Is A Timeshare Worth It?

Some products in this article are from our partners. Read our Advertiser Discloser.

I’m sure you’ve probably gotten–or at least heard about–free weekend getaways and other fun stuff in exchange for listening to a timeshare sales presentation. But is a timeshare worth it?

You’ve likely heard stories of people who got ripped off when buying a timeshare. Or of people who are chained to their timeshare forever, serving a life sentence. Can timeshare ownership really be that bad?

We’ll go over some of the most important details of what happens when you purchase and own a timeshare. Then you’ll be able to take that information and decide if timeshare ownership is right for you.

What You Should Know About Timeshares

Let’s start with stats on timeshare ownership. Timeshares are still big business, even with all of the negative publicity out there. The American Resort Development Association (ARDA for short) acts as an advocate for timeshare companies and consumers, their website says.

According to the ARDA website, the timeshare industry is a 10+ billion-dollar business. The site says that 9.9 million U.S. households (there are roughly 120 million U.S. households according to the U.S. Census Bureau) own timeshares or points in timeshare associations.

What I found interesting on the ARDA web page was that it stated that only 13% of timeshare owners earn more than $100,000 per year.

That leads me to ask several questions. Does the lure of a free vacation weekend or another big-ticket item draw in those with tighter financial situations?

Does the promise of a guaranteed annual vacation sound too appealing to pass up for those who work hard but have little extra cash floating around?

Do timeshare sales teams prey on lower-income individuals, couples, and families? I can’t answer that question myself as I don’t have any idea about the intentions of timeshare resort owners.

The Average Price of a Timeshare

The average price of a timeshare is $24,140 according to the American Resort Development Association. And the average maintenance fee is $1,000 per year.

Over $4.9 billion in timeshare units were sold in 2020 alone. Many timeshare owners think it’s worth it to purchase timeshare intervals.

I mean, you pay your upfront price, and your week is there forever. Many timeshare associations offer intervals that you can pass on to children and grandchildren. Although you still have to pay maintenance fees, at least the purchase price is a “one and done” deal.

But what if you want to sell your timeshare? Sadly, resale data favors buyers and not sellers in the timeshare market.

One report shared that a secondary timeshare buyer could expect to get two or three similar timeshares for the $20,000 the original buyer spent when they bought it.

While that’s great news for the buyer, it’s not great news for the seller who paid full price. However, only you can decide if the cost to buy one first hand is worth it.

Next, let’s talk about common types of timeshare intervals available for sale.

Timeshare Versus Investing

Lets say you totaled up what it would cost you to have a timeshare over 30 years.

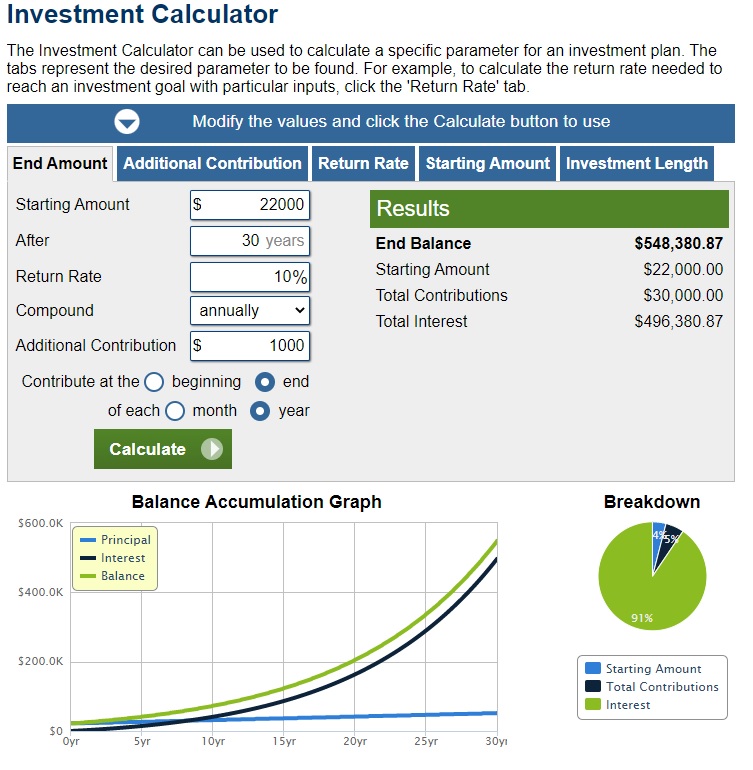

If you were to pay $22,000 up front, then an additional $30,000 in maintenance fees, your total base cost would be $52,000.

If you were to take that $22,000 and instead invest that money into an index fund with the potential to get a 10% annual return, you would have $548,380.87. This includes the $1000 annual contribution you would have normally put toward maintenance fees.

See details below:

Types of Timeshares

Three types of timeshares are most common in the timeshare world: Fixed week, floating, and points-based.

Let’s go over some details about each one.

Fixed Week Timeshare

With a fixed week timeshare, your interval remains the same every year. You can stay at your resort during X week of the year, every year, with no changes.

Floating Week Timeshare

Floating week timeshare intervals can work in a few different ways. You might have options to choose a week within a designated season, or you might be able to choose from any week of the year to use your timeshare interval.

Some floating timeshares also allow you to choose between more than one resort too.

Points Based Timeshare

A points based timeshare is sometimes called a vacation club as well. With a points based timeshare, you are awarded (or more truthfully, you pay big money for) some points from your timeshare association.

You can use those points in exchange for accommodations at one of several different resorts.

Deeded Ownership or Right-to-Use

Another essential factor to be aware of when considering purchasing a timeshare is whether the ownership is deeded ownership or right-to-use.

With deeded ownership, you own the rights to your usage period until you decide to sell, bequeath, or relinquish that right.

If you purchase a timeshare with a right-to-use contract, you typically agree to own your user rights for a specific time (often between one and five decades). Once your time is up, you are no longer responsible for your annual maintenance fees.

A right-to-use contract, in short, means you never really have ownership of the timeshare interval. It’s more like a rental situation.

If you’re considering purchasing intervals, be sure you’re aware of all of these types of details for any timeshare. In other words, read the fine print.

Next, let’s go over the pros and cons of owning a timeshare.

Pros and Cons of Owning a Timeshare

So what are the pros and cons of owning a timeshare? Let’s talk about them.

Why a Timeshare May Be Worth it

Guaranteed Vacation Slot

Well, you do have a guaranteed vacation slot every year when you own a timeshare. Even if you purchase a floating or points-based timeshare interval, at least you’ve got a vacation waiting for you at some point during the year.

Potential to Rent Out

If you’ve purchased your timeshare interval on a deeded contract, you may have the ability to rent it out if you can’t use your interval in any given year. It means you could have the opportunity to try and recover part of your annual maintenance fee.

However, be aware that not all timeshare resorts allow you to rent out intervals. Again, reading the fine print is vital.

Timeshare Annual Fees Can Be Cheaper Than Hotel Stays

In some cases, you may find it cheaper to pay your annual timeshare maintenance fees than it would be to rent a hotel or cabin for the week. This aspect can be beneficial if you don’t mind staying at the same resort each year or choosing from the same group of resorts every time.

However, depending on what the annual maintenance fees are, what amenities the resort has to offer and what other vacation options are available, you might find it cheaper to get a hotel or get an Airbnb for the week.

Less Costly Than Owning a Vacation Home

And finally, owning a timeshare interval does cost less than purchasing a full vacation home on your own. You pay your upfront amount and your annual fee, and you’re done.

No maintenance needed, no repair costs, no property taxes, and less cash out of pocket as a whole. If you’re looking for an easy way to have a regular vacation slot, this could be your answer.

Next, let’s go over the cons of owning a timeshare.

Why a Timeshare Is Not Worth It

Yes, as with everything, there are downsides to owning a timeshare. Here are a few.

Annual Maintenance Fees

As mentioned above, the annual maintenance fees on timeshares average about $1,000 per year currently. What this means for you is that your timeshare fees could be less than that–or they could be more than that.

Also, most timeshare companies and HOAs have the right to raise your annual timeshare maintenance fees. You’ll do yourself a favor if you figure out the hows and whens of raising those fees before you sign your timeshare purchase agreement.

Additional Hidden Fees and Assessments

And sometimes it’s not just the annual maintenance fee you’ll pay as a timeshare interval owner. Some resorts deem interval owners responsible for a portion of the property taxes.

Others will hit timeshare owners with assessments for improvements or repairs. If you don’t entirely understand what the fine print means on a timeshare purchase contract, have a real estate attorney look it over. That way, you’ll know exactly what you’re getting into before you buy.

Timeshares Are Not an Investment

Although timeshares might cost less money upfront when it comes to purchasing, it’s important to remember that timeshares don’t appreciate over time.

When you purchase a vacation home outright, you’ve got a fair chance that the property will appreciate in value and that you’ll be able to sell it at a profit. However, that’s not the case with timeshares.

There’s typically no appreciation on the interval, and in fact, timeshare intervals often sell for up to 75% less than what the original owner paid for them. And you may or may not be able to get out of your timeshare contract. The cash draining maintenance fees could go on for years.

If you’re looking for a real estate purchase that is a truly potentially profitable investment, consider crowdfunded real estate investing.

Crowdfunded real estate investing allows you to invest in real estate without huge out-of-pocket dollars or the commitment of managing renters and caring for properties.

Timeshares Are Often Difficult to Sell

On top of that, you might have difficulty selling your timeshare interval at all. Depending on the market, the resort and other factors, the value of your timeshare interval may have greatly dropped in resalable value.

If that’s the case, you may have trouble even giving it away.

You Usually Can’t Cancel Your Timeshare Agreement

So you can’t sell your timeshare interval. Can you just cancel it and walk away? Typically not. The FTC rules on a 3-day cooling-off period for large purchases don’t apply to real estate transactions.

And all state laws regarding timeshare contract cancellations vary. See our article on canceling timeshares for more information.

No Capital Gains Loss on a Reduced Sale

On top of that, Uncle Sam certainly doesn’t look upon timeshare intervals favorably. When you sell a home at a loss, the IRS often lets you subtract the loss from your taxable income from a capital gains perspective.

Not so with timeshare ownership. Selling a timeshare at a loss–even a significant loss–is no different than selling a vehicle or other depreciating asset at a loss. It’s all on you.

Verdict: Is A Timeshare Worth It?

When I was in my early thirties, my parents bought two timeshare intervals. As young parents, my brothers and I enjoyed taking our families up there and having a free vacation week, a gift my parents generously offered us when they couldn’t use their timeshare weeks.

However, for my parents, timeshare ownership was a financial disaster. They ended up selling the timeshare intervals for pennies on the dollar, merely happy to be free from the annual maintenance fee.

They also didn’t like that they were committed to going to the same vacation destination every year. And so, they gave their weeklong intervals to us kids a lot more as the years went on.

Today, free of timeshare ownership, my parents simply choose to vacation when and where they wish. And they like it a lot better that way!

So is a timeshare worth it? Most personal finance and investment specialists would answer that question with a resounding “No!”.

My personal opinion is that you’re better off renting a cabin or home in a city you might enjoy each year. There’s no upfront cost, no maintenance fees, and no need to sell when you don’t want to visit that place anymore.

Just go, pay, and then find a new place to go again next year.