10 Best Debit Cards With Rewards

Some products in this article are from our partners. Read our Advertiser Discloser.

One of the reasons people love using credit cards is because of the benefit of cash back and/or rewards. However, using credit cards means that you risk accumulating debt.

Opting to use a rewards debit card instead gets you the benefit of cash back or other rewards without the risk of racking up a credit card balance.

We’ve found the top rewards debit cards so you can decide which one is right for your wallet.

What Is a Rewards Debit Card?

A rewards debit card works almost exactly like a rewards credit card.

Essentially, you use it to make purchases. Then, you’re rewarded with cash back or other rewards on those purchases depending on the terms and conditions of the card.

The difference between a rewards credit card and a rewards debit card is that the debit card has no bill to pay at the end of the billing cycle.

Instead, the money you spend using a rewards debit card comes from your checking account.

This means that you can’t spend more money than what you have on hand. However, you still get the bonus of earning rewards on your purchases.

Top Rewards Debit Cards

The best rewards debit cards share various features and benefits, including minimal to no fees and extensive rewards.

Here are some of the top rewards debit cards.

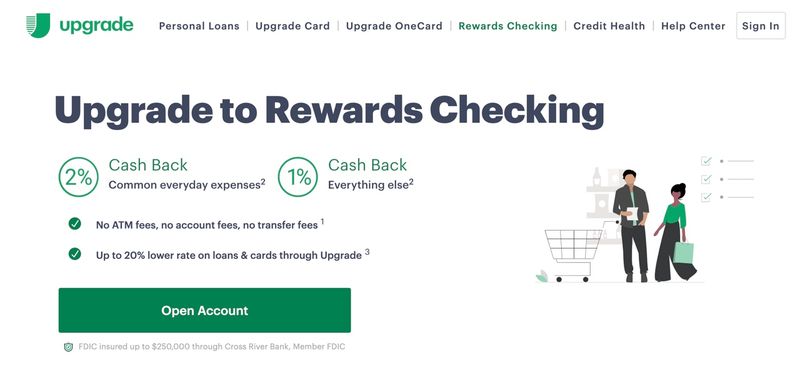

1. Upgrade – Rewards Checking

Upgrade is a pioneer in the fintech industry, providing consumers with affordable loans, rewards checking, and credit education tools to help them make the best personal finance decisions.

Rewards Checking is one of the latest features they offer. Here are the features:

- Minimum opening requirement: $0

- Minimum balance: $0

- Monthly maintenance fee: $0

- ATM: Upgrade refunds up to five third-party ATM fees per month if you have an average daily balance of $2,500, direct deposits of at least $1,000, or at least eight purchases with your Upgrade Rewards debit card

- Rewards: 2% cash back on everyday expenses and 1% cash back on everything else

- Bonus: $200 bonus after opening a Rewards Checking account and making 3 debit card transactions

The ‘everyday expenses’ included in the 2% cash back rewards are convenience stores, restaurants, gas stations, utilities, phones, and subscriptions.

The 2% cash back rewards are limited to $500 in rewards per year. Once you reach the $500 threshold, you’ll earn unlimited 1% cash back on all purchases.

It’s important to note, too, that Upgrade doesn’t have an ATM network. You can use your ATM card at any ATM, but the third-party bank may charge a fee. If you meet the guidelines to have an active Rewards Checking Account, Upgrade will pay back the fees up to five times a month.

Best for: Customers who don’t need to deposit cash or use ATMs often

Pros

- Doesn’t charge any fees

- May earn up to 2% cash back on qualified purchases

Cons

- You cannot deposit cash

Upgrade is a financial technology company, not a bank. Rewards Checking services provided by Cross River Bank, Member FDIC. Upgrade VISA® Debit Cards issued by Cross River Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Personal Loans made by Upgrade’s bank partners. Personal Credit Lines are issued by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender. The Upgrade Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc.

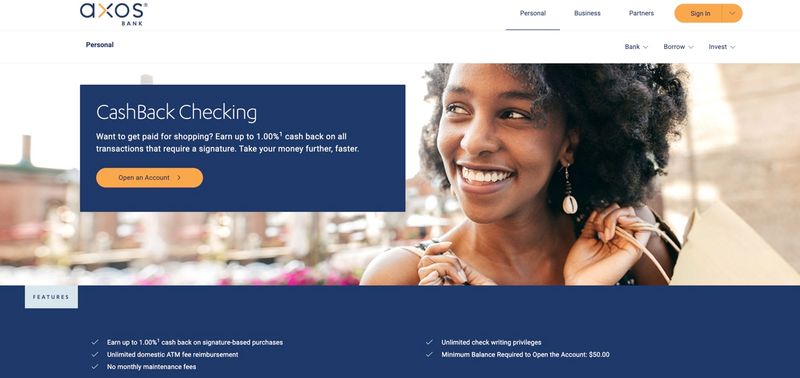

2. Axos

Axos Bank is primarily an online bank. Headquartered in San Diego, California, the company is FDIC insured and has branch offices in California, New York and several other states.

The Axos CashBack Checking account has the following features:

- Minimum to open: $50

- Minimum balance: $0

- Monthly maintenance fee: $0

- ATM: Unlimited domestic ATM fee reimbursement

- Rewards: Up to 1% cash back on eligible purchases with a minimum $1,500 balance

If your balance falls below the $1,500 mark, you’ll still earn up to 0.50% cash back on eligible purchases.

Better yet, you can earn up to $2,000 per month in cash back earnings. Cash back will be deposited directly into your Axos checking account.

Note that with Axos, only signature-based transactions are eligible for cash back earnings.

Other features of the Axos CashBack Checking account include peer-to-peer transfer capabilities and referral bonuses.

You can use the Axos Bank mobile banking app to receive account alerts and manage debit card availability.

In addition, this account comes with unlimited check writing capabilities.

Best for: Customers who make a lot of signature-based transactions

Pros

- Unlimited domestic ATM reimbursements

- Referral bonuses

- Peer-to-peer transfers

Cons

- Cash back applies for signature-based transactions only

- Opening deposit required

Learn More: Axos Bank Review

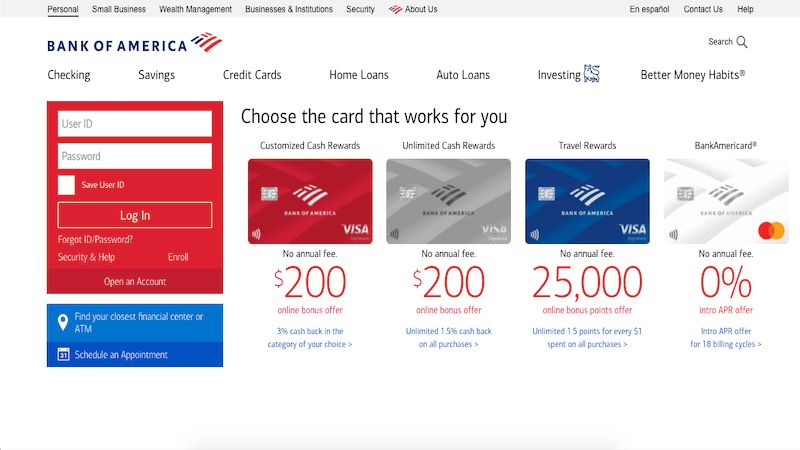

3. Bank of America

Banking giant Bank of America has a checking account called the Bank of America Advantage Plus account.

Here are some of the main features of the Advantage Plus account:

- Minimum opening requirement: $100

- Minimum balance: $0

- Monthly maintenance fee: $12 (with ways to waive the fee)

- ATM: Fee-free at in-network ATMs

- Rewards: Variable cash back percentages

With this account, you don’t earn cash back on every debit card purchase. Instead, you earn cash back on BankAmeriDeal purchases.

BankAmeriDeals are special cash back offers you can see when you log into your BankAmerica account using your mobile app or online banking.

When you make a BankAmeriDeal purchase using your debit card, you’ll get the cash back percentage credited to your checking account 30 days after the purchase.

Best for: Current BankAmerica customers or those who are already considering opening an account with BoA

Pros

- Cash back rewards may be higher than what you’d normally get with a standard card

- No minimum balance requirement

Cons

- Cash back rewards only on BankAmeriDeals

- Monthly maintenance fee (but can be waived)

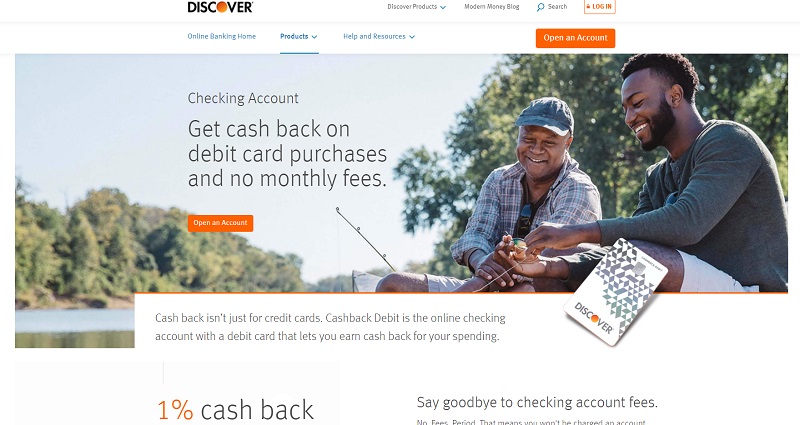

4. Discover

The Discover Cash Back Debit Checking account will pay you up to $3,000 per month in rewards debit earnings.

Here are some of the features of this online-only checking account:

- Minimum to open: $0

- Minimum balance: $0

- Monthly maintenance fee: $0

- ATM: Fee-free at in-network ATMs

- Rewards: 1% cash back on all debit card purchases

One nice thing about this account is that it doesn’t charge fees that other banks typically charge.

For instance, you’ll never see fees for standard check orders, overdrafts, or stopped payments.

You also won’t see a fee for an outbound ACH transfer, a replacement debit card, or a fee for online bill pay usage either.

Note that this account might see a service charge if you use an out-of-network ATM. However, there are 60,000+ ATMs in-network.

Bonus: When you open a Discover online savings account, have your cash-back rewards transferred to that account. This lets you earn 5x the national average interest rate.

Best for: Those who are happy with online-only banking

Pros

- Many standard features that other banks charge for are free

- Comes with checks

Cons

- Just one branch location (located in Delaware)

5. Empower

Empower is a fintech company that offers an online banking account. Just transfer money from your bank account to your Empower account and start spending.

Although there are no checks with this account, you do get an Empower debit card that gives you rewards on purchases.

In addition, if you have Direct Deposits going to your Empower account, you can get the money up to two days early.

Some of the features of the Empower banking account include:

- Minimum to open: $0

- Minimum balance: $0

- Monthly maintenance fee: $0

- ATM: Fee-free at in-network ATMs

- Rewards: Up to 10% cash back on debit card purchases

With the Empower Perks cash back feature, you activate the store where you want to earn cash back.

While you can only have one store activated at any given time, you can switch your activated store at any time.

So, if your activated Perks store is Walmart and you want to head to Starbucks to get a coffee, just switch your activated store before you go into Starbucks.

The percentage of cash back rewards you earn on purchases made with your Empower card will vary based on different factors. See the Empower website for details.

Best for: Those who like the benefits of potentially higher cash back earnings

Pros

- Early direct deposit available

- No fees

- Higher cash back percentages

Cons

- Only one retailer can earn cash back at a time

Learn More: Empower Review: A Banking App With Instant Cash Advance Option

6. Extra

Extra is a debit card with a twist. When you make your purchases with the Extra debit card, you not only earn up to 1% back in redeemable reward points with every purchase, you build credit as well.

Each time you make a purchase with your Extra debit card, Extra pays itself back the next business day¹ by making a withdrawal from your linked bank account. Note: ¹All transaction and account activity is subject to review and approval by both Extra and the Issuing Bank. See Extra Terms and Conditions for more details.

Then, at the end of each month, they report the purchases as creditworthy payments. This helps to build your credit score.

There’s no credit check when you apply for an Extra card. Your spending limit is based on your bank account balance.

Here’s a rundown of Extra debit card features:

- Minimum to open: $0

- Minimum balance: $0

- ATM: N/A

- Rewards: Select purchases earn points redeemable at the Extra rewards store

As an Extra member, you get to redeem your reward points in extra’s iconic rewards store which includes everything from clever kitchen gadgets to trending seasonal must haves.

After you sign up as a member, you can see the list of available rewards items you can choose from.

Best for: Those who need or want to build credit or those with subpar credit who might not qualify for a traditional bank debit card.

Pros

- 1% rewards

- Affordable annual cost

Cons

- Not reported to TransUnion

- Rewards redeemable with Extra

Learn More: Extra Debit Card Review

7. LendingClub

LendingClub Bank’s Rewards Checking account offers several great features. For instance, you can get your direct deposit paycheck up to two days early.

In addition, you can earn interest on balances of $2,500 or more.

Here’s a summary of a few other features of the Rewards Checking account:

- Minimum to open: $100

- Minimum balance: $0

- Monthly maintenance fee: $0

- ATM: Fee reimbursements for all ATM transactions

- Rewards: 1% cash back on qualifying purchases

Note that cash back is only earned on online and in-store signature-based purchases.

LendingClub suggests choosing “credit” instead of “debit” when making a purchase to help ensure you receive your cash back rewards.

Another great feature is that you can order and use checks with this account. The first 25 checks are free.

Best for: Those who want to earn interest and earn rewards

Pros:

- The app is free

- You can have all your financial information in one place

- Has over 55,000 free ATMs

Cons:

- Doesn’t report to the credit bureaus

8. Sable

Sable is another fintech banking company. All Sable deposits are FDIC insured (up to specified limits) through Coastal Community Bank.

Sable can be a good choice for those who don’t have a credit history or anyone who is new to the United States.

You can fund your Sable account via direct deposit or wire transfer.

Here are some of the other Sable features you should know about:

- Minimum to open: $0

- Minimum balance: $0

- Monthly maintenance fee: $0

- ATM: $0 by Sable, although ATM owners may charge a fee

- Rewards: 1% cash back at select retailers

Note that as of this writing, cash back is limited to select retailers, including Amazon, Netflix, Hulu, Uber, Uber Eats, Spotify and Whole Foods.

Sable reserves the right to change cash back-eligible retailers at any time.

Best for: Those with zero credit history or those who are new to the U.S.

Pros

- No bank fees, including overdraft fees

- No minimum opening deposit

Cons

- Limited retailers for cash back rewards

Learn More: Sable Review: Is This Cash Back Debit Card Worth it?

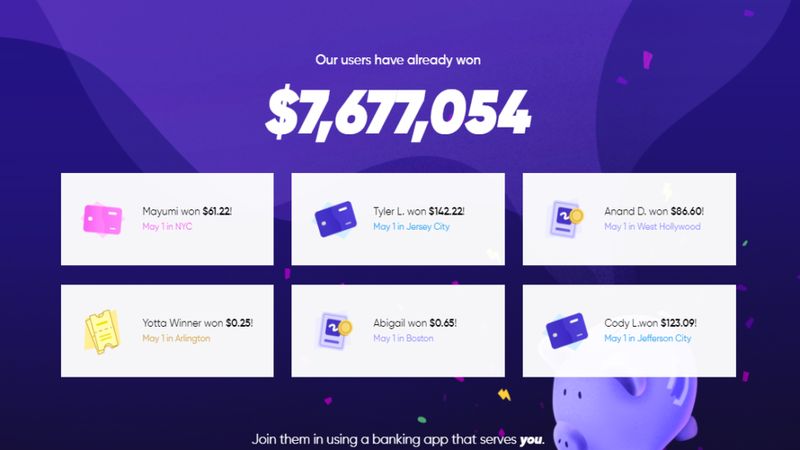

9. Yotta

Yotta is a debit card that rewards you for spending and for saving. The card will pay you an annual interest of at least 0.20% (as of this writing) when you have money in your account.

And if you put money into Yotta’s Crypto Bucket (crypto investing), you could earn up to a 4% APY.

However, for every deposit you make, you get entered into sweepstakes for cash and other prizes.

The sweepstakes feature of the card promises prizes ranging from a few dollars to up to 10 million dollars.

Or you could win an instant “free” purchase when using your debit card. Some of Yotta’s other features include:

- No fees on account balances above $5

- No foreign transaction fees

- $0 minimum balance requirement

- 55,000+ in-network, fee-free ATMs

You can also apply for a Yotta credit card to earn even more cash and other prizes and to help build your credit.

Best for: Those who really want to ramp up their savings account.

Pros

- Daily and weekly chances at prizes

- Higher than average yield

Cons

- Monthly fees for balances under $5

- Higher APYs available elsewhere

Learn more: Yotta Review

10. Firstcard

Firstcard offers banking services for college students made easy. At Firstcard, they recognized that college students are under a lot of stress and that finances play a significant role.

So to alleviate the pressure, they’ve created a Mastercard debit card for students. The user-friendly card pays students back up to 15% of select purchases at over 27,000 partner retailers.

Firstcard has a discount network that revolves around a student’s campus and outside of it.

Firstcard is a financial technology company, not a bank, but they are serious about security, doing what they can to protect your private information using industry-standard encryption technology. Your funds are insured up to $250,000 per depositor.

It’s easy for college students to sign up for the Firstcard reward debit card. It takes only a few minutes online, and no signup fees or minimum balance are required.

Pros

- Students can earn up to 15% cash back on select purchases

- Pays cash back right away in your account

Cons

- Students must be at least 18 years old to apply

Firstcard is a financial technology company, not a bank. Banking services provided by Lewis & Clark Bank, Member FDIC. The Firstcard debit card is issued by Lewis & Clark Bank, pursuant to a license from Mastercard. Cash back at select merchants.

Key Features of the Top Rewards Debit Cards

The top rewards debit cards share several important features.

These features include:

- Bank-level security that minimizes the risk for fraud

- No added fees, which means more money in your pocket

- No interest charges on purchases made with your rewards debit card

One of the big differences between rewards debit cards and rewards credit cards is that when you make purchases with a cash back credit card, you could be subject to interest charges if the balance isn’t paid in full every month.

Luckily, you can’t be charged interest on the purchases you make with your rewards debit card because there is no accrued balance. The money comes right out of your checking account.

Note: Some rewards debit card checking accounts do offer overdraft lines of protection.

If you choose to use your overdraft line of protection to make debit card purchases, you will likely pay interest charges to do so.

Frequently Asked Questions

Before signing up for a rewards debit card, check out answers to these frequently asked questions.

There are typically no fees associated with the top rewards debit cards. However, you’ll want to read the fine print on the account agreement when you open any bank account.

The best rewards debit card for you is the one that has the checking account features that most fit your needs and wants.

Check the account details on each of the cash back debit cards listed here and choose the one that best fits your usage habits and needs.

Yes. Rewards debit cards that are issued by banks that are FDIC insured and have bank-level security and encryption should be safe to use.

However, identity theft and fraud are on the rise. To help protect your debit card from fraud or theft, be sure to monitor your account activity regularly.

Be sure to call your bank right away if you suspect fraud or lose your debit card.

Summary

Using a rewards debit card can be a great way to earn prizes or cash back on your purchases.

Additionally, when you use a rewards debit card instead of a rewards credit card, you help ensure you won’t accrue a credit card balance.

The best rewards credit cards can help you put more money in your pocket while keeping you free from burdensome credit card debt.