Average Grocery Bill for 2 People

Some products in this article are from our partners. Read our Advertiser Discloser.

Do you spend more than you need to on groceries? I know I used to.

When I first started tracking my family’s spending, our grocery bill was high. Not high compared to the country’s average (we’ll talk more about that later).

However, it was high compared to what we’re spending on groceries now. What is “average” for a grocery bill? Are you spending more than others on groceries? Less?

Let’s look at the numbers and discuss ways to reduce your grocery spending if you need or want to.

How Much Is the Average Grocery Bill for Two?

When I first started tracking our grocery and other spending, we had no “plan” for our shopping. I’d just hit the store on a whim and get whatever foods sounded good, plus a few basics.

At that time, we were spending roughly $1,000 a month to feed our family of five.

That’s not a lot according to nationwide averages. However, it was a lot for us at the time. We were deep in debt and struggling to pay the bills.

These days, I never spend more than $750 a month on groceries. In fact, my average is usually closer to $650 a month — and that’s with four teenagers in the house.

My point in sharing my numbers is to prove that it is possible for most people to spend less on groceries.

So, is it realistic for you to cut your grocery budget too? Let’s start by sharing the average grocery bill for two.

We’ll look at a variety of statistics, and then we’ll share some tips for buying groceries on a budget. Ready?

USDA Food Cost Report

Every month, the U.S. Department of Agriculture (USDA) issues its Cost of Food Report.

The report details the average weekly and monthly cost of food for individuals, couples and families.

We’ll use that report to talk about the average grocery bill for two. The USDA report details three levels of food cost plans:

- Low-cost plan

- Moderate plan

- Liberal plan

The report also counts age as a factor. After all, a household of two adults will likely spend more on groceries than one adult and a two-year-old.

In this article, we’ll share the costs for two adults living in one household: a man and a woman. For the month of July 2023, the average grocery bill for two was as follows:

Household of two adults, one female and one male, aged 19-50, July 2023

| PLAN | AMOUNT |

| Low-cost plan: | $559.20 per month |

| Moderate plan: | $693.60 per month |

| Liberal plan: | $862.60 per month |

For older couples, the average food costs were lower.

Household of two adults, one female and one male, aged 51-70, August 2021

| PLAN | AMOUNT |

| Low-cost plan: | $507.50 per month |

| Moderate plan: | $633.60 per month |

| Liberal plan: | $766.40 per month |

Using the numbers stated above, we can calculate what the average grocery bill for two is.

- The average grocery bill for two adults aged 19-50 is $668.57 per month

- The average grocery bill for two adults aged 51-70 is $635.83 per month

These are the most recent grocery spending numbers as of this writing.

Note: This report used to include a fourth plan; the Thrifty Plan. That plan is no longer included in the USDA report.

The Older We Get, The Less We Spend

An interesting point is that older couples spend less on groceries than younger couples. There could be a number of reasons for this.

We as humans tend to eat less as we get older. It’s possible that many people get more frugal as they age, too.

And, there are other factors that influence what we spend on groceries. We’ll talk about those in a bit, but first let’s talk history.

Are grocery costs on the rise? Do people spend more on groceries now than they did in years past? Let’s take a look.

Is the Average Grocery Bill for Two on the Rise?

Luckily, the USDA keeps a historical record of food costs. This enables us to compare historical costs of food to see if food costs are on the rise.

Let’s look at a chart that’s similar to the one above, only with costs from May 2015.

We’ll share the numbers along with the percentage of increase compared to current numbers.

Household of two adults, one female and one male, aged 19-50, May 2015:

| PLAN | AMOUNT | INCREASE |

| Low-cost plan: | $496.30 per month | 6.41% increase in six years |

| Moderate plan: | $619.10 per month | 5.62% increase in six years |

| Liberal plan: | $774.80 per month | 5.55% increase in six years |

Again, for older couples, the average food costs were lower.

Household of two adults, one female and one male, age 51-70, May 2015:

| PLAN | AMOUNT | INCREASE |

| Low-cost plan: | $475.00 per month | 6.40% increase in six years |

| Moderate plan: | $592.10 per month | 6.55% increase in six years |

| Liberal plan: | $713.70 per month | 6.45% increase in six years |

- The average grocery bill for two adults aged 19-50 in 2015 was $630.07 per month, meaning average grocery costs for this age group have risen 5.76% in the last six years.

- The average grocery bill for two adults aged 51-70 in 2015 was $593.60 per month, meaning average grocery costs for this age group have risen 6.47% in the last five years.

As expected, prices were lower in 2015. While a roughly 5 to 6 percent increase over five years isn’t horrible, I’m certain the increase does make an impact on many families.

How Does Location Affect the Average Grocery Bill?

We can’t talk about grocery spending without taking location into account. Groceries on the East Coast, for example, often cost much more than groceries in the Midwest.

But how does location affect the average grocery bill?

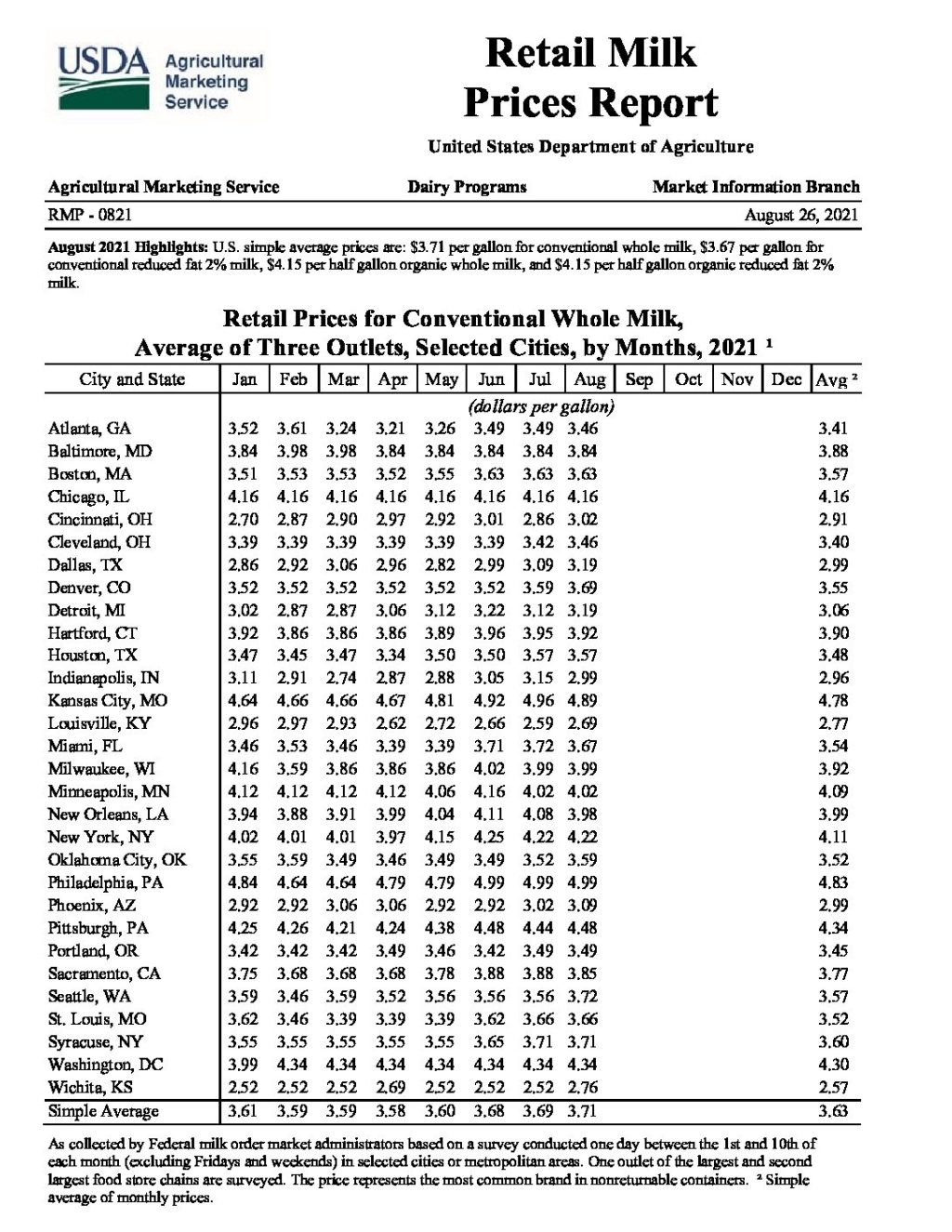

There are limited sources of reliable data recording grocery prices by state. However, I did find one USDA report on milk prices for the first few months of 2021.

The average prices reported from various cities were not what I expected.

I was surprised to find that milk in Dallas was quite a bit cheaper than in Milwaukee. After all, Wisconsin is a high producer of dairy products.

And New York has notoriously high grocery prices. However, milk in Syracuse, New York, was also shown to be cheaper than in Milwaukee.

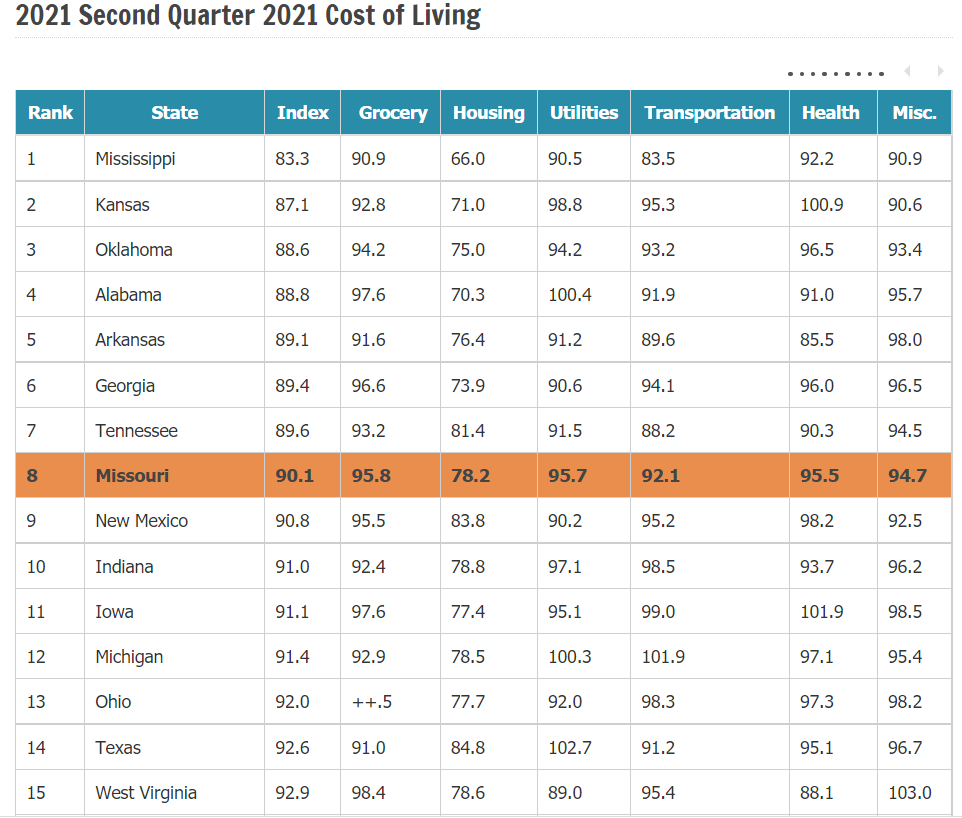

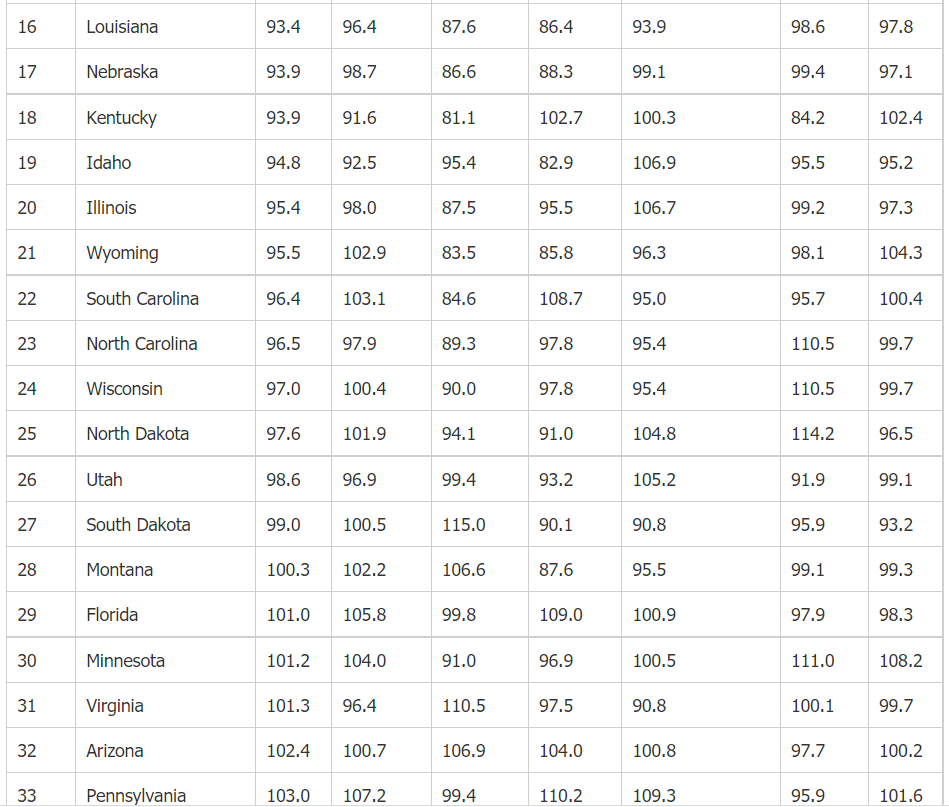

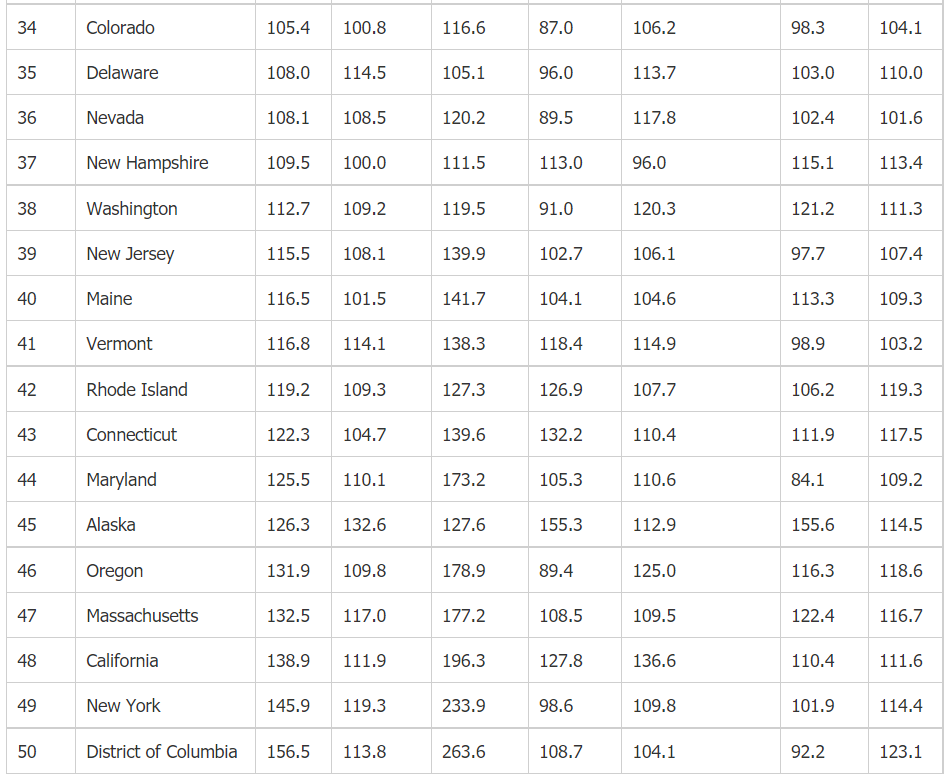

However, milk prices don’t tell the whole story. This report from the Missouri Department of Economic Development rates the cost of living per state. It ranks costs, including groceries, housing, and more.

As you can see, the chart shows a noticeable difference in grocery prices. Arkansas residents, for instance, spend a lot less on groceries than those living in Nevada.

It’s clear that where you live does make a difference in how much you’ll spend on groceries.

Does Income Play a Factor?

According to the USDA, income also plays a factor in grocery spending.

A USDA Report on Food Prices and Spending from 2019 found that the average family spent roughly 9.5% of its disposable income on food, which was a historically low number.

And an average of 54.8 percent of that money was spent on food away from home.

If you’re average, then your income makes a difference in your grocery spending.

For instance, if you bring home $2,000 per month then you’re apt to spend around 190 a month on groceries and eating out.

However, the higher your income goes, the lower the percentage of it you’ll spend on groceries.

In 2019, households in the middle-income bracket spent roughly 13.5% of their income on food, while those in the lowest income bracket spent 35.1% of their income on food.

How Can You Save Money on Groceries?

Whether you’re in line with the USDA’s Low-Cost or the Liberal plan, you can save money on groceries.

As I mentioned earlier, I spend an average of $650 a month on groceries for myself and my four teens.

And guess what: We eat GOOD and healthy food. We even buy a lot of organic products.

Here are some tips to help you save money on groceries.

Start With a Plan

A menu plan is key to cutting down on grocery costs. It helps you avoid random trips to the grocery store. It also prevents last-minute take-out or restaurant runs.

Start by making a list of dinners for the week. Try to keep dinner costs moderate.

We usually do one or two expensive dinners, like pot roast. Then, we sprinkle in low- and moderate-cost dinners for the rest of the week.

Some ideas for cheaper dinners include:

- Potatoes and vegetables (usually a green veggie like broccoli)

- Pasta dishes

- Beans and rice with homemade tortillas

- Burgers and a side salad

By balancing out how much you spend on meals and including several cheaper meals in your menu plan, you can help keep costs lower.

Shop the Sales

When making our weekly menu plan, we plan meals around the week’s sales. If chicken is on sale, that’s our primary meat for the week.

If apples are on sale, I’ve got apples to give the kids for snacks. Work the sales to your advantage and try not to pay full price if you don’t have to.

Shop the sales to buy stuff ahead of time, too. Stock up on sale items you know you’ll need and use in the future.

Also, use money-saving apps like Ibotta to get extra cashback on grocery purchases. Ibotta has paid over $1 billion to members in cashback on everyday purchases.

But make sure you’re not buying an item you won’t eat just because it’s on sale. The food is no bargain if it just goes to waste.

Ease Up on Processed Food Purchases and Eating Out

Processed food and junk food purchases can get expensive. Trim your grocery budget by cutting soda and other processed foods from the list.

If there’s a food you buy that you can make from scratch, do it. It’ll be better for you (no chemical preservatives) and taste better, too.

The same goes for eating out. Eating out is almost always more expensive than eating at home.

Grow Your Own and Buy Local

If possible, plant a small garden or use planters to grow vegetables. If you don’t have a lot of space, choose to grow the items you eat most often.

You can freeze or can them to make them last all year long.

Depending on where you live, buying locally can help cut costs, too. Farmers markets and local meat farmers sometimes charge lower prices than grocery stores.

Shop your local farmers and see if you can save money on groceries.

Summary

The charts above on the average cost of food for Americans vary greatly. There’s a big difference in spending $507 a month and $820 per month on food.

Of course, factors like income and location come into play. That being said, there are almost always ways to cut down on grocery costs.

Follow the tips above to save where you can.

I don’t know how you came up with those numbers. It seems like my grocery bill has gone way up since Covid-19. I brave the supermarket once every 2-3 week, usually early morning senior hours. For my wife and I we have been spending about $150- $200 a week on groceries now.

We make a list. hardly buy any meat. We buy organic and that is a little more but not much.

Are you including things like, Shampoos, Soaps, Laundry detergent, Brillo pads, Windex, paper towels, etc etc? you know things for home cleaning and personal maintenance? because that can run $100 bucks a month or more just for that. I have been including that stuff in my grocery numbers.

Hi Paul. Thanks for your comment! These numbers are straight from the USDA (see link within article). It looks like you do fall in line with the numbers listed in the USDA’s Liberal plan, which states $805.70 per month on food. This quarterly USDA report includes food items only; it doesn’t take into account personal and cleaning items. Grocery costs will vary too, based on where you live. Some states and cities have much higher grocery costs than others. Best of luck to you as you work to keep grocery costs in line with your budget!

Wow. What is everyone buying?

We live in a high cost state, and we spend under $100 a month for 2 on all groceries and restaurants. And we entertain…a lot. We hold a BBQ for the whole neighborhood every week all summer, for example.

We cook our own food, never do takeout, and go to restaurants only about 2x a month.

I shop sales, clip coupons, know my stores and where to buy items, cook from scratch.

I am trying to figure out what everyone is buying that costs $250 a month per person. Steak and lobster every night? Restaurants 3x a week? I guess it is about priorities…if folks want to spend money on food rather than retirement funding….it is their life!

I actually spend $250 to $300 monthly for my husband and I. When the children (3) were at home I only spent $450 monthly.

Wow. This was really helpful. I hope I can start saving money for my family with these tips! Thanks so much and God bless you for this information.

Your welcome! I’m glad we could help! 🙂

The last time I checked, there were 50 states, not 38. Also, there are cities on the West Coast that have milk for sale!

Yes, you have to follow the link to see the whole report. That is just a snapshot of what the report looks like. 🙂