ADP Payroll Review: Is This Payroll Service Right For You?

Some products in this article are from our partners. Read our Advertiser Discloser.

Ensuring employees get the correct pay and withholding can be time-consuming as well as stressful. Consequently, outsourcing payroll can be one of the best decisions a growing company can make.

Many businesses, regardless of size, use ADP. The company provides extensive payroll and HR services, helping businesses increase their efficiency.

This review of ADP can help you decide if it is the right payroll solution for your business.

Overall Rating

Summary

ADP offers payroll and HR solutions for businesses of any size and offers more features than similar services. Employers can pay W-2 and 1099 workers any package.

-

Features

5

-

Plan options

4

-

Fees

4

-

Customer Service

5

-

Ease of use

4

Pros

- Many payroll features

- Full-service plans

- Good customer service

- Video tutorials

Cons

- No online quotes

- HR is optional add-on

- Can be expensive

- Long term contract option

How ADP Works

ADP is one of the largest, most established payroll companies for both small businesses and large corporations. It’s possible to use the ADP payroll services for companies with as little as one employee.

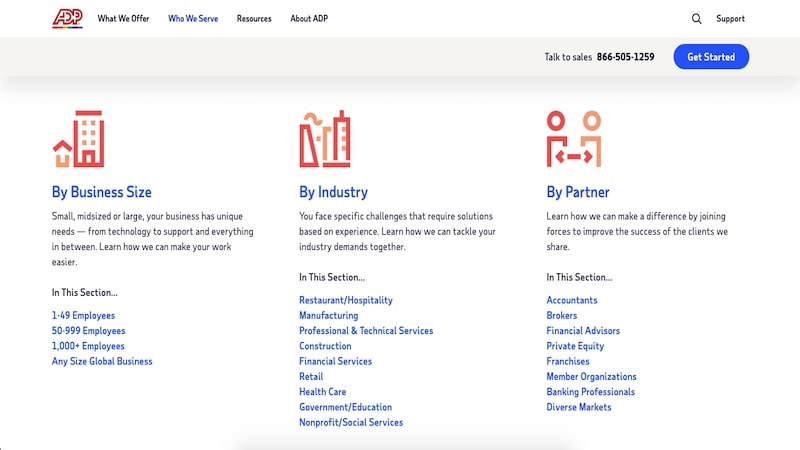

Service levels are divided by business size. When getting a price quote, ADP asks how many employees you have and your location.

Then, an ADP representative for the appropriate service level will contact you by phone to discuss plan options and pricing.

While ADP can serve any sized business, the company offers different service levels to provide personalized service to each customer.

For example, a business with eight employees may have different payroll options than a business with 300 employees. ADP assigns an agent that specializes in a specific company size to provide the best payroll package.

You can use ADP for various services, including:

- Payroll

- Time and attendance

- Benefits and insurance

- Human resources (HR) services

- Professional employer organizations (PEO)

The company can be an all-in-one payroll solution because they offer more options than other payroll services.

ADP has a Trustpilot rating of 2.1 out of 5. However, there are some complaints that the service costs more competitors.

That said, the customer service quality and features may be worth the extra cost since they can help reduce your stress levels.

Who Should Use ADP?

ADP can be a good option for business owners who want to use a trusted payroll company. It’s also worth using the platform since they offer personalized plans and extensive features.

Furthermore, this service can be a great solution if you have a complex situation or want to integrate with multiple software like Intuit QuickBooks, ZipRecruiter and Slack.

While there may be cheaper online-only payroll providers, such as Gusto, they may not provide as many features. As a result, these companies can be better if you only need basic HR benefits and payroll scheduling.

ADP provides free price quotes. Consequently, taking a few minutes to compare rates can be wise.

How Much Does ADP Payroll Cost?

Customers will pay an annual base fee and a per-payroll processing fee. The plan cost can be paid monthly.

Other factors that affect the payroll cost include:

- Payroll frequency

- Number of employees

- Services needed

- Business location

- Contract length

Business owners who want online quotes may be discouraged because ADP doesn’t disclose pricing on its website. You need to schedule a phone consultation to choose the best package and contract for your business.

This consultation can help you avoid paying for services that are unnecessary. On the other hand, it can also help prevent you from choosing a plan that is too basic.

For this review, I spoke with a representative who explained they review the customer’s needs to produce a final price quote. The company didn’t disclose estimated price ranges.

As an unofficial estimate, various online data points indicate that ADP charges between $10 and $50 per employee per month depending on the chosen plan features. There is also a monthly service fee.

New customers may also have to pay a one-time setup fee. This charge is waivable when signing a one-year or multi-year contract.

Business owners will need to speak with an ADP representative to receive an official price quote. New customers can also qualify for an introductory discount such as three free months.

The monthly rates are competitive with other payroll companies but may be higher than online-only options.

ADP Small Business Packages

Below are the various ADP small business packages.

Roll by ADP

Roll by ADP is the payroll provider’s newest option. It is built for businesses with up to nine employees.

This mobile app is chat-based and can be a good option for simpler situations. Businesses can run payroll and schedule next-day payments without any initial training.

With Roll, it’s possible to onboard and start running payroll in approximately 15 minutes.

Roll by ADP functions include:

- Paying W-2 and 1099 workers

- Can pay works in any state

- Calculating and deducting payroll taxes

- Next-day direct deposit

- Payroll reports can be sent to accountants and bookkeepers

- Unlimited chat support

Businesses wanting phone-based customer support or additional features like HR benefits should consider a standard Run by ADP small business package.

The company states that Roll costs $29 monthly plus $5 per employee. This can be the cheapest service option, and no long-term contracts are necessary.

Best for: Mobile-only payroll services

Essential

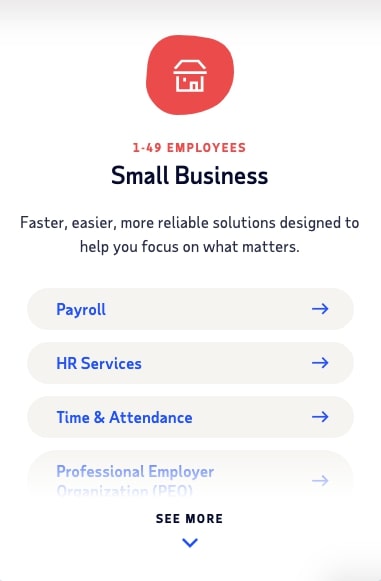

Essential is the entry-level plan tier for the Run by ADP platform. Focused on small business (1-49 employees) This package can require a contract to get the best monthly rate.

Package features include:

- Scheduling payroll by computer, mobile app or phone call

- W-2 and 1099 payments

- Direct deposit

- Tax filing

- New-hire reporting

- Federal and state forms

This package offers complimentary HR checkups. You can compare your current HR practices to the industry’s best standards.

Employees can also get a free Wisely direct debit card instead of receiving a direct bank deposit. This prepaid debit card can be a good payment solution for unbanked workers.

Best for: Payroll and new-hire reporting

Enhanced

The Enhanced package provides stronger tools that can be useful for hiring new employees. This service tier also offers more paycheck services that can be a headache to manage alone.

Key Enhanced package features include:

- State unemployment insurance management

- Garnishment payment services

- Check signing and stuffing

- Poster compliance

- ZipRecruiter access

- Background checks

Businesses that offer paper check payments may choose this service since the Essential package only offers direct deposit and prepaid debit cards.

The ZipRecruiter access can make it easier to post job openings. Then, you can run background checks on potential new hires.

Best for: State unemployment insurance and background checks

Complete

Companies that don’t need an in-house HR department may like the Complete package.

This offering provides these HR benefits:

- HR HelpDesk

- Compliance database and alerts

- HR forms and documents

- Employee handbook wizard

- Job description wizard

- New hire onboarding

- Document vault

Instead of spending time making documents for new hires and current employees, the HR benefits provide customizable forms.

It’s possible to contact the HR HelpDesk by email, chat or phone.

ADP can also help you determine if you remain in compliance and implement the best industry practices.

Best for: Basic HR benefits

HR Pro

The highest-tier HR Pro package can be a good option if you want full access to the ADP human resources tools. It’s also possible to get legal assistance, and employees can get special discounts as well.

Package benefits include:

- Work-life employee assistance programs

- Enhanced employee handbook support

- Employee discount programs

- Trainings

- Legal assistance

This package provides more support for complex HR matters. For example, you can get legal assistance from Upnetic Legal Services, powered by Legal Club.

Customers can also get enhanced help desk and employee handbook support.

Employees will enjoy special discounts to participating brands to save money on lifestyle purchases.

Best for: Advanced HR tools and employee software discounts

ADP Midsize Business Packages

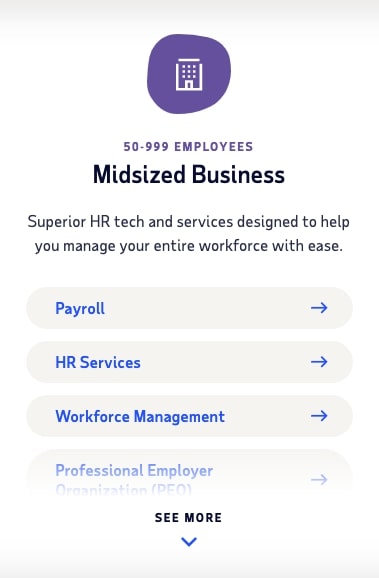

Businesses with between 50 and 999 employees qualify for the ADP Workforce Now tier. There are four packages with various levels of payroll and HR support.

Additional add-ons are available for each plan. The more expensive plans have more add-on options.

Payroll Essentials

This entry-level package offers some payroll customization tools. Pricier packages are better for in-depth HR tools.

The Payroll Essentials package offers these benefits:

- Real-time processing

- Prorated and retroactive pay adjustments

- Customer report builder

- DIY hours, earnings and deductions

One optional add-on includes Workforce Management. This can help with employee scheduling and tracking paid time off accruals.

Another add-on is HR Assist. This tool provides HR HelpDesk support, an employee handbook and compliance reporting.

Best for: Basic payroll services

HR Plus

HR Plus provides tools for employee management, onboarding and digital record keeping.

Some HR Plus services include:

- Compliance reporting

- HR recordkeeping

- New hire and termination workflows

- Customizable employee portal

- Electronic I-9 processing

- Unlimited cloud-based document storage

Optional add-ons include benefits administration and enhanced report analytics.

Best for: Payroll and basic HR services

Hiring Advantage

Businesses that want an easier way to post job openings and onboard employees can benefit from the Hiring Advantage package.

Plan benefits include:

- ZipRecruiter job postings

- Access to over 25,000 job boards

- Onboarding integration

- Interview scheduling and offer letter management

Best for: Posting job openings and hiring employees

Performance Plus

The Performance Plus package provides performance management and compensation management tools.

Select features include:

- Goal assignment and tracking

- Employee self-evaluation dashboard

- Customizable merit and budget guidelines

- Payroll integration for award allocation

Best for: Tracking employee performance and compensation

ADP Payroll Features

Here are some of the best tools that ADP offers for its payroll, HR services and app integrations. It’s important to note that additional features may be available as a special add-on.

Payroll

All small business and mid-size business plans include payroll services, but exact benefits vary by package type.

Employers can expect access to these tools:

- Pay W-2 and 1099 workers

- Automatically calculate and pay payroll taxes

- Direct deposit, paper check and prepaid debit card payment methods

- Employee self-service kiosk

- Payroll software and tax support via chat, email and phone

The payroll platform integrates with time tracking and HR service apps.

Time and Attendance

Remote works can track their working time through ADP. On-site employees can do so as well with a touchless kiosk.

The service helps managers perform these tasks:

- Schedule employee shifts and vacations

- Review timecards

- Track attendance

- Forecast scheduling conflicts

Benefits and Insurance

ADP makes it simple to manage insurance and special benefits.

The benefits administration tools can make it easier to track:

- Retirement plans (i.e. 401k, SIMPLE IRA, SEP IRA)

- Group health insurance

- Business insurance

- Workers’ compensation

HR Services

Human resources packages are another valuable reason to outsource payroll.

Some of the HR services include:

- HR forms and documents

- Online answers to simple HR questions

- HR HelpDesk for personalized support by chat, phone or email

- Employee handbook wizard

You can also compare your company’s HR practices to the industry best practices.

HR Outsourcing and PEO

Businesses can have ADP hire new employees and handle other issues regarding payroll, benefits and compliance. It’s possible to outsource all or some HR tasks as well.

Customers wanting a full-service experience may also appreciate that ADP offers professional employer organization (PEO) outsourcing.

The service acts as a co-employer and handles most of the administrative tasks so you can focus on growing your brand.

Talent

Businesses can create job postings and hire full-time employees or independent contractors through the ADP platform. Additionally, businesses can create and track career development plans and training.

Integrations

The payroll company integrates with many small business software options that other payroll companies may not.

Some of the integration partners include:

- Intuit QuickBooks

- Xero

- Workday

- ClockShark

- Microsoft Teams

- Slack

- ZipRecruiter

- Docufree

Data Security

ADP uses these industry-leading data security practices to protect customer data:

- SOC 1 Type 2 reports

- SOC 2 Type 2 reports

- ISO 9001:2015

- ISO 27001:2013

These protocols look for potential weak spots in the ADP security practices. SOC and ISO measures are widely recognized as the leading methods to evaluate the current practices and prevent data theft.

The company also uses encryption and keeps information on secure servers to limit the risk of data theft.

Positives and Negatives

Before talking to an ADP representative to determine how much it would cost to use the service for your payroll needs, it’s important to look at the pros and cons.

Pros

- Can pay W-2 employees and 1099 contractors

- Multiple package options

- Offers HR, talent acquisition and benefits management

- Business as small as one employee can join

Cons

- No instant online price quotes

- Basic packages don’t include HR benefits

- May require long-term contract to avoid add-on fees

Is ADP Worth It?

When it comes to managing your people and payroll, it is worth the cost knowing your biggest investment is managed right.

Plus when it comes to saving time, ADP will save tons of time.

Knowing which package to choose is important as well. If you are just starting out and still manage a few tasks in-house, you may want to start with a few pieces like payroll. As you grow and need more, like HR Outsourcing or Compliance, then add on.

FAQs

Here are some common questions about ADP.

Small businesses with as few as one employee, the world’s largest businesses and many employers in between use ADP.

It depends. Businesses must speak with an ADP representative to get a price quote. The free consultation helps the service recommend a relevant package and add-on features.

Pricing depends on the monthly package cost, number of employees, contract length and business location. There is also a basic charge every time you run payroll.

One plan that ADP discloses prices for online is Roll by ADP. Roll costs $17 per month plus $5 per employee.

Yes. Businesses wanting a full-service payroll and HR solution can use ADP as a co-employer.

A professional employer organization (PEO) package is available for small businesses (1 to 49 employees) and mid-size businesses (50-999 employees).

The PEO service can manage payroll, HR,talent acquisition, benefits administration and risk reduction.

There are several competitors to ADP that may offer better rates for similar features.

Paychex is a closer match to ADP, but it may offer different features and pricing. This alternative is a good option for businesses with a bigger budget or who want more hands-on help.

Another ADP alternative is Gusto. This can be better for cost-conscious companies. Gusto can be cheaper than ADP, but it offers fewer features and less hands-on support.

Related: Gusto Payroll Review: Is it Worth it?

Best ADP Alternatives

If ADP doesn’t feel like the right fit for you, these alternatives may offer better solutions for your company.

Gusto

Gusto is a more straightforward payroll software program that operates online. If you use FreshBooks, you can use Gusto for free. Otherwise, their plans start at $40/month.

Gusto offers three competitive plans, but most companies get more than enough from the Simple plan, which handles all basic payroll needs, including wage garnishments, unemployment insurance, health benefits, and workers’ compensation.

If you operate a larger company, the next levels include other HR tasks, including offer letters, management of paid-time off requests, and an employee directory. Gusto also integrates with an existing QuickBooks or Xero account.

Paychex

Paychex is one of the country’s largest payroll and HR services and offers platforms for small companies (as little as one employee) to companies with 1,000+ employees.

Like Gusto, Paychex handles state and federal tax withholding, direct deposits, new hire reporting to the appropriate state agency, and new hire reports. In addition, you can upgrade your plan to access a full-time payroll specialist, and your employees can access their pay history on the website.

Paychex is an all-in-one platform for businesses looking to simplify their backend and free up administrators’ time.

Summary

ADP can be great for businesses of any size, whether they have employees, contractors or both. The service offers more payroll, HR and hiring tools than other software.

Scheduling a phone consultation is free and can help you decide if ADP is the best way to outsource payroll. If you decide to use ADP, the company can provide hands-on support along the way.