promote.

Investment Methods

FarmTogether allows you to invest in farmland through several methods. You can choose a taxable account, a self-directed IRA, a solo 401k account or invest via your own LLC or corporation.

Investment Minimums

FarmTogether offers fractional share investing with minimums as low as $10,000. If you’re interested in backing an entire farm on your own, you can expect to shell out one million dollars or more.

Fees

Fees vary with each investment, so you’ll have to sign up to view the investments and see individual fees. However, you can expect to pay somewhere between 0.5% and 1% upon initial purchase.

This purchase fee is written as an origination fee. Annual management fees are roughly 1% as well.

Minimum Holding Periods

FarmTogether offers long-term investments. You can expect to hold your investment for roughly five to ten years, sometimes longer.

In other words, this is not for those who want short-term investment options.

Distributions and Payouts

Distributions from lease payouts are usually made on a quarterly, semi-annual or annual basis. Those from the sale of land are paid out when the land is sold at the end of the investment term.

How To Open A FarmTogether Account

Opening a FarmTogether account is easy. Just visit the FarmTogether homepage and hit the “Sign Up” button in the upper right corner. You’ll need to answer a series of questions, and then you can create your account.

Once you’ve created your account and signed an electronic agreement for funds transfer purposes, you can make your first investment purchase.

Remember that this is only open to accredited investors. As you begin, they want to know what you are looking for as an investor.

Is FarmTogether Safe?

FarmTogether is an investment, and all investments involve a certain level of risk. Furthermore, crowdfunded real estate is a relatively new investment concept.

Other crowdfunding companies have gone under, and backer’s investments have disappeared.

Could that happen with FarmTogether? Yes, though it could happen with any investment company.

Diversification is critical when investing, especially when it comes to alternative investments. Keep that in mind when deciding what percentage of your assets you’ll invest in companies such as FarmTogether.

The most predominant risks are overpaying for land or choosing the wrong operator partners.

FarmTogether works to mitigate those risks by having strict underwriting guidelines. The company also strives to work only with experienced farmers and farmland investment managers.

In addition, other factors could influence the value of money you invest with FarmTogether. Adverse weather conditions could affect crops, or land values could decline.

Ultimately, only you can decide whether investing with FarmTogether is a risk worth taking.

Positives and Negatives

As with any investment opportunity, FarmTogether has its pros and cons. Here’s a rundown of some of the most prominent benefits and downsides of FarmTogether.

Pros

- Can be a nice hedge against inflation

- Annual projected returns between 7% and 13%

- Open to domestic and foreign investors

- Investments secured by underlying farmland, minimizing risk

- Taxable and non-taxable accounts

- Management team has decades of combined experience

Cons

- Only open to accredited investors

- Minimum of five years holding period for investments

- Limited customer service options (phone appointment only)

- Minimum investment of $10,000

FarmTogether Reviews

Here is some review information on FarmTogether.

| Website | Rating | Number of Reviews |

| Apple App Store | none | no app |

| Google Play | none | no app |

| Better Business Bureau | none | not listed |

In our research we could find no reviews listed on any of the major review sites. Given the company was founded over five years ago, we found this surprising.

The site requires all investors be accredited, which may give you some indication of the risk involved with this type of investing.

FarmTogether Alternatives

Currently, there’s really only one other major company that mimics FarmTogether’s mission. This company is called AcreTrader.

Like FarmTogether, AcreTrader is only open to accredited investors. They offer similar types of investments, including fractional shares in a variety of farms.

The minimum investment with AcreTrader is $10,000, but often up to $40,000 or more. This is similar to FarmTogether.

Interestingly, AcreTrader already has a secondary market for those who wish to sell their investment early. This means that buyers can scoop up shares from the secondary market.

AcreTrader charges a 1% annual management fee and a 0.75% origination fee, compared to FarmTogether’s 0.50% origination fee.

Read our full Acretrader Review to learn more.

Related Article: AcreTrader vs. FarmTogether

FAQs

There are a few other things you should know about investing with FarmTogether.

FarmTogether requires certificates of accreditation from companies such as InvestReady and VerifyInvestor. You must be an accredited investor to use the platform.

If you’re interested in investing in a portfolio of properties instead of a single farm, you may have that option. You can contact FarmTogether if you’re interested in portfolio investing.

Yes, FarmTogether facilitates 1031 exchanges if that’s something you need in an investment. 1031 exchanges allow you to swap investment properties in order to reduce your taxes.

FarmTogether investments offer holding periods of five years or more. Many investments require a seven to 10 year holding period, and some even longer than that.

If you need to sell your investment before the end of the target holding period, FarmTogether will help you find a buyer. That said, you’ll likely end up selling at a discounted rate, losing money in the process.

Interestingly, FarmTogether is working on introducing a secondary liquidity market in 2021. This development could be a great way for you to pick up farmland investments at a discounted rate.

Summary

If you’re looking for alternative investment options to free investing apps, you might like FarmTogether. Along with higher returns, farmland investing can offer the potential for secure long-term investments.

Given the risk level of any investment, you may want to avoid putting a large percentage of your wealth into farm investments. A diversified, balanced portfolio is always best for long-term sustainability.