10 Ways to Pay off Your Mortgage Faster

Some products in this article are from our partners. Read our Advertiser Discloser.

If there’s one goal that’s in the back of every homeowner’s mind, it’s that of the day when they make their last mortgage payment.

Loan giant Freddie Mac tells us that recent statistics show us that nearly 90 percent of homebuyers get 30-year mortgage.

Thirty years is a long time to owe someone money, and a long time to pay interest to a bank.

How to Pay Your Mortgage Off Quickly

We’d like to help you cut down the amount of time you owe on your home by sharing with you 7 ways you can pay off your mortgage faster.

1. Refinance to a Shorter Term

According to the St. Louis Federal Reserve Bank, the average price for a home in the U.S. (as of December 31, 2021) was $477,900.

Putting 10 percent down leaves the buyer with a mortgage balance of $430,110.

If a consumer took out a 30-year, 4.00% note on that mortgage, their principal and interest payment would be $2053.00.

The total paid by the end of the 30 years? $739,365.46. That’s over $309,000 paid in interest alone.

However if that same borrower took out a 15-year note at 3.00% interest, their payment would be somewhat higher at $2970.00.

The difference is that their total paid at the end of the 15 years would drop substantially: down to $534,659.07.

That’s a savings of over $204,700 in interest and 15 years less of slavery to the bank that holds your mortgage note.

2. Make Extra Payments Each Month

If you’re not crazy about lowering your mortgage term (and even if you are) a good way to pay off your mortgage faster is pay a bit more on the principal each month.

Depending on how your budget looks, that amount could be $100 each month or it could be $500 each month.

Just choose a dollar amount that you know you can live with, and add that amount to your mortgage as an extra principal payment each month.

For instance, let’s take another look at our borrower mentioned above. Let’s say this borrower added $200 each month as an extra principal payment to their mortgage.

They’d pay off their mortgage almost five years early, and save nearly $40,000 in interest.

Tip: Use a zero-sum budget to maximize your income’s leverage.

3. Use Your Debt Snowball Payments

Have you recently paid off consumer debt using the debt snowball method?

If so, why not take the amount of money you were putting toward your consumer debt payments and simply apply it toward your mortgage balance?

You’re already used to spending that money on debt each month.

Using it to make principal payments on your mortgage means you won’t feel extra strapped for cash, but the drop in your mortgage balance will be astonishingly noticeable.

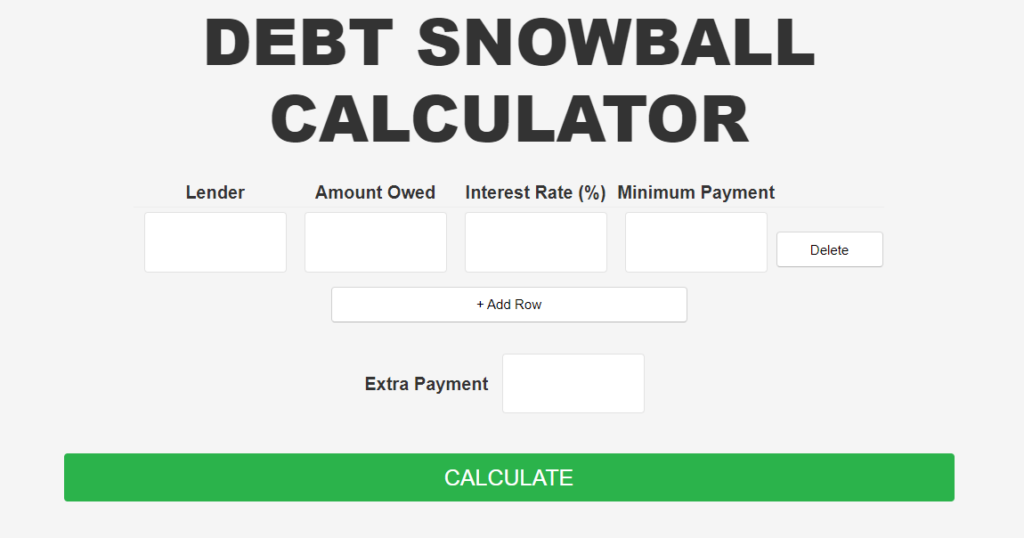

Tip: Use our Debt Snowball Calculator to determine your best payoff plan.

4. Get an Extra Job

Whether it be via a part-time job on nights and weekends (Deacon delivered pizzas in order to accelerate the payoff of their $52k in consumer debt in 18 months) or a side hustle business that you can work on in your own time, money from an extra job can substantially reduce your mortgage balance.

Last year alone I made well over $12,000 in freelance jobs working from home. Imagine what kind of impact that amount of cash could make on your mortgage balance.

There are other options you have for earning extra cash for mortgage payoff purposes too, such as:

- Making money from home

- Using a deliver app to make money

- Earn money writing reviews

- Work a retail job

- Work as a server at a restaurant

Or you can find some other type of job that fits in with your talents and your schedule. Commit to using all of the money you earn to pay off your mortgage faster.

Tip: Use this list of creative side hustles to maximize your income and pay off your mortgage super fast.

5. Declutter Big Time

Most all of us have closets and garages full of stuff we never use anymore. What about those snow skis you swore would become your next pastime?

That boat you never have time to use. The designer shoes you had to have but never wear.

Go through each and every closet, drawer and storage area, pile up the things you don’t use or want anymore, and sell them on EBay, Craigslist or on a local Facebook group.

Use popular apps to sell your unused stuff online or in person in order to get buyers as fast as possible.

I’m willing to bet you can make yourself at least a few hundred dollars to put toward your mortgage debt in the process.

Tip: If you haven’t used it in over a year, it’s time to think seriously about selling it.

6. Create a Challenge Everything Budget

A Challenge Everything Budget is a budget by where you take every single line item in your budget and work to reduce or eliminate it.

After you’ve done that, you take the monthly savings that you’ve earned and put those dollars toward the mortgage balance each month.

Some ideas for budget cuts can include:

- Cut your cable or satellite service

- Reduce/eliminate your entertainment/restaurant/liquor spending

- Go on a clothes shopping ban for a year

- Shop around for reduced insurance rates

- Work to minimize your electricity bill by using less

- Learn how to spend less on groceries

By cutting costs where you can and putting the money savings toward your mortgage balance, you can easily add hundreds of dollars a month toward your mortgage payoff.

Tip: Use this list of money saving tips to help dramatically reduce your expenses.

7. Use Your Tax Refund

Do you get a tax refund each year? If so, why not use it to save yourself some cash?

Instead of using your tax refund to splurge on a vacation or other large purchase, how about using it to make an extra principal payment on your mortgage?

Note: In an idea world, you would set up your withholding status at work so you didn’t get a tax return.

If you do get a refund consider using that money to invest or pay down your mortgage. You’d use the money to better your financial situation instead of letting the government earn interest on it.

However, if you like the idea of getting a tax return each year, choose to set aside some (or all) of that return to pay your mortgage off faster.

Tip: Are you claiming these popular tax deductions to minimize your tax bill and get a larger return?

8. Put Unexpected Money Toward Your Mortgage

This idea is kind of a bounce off of idea #7. How about using any unexpected money you get to pay your mortgage off quicker?

Ideas of “unexpected” money might include:

- Money you get for birthday or holiday gifts

- Bonus or overtime pay from your job

- Money you get when you return something you bought at the store

- Cash you get from selling something you have

- Money you find laying around the house

- Any other money you get that you weren’t expecting

Since you aren’t expecting this cash to begin with, using it to pay down your mortgage balance is nearly painless.

And if you’re really diligent about putting all of your unexpected money toward your mortgage, you might make several hundred dollars a year in extra payments.

Tip: This method works for paying down consumer debt faster as well.

9. Rent Out A Bedroom In Your House

Do you have a spare bedroom in your house? Or an unused, finished basement?

Why not rent the space out to earn money to put toward your mortgage payment?

You can find a long-term renter that needs a place to live. Or you can use Airbnb to rent out a bedroom or finished lower level to vacationers and business travelers.

It’s not uncommon to make several hundred dollars a month by using Airbnb to rent out a space in your home.

Especially if you live in a highly populated area or an area that is a popular vacation destination.

The key to having a successful Airbnb business is to create a clean, welcoming environment for guests with lots of little touches like a mini fridge and a dish of candies.

Airbnb will help you determine a competitive price for your rental and give you tips for maximizing exposure.

Not interested in doing short-term rental of space in your home? Find a college student or other renter to rent your room or space long-term.

Renters can help you bring in up to $400 or more each month to help pay down your mortgage quickly.

Tip: You can rent out storage space in your garage or home to bring in extra cash too! Check out Neighbor.com for more information on renting out your garage.

10. Downsize to a Smaller Home

Downsizing to a smaller home may not be the simplest or most fun option.

However, as many of our debt success story participants have learned, downsizing is often well worth the freedom that comes with being debt free.

If you’re really fired up about eliminating your mortgage debt, consider whether downsizing your home is the right move for you.

It might be a way to become totally debt free and to start on the road to building wealth.

Related Article: How to Buy a Home WITHOUT a Mortgage

Summary

By utilizing the tips above, you can surely reduce the amount of time you’re paying on your mortgage by several years.

What would you do with all of that extra cash once your mortgage was paid off? Work less?

Travel more? Switch to a lower paying job that offered less stress? Take a sabbatical?

Have you paid off your mortgage early? Or are you in the process of doing so? Feel free to share your tips in the comments section.

These are great tips! It’s very helpful advice. Thanks for sharing!

I like the last tip the most. That’s what we did and it really has dropped our interest payment so much. I much prefer to take extra money each month and invest in the stock market vs. paying off my home earlier. It is more risky, but the potential reward is also much greater.

This is great article, but be honest. Nobody will consider downsizing to a smaller home. I have a house with 3 rooms – one for each of my two kids and a third for me and my wife. If I change it for a smaller home, social services would visit me and ask me about conditions in which my children are living.

I think that is a stretch. I have a friend that has a wife and two kids who live in a two bedroom condo with less than 1000sf. They do just fine. I remember when I visited Hong Kong, they said it is not uncommon for a family of 4 to live in 200sf place. It’s all about perspective.

“Downsizing” doesn’t have to mean “smaller”. It can mean moving to a different neighbourhood, or even moving to a house that is the same size but with fewer maintenance costs. Looking solely at square footage can narrow your options to reduce your daily costs.