10 Best Personal Loan Companies

Some products in this article are from our partners. Read our Advertiser Discloser.

Looking for the best personal loan companies to choose from? You’re in the right spot.

Personal loans can help you avoid payday loans and save you money if you’re able to secure a lower interest rate. They can also improve your credit score with every on-time payment you make.

Since personal loans are for a fixed borrowing amount, you can’t add to the balance like you can with credit cards. This makes it easier to get out of debt and stay out.

As you will find out, you may be able to refinance your debt with a personal loan and get a lower interest rate.

Note: Our team has spent hours reviewing loans from over dozens of personal loan lenders to identify the “best companies” for personal loans.

We looked at each lender’s interest rates, eligibility requirements, fees, time to receive funds, and the availability of repayment terms and discounts.

List of Top Personal Loan Companies

We’ve researched some of the best personal loan companies out there, just for you. The companies mentioned below offer great loan options and don’t have hidden fees.

In a hurry? Here are our top picks:

- Overall Best Personal Loans: Upstart

- Best Personal Loan For Excellent Credit: SoFi

- Best Personal Loans For Average Credit: Upgrade

Note that with some of the best personal loans, you may have to pay an origination fee or application fees.

However, you can still save thousands of dollars compared to high-interest loans and high credit card interest rates.

* Varies depending on the level of education

1. Upstart

Young professionals who need a personal loan and have a minimal credit score history should consider Upstart. It offers some of the best personal loans of $1,000 to $50,000 in three and five-year repayment terms.

This could help you to consolidate credit card debt or student loans. You could also get a loan to start a business or pay for personal expenses.

Upstart considers your education, area of study, and job history when you apply for a loan.

No minimum credit score is required to get a personal loan from Upstart. This differs from other lenders, who only accept applicants with fair credit scores.

If approved, you can have funds in as fast as one business day. Loan amounts vary based on your unique profile.

Since launching, Upstart has funded more than $3.2 billion in personal loans.

Here’s another cool fact about Upstart: it was founded by ex-Google employees.

They used their knowledge to build the first lending platform that uses artificial intelligence and machine learning to price credit and automate the borrowing process.

Upstart Highlights:

| Loan Terms: | 3-5 years |

| Max Loan: | $50,000 |

| Minimum Credit Score: | None |

| Trustpilot: | 4.9/5 |

2. Upgrade

Upgrade is a newer company founded by two former executives of Lending Club. With a $1,000 borrowing minimum and a low APR, Upgrade is one of the most affordable lenders.

You can apply for a three or five-year unsecured personal loan. Loan amounts can vary, but applicants may get loan funds of up to $35,000 using Upgrade. If all goes well, it will work on delivering the money to your bank account the next day.

Like most lenders, Upgrade evaluates credit scores when granting or rejecting loan requests. To be eligible for a personal loan from Upgrade, you’ll need a minimum credit score of at least 560. This means you need a fair credit score to qualify.

Upgrade even lets you customize your payment due date. This feature makes it one of the most flexible lenders on this list.

While you can’t get secured loans from this personal loan lender, it offers some of the best personal loan rates to help you consolidate debt.

Ultimately, this is one of the best online lenders that will accept most people regardless of their credit history as long as they have a fair credit score.

Upgrade Highlights:

| Loan Terms: | 3-5 years |

| Max Loan: | $35,000 |

| Minimum Credit Score: | 560 |

| Trustpilot: | 4.7/5 |

3. LendingClub

LendingClub is a P2P lender that can offer lower interest rates and possibly give you a better chance of approval than a bank would.

LendingClub offers fixed-rate personal loan amounts of $1,000 to $40,000 for either 36 months (three years) or 60 months (five years).

When you apply, LendingClub performs a soft credit check so your credit score will not be affected by applying for a loan.

The entire approval process takes about seven days. You’ll need to be prepared to pay an origination fee of 5% to get a personal loan from this online lender.

You can use LendingClub to apply for personal loans, small business loans and auto refinancing.

If you are looking for an unsecured loan and you don’t need a high loan amount, Lending Club is worth evaluating.

LendingClub Highlights:

| Loan Terms: | 3-5 years |

| Max Loan: | $40,000 |

| Minimum Credit Score: | NA |

| Trustpilot: | 4.8/5 |

| Origination fees: | Up to 5% |

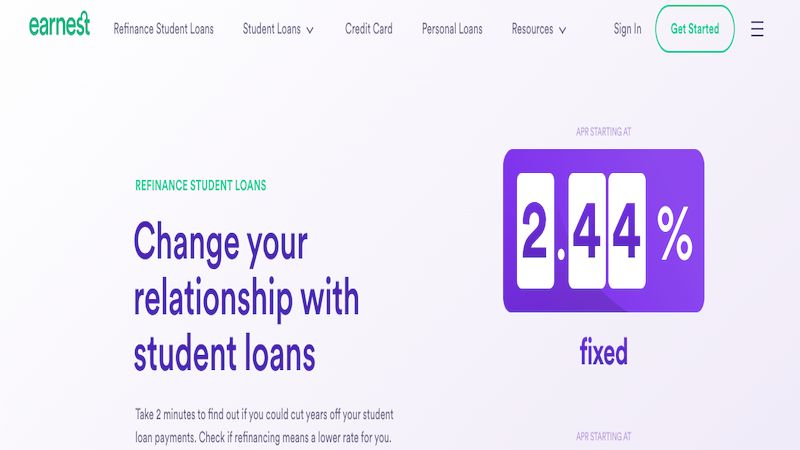

4. Earnest

Some lenders rely solely on your credit report and credit history to approve or deny your application. However, Earnest does not.

This lender doesn’t look at credit scores or credit history to evaluate applicants. This means it won’t automatically reject people with lower credit scores.

Instead, it looks at “deep data” like your job history, income potential, college experience, and saving patterns to get the lowest interest possible.

Loan amounts can based on your borrower profile.

Earnest additionally offers student loan refinancing with variable rates and gives discounts for autopay.

It also offers some of the best personal loans with fixed rates with three to five-year terms.

If you want to get a personal loan from a lender that offers low rates, Earnest is worth considering. Their rates are as low as 2.44%.

Bonus: Earnest will let you get an estimated interest rate without affecting your credit score or credit history.

Earnest Highlights:

| Loan Terms: | 3-5 years |

| Max Loan: | $250,000 |

| Minimum Credit Score: | NA |

| Trustpilot: | 4.7/5 |

5. Best Egg

Best Egg offers deposits as fast as the next day once they approve your application.

This might be the first time you’ve ever heard about Best Egg. It’s important to know they have an A+ Better Business Bureau rating.

With a $2,000 minimum borrowing requirement, it can be really easy to qualify for a personal loan if you only have a small balance.

Additionally, Best Egg starts with a soft credit inquiry that won’t hurt your credit score. You can get personal loans from Best Egg for credit card consolidation, home improvement, and more.

No matter what you need personal loan funds for, Best Egg is worth reviewing.

Best Egg Highlights:

| Loan Terms: | 3-5 years |

| Max Loan: | $35,000 |

| Minimum Credit Score: | NA |

| Trustpilot: | 4.6/5 |

Best Egg Disclosure:

— *Trustpilot TrustScore as of June 2020. Best Egg personal loans, including the Best Egg Secured Loan, are made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender or Blue Ridge Bank, a Nationally Chartered Bank, Member FDIC, Equal Housing Lender. “Best Egg” is a trademark of Marlette Holdings, Inc., a Delaware corporation. All uses of “Best Egg” refer to “the Best Egg personal loan”, “the Best Egg Secured Loan”, and/or “Best Egg on behalf of Cross River Bank or Blue Ridge Bank, as originator of the Best Egg personal loan,” as applicable.

— You need a minimum 700 FICO® score and a minimum individual annual income of $100,000 to qualify for our lowest APR. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

— The term, amount, and APR of any loan we offer to you will depend on your credit score, income, debt payment obligations, loan amount, credit history and other factors. Your loan agreement will contain specific terms and conditions. About half of our customers get their money the next day. After successful verification, your money can be deposited in your bank account within 1-3 business days. The timing of available funds upon loan approval may vary depending upon your bank’s policies. Loan amounts range from $2,000– $50,000. Residents of Massachusetts have a minimum loan amount of $6,500 ; New Mexico and Ohio, $5,000; and Georgia, $3,000. For a second Best Egg loan, your total existing Best Egg loan balances cannot exceed $50,000. Annual Percentage Rates (APRs) range from 4.99%–35.99%. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0.99%–5.99% of your loan amount, which will be deducted from any loan proceeds you receive. The origination fee on a loan term 4-years or longer will be at least 4.99%. Your loan term will impact your APR, which may be higher than our lowest advertised rate.

6. PersonalLoans.com

PersonalLoans.com is not a lender but a search engine for personal loan companies. This search engine can help you find personal loans as small as $1,000.

You can also specify your loan term as short as 90 days or up to six years.

Lenders in PersonalLoans.com’s network offer personal loans up to $35,000. This amount of money can help you consolidate debt, finance a purchase or help with other financial needs.

To begin finding your personal loan offer, all you have to do is submit a request with some basic information. You’ll need to share your bank account information, for instance. You’ll also need to share your income and credit score.

Multiple lenders will review your information quickly. Provided you meet a lender’s minimum credit score requirement, you could be presented with a great loan opportunity within just a few minutes!

Whether you need to consolidate credit card debt, need unsecured or secured loans, require higher loan amounts or are trying to avoid taking out a payday loan, PersonalLoans.com can help you find the right solution for your situation.

PersonalLoans.com Highlights:

| Loan Terms: | 90 days to 6 years |

| Max Loan: | $35,000 |

| Minimum Credit Score: | NA |

| Trustpilot: | 4.6/5 |

7. Marcus by Goldman Sachs

Financial powerhouse Goldman Sachs created Marcus to “help people achieve financial well-being”, according to their website. They offer personal loans that can be used for debt consolidation, home improvements and more.

Loan amounts from this lender range from a minimum loan amount of $3,500 up to maximum amount of $40,000.

Applicants don’t need excellent credit to get approved by this lender. Instead, you’ll need a fair credit score of at least 600 to get approved for a personal loan.

Their website says there are never any fees with a Marcus loan. That means no application fee, no origination fees or no fees for early repayment.

There aren’t even any late fees with Marcus, although you should still pay your loan on time to protect your credit rating.

Marcus offers personal loans lasting from 36 months up to 72 months. It’s important to note that interest rates with Marcus are generally higher if you stretch out your term.

Also, the better your credit, the lower the interest rate you’ll qualify for.

Marcus Highlights:

| Loan Terms: | 3-5 years |

| Max Loan: | $40,000 |

| Minimum Credit Score: | 660 |

| Trustpilot: | 3.3/5 |

8. SoFi

SoFi is another top pick because of its low-interest rates and generous lending terms.

With SoFi’s personal loans, you can borrow loan amounts between $5,000 and $100,000 for up to seven years.

It also offers low fixed interest rates if you set your payment up on autopay.

This is one of the online lenders that requires applicants to have a good credit score. To get unsecured loans from SoFi, you’ll need a score of at least 680.

SoFi has other benefits, too. Hopefully, you will never need to use this benefit, but SoFi does offer unemployment protection.

If you lose your job through no fault of your own, you may apply for this protection. SoFi will suspend your monthly SoFi loan payments and provide job placement assistance during your forbearance period.

However, interest will continue to accrue and will be added to your principal balance at the end of each forbearance period to the extent permitted by applicable law.

Benefits are offered in three-month increments and capped at 12 months, in aggregate, over the life of the loan.

To be eligible for this assistance, you must provide proof that you have applied for and are eligible for unemployment compensation. Plus, you must actively work with their Career Advisory Group to look for new employment.

And, you will never pay origination fees or penalties for prepayment.

Sofi Highlights:

| Loan Terms: | 2-7 years |

| Max Loan: | $100,000 |

| Minimum Credit Score: | 680 |

| Trustpilot: | 4.0/5 |

| Origination Fee: | Not required |

9. Happy Money (Previously Payoff)

When it comes to the best personal loans for debt consolidation, Happy Money (formerly Payoff) specializes in credit card debt consolidation loans. The lender has refinanced more than $100 million so far.

This online lender offers personal loans to people with a credit score of at least 600 and who need debt consolidation loans for things like credit card debt, student loans, and more.

The only fee you will pay for personal loans from this provider is an origination fee. You won’t pay typical fees with Happy Money.

For instance, other online lenders might charge more if you make a payment by paper check. However, with Happy Money, payments made by snail mail never cost extra.

Happy Money offers lower loan amounts than other personal loan lenders. However, it’s still a great provider that is worth considering.

Happy Money Highlights:

| Loan Terms: | 2-5 years |

| Max Loan: | $40,000 |

| Minimum Credit Score: | 600 |

| Trustpilot: | 4.5/5 |

| Origination Fee: | None |

Payoff also offers job loss support to restructure your payments if you lose your job. This benefit is becoming more common, but it is still a rarity among private lenders.

Learn More: Happy Money Loan Review

10. Peerform

Peerform is one of the few P2P platforms that lend to borrowers who have a credit score as low as 600. If you have average credit, you may not qualify for their top category APR, but you can still potentially get a lower interest rate than at a bank.

P2P lenders like Peerform have been so successful in recent years because they have made loan and debt consolidation easier. Borrowers can more easily responsibly refinance their current debt and avoid the bank for new financing too.

This lender offers unsecured loans with fixed rates. It is one of the best personal loan options for needs like credit card consolidation.

With Peerform, loan amounts range from $4,000 up to a maximum loan of $25,000 per loan.

If you are looking for unsecured personal loans for debt consolidation and need lower loan amounts, Peerform is worth considering.

Peerform Highlights:

| Loan Terms: | 3-5 years |

| Max Loan: | 25,000 |

| Minimum Credit Score: | 600 |

| Trustpilot: | 3.5/5 |

Related Post: Stilt Loans Review: Personal Loans For Immigrants And Visa Holders

How Do These Personal Loan Companies Compare?

| Company | Trustpilot |

| Upstart | 4.9 |

| Upgrade | 4.7 |

| LendingClub | 4.8 |

| Earnest | 4.7 |

| Best Egg | 4.6 |

| PersonalLoans.com | 4.6 |

| Marcus By Goldman Sachs | 3.3 |

| SoFi | 4.0 |

| Payoff | 4.5 |

| Peerform | 3.5 |

Summary

Many people think their only option to save money on high-interest debt is to use a debt consolidation agency. In reality, that’s one of the most expensive ways to refinance your debt. Consider applying for a personal loan.

You can easily reduce your interest rate by 15 percentage points and save thousands of dollars.

Until now, personal loans might have been the best-kept secret that high-interest lenders didn’t want you to know.

Disclaimers

All loans made by WebBank, Member FDIC. Your actual rate depends upon credit score, loan amount, loan term, and credit use and history.

The APR ranges from 6.95% to 35.89%. For example, you could receive a loan of $6,000 with an interest rate of 7.99% and a 5.00% origination fee of $300 for an APR of 11.51%. In this example, you will receive $5,700 and will make 36 monthly payments of $187.99. The total amount repayable will be $6,767.64.

Your APR will be determined based on your credit at time of application. *The origination fees range from 1% to 6%; the average origination fee is 5.2% (as of 12/5/18 YTD).* There is no down payment and there is never a prepayment penalty.

Closing of your loan is contingent upon your agreement of all the required agreements and disclosures on the www.lendingclub.com website. All loans via LendingClub have a minimum repayment term of 36 months or longer.

Upstart range of available rates varies by state. Rates range from 6.53% – 35.99%. The average 3-year loan on Upstart will have an APR of X% and 36 monthly payments of $Y per $1,000 borrowed. There is no down payment and no prepayment penalty.

The average APR on Upstart is calculated based on 3-year rates offered in the last 1 month. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

For Upstart loan ranging from $1,000-$50,000; your loan amount will be determined based on your credit, income, and certain other information provided in your application. Not all applicants will qualify for the full amount.

Loans are not available in West Virginia or Iowa. (IF LOAN AMOUNT ISN’T ALREADY VARIED BY STATE: The minimum loan amount in MA is $7,000. The smallest loan amount available in Ohio is $6,000. The loan minimum in NM is $5,100. The minimum amount for loans in GA is $3,100.)

Upstart Trustpilot rated 5 out of 5 based on 5,686 reviews and ranked 3 out of 172 in the category Non-Bank Financial Service on Trustpilot as of 2/10/20.

Upstart full range of available rates varies by state. The average 3-year loan on Upstart will have an APR of X% and 36 monthly payments of $Y per $1,000 borrowed. There is no down payment and no penalty for prepayment.

The average APR on Upstart is calculated based on 3-year rates offered in the last 1 month. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

All loans available through FreedomPlus.com are made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender. All loan and rate terms are subject to eligibility restrictions, application review, credit score, loan amount, loan term, lender approval, and credit usage and history. Eligibility for a loan is not guaranteed.

Loans are not available to residents of all states – please call a FreedomPlus representative for further details. The following limitations, in addition to others, shall apply: FreedomPlus does not arrange loans in: (i) Arizona under $10,500; (ii) Massachusetts under $6,500, (iii) Ohio under $5,500, and (iv) Georgia under $3,500. Repayment periods range from 24 to 60 months.

The range of APRs on loans made available through FreedomPlus is 4.99% to a maximum of 29.99%. APR. The APR calculation includes all applicable fees, including the loan origination fee. For Example, a four year $20,000 loan with an interest rate of 15.49% and corresponding APR of 18.34% would have an estimated monthly payment of $561.60 and a total cost payable of $7,948.13.

To qualify for a 4.99% APR loan, a borrower will need excellent credit on a loan for an amount less than $14,000.00, and with a term equal to 24 months. Adding a co-borrower with sufficient income; using at least eighty-five percent (85%) of the loan proceeds to directly pay off qualifying existing debt; or showing proof of sufficient retirement savings, could help you qualify.

Fixed rates from 8.99% APR to 25.81% APR reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. SoFi rate ranges are current as of 05/19/23 and are subject to change without notice. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors.

Loan amounts range from $5,000– $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0%-6%, which will be deducted from any loan proceeds you receive.

Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi.

Direct Deposit Discount: To be eligible to potentially receive an additional (0.25%) interest rate reduction for setting up direct deposit with a SoFi Checking and Savings account offered by SoFi Bank, N.A. or eligible cash management account offered by SoFi Securities, LLC (“Direct Deposit Account”), you must have an open Direct Deposit Account within 30 days of the funding of your Loan. Once eligible, you will receive this discount during periods in which you have enabled payroll direct deposits of at least $1,000/month to a Direct Deposit Account in accordance with SoFi’s reasonable procedures and requirements to be determined at SoFi’s sole discretion. This discount will be lost during periods in which SoFi determines you have turned off direct deposits to your Direct Deposit Account. You are not required to enroll in direct deposits to receive a Loan.

Lightstream Disclosure: *Payment example: Monthly payments for a $25,000 loan at 6.89% APR with a term of 12 years would result in 144 monthly payments of $255.63.

Truist Bank is an Equal Housing Lender. © 2022 Truist Financial Corporation. Truist, LightStream, and the LightStream logo are service marks of Truist Financial Corporation. All other trademarks are the property of their respective owners. Lending services provided by Truist Bank.

Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of 8.49%-35.97%. All personal loans have a 1.85% to 9.99% origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of existing debt directly. Loans feature repayment terms of 24 to 84 months. For example, if you receive a $10,000 loan with a 36-month term and a 17.59% APR (which includes a 13.94% yearly interest rate and a 5% one-time origination fee), you would receive $9,500 in your account and would have a required monthly payment of $341.48. Over the life of the loan, your payments would total $12,293.46. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. Actual rate depends on credit score, credit usage history, loan term, and other factors. Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. There is no fee or penalty for repaying a loan early. Personal loans issued by Upgrade’s bank partners. Information on Upgrade’s bank partners can be found at https://www.upgrade.com/bank-partners/.

The following payment example depicts the APR, monthly payment and total payments made during the life of a personal loan with a single disbursement. All loan rates below are shown with the autopay discount (0.25%) and direct deposit discount (0.25%). The monthly payment for a $30,000 loan with a 60-month term and a fixed annual percentage rate (APR) between 12.95% – 25.03% would be $681.82 – $881.07 in monthly payments, with total payments between $40,909.47 – $52,864.05. Your actual interest rate may be different than the loan interest rates in these examples and will be based on term of loan, your financial history, and other factors, including your cosigner’s (if any) financial history. Lowest rates reserved for the most creditworthy borrowers. See SoFi.com/eligibility for details.

Fixed rates from 8.99% APR to 25.81% APR reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. SoFi rate ranges are current as of 05/19/23 and are subject to change without notice. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors.

Loan amounts range from $5,000– $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0%-6%, which will be deducted from any loan proceeds you receive.

Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi.

Great article! This is totally a big help for me since I am looking for a reliable personal loan company. I think that the companies that you shared here are very helpful and reliable. Thanks for sharing this article.

I will select LightStream because it fits my personal goal.

I want to take a personal loan. Thanks for sharing the different companies which I can get a loan. This will surely help me to choose the right one for me. I am interested to LightStream. I will try to apply for a personal loan from it.

I want to take personal loan. I think that this article will definitely help me to get the right personal loan provider that’s best for me and my budget. Thanks for sharing this article.

This article is very helpful. I thinkthat this article help me to choose the right and reliable personal loan provider. This article is really helpful for me to avoid issues or problem. This is really a great article.

I already have a loan with Citibank that I’m currently paying back. But, do you think I can still apply for another personal loan from either Citibank or any of these credit unions? If yes, please specify which credit unions I can contact because I’m based in Hayward, CA.

If you already have a loan, I would discourage you from getting another unless it’s absolutely necessary. It’s much better to save up your cash for whatever you’re wanting, unless it’s a crisis. If it is an emergency, that is what emergency funds are for. So, once you’re past your emergency, you should start an emergency fund as quickly as possible, if you don’t already have one. That being said, if you must get another loan, check out the links in this post to see if any of those options will work for you. Once you are on the site, check out their site map, policies, terms and conditions, and FAQ’s to see if they will work in your state. If that doesn’t answer your question, try contacting them directly to ask using the contact information on their site.

Can people from Asia avail a loan from any of the lenders above?

You might be able to find out by checking out the FAQ’s, terms of use, privacy, or policies and procedures of the sites you’re interested in. If that doesn’t answer your questions, try using the contact information in each site to ask them directly.

Dear, I need $1000.

Try a few of the ideas in this post. You could also ask others for help by checking out our post about how to get strangers to give you money. Also, you can make money using your smartphone. We have a post about it. Or, try making money from home. We have several posts that can help you get started. Our site actually has a TON of ways you can make money that might help. Good luck!

I would like to know if I may qualify for a loan.

You will need to see if you can pre-qualify for these companies. Only they can access your credit profile.