Top 10 Online Banks

Some products in this article are from our partners. Read our Advertiser Discloser.

If you are looking for an online bank, there are several options to choose from.

The best online banks are held to the same standards required by the federal government and are insured by the FDIC. It’s just that you won’t find an actual physical location for most of these banks.

We will go over their fees, how they keep up with competitive rates and what banking options they provide.

Note: We have ranked these accounts in no particular order. If in some cases interest rates are mentioned, those rates are subject to change.

Top Online Banks

There are many online banks these days, and most have plenty of attractive features to offer. We found top 10 online banks so you can pick the best option that works for you.

1. Axos Bank

Axos Bank, formerly Bank of the Internet, calls itself “America’s oldest and most trusted Internet bank.” It has some great products to offer.

- Monthly fees: $0

- Minimum balance requirement: $0

- Minimum opening deposit: $50

- ATM fees: Unlimited domestic ATM fee reimbursements

- Interest earned: Yes, on some checking and all savings account offerings

- Better Business Bureau rating: A+

Rewards Checking

Axos Bank’s Rewards Checking account will pay you interest on its several interest-earning conditions.

- It’ll pay 0.40% APY if you have direct deposits of at least $1,500 coming into your account each month

- It’ll pay you 0.30% APY if you have at least ten debit card transactions each month (the minimum amount for debit transactions is $3)

- The account will pay you 0.20% APY if you maintain an average daily balance of $2,500 per month in a self-directed trading account.

- The account will pay you 0.20% APY if you maintain an average daily balance of $2,500 per month in a managed portfolio account.

- And if you use your Axos checking account to make your full Axos loan or mortgage payment you can earn 0.15% APY as well.

If you hit all of the interest-earning opportunities, the account will net you 1.25% APY.

Also, there are other account options with Axos, including a cash back checking.

High-Yield Savings Account

Besides, Axos has a High-Yield Savings Account and High-Yield Money Market account that pay attractive rates.

Best for: Those looking for an online bank that pays you interest on your checking account.

Learn more: Axos Bank Review

2. Discover Bank

The clever tagline from Discover Bank reads, “Everything you want from a bank, without ever setting foot in one.”

That about sums it up. Who needs bank branches when you can do banking from your own home?

Discover online banking has lots to offer, including checking, savings, money market accounts, CDs and IRAs. Here’s a bit of info about their checking account.

- Monthly fees: $0

- Minimum balance requirement: $0

- ATM fees: None at over 60,000 in-network ATMs

- Interest earned: Yes, but only on your savings, not on checking, but cash back on debit card purchases

- Better Business Bureau rating: A+

Discover Cash Back Checking

Discover’s Cash Back Checking account gives you 1% cash back on debit card purchases up to $3,000 every month.

This is a great feature for those of you who like to earn some money back on credit card purchases.

Discover Online Savings

Discover’s Online Savings account pays interest, carries no monthly fees, no minimum balance fees and has no minimum opening deposit.

Other Discover Products

In addition to the two mentioned above, they also have a Money Market account that pays an attractive yield and high-yield CDs and IRAs.

Best for: Those looking for an online bank that has several different banking solutions.

Learn more: Discover Bank Review

3. Bank 5 Connect

Bank 5 Connect has great savings and checking accounts options. But they’re also well known for providing “above and beyond” customer service.

This is one of the reasons they made our list.

Some account features include:

- Monthly maintenance fees: $0

- Minimum balance requirement: $10 to open, $100 to earn interest

- ATM fees: Free access to SUM Network ATMs, up to $15 in reimbursements per statement cycle for other ATM charges

- Interest earned: Yes

- Better Business Bureau rating: A+

High Interest Savings

Bank 5 Connect has a high-interest savings account available. There is a small $10 minimum to open the account, and the minimum balance to earn the high yield interest rate is only $100.

There are no monthly maintenance fees for having the account.

However, they do charge $1 per month if you want to receive your statements via U.S. mail instead of choosing the electronic statement option.

Attractive CD Rates

Bank 5 Connect also has attractive CD special rates.

Best for: Those who value customer service when using an online bank.

4. FNBO Direct Bank

FNBO Direct Bank has online saving and checking accounts with many attractive features.

- Monthly fees: $0 to open or maintain

- Minimum balance requirement: $0 to open, $0.01 to earn interest

- ATM fees: No ATM fees from FNBO Bank

- Interest earned: Yes

- Better Business Bureau rating: A+

Online Checking Account

FNBO’s Online checking account has cool added benefits such as free debit card fraud monitoring and free stop payments for checks.

Online Savings Account

This online bank offers an online savings account with an attractive interest rate and free transfers with Popmoney.

Learn More: FNBO Direct Review

5. Capital One 360

Capital One 360 has several great products to offer online banking customers, including both savings and checking accounts.

- Monthly fees: $0 to open or maintain

- Minimum balance requirement: $0 to open, no minimum balance requirement after that

- ATM fees: Fee-free ATM access at over 40,000 ATMs

- Interest earned: Yes

- Better Business Bureau rating: A

The 360 Checking Account

The 360 Checking Account has some great benefits. If you become overdrawn on your checking account, you can set up transfers from your Capital One savings. Note that you have to set this up in advance of an overdraft.

Capital One also has a Teen Checking Account with similar benefits:

- No minimum balance requirements

- No monthly service fees

- Interest earned on all account balances

Note that teens under 18 years of age who want to open a teen checking account are required to have a cosigner on the account who is over 18 years of age.

The 360 Savings Account

The 360 Savings account is currently paying attractive interest rates on account balances of any amount.

There are no monthly fees for this account and no minimum balance requirements.

The 360 Kids Savings Account

Capital One’s Kids Savings account pays interest as well. As with their traditional account, there are no monthly fees and no minimum balance requirements.

Capital One also has Traditional IRAs, Roth IRAs and CDs available.

6. Charles Schwab

Charles Schwab has several accounts that could be great for you. Here are some of the benefits of Schwab checking and savings accounts.

- Monthly maintenance fees: $0

- Minimum balance requirement: $0

- ATM fees: unlimited ATM fee rebates

- Interest earned: Yes

- Better Business Bureau rating: A

High Yield Investor Checking Account

Charles Schwab’s High Yield Investor Checking Account pays interest on all checking account balances.

However, this checking account must be tied to a Charles Schwab brokerage account in order to qualify for the deal.

The good news? Schwab One Brokerage Accounts are super affordable: there are no monthly fees for a brokerage account.

Bonus: the minimum account balance is waived if you have automatic deposit amounts of at least $100 going into your Schwab One Brokerage account each monthly.

And online trades cost $0 each.

Although the Charles Schwab interest rate is lower than some of the other banks mentioned here, it’s still higher than many traditional banks are paying.

And the connection with the brokerage account is a nice feature.

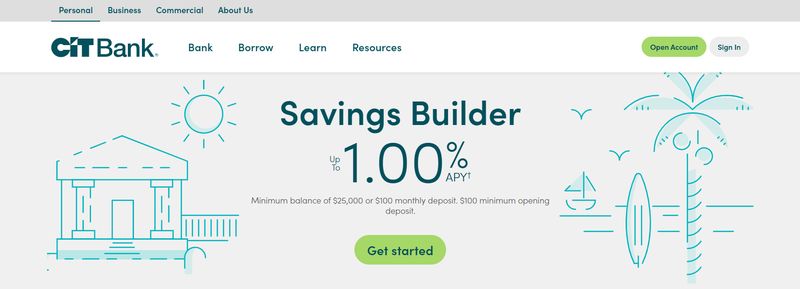

7. CIT Bank

One of the reasons we love CIT Bank is because it pays higher than most banks on its Money Market Savings Account. GOBankingRates chose CIT as one of its Top Ten Online Banks.

Here’s some information about CIT Banks personal accounts.

- Monthly fees: $0

- Minimum balance requirement: $100 to open, no minimum balance requirement after that

- ATM fees: None from CIT Bank, reimbursed up to $30 per month for fees from other banks

- Interest earned: Yes

- Better Business Bureau rating: A-

CIT Bank eChecking

CIT Bank’s eChecking account is a true online checking account. You’ll use your eChecking funds via your debit card, bill pay, ACH or other electronic methods.

Savings Accounts and CDs

CIT Bank offers a competitive rate on its savings accounts too. The Money Market account, the Savings Builder account and the Premier High Yield Savings account carry minimum opening balances of just $100.

This low opening balance for this high yield savings account makes each doable for nearly all levels of savers.

They also have a wide variety of CD and IRA options that pay some of the highest interest yields in the country.

Also, many of their offerings come with a low $1,000 minimum opening balance.

If you have kids, you might be excited to know that CIT offers custodial accounts as well.

This bank may also be able to help you if you need a mortgage loan, whether it be a purchase loan or a mortgage refinance.

Learn more: CIT Bank Review

8. PNC Bank

PNC Bank has been around since 1845. The company has nearly 3,000 locations worldwide.

Most recently, they acquired BBVA Bank’s U.S. locations. Branch locations for PNC Bank in the U.S. include nearly two dozen states from Wisconsin to New York to Florida.

PNC Bank’s online accounts include the Virtual Wallet checking and savings accounts. Features of the Virtual Wallet accounts include:

- Monthly Service Charge: No monthly service charges

- Minimum balance requirement: $1 to open, no minimum balance requirement after that

- ATM fees: None at; over 18,000 in-network ATMs, $20 ATM fee reimbursement per period

- Interest earned: Yes, but only on your savings account

- Better Business Bureau rating: A+

Online Checking (Virtual Wallet)

PNC Bank’s online checking account comes with a free debit card. And PNC also partners with Zelle for immediate transfers.

You can get the Virtual Wallet Checking Pro on its own, or you can combine it with PNC;s Reserve and Growth accounts.

Reserve Checking

The Reserve account is an additional checking account that helps you set money aside for upcoming bills or unforeseen expenses.

Online Savings (Growth Account)

The Growth account functions as an online savings account. It earns interest and is meant to encourage you to save for larger, long-term financial goals.

Both the Virtual Account and the Virtual plus Reserve and Growth accounts come without any monthly fees or minimum balance requirements.

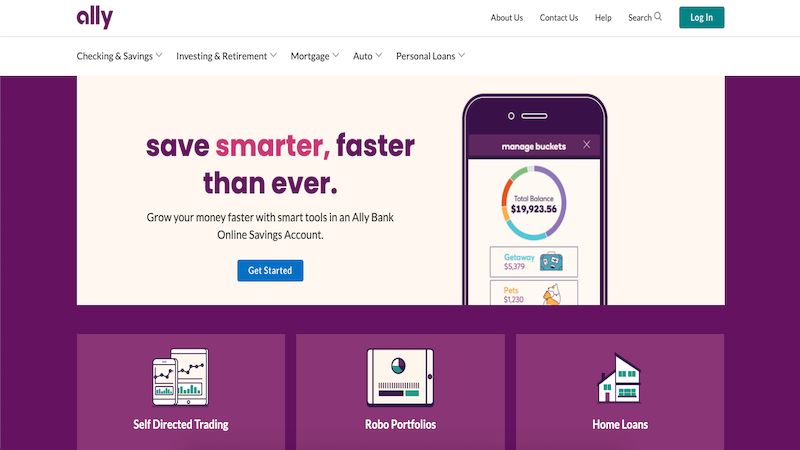

9. Ally Bank

Ally Bank offers checking and savings accounts, auto loans, home mortgage loans, credit cards, investment options and more with their online banking services.

Here’s a little bit of info about their online checking accounts.

- Monthly fees: $0

- Minimum balance requirement: $0

- ATM fees: None at Allpoint ATMs, reimbursement for other bank ATM fees up to $10 per statement cycle

- Interest earned: Yes

- Better Business Bureau rating: C

Interest Checking

Ally’s interest checking account pays an interest rate that depends on the balance you keep in the account.

There are no monthly fees associated with this account and you get free checks.

Online Savings

Ally’s online savings account pays interest on all balances, and there are no monthly fees associated with the account.

Ally also offers home mortgage loans (both purchase and refinance loans), and a wide array of other banking and investment services.

Bonus: Ally’s customer service center is available to take calls 24 hours a day, 7 days a week.

10. Marcus by Goldman Sachs

Marcus by Goldman Sachs provides an online high yield savings account that can help you earn more on the money you save.

The Marcus website says the account earns 4x the nation average interest rate.

Online Savings

This online savings account has the following features:

- No minimum balance requirement

- $0 monthly fee

- No opening deposit minimum

Marcus also offers no penalty CDs and high yield CDs if you’re interested in earning a higher interest rate on your money.

Both the high yield CD and the no penalty CD products have a $500 minimum opening balance requirement.

How to Choose the Best Online Bank

You won’t necessarily go wrong by choosing any online bank as you can earn more interest and access your money from any phone or computer.

However, these pointers can help you compare banks to find the best platform for your finances:

- Account Options: Do you want a service that offers both a checking and savings account option, or just one type of account? Having all your money in one place can make monitoring your accounts and transferring funds convenient.

- Member Benefits: Some banks offer additional features like free ATM access, paper checks and rewards debit cards.

- Service Fees: While online banks are less likely to charge service fees, familiarize yourself with the potential fees for ATM withdrawals or not maintaining a minimum ongoing balance.

- Minimum Initial Deposit: Some banks required higher minimum initial deposits than others to open an account.

- Interest Rates: After finding the banks with the best account options and lowest fees, consider choosing the bank with the highest yield to earn more interest.

- Customer Support: Select banks offer better customer service access than others. For example, you may have phone support or 24/7 availability.

- Customer Reviews: Choosing a bank with happy members and many positive reviews is a positive sign. After all, not being able to easily access your money or pay bills isn’t worth the frustration.

Many online banks have a low initial deposit requirement of $100 or less. Neither do they have ongoing fees or balance requirements to enjoy the best benefits like physical banks.

Do Online Banks Have ATM Availability?

Most online banks don’t maintain their own ATM network like traditional banks and credit unions.

Thankfully, online-only checking accounts come with a debit card for cash withdrawals. However, you have to go to a GreenDot retail kiosk and pay a fee to deposit cash.

Many online banks also partner with an ATM network like Allpoint (43,000+ locations nationwide) or MoneyPass (37,000+ locations). They may offer monthly ATM fee reimbursements for non-network transactions too.

As a result, you can usually find a fee-free ATM in most cities at supermarkets and gas stations. The online bank mobile app usually has an interactive map displaying free ATMs nearby.

The ATM policies can differ widely between institutions so it can be worth closely comparing potential banks if free ATM access is vital.

Some of the online banks with complimentary ATM access include:

- Ally Bank: Free withdrawals at Allpoint ATMs and up to $10 in monthly reimbursements at other ATMs nationwide

- Axos Bank: Unlimited domestic ATM fee reimbursement

- Capital One 360: 70,000+ fee-free ATMs (Allpoint, MoneyPass and Capital One)

- Charles Schwab Bank: Unlimited free ATM reimbursements worldwide

- CIT Bank: Up to $30 in monthly fee reimbursements at other banks

- Discover Bank: 60,000+ fee-free ATMs nationwide

- FNBO Direct: Allpoint ATMs are fee-free. Non-network charges can apply.

As you can see, the reimbursement policies between these banks have several variations. Some offer unlimited fee reimbursements regardless of the network.

However, others may only waive transaction fees at partner networks and you’re responsible for any fees an non-network ATMs.

Online Bank Glossary

- APY: Short for “annual percentage yield.” This is the annual interest your deposits earn.

- Certificate of Deposit: A bank CD can have a higher APY than savings accounts but has a fixed investment term. Withdrawing your funds early causes an early redemption policy.

- Checking Account: This account is primarily for paying bills and receiving direct deposits. It usually doesn’t have any monthly withdrawal limits but is less likely to earn interest like a savings account.

- Direct Deposit: When your employer paycheck or government benefits go directly to a linked bank account instead of depositing a paper check.

- FDIC Insurance: Banks offer complimentary insurance benefits from the Federal Deposit Insurance Company (FDIC). If your bank fails or go out of business, the FDIC can reimburse up to $250,000 of your account balance.

- Funds Availability: The date when your bank deposits are available for withdrawal. There can be a waiting period of up to ten days before mobile check deposits or online bank transfers clear to verify there are sufficient funds.

- Mobile Deposit: Using a bank’s mobile app to take a picture of the front and back of a paper check to deposit into your linked account. Most online banks offer this feature as they don’t have local branches and to avoid mailing a deposit.

- Online Banking: Accessing a checking or savings account from a computer, mobile phone or tablet instead of visiting a local branch. Many banks only operate online and don’t offer in-person services.

- Online Bill Pay: Paying bills online through a checking account or money market account. The bank may transfer the funds electronically or mail a paper check on your behalf. This service is usually free of charge.

- Remote Deposit: Another term for “mobile deposit.” Most banking apps let you deposit paper checks by uploading snapshots using your phone or tablet camera.

Methodology

The publishing team analyzed over 80 banks that might be online-only or offer local branch access as well. The rating factors include the size of the bank, account options, additional features, customer ratings and service fees.

However, the banks listed above are in no particular order instead of preference.

FAQ

Online banks are mainly online. The benefit of them not having local branches is you can bank from anywhere online.

With any online bank, simply go to their online website and look for the get started or open an account button.

We recommend you look for an online bank that is FDIC insured and has been reviewed by the BBB. Financial institutions aren’t risk free yet make sure you do your due diligence prior to signing up.

Most banks will offer similar types of accounts. Ask yourself what you need most. Do you need a checking account that gives you rewards or lets you access your direct deposits faster?

Make a list of what is offered and what fits your needs.

Summary

If you’re interested in earning more money on your bank account, consider opening an interest-bearing online bank account.

Many of the best online banks also offer better mortgage rates, consumer loan rates or credit card rates than many traditional banks.

And earning a higher interest rate on your accounts can help make it easier for you to save more money in the long run.

Although you might find it disconcerting to do your banking at a bank that doesn’t have a physical location, take comfort in the fact that a reputable online bank will be FDIC insured. Many have been around for decades.

Plus, in today’s world, most of us are used to using a mobile app to do most everything. Why not a mobile check deposit account?

However, make sure to do your due diligence and read the fine print with any bank.

Besides, watch for any transaction or overdraft fees, and understand what banking products they offer.

I found this site, Well Kept Wallet, to be very helpful when considering online banks.

That’s great! We’re glad we could help! 🙂

You are forgetting PSECU! They have members all over the world, excellent customer service, tons of free services (that many of the banks on your list charge for…i.e. Checks, bill payer, minimum balances, overdraft protection, etc), $5 minimum requirement to have an account, interest (including in checking), etc.

There very well may be others we could add, but didn’t, to this list. Thanks for mentioning that one. There may be individuals who want to check it out. 🙂