UNest Review: An App That Makes It Easy To Invest For Your Kids

Some products in this article are from our partners. Read our Advertiser Discloser.

For many parents, saving for their child’s college education is among their greatest financial concerns. Not only is a college education expensive, but the price grows each year.

Custodial accounts have become one of the most popular tools to help families save for their child’s future. They allow families to grow their savings with investments while also offering added flexibility.

UNest aims to make saving for college even easier by making contributions simple for parents, family members and friends. Our UNest review can help you determine if this service is the right fit for your family.

Overall Rating

Summary

UNest makes it easy to save for and invest in your child’s future right from your phone. With its simple investment options and an easy way to invite friends and family to contribute, any parent can get started investing today.

-

East of use

5

-

Customer review

4.5

-

Investment options

3.5

-

Pricing

4

Pros

- User-friendly app and website

- Simple ETF-based investment options

- Easy to invite friends and family to contribute

- Additional ways to grow your account through UNest Rewards and referral bonuses

Cons

- No longer offers a 529 plan for college savings

- Fewer investment options than most major brokerage firms

What is UNest?

UNest is a fintech company that empowers parents to invest and save for their children’s future. It is a female-founded brokerage firm that is headquartered in Los Angeles.

Since its launch, the company has served more than 400,000 parents and children.

Unest is the perfect tool for families who want to save for their child’s future expenses. It’s easy for parents to set up an account and start contributing. They can even invite friends and family to contribute.

The account you can open with this app is a Uniform Transfers to Minors Act (UTMA) account. This type of account stands out for its flexibility and tax advantages.

How Does UNest Work?

UNest offers UTMA accounts. These are popular custodial accounts that allow parents or other adults to open an investment account on behalf of a minor.

The person who opens the account, known as the custodian, can contribute to the account and select investments.

While the custodian manages the account, all of the funds contributed belong to the child whose name is on the account. Contributions are considered irrevocable gifts, meaning you can’t withdraw them later.

Once the child reaches the age of majority, they get control of the account.

Like a 529 plan and other popular savings vehicles, the money within a UNest UTMA account can help your child pay for college. However, the funds can also be used to help them reach any other financial goal.

This flexibility is a huge perk of a UTMA account. While 529 plans will penalize your child if they use the money for a purpose aside from college, a UTMA account lets your child use the money for anything without penalty.

How to Use UNest

To get started with UNest, the custodian (usually a parent, but it could also be another adult) opens the account on behalf of a child. It only takes a few minutes to get your UNest account up and running.

Once your account is set up, you can establish a future goal for your child and set up a monthly contribution to help you reach it. UNest features a college savings calculator to help you determine how much you should save.

The app makes it easy to invite friends and family to contribute to your child’s account. Anyone can contribute with a simple link, regardless of whether or not they have a UNest account.

As an account custodian, you can easily check your child’s UNest account, view the account balance, change your monthly contribution and more. Plus, because it’s an app, everything can be managed from your phone.

UNest funds have certain tax advantages over those in a traditional taxable brokerage account. Since the investments belong to your child, the first $2,200 of investment earnings per year are tax-advantaged.

The first $1,100 is tax-free, while the next $1,100 is taxed at your child’s tax rate. It’s not until your investment earnings exceed $2,200 that you’ll pay taxes on them at your (the custodian’s) tax rate.

UTMA Account vs. 529 Plan

UNest previously offered a 529 plan to parents, but the app no longer has that option.

A 529 plan is an account that allows parents and loved ones to save on behalf of their child. The difference is that 529 plans are specifically designed for college savings.

With a 529 account, your investment earnings and withdrawals are tax-free as long as you spend them on qualified education expenses. However, if you use the funds for anything else, you’ll pay taxes on your withdrawals and pay an additional penalty.

The other key difference between a UTMA account and a 529 plan is who owns the funds within the account. While any adult can open a UTMA account, the funds ultimately belong to the child. They can’t be withdrawn or given to a different child.

However, the person who sets up a 529 plan ultimately owns the account. They can decide to withdraw the funds or use them for someone else’s college education.

How Much Does UNest Cost?

UNest offers two different plans for families to choose from, each of which has a low monthly fee.

Here’s a breakdown of the pricing and plan differences:

| Details | Regular | Family |

| Price | $2.99/month | $5.98/month |

| Number of children | 1 | 5 |

| Easy account setup and management | ✓ | ✓ |

| Five investment options | ✓ | ✓ |

| Gifts from friends and family | ✓ | ✓ |

| UNest Rewards | ✓ | ✓ |

| Savings Calculator | ✓ | ✓ |

The regular plan costs $2.99 per month. It comes with access to all of the features within the app. However, it can only be used for one child.

You can also choose the family plan. This costs $5.98 per month. It offers all of the same features as the regular plan, but it can be used for up to five children.

Key Features

UNest offers some key features that make it a great option for saving for your child’s future.

Investment Options

When you open a UNest account, you can choose from five different investment options. The five ETF-based portfolios range from very conservative to very aggressive, with more balanced options in between.

There are also age-based choices that are most aggressive when your child is young and will become gradually more conservative as your child gets older.

The choice of five different risk-based portfolios is a great addition to UNest since it means that each family can choose a level of risk they’re comfortable with.

However, compared to the options in UTMA accounts with companies like Fidelity and Schwab, UNest’s options are fairly limited. There’s little freedom to choose individual stocks and ETFs on your own.

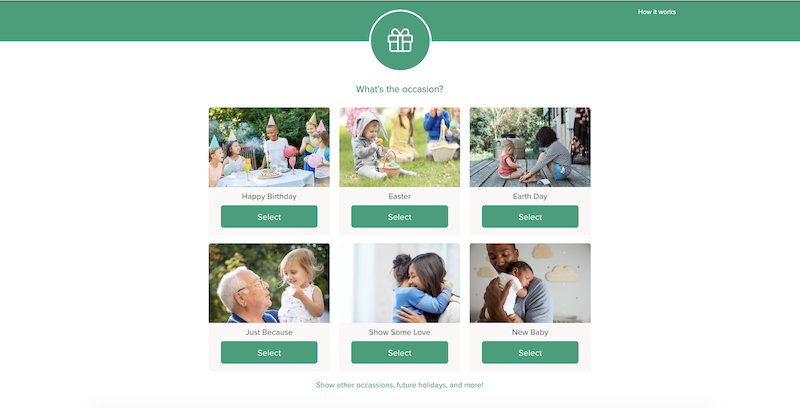

Send a Gift

UNest has a gifting feature that allows you to send a gift to anyone, regardless of the occasion. To send a gift, you can visit the UNest website, set an amount you want to give and add a message to the recipient.

Once the recipient receives your gift, they can easily redeem it on the UNest website. Parents can redeem a gift either in an existing UNest account or by opening up a new account for their child.

UNest Rewards

Using UNest Rewards, you can earn additional cash for your child’s investment account by shopping with UNest’s partners. You can click through to a specific offer and earn rewards in seven to 10 days.

This feature works a lot like other online shopping apps like Rakuten, but the money goes right into your child’s investment account.

Referral Bonuses

UNest allows you to earn additional rewards by inviting family and friends to join. You’ll get a referral bonus of $15 for each person that joins using your link.

Like the UNest Rewards, your referral bonuses go directly into your child’s investment account.

Education Resources

Many parents aren’t just facing the financial stress of saving for their child’s future. They’re also learning about many important money skills.

UNest helps parents by offering free educational resources so that they can learn about investing, taxes and other areas of personal finance.

There’s also an easy-to-use college savings calculator to help parents determine how much they should save for their child’s future.

Unest Reviews

If you are on the fence about trying Unest, knowing what other users have to say about the service could help you determine if it’s right for you.

Here are the exact rankings for UNest on these two sites:

| Website | Rating | Number of Reviews |

| Apple App Store | 4.7 out of 5 | Over 3,400 |

| Google Play Store | 4.4 out of 5 | Over 2,400 |

| Better Business Bureau (BBB) | 1 out of 5 | 1 |

It’s important to note that, while Unest has received five complaints on the BBB website in the last five years, the company resolved each of those complaints.

Here are some of the positive and negative things that UNest users had to say:

“I have 2 young kids and have been thinking about the college savings account since they were born but didn’t know where to start. I have been referred to U-nest by a friend of mine and I couldn’t be happier.” – Diannchik

“I’m having issues with the app and tried to contact them, they do not answer your call it goes automatically to robot and they response to your email don’t know when… frustrating.” – Razipkhadka

“This app is great for setting savings and investing goals for my kids. I love the intuitive and user-friendly interface design that makes it easy for me to do in just a few minutes.” – Tamay Ozbeck

“I would not recommend this app nor company. I’ve tried to contact customer service multiple times without success.” – Kayla Riney

Alternatives to UNest

Custodial accounts aren’t a new product, and parents looking to open a custodial account for their children have plenty of options. Here are some of the best alternatives to UNest.

Acorns

Acorns started as a micro-investing app, but it now allows users to invest in a variety of ways. One of the accounts available through Acorns is its Acorns Early account. This is a custodial account like UNest.

The funds in your Acorns Early account are invested in a diversified ETF-based portfolio. To access Acorns’ custodial account, you’ll need a family plan. This comes with a price tag of $5 per month.

However, you can add additional children at no additional cost.

Read our Acorns review to learn more.

Fidelity

Investors who want more control over their custodial account investments should consider Fidelity. Since it’s a traditional brokerage account, users have a wider variety of investments to choose from.

You’ll have access to all of Fidelity’s stocks, bonds, funds and more. This is a contrast to UNest’s pre-made ETF portfolios.

Fidelity’s custodial account also doesn’t charge any account fees.

Greenlight

Greenlight got its start as a debit card for children. It has since expanded its offerings to include its Greenlight + Invest and Greenlight Max plans, both of which allow families to start investing for their children.

Greenlight doesn’t technically offer custodial accounts. Instead, they offer taxable brokerage accounts to parents. These accounts allow parents to invest with their children and focus on financial education.

To open a Greenlight + Invest or Greenlight Max account, you’ll pay $7.98 per month or $9.98 per month, respectively.

Learn more in our Greenlight review.

EarlyBird

At face value, EarlyBird most closely resembles UNest. It offers a custodial account that parents can open and set up recurring contributions.

Each account invests in one of five ETF-based portfolios, though EarlyBird has also expanded to allow users to hold a small amount of cryptocurrency.

Like UNest, EarlyBird has a focus on gifting and makes it easy for loved ones to contribute to a child’s account. Plus, EarlyBird doesn’t have any account fees.

FAQ

Before signing up for UNest, don’t miss these frequently asked questions to help you determine if it’s a good option for you.

UNest is a UTMA account, which is a type of custodial account that allows parents to invest on behalf of their children.

The key characteristic of a custodial account is that, while an adult is the one to open the account, the funds within it belong to the child and are theirs to manage as they see fit once they reach adulthood.

UNest started off as a 529 plan designed to help parents save for college.

However, UNest later switched direction to offer a UTMA account. The company no longer offers a 529 plan.

Yes, UNest charges a monthly fee that ranges from $2.99 to $5.98 depending on the plan you choose. You’ll pay $2.99 for a regular account with one child and $5.98 for a family plan with up to five children.

UNest is an investment account, not a savings account. As a result, if the stock market goes down, you could lose money.

However, UNest accounts are insured by the SIPC. This means that if the company goes out of business, you’ll be reimbursed for your losses.

Summary

UNest offers a new twist on custodial accounts by allowing parents to start investing in their children while inviting friends and family to contribute along the way. It is user-friendly, so it’s easy to see why many people use the app.

This app makes investing simple with its five ETF-based portfolios and age-based investments, meaning parents don’t have to choose individual investments for their child’s portfolio.

If you’re considering opening an investment account for your child’s future, UNest is definitely worth considering.