Worthy Bonds Review: Can You Really Earn 7% Interest?

Some products in this article are from our partners. Read our Advertiser Discloser.

Are you looking for a way to invest without putting all of your money into the stock market?

Worthy Bonds can be the alternative investment you’re looking for. Through the bonds, you invest in community real estate projects and earn over 7% annual interest, and you only need to invest $10 at a time.

The 7% yield is higher than the current savings account and bank yields.

Overall Rating

Summary

Worthy Bonds lets you earn an attractive 7% annual return by investing in a portfolio of real estate loans and only requires a $10 investment. This is an easy way to add to your fixed income.

-

Investment amounts

5

-

Easy to join

4.5

-

Risk

3.5

Pros

- Can invest in small amounts

- No early withdrawal penalties

- Non-accredited investors

Cons

- Taxed as ordinary income

- Not FDIC Insured

What is a Bond?

A bond is a loan where a business or government is the borrower. Most investors invest in individual bonds and bond funds through their online brokerage or 401k plan.

Also, some choose to buy savings bonds from the U.S. Treasury.

Each month, your bond investment can pay fixed interest payments until either the bond matures or you sell the bond.

Worthy Bonds are corporate bonds backed by a portfolio of community real estate projects. Each bond costs $10 and doesn’t have a minimum investment term or maturity date. Therefore, you can redeem your bonds when you need the cash for other priorities.

Each bond earns 7% interest, although you receive daily interest payments.

I like Worthy because of its competitive yields, and I have invested a small amount of money in the past because of the earning potential, easy redemption process, and the ability to help small businesses.

You may prefer bonds to stocks as it’s easier to project your potential investment returns with less share price volatility. Additionally, bonds can have higher yields than stocks as you are lending money directly to the company and can get paid back first before shareholders.

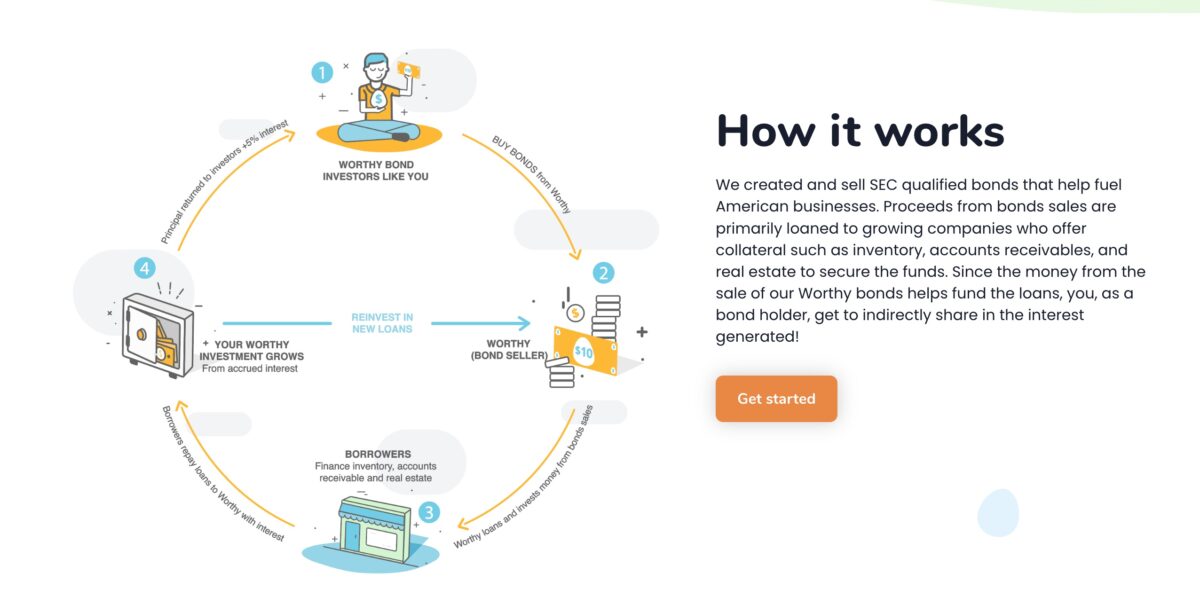

How Does Worthy Bonds Work?

Worthy is an investing platform and mobile app that started in 2016. They let investors benefit from investing in loans to grow businesses and real estate without using a bank.

As a result, you can earn a higher investment return, although you may also assume more risk in this asset class. That’s one reason why I like the $10 minimum investment, as you can allocate a small amount to diversify your portfolio while still managing risk.

This investing option (into private credit) was previously only available to “accredited investors” with a high annual income or liquid net worth. Worthy Bonds are open to all U.S. investors at least 18 years old.

Investing in a private credit product can be riskier than a bank savings account. But your potential investment return is higher.

That’s how Worthy Bonds can offer a 7% annual yield.

In contrast, the highest saving account yields are closer to 4%. Worthy Bonds can be riskier than the bank but is still a legit way to earn more interest on your savings.

You invest in business and real estate loans secured by assets worth more than the loan value.

In other words, Worthy should be able to access the borrower’s cash assets to recoup the remaining loan principal so your bonds don’t lose money.

How Worthy Bonds works:

- You link a bank account and buy bonds in $10 increments

- Worthy uses bond sale proceeds to lend to real estate developers (including affordable housing) and charges borrowers an interest rate higher than the 7% they pay their bondholders.

- You earn fixed daily interest payments with a 7% annual yield

No Preset Investment Term

Unlike most fixed-income investments, Worthy doesn’t have maturity dates or early redemption penalties. So, it’s possible to earn a fixed 7% interest yield for your entire investment period.

This feature is one way Worthy differs from bank CDs and peer-to-peer lending platforms that charge an early withdrawal fee.

The easy redemption policy is a primary reason I invested money with this platform instead of other crowdfunding platforms where you might pay an early redemption penalty when redeeming your shares before the loan matures. That’s usually three years or five years.

Note: If you’re a long-time Worthy Bonds investor, previous offerings had a 36-month maturity date but penalty-free early redemptions. The current offering of Worthy Property Bonds has an open-ended maturity date for maximum flexibility.

Are Worthy Bonds FDIC-Insured?

Another notable difference between Worthy and your local or online bank is that Worthy isn’t FDIC-insured.

So if your Worthy Bonds investments default, you can lose your entire investment and never receive repayment. As a result, these investment options shouldn’t replace your federally insured savings account.

But, in spite of this, Worthy Bonds is a legitimate company. The bond offerings are SEC reviewed and qualified and the company is publicly reporting and independently audited annually.

Account Types

Worthy Bonds only offers taxable accounts.

Individuals and businesses can hold bonds in the following accounts:

- Taxable (individual accounts only)

- IRA

- Trust

- Business

- Non-profit

You can open an account by making a $10 initial purchase for your first bond. Taxable accounts are the most common account type.

You will receive a Form 1099-INT each year reporting your interest earnings. This form is similar to the ones you receive from your bank and other investing platforms.

Fees

There are zero fees to buy or sell Worthy Bonds. Not paying an early withdrawal penalty makes Worthy Bonds unique. Other investing platforms we’ve seen charge a 1% early withdrawal fee.

Who Can Invest?

All U.S. citizens and permanent residents at least 18 years old with a U.S. bank account can invest in Worthy Bonds.

Investing Limits

Although Worthy Bonds is open to all U.S. investors, there are income-based investing limits. Due to securities regulations, Worthy Bonds has different investing limits for accredited and non-accredited investors.

You’re an accredited investor if you earn $200,000 annually ($300,000 for married investors). Or if you have a minimum $1 million net worth, not including your home value.

Most U.S. investors are non-accredited investors because they don’t meet the income or net worth requirements.

The current Worthy Bonds investing limits are as follows:

- Non-accredited investors can invest up to 10% of their annual income or net worth, whichever is greater.

- Accredited investors can invest up to $50,000 (5,000 bonds) online.

How to Invest

You need to link your bank account to fund your investment account. Worthy only allows you to buy bonds in $10 increments.

It takes between four and five business days for Worthy’s payment processor to transfer the funds from your bank account and buy bonds. You will start earning interest once the transaction finishes.

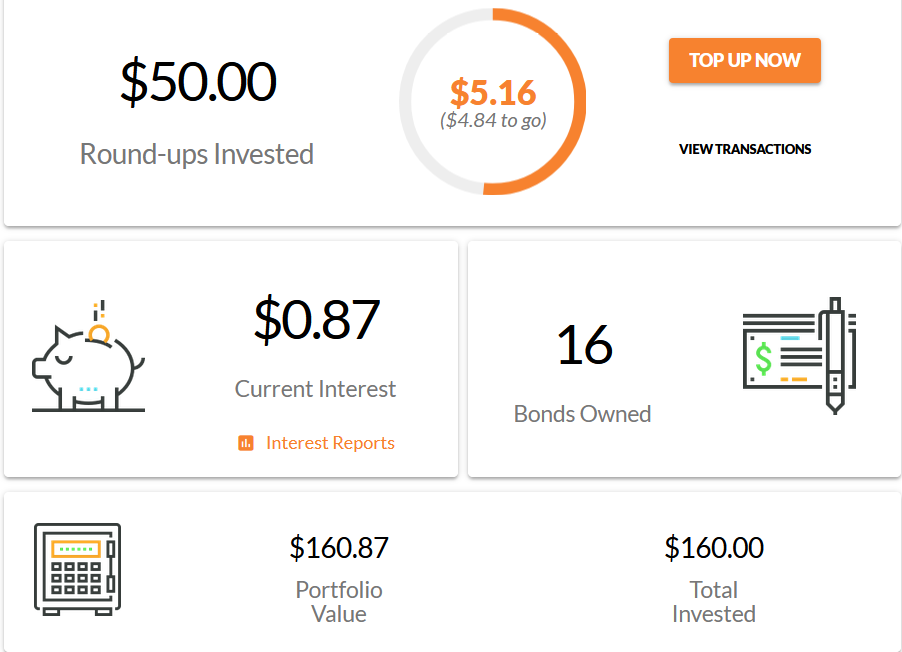

Worthy lets you make one-time and recurring monthly contributions. You can also invest small amounts of money with the spending roundups from your credit and debit purchases.

Recurring Contributions

You can also schedule recurring weekly or monthly contributions in $10 increments. All withdrawals come from your linked bank account.

In addition to linking your banking account, you can automatically reinvest your interest. The platform can buy new bonds when your interest balance reaches $10.

Spending Roundups

Worthy Bonds can also monitor your credit card and debit card purchases to track the “spare change” from these transactions. If you choose this feature, they round each purchase up to the next dollar. then a new bond purchase is triggered when your spare change round-up balance reaches $10.

For instance, Worthy rounds a $23.30 purchase to $24 and invests the 70-cent round-up. A full-dollar transaction, like $15.00, would add a $1 round-up to the total.

All cash withdrawals come from your linked bank account and never from your credit or debit card.

This round-up option can be an easy way to invest each time you spend money. Plus, it increases your investing frequency.

Earning Interest

All Worthy Bonds earn 7% compound interest with fixed daily interest payments.

All bonds collect the same interest rate. This rate can fluctuate depending on market conditions. For reference, the platform increased the yield in 2024 from 6.5% to 7% as savings and loan rates have risen recently.

Related: What Happens When You Double a Penny Everyday For 30 Days?

Withdrawing Bonds

Worthy Bonds lets you sell bonds at any time penalty-free and fee-free with a $10 withdrawal minimum.

To access your cash, you must sell the original investment or accumulate at least $10 in uninvested interest. You can withdraw your interest earnings twice in a 30-day period.

After scheduling a withdrawal, Worthy deposits the original investment and uninvested interest into your bank account within four to six business days.

For example, I withdrew my accumulated interest and sold my bonds without paying trading fees or early withdrawal penalties. The funds were deposited in my checking account within a few business days, and I could use the cash for another financial priority.

If this withdrawal policy is a hindrance, a savings account or a bond ETF can be a better option. With these types, you can make interest-only withdrawals without touching your principal.

Are Worthy Bonds Safe?

There’s an element of risk to any investment. For instance, businesses can go bankrupt. Stock share prices can drop to $0.

In general, Worthy Bonds are riskier than savings accounts and bank CDs, which are FDIC-insured and typically backed with more financial reserves.

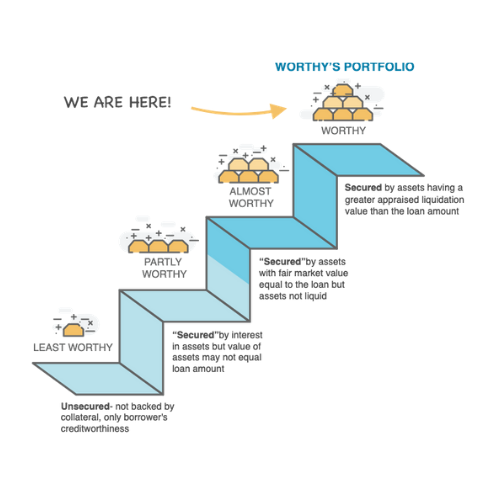

Each bond is collateral-backed by a portfolio of real estate. These small business bonds are more secure than peer-to-peer personal loans, a similar investment option with competing yields.

Further, they can be safer than investing in stocks whose share prices are more volatile and can even take years to recover from a steep price decline.

With a 7% annual yield, Worthy Bonds can be considered a less risky investment. They are a good option if you want to invest in bonds that don’t trade on the stock market.

Like any investment, only invest what you feel comfortable potentially losing. A portfolio analyzer can also help you evaluate your asset allocation and investment goals.

Why Worthy Bonds Are Safe

The following reasons show how Worthy Bonds are potentially safer and riskier than other investment options.

Collateral-Backed Loans

Worthy states they invest in real estate small business loans which means they are secured by the value of properties. They primarily lend at a 60% loan to value which gives plenty of room should any type of market correction happen.

If a real estate developer stops making payments, Worthy can assume ownership of the property and sell it to recover the remaining loan balance.

If these loans were not secured, then Worthy couldn’t use the borrower’s collateral to recover the loan balance. (investors are not tied to individual loans/borrowers)

Regrettably, loan defaults are sure to happen. And Worthy may not be able to recover enough collateral to offset unpaid balances if a significant number of loans in a given portfolio default. But to date, Worthy has never had a loan loss in its real estate portfolio.

Invest in Multiple Loans

Worthy invests in multiple real estate loans. Investing in as many loans as possible helps minimize risk and create a diversified portfolio.

Additionally, as a safeguard, the lender only offers a limited number of bonds. Late investors may not be able to purchase bonds if the funding round is complete. Worthy won’t oversubscribe and lend more than advertised, which can result in lending to unqualified borrowers.

Worthy Bonds are SEC Qualified

Having their bond offerings reviewed and qualified by the U.S. Securities and Exchange Commission means Worthy Bonds is a legit company that must comply with securities regulations. Any credible crowdfund platform or stock investing brokerage is SEC-registered.

Being SEC-qualified isn’t the same thing as being FDIC-insured. Worthy isn’t a bank. If the bonds default and Worthy can’t recoup your original investment, you lose your remaining balance.

Potential Risks

Like anything, there are some potential risks to consider.

Borrowers May Default

Worthy Bonds inherent market risk is if too many borrowers default on their loan payments. Default rates can increase during a recession or if Worthy makes poor investment decisions.

However, you face the same risk if you invest in any loans with another crowdfunding platform. And remember, the loans are backed by physical real estate that can be sold if necessary.

Cannot See Investment Portfolio

Since the bonds are backed by an ever changing portfolio of properties, investors cannot see the loans in which they are investing.

Worthy only states each loan is fully secured and doesn’t exceed two-thirds of the business’s net worth. Also, the platform charges an interest rate to higher than 7% which can make the interest payments challenging to afford in a challenging business environment.

Although the lack of transparency can be a risk, banks don’t disclose specifics of their loan details to savings and CD account holders either.

Only in Operation Since 2016

While Worthy didn’t pioneer real estate loan investing, they have only been issuing bonds since 2016. The crowdfunding industry has matured and weathered several economic challenges but hasn’t been through an entire economic cycle.

Is Worthy Bonds Legit?

Yes. Worthy Bonds is a legitimate organization regulated by the SEC and has a score of 3.6 out of 5 on Trustpilot with 150 reviews. This is a great rating on this customer review platform.

Like any investment, Worthy isn’t risk-free. It has only been around since 2016 and hasn’t been “recession-tested.” However, it has been tested through the pandemic and has fared well.

Perform due diligence and only invest money in Worthy Bonds if you feel comfortable investing in business or real estate lending.

Customer Reviews

Here are a few reviews from Trustpilot:

I’ve used worthy for a few years now with no issue. the returns have been consistent as advertised and any questions are answered quickly via the app.

Jeff K.

This has been a solid 5 % platform thus far and I have not had any problems. I use this account to diversify my investment portfolio and it’s been workout out so far. Great customer communication as well. They send you monthly updates about the company’s progress.

Mr. P

Their support has been responsive, they are attempting to be transparent, but I believe there needs to be a 30-60-90 day update to investors. This was not advertised as a risk free investment, but was promoted as a safe way to build your savings through “bonds”.

Jason C

Pros

- Can invest in $10 increments

- No early withdrawal penalties

- All notes earn 7% annual interest

- Non-accredited investors can join

- Potentially less risky than stock investments

Cons

- Interest taxed as “ordinary income” instead of capital gains

- Worthy is still a relatively new investment option

- Default risks increase during a recession

- Bonds periodically sell out

Summary

Worthy Bonds is a legit and affordable way to earn a fixed income. The 7% annual yield is better than the current savings account and bank CD rates.

It can also be a good way to diversify your investment portfolio without relying only on the stock market to earn passive income. It’s also easy to withdraw or reduce your balance without fees or long waits.

You shouldn’t put all your money into real estate. However, it can be a pivotal passive income idea to diversify your investment portfolio and save for retirement.

For 6 months, so far, so good. Worthy is a simplistic way to increase your savings. I wanted to find out how long it took to initiate a withdrawal and actually receive the $ into my checking account, and the funds were there in 4 business days. As always, DIVERSITY. You know the drill. “Get rich SLOWLY”!

This sounds like a great way for investors to earn a higher interest rate than banks are presently paying on CDs or savings accounts. However, it is not accurate to imply that purchasers of Worthy Bonds are essentially taking on the same risk profile as someone holding deposit accounts at an FDIC-insured bank. If an FDIC-insured bank goes bankrupt most depositors will – in fact – NOT lose any money. More specifically, if an FDIC-insured bank goes bankrupt because they’ve made bad loans then holders of deposit accounts in that bank are federally insured against losses up to $250,000 per individual. Conversely, if too many small businesses should default on their Worthy Bond-backed loans the investors in those bonds actually ARE exposed to potential loss of their investment capital (i.e. there is no federally guaranteed program insuring investors against such losses). With that said, the higher interest rate premium associated with purchasing Worthy Bonds arguably represents reasonable compensation to the investor for assuming this added level of risk.