Monarch Money Review: Manage Money In One Place

Some products in this article are from our partners. Read our Advertiser Discloser.

Budgeting and creating long-term personal finance goals while managing all of your different bank accounts can be overwhelming.

Luckily, a platform like Monarch Money can help. Monarch Money recognizes that keeping track of your funds can be complicated and provides a streamlined solution to better money management.

Our Monarch Money review can help you decide if it’s the right solution for your personal finance needs.

Overall Rating

Summary

Monarch Money is a comprehensive money management platform. You can use it to build a budget, set goals, track your financial progress and more.

-

Price

4

-

Ease of use

5

-

Features

5

-

Budget Tracking

4.5

Pros

- Collaboration available

- Budget tracking

- Investment tracking

- Visually appealing experience

Cons

- Cost

- Relatively new

What is Monarch Money?

Monarch Money is a money management platform that focuses on helping users reach their financial goals. It offers the most modern and intuitive way to manage your money.

Specifically, this personal finance app focuses on hitting your short-term and mid-term goals. That said, you’ll also get a big-picture look at your long-term goals and everyday budgeting.

The company’s mission is to help you improve your financial health and achieve your goals.

With multiple unique features that give you a more comprehensive approach to overseeing your finances, the platform is an excellent option to help with your personal finance needs.

How Does Monarch Money Work?

Getting started with Monarch Money is easy. Here’s a step-by-step look at the process of setting up your account and working with the personal finance platform.

1. Create Your Account

To get started, you’ll need to register for an account. This can be accomplished on the Monarch Money website or by downloading the mobile app from the Apple App Store or Google Play.

2. Connect Your Accounts

After you’ve registered, it’s time to add your financial accounts from your different financial institutions. You can do this by providing your login information for each account so that the app can track your financial data.

If you don’t feel comfortable providing these details, you can manually enter all of your information. This option is most useful for tracking valuables.

However, choosing manual entry means that your accounts won’t have their information updated automatically. This can be a hassle if you have multiple financial institutions you need to monitor.

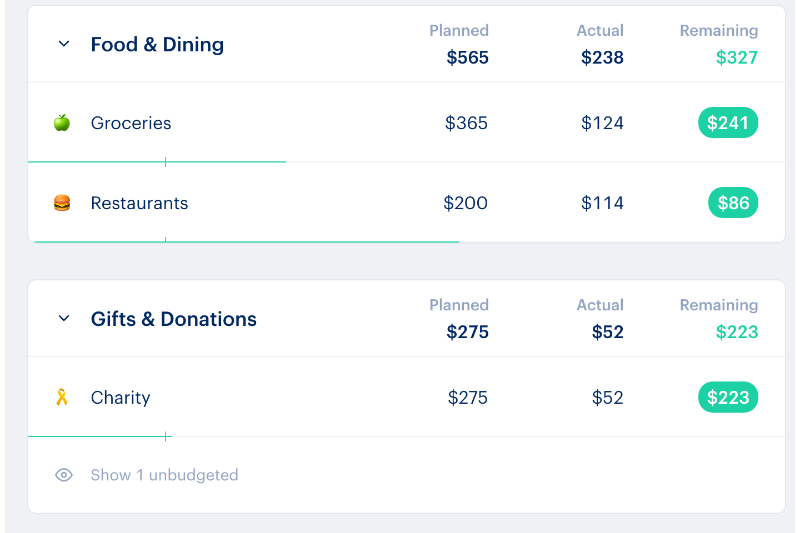

3. Customize Your Categories

Everyone’s financial picture is a bit different. As a result, Monarch Money gives you the chance to customize your budget categories.

A few of the defaults include housing, transport, children, income, charity and education. If you have unique categories that take up a part of your budget, you can add those as well.

4. Create a Financial Plan

Monarch Money dedicates a large portion of the platform to your financial planning. You can create a plan that includes budgets, forecasts and goals.

As you create your plan, you can add both short-term and long-term goals. This gives you the ability to map out a more comprehensive plan than some of the company’s competitors.

If you need help creating a plan, Monarch Money offers advice along the way so that you can achieve your goals.

5. Additional Customization

Beyond creating a plan, Monarch Money lets you set up a customized dashboard that matches your interests.

Depending on your situation, you might want to focus on your day-to-day budget or a long-term goal. You can create an experience that makes you more excited to monitor your funds.

Plus, you’ll have the ability to add members of your household to your account. If you are managing funds with a partner, this feature is useful.

6. Track Your Progress

Once everything is set up, you can enjoy the power of Monarch Money. At this stage, you can track your progress to see where your finances are heading.

A regular progress report walks you through how your finances are doing and helps you stay on track.

The monthly report includes personal finance information about:

- Cash flow

- Top income categories

- Biggest expenses categories

- Net worth

- Asset breakdown

- Liability breakdown

- And more

A closer look at your budget is another option to ensure you don’t get off track. For example, you can see how much you spent for a budgeting category versus how much you planned to spend.

These tracking abilities, especially in terms of your cash flow, can help you move toward your financial goals more efficiently.

How Much Does Monarch Money Cost?

Monarch Money offers two different options for customers, including Free and Premium.

Free

The Free option doesn’t cost anything. While it has a decent amount of features, it’s not quite as robust as the Premium plan.

This plan lets you connect two bank accounts and implement ten transaction rules.

You’ll also get unlimited:

- Collaborators

- Cash flow reports

- Budgeting

- Transactions list

- Financial goals

The Free version is enough to get you started and can help you determine if the platform is a good solution for your needs.

Premium

The Premium option is a step up from the Free plan. You can pay $9.99 per month or $89.99 per year if you pay upfront (which is a 25% savings)

Premium gives you access to everything Monarch Money has to offer, including:

- Everything in the Free plan

- Unlimited connections

- Crypto tracking with Coinbase

- Unlimited categories

- Property value tracking with Zillow

- Connect to Venmo

- Priority email support

Premium also comes with a one-week free trial to determine whether or not the added features are of value for your needs.

Choosing between the $9.99 per month or $89.99 per year options depends on if you want to commit to the service and save money or just try it out to ensure it will meet your needs.

Is Monarch Money Worth It?

Whether or not Monarch Money is worth it depends on your situation. The platform is focused on providing a comprehensive overview of your finances while helping to track progress toward your financial goals.

If you are comfortable tracking all of this information on your own, then Monarch Money might not be a good fit. But, if you love diving into the numbers without having to pull information from multiple accounts, then Monarch Money is worth it.

To help you decide if the platform is ideal for your particular situation, there’s a Free plan as well as a seven-day free trial to let you test it out before incurring any charges.

Also, the platform won’t try to sell your data to third parties, making it safe to use.

Monarch Money Features

Monarch Money is a comprehensive platform with multiple tools that set it apart from the competition. Here’s a look at the features that make it unique.

Advice

Monarch Money offers personalized advice for users. After answering a few questions, you’ll find actionable tips that are already broken down into manageable steps.

This advice wizard was created by financial planners. The advice you receive is not only relevant to your unique situation, but it is also grounded in sound financial advice.

Collaboration

Household finances are challenging to manage when only one party has access to account information. It’s critical for everyone to be on board when it comes to managing money.

Monarch Money makes it easy to collaborate with other members of your household. This built-in collaboration allows multiple users to get a comprehensive look at their joint financial picture.

Custom Dashboard

Everyone cares about a different aspect of their financial journey. Some want to focus on income and expenses, while others may want to focus on net worth.

There’s no right or wrong focus when it’s part of the bigger picture.

Instead of making you use a standard dashboard, Monarch Money allows you to switch it up to your own preferences. This way, you can see exactly what you want to see, allowing you to manage your finances more effectively.

Calculators

Financial calculators can help you visualize future money moves. Monarch Money thoughtfully provides four handy calculators.

These calculators can help with:

- Mortgage payments

- Debt paydown

- Retirement

- Financial health

Each one is designed to help you map out your financial future. Even if you decide not to use this platform, these calculators are worth checking out.

Financial Planning

The act of creating a financial plan might seem complicated. Fortunately, Monarch Money makes it easy.

After you set up a plan, the platform will send you notifications when you are heading off track. It’s a helpful way to stick to your budget and make sure you don’t derail your finances.

Goals

Financial goals are a critical part of a successful financial future. Without goals, it’s easy to overspend on things along the way.

Monarch Money lets you focus on different types of goals. You can set up a goal to save for a vacation in a few months or a retirement goal in a few decades.

Plus, you can allocate your savings across your various accounts to each of your goals.

Investments

The platform goes well beyond budgeting thanks to its investment tracker. This tool allows you to track your investments across several different platforms and brokers.

If you like to check in with your investments regularly, this tool makes it easy by allowing you to do so within the Monarch Money interface.

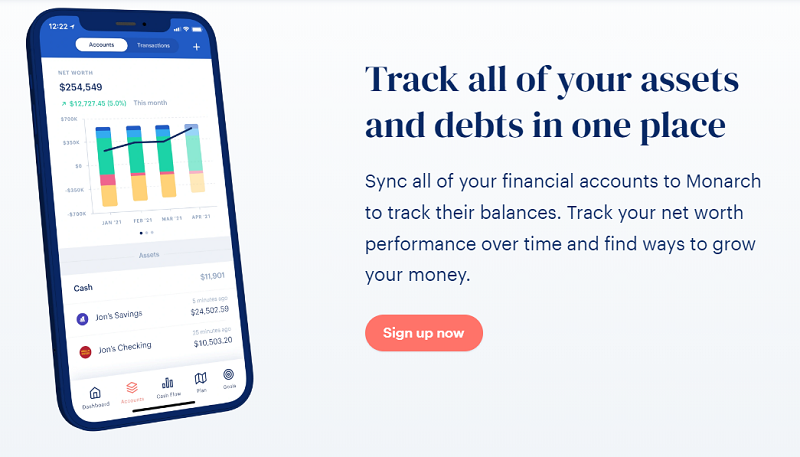

Net Worth Syncing

Your net worth offers a snapshot of your financial health. Instead of tallying up all of your assets and liabilities manually, you can check in with the platform.

Better yet, this feature allows you to find ways to grow your money.

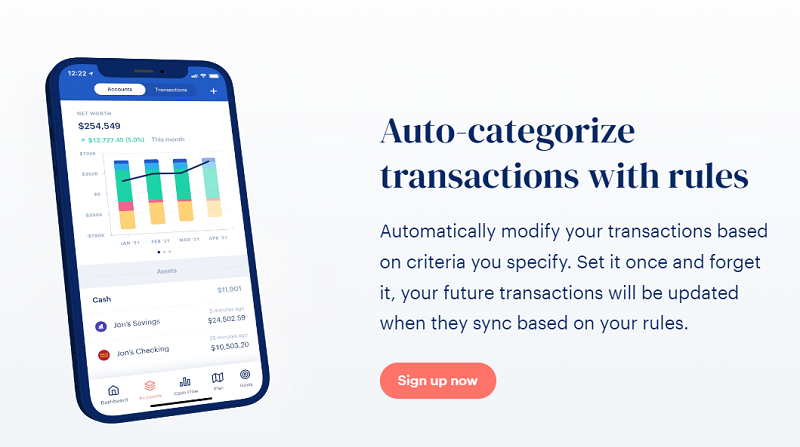

Transaction List and Rules

Budget tracking can go awry when transactions aren’t properly recorded. Monarch Money allows you to set up transaction rules to avoid this common problem.

After you let the platform know how to handle transactions from certain merchants, future transactions are categorized accordingly.

Spending Insights

Spending insights are designed to help you see exactly where your money is going. The pleasant visuals offer a look at where you are spending.

If you spot unwanted bills, you can make tweaks to move in the right direction.

Track Recurring Bills & Subscriptions

Recurring bills can slip under the radar. But Monarch Money’s new feature makes it easy to bring any recurring transactions into the light.

The platform will scan your transactions to spot any recurring bills. A few examples include your rent, utilities, insurance, and subscriptions.

With those details, you can view upcoming bills on a monthly calendar, confirm payment, or explore upcoming recurring transactions.

If you want a heads-up about a recurring bill, the platform can send you a notification three days in advance.

Monarch Money Reviews

Before committing to a personal finance management platform, checking out the reviews is helpful. Although it’s currently not rated on Trustpilot or the Better Business Bureau, there are plenty of reviews of Monarch Money’s mobile apps.

Here’s how the service stacks up on the app stores:

| Website | Score | Number of Reviews |

| Apple App Store | 4.8 out of 5 | 1.1K |

| Google Play | 4.5 out of 5 | 272 |

Here’s a look at some Monarch Money reviews from customers:

“I use this instead of mint now because mint is very clunky and has lots going on. This app works quicker, easier to navigate, and the best feature (monthly budgets) is structured in my opinion the right way.” – bsilva09

“I thought it was great at first but I have hundreds of transactions that didn’t go through with my card, and no response from support. $100 subscription isn’t worth it without support and these bugs sadly.” – Brandon Unglaub

“Best budgeting app I’ve come across. Easy to track and categorize expenses; consistent, clean UI that makes me want to check-in with the budget daily. I prefer paying a monthly fee to an Ad/Data Capture driven model.“ – Will Shafferman

“Not quite as good as Mint. This app is good for simple income and expenses tracking. The budget tool is very simple and automatic. You can customize it, but some of the defaults are confusing.” – Seth Wright

Alternatives To Monarch Money

Monarch Money isn’t the right fit for everyone. If you think you might need an alternative, here are some of the top competitors worth considering.

Mint

Mint is a free budgeting platform. However, you’ll have to put up with ads, which can be a deterrent for some people.

With Mint, you’ll get access to spending trends, a free credit score and alerts about upcoming bills for your credit card, utilities and more.

Unfortunately, a big drawback to the platform is the inability to add collaborators. This means that you can’t work with someone in your household to build a complete financial picture and manage your money.

Additionally, the platform lacks in-depth investment tracking options.

Tiller

Tiller offers a lower price point than Monarch Money at just $70 per year. Its features include extensive money tracking, net worth tracking, a debt snowball spreadsheet, a weekly expense tracker and more.

While there’s no app, you’ll find customized spreadsheets designed to track your money. If you love spreadsheets, the Tiller is right up your alley and will let you track credit cards, loans, bank accounts and more.

But, if you want a mobile service, then Monarch Money is a better fit.

You Need a Budget

You Need a Budget (YNAB) is focused on offering users a top-notch budgeting experience. The platform focuses on helping customers get the most out of their budget by putting their dollars to work.

This budgeting app provides a robust experience. However, it lacks the bigger picture overview. You won’t be able to track your investments or save for long-term goals.

Instead, the focus for this budget tracker is more short-term. This is great if you need to work on your short-term budget.

The platform costs $11.99 per month or $84 per year if you pay upfront.

FAQ’s

Do you still have questions about Monarch Money? These answers might be able to help.

Is Monarch Money legit?

Yes, Monarch Money is a legitimate platform that takes steps to keep your financial information secure.

Furthermore, with its free trial, you can test it out before fully committing. This way, you can make sure it’s the right option for you.

What customer service options does Monarch Money offer?

Monarch Money offers an extensive help section on its website. You can also email support@monarchmoney.com for help.

Is Monarch Money safe?

Yes, Monarch Money institutes strict safety measures that essentially provide bank-level security. It uses Plaid in addition to a multi-factor authentication for logins. This allows users to securely sync all of their financial accounts.

Better yet, it promises that it won’t try to sell your information to third parties.

With Monarch Money, you know your financial data is safe.

Does Monarch Money have a mobile app?

Yes, Monarch Money has a mobile app. It’s available for iOS and Android devices on the Google Play and Apple App Store.

Summary

Monarch Money offers a comprehensive money management experience. You’ll find useful tools to help you budget, track your net worth, follow your investment portfolio and more.

The customized advice available when you are using Monarch Money is the cherry on top of this stellar platform. Plus, with the free trial, there’s no harm in giving it a try.