10 Best Dividend Trackers To Monitor Your Investment Income

Some products in this article are from our partners. Read our Advertiser Discloser.

Monitoring your dividend income can be complicated. Fortunately, there are dividend trackers that can eliminate this issue by helping you effortlessly monitor your dividend income.

How To Track Your Dividends

The easiest way to track your dividends is to download one of these apps to keep an eye on the stocks you are holding, the dividends each pays, news alerts, and more, all from a single platform.

Here are the best dividend trackers that are currently available to help you monitor your dividend income.

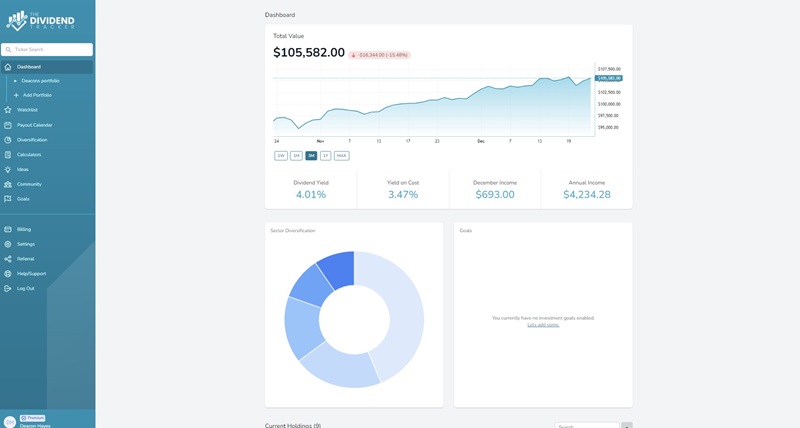

1. The Dividend Tracker

📱Apple 4.6 / Google Play 3.6

The Dividend Tracker aims to streamline your dividend monitoring process with metric evaluations. The platform uses ‘Dividend Grades’ to assess your portfolio’s risk.

One of the coolest perks of The Dividend Tracker is the ‘Payday’ feature. This maps out how much income you can expect through your dividend portfolio for the next 12 months.

You can try The Dividend Tracker with the free version offering one manual entry portfolio. But you’ll likely want to upgrade to the premium version at $99.99 annually to gain full access to all the features.

This is a great option if you want to create a portfolio where you plan to live off of your dividends.

2. Empower

📱Apple 4.7 / Google Play 3.2

Empower is not only a free dividend tracker, it tracks all of your finances in one place.

This site is not entirely dedicated to the ins and outs of tracking your dividends. It also tracks all of your returns on your dividend stocks.

Furthermore, this app can help you assess your wider investment portfolio. If it’s relevant, the platform will advise rebalancing your portfolio and reinvesting your dividends.

With Empower, you can see your net worth, access a savings planner, create a budget, and more. These features make it a useful financial tool for anyone who wants to improve their finances.

Want to learn more about this robust option? Check out our full review of Empower.

3. DivTracker

📱Apple 3.8 / Google Play 4.7

DivTracker is a mobile-only option that currently only has an iOS app. With DivTracker, you can monitor your dividend income across your investments and review information for thousands of stocks.

Once you link your accounts, DivTracker creates a handy calendar. This will show you all of your expected dividend payments.

Additionally, the app provides news alerts that might affect your stocks. You’ll even have complete control over the number of notifications you receive, and the app provides support for dark mode.

You’ll have to pay a one-time $8.99 fee to get full access to the features. You also have the option to remove ads for $2.99.

4. Finbox

G2 rating: 4 out of 5

If you have a portfolio with both active and passive components, Finbox is an option that offers diverse tools to suit your needs.

You can use a helpful Google Sheets add-on to track your dividend earnings. This has several financial models built in.

Beyond the helpful tracking and analysis tools, you’ll find up-to-date information for more than 100,000 stocks and 135 exchanges around the world.

The large number of data points the platform offers ensures you have all the information you need when executing trades. If you aren’t sure about signing up for a paid subscription, you can take advantage of FinBox’s free ten-day trial.

5. Sharesight

Trustpilot rating: 4 out of 5

Sharesight is a stock portfolio tracker that can track your dividends. Once you connect your accounts, you can take a retroactive look at your dividends for the last 20 years.

With the platform, you can access easy visuals to help you track your investments.

This portfolio tracker sets itself apart by offering highly sophisticated tax information. You’ll find the latest relevant tax information through the platform, regardless of what country you live in.

All paid plans include a free trial. If you have more than five portfolios that you need to track, you can upgrade to Sharesight Pro for $8.40-$12 per portfolio.

6. Simply Safe Dividends

Trustpilot rating: 3.7 out of 5

Simply Safe Dividends promises to help you find more stable investments. As one of the best dividend trackers, you’ll have access to a comprehensive selection of tools to stay on top of your dividends.

When you use Simply Safe Dividends, you’ll be able to utilize a helpful scoring system that is designed to evaluate the potential for a company to cut its dividend.

The platform provides this score for almost 1,000 stocks and notifies you if it expects a company to raise, reduce, or eliminate its dividends. According to the site, this tool has helped its members avoid 98% of cuts.

You’ll have to pay $399 per year to access these tools. If you aren’t sold on that price point, you can give the platform a 14-day trial run.

7. Stock Rover

Business Insider: 4.22 out of 5

Stock Rover offers stock screening and analysis tools to investors. The platform prides itself on offering comprehensive comparison tools to help you make investment decisions that fit your risk tolerance.

Its Dividend Insights tool will likely be the most valuable for dividend tracking.

This platform offers the following plans:

- Free

- Essentials: $7.99 per month

- Premium: $17.99 per month

- Premium Plus: $27.99 per month

The tools within each price level vary; you can access more if you pay more. You can also get cheaper rates if you pay for a one or two-year plan.

Ultimately, you can use Stock Rover to evaluate a wide range of stocks. However, if you are a dividend investor, the tools available are sufficient to track and evaluate your dividend stocks.

Learn more in our review of Stock Rover.

8. Dividend.com

Facebook: 4.4 out of 5

Dividend.com offers a streamlined platform for anyone who wants to track their dividends. Unlike other platforms, this site strongly emphasizes tracking and optimizing your dividend portfolio.

You can link brokerage account information to Dividend.com for a simple way to monitor your investments. The site quickly gives you a breakdown of each of your stocks.

This platform offers a limited free version that provides dividend strategy lists, dividend screeners, dividend stock profiles, relevant news, and dividend payout information.

To access watchlist alerts, data downloads, and more, you need to upgrade to the Premium plan. This costs $199 per year and comes with a 30-day money-back guarantee.

9. TheRich

📱Apple 3.5 / Google Play 3.8

TheRich is an investment app that puts the spotlight on your dividends. Within the platform, you’ll find a dividend calendar to keep track of your upcoming dividend payments.

This site has a robust community of other dividend investors. Within the community, you can access a timeline and popular articles.

The site even offers backtesting to see how certain investments would have performed over time.

You can also use The Rich’s website to check out investments from billionaires like Warren Buffet, Paul Singer, Bill Ackman, and more.

See what people are saying about TheRich.io on Reddit here.

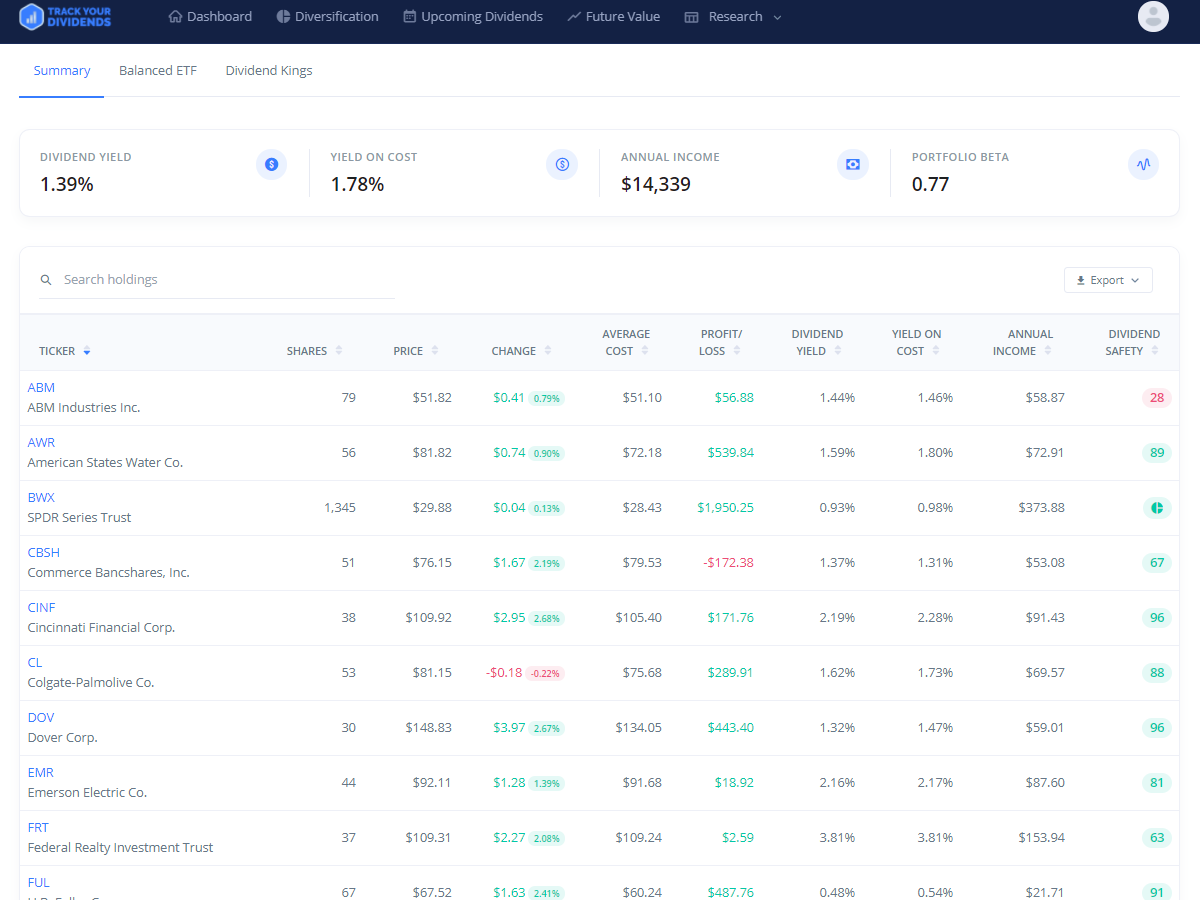

10. Track Your Dividends

Track Your Dividends is another free dividend tracker that offers investors a streamlined way to monitor their dividends automatically. You’ll find a comprehensive dashboard to help you track the ins and outs of your dividend portfolio.

One great feature is the Future Value Projections tool. This provides a projection of your portfolio’s yield in five, 10, or 25 years. It can be useful if you will use dividend income as part of your retirement strategy.

Once your portfolio is linked, you can use the tools to see how well-diversified it is. You can evaluate your options using the platform to make changes.

Track Your Dividends is a free app, but you will miss out on key features if you don’t have a paid subscription. Upgrading to the premium version lets you eliminate ads, use the Dividend Screener, access the dividend idea list, and create a personal watchlist.

This costs $9.99 per month and comes with a free seven-day trial.

See what people are saying about Track Your Dividends on Reddit.

Frequently Asked Questions

If you are on the fence about using dividend trackers, these frequently asked questions can help you determine why you should use this tool and which platform might be the best option.

Why should I use a dividend tracker?

The potential income stream dividends can provide is enticing, but the logistics of monitoring different stocks across multiple platforms can be daunting.

This is where a dividend tracker can come in handy. The ability to check on the performance of all of your dividend stocks in a single place is a big win.

What are the benefits of using a dividend tracker?

Since not all investments will bring in the returns you had hoped for, a dividend tracker provides the benefit of helping you spot underperformers to cut from your portfolio potentially.

What should I look for in a dividend tracker?

The right dividend tracker will depend on your goals. But, it’s good if your tracker aggregates data from multiple accounts, stock notifications, accessibility, and investment overviews and is affordable.

The bottom line is that you’ll have to decide what tools you seek in a dividend-tracking platform.

Are dividend trackers safe to use?

In most cases, dividend trackers provide top-notch security to secure your financial information.

Regardless, it is always smart to confirm that the security features are up to your standards before moving forward with any dividend tracker.

What To Look For In A Dividend Tracker

When tracking your dividends and managing your investments, it’s important to find a dividend tracker that meets your needs and fits your budget.

Here are some key things to consider when choosing a dividend tracker.

How Much Does It Cost?

One of the first things to consider is the cost of the tracker. Some options are free, while others require a subscription fee. Be sure to compare the cost of different options and weigh the value of additional features or tools against the price.

Can It Track Multiple Accounts?

If you have multiple investment accounts, you may want to look for a dividend tracker that allows you to track all of your accounts in one place. This can save you time and help you get a more comprehensive view of your portfolio.

Does It Have A Dividend Calculator?

Some dividend trackers include calculators that can help you estimate your future dividends based on the stocks you own and the dividends they pay. This can be a helpful tool for planning your investments and managing your income.

Can You Get Stock Alerts?

Alerts and notification options can be useful for staying on top of changes to your portfolio and any important updates. Look for a dividend tracker that offers alerts for dividends, stock price changes, and other important events.

Is It Reliable?

When choosing a dividend tracker, it’s a good idea to consider the overall reliability and reputation of the tool. Be sure to read user reviews and ratings and seek recommendations from other investors or financial advisors.

Summary

If you are looking for the best investments for monthly income, dividend investing can be a great option. That said, tracking your dividends can be a hassle without the assistance of a dividend tracker.

Take the time to consider the tools and features that are most important to you, and then simplify your dividend monitoring process by using the platform that best fits your needs.

If you aren’t sure which option to choose, take advantage of a free trial or use one of the free dividend trackers mentioned above.