The 15 Best Apps for Freelancers

Some products in this article are from our partners. Read our Advertiser Discloser.

If you’re a freelancer, you’re well aware of the awesome perks of solopreneurship—working in your PJs, freedom and flexibility over your schedule, and the potential to earn more. Conversely, self-employment also comes with downsides.

Primarily, the extra financial housekeeping that’s involved. Sending and managing invoices, saving for self-employed taxes and budgeting on fluctuating income can all make you want to tear your hair out.

To help you manage your business, here are some of the best apps for freelancers.

Top Apps For Freelancers

These days there are plenty of tools and apps for freelancers to help you manage your finances. If you’ve just started your freelance business or are operating on a tight budget, you may not want to spend too much at first.

We’ve rounded up the best freelance tools for success. Not only do these apps for freelancers have great features to help you with your finances, but they’re free!

1. Axos Basic Business Checking

When I took the leap to full-time freelancing, I walked into the branch of my main bank to inquire about small business accounts.

To my dismay, I’d be charged fees for a small business account. For obvious reasons, I walked out in search of better options.

To minimize fees, look for a free small business checking account. For instance, come business checking accounts offer unlimited transactions, free bill pay and no ATM fees worldwide.

Remember that the money you save from not having to pay bank fees is money you can invest back into your business.

One option is to use Axos Basic Business checking. It was created with the busy business owner in mind.

They offer no monthly maintenance fees, no minimum deposit requirement and unlimited domestic ATM fee reimbursements. Access your money anytime, anywhere.

Learn more: Axos Bank Review

2. Qapital

You know those pesky self-employed taxes that you owe to Uncle Sam each quarter? We all know what a pain in the rear it is to have to sock away a portion from each paycheck.

The easiest way to save for self-employed taxes is to “set it and forget it” with Qapital.

Qapital’s Freelancer Rule enables you to save a percentage of every deposit that’s over $100 into a designated account. That money can be used to sock away toward self-employed taxes or other business-related expenses.

Come quarterly tax time, you won’t come short and have to pay penalties.

3. CIT Bank Savings Connect

Because a freelancer’s income can shift wildly from month to month, you’ll need a robust savings account.

While the typical recommended amount is anywhere from three to six months of living expenses, it certainly couldn’t hurt to save more when you work for yourself. If you can, aim to auto-save a portion of your income each month.

CIT Bank Savings Connect is a great option and offers a very competitive APY.

Having a savings account is a great way to save for emergencies. As a rule of thumb, try to have three months of income saved in the event of job loss.

Learn more: CITBank Review

4. IRS2Go

Yup, the IRS has jumped on the app bandwagon. Through its official app, IRS2Go, you can check your tax refund status, make a payment and look for free tax prep services.

While it’s probably an app you’ll only tap into a few times of the year, anything that makes paying taxes easier get a gold star in my book.

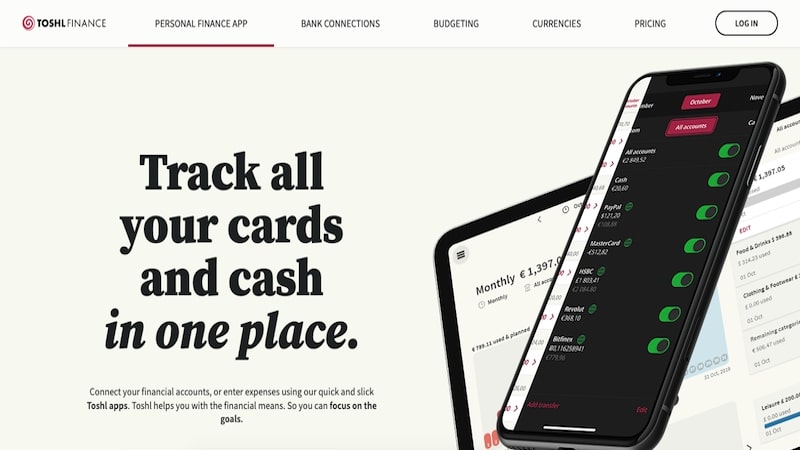

5. Toshl Finance

I love budgeting—said no one, ever. If you are someone who needs a budget to stay on track, look no further than Toshl. With Toshl Finance you’re able to monitor what goes in and comes out.

It’s way better than using a spreadsheet in Google Drive. It lets you stay on top of your budget in one place with no need to make extra time in your schedule to fill out a budget sheet.

What’s neat and different about Toshl is that you can get very specific with your savings goals.

Features include setting specific amounts for each spending category, such as for health insurance and business expenses. You’ll get a “nudge” once you near your spending limits.

We, freelancers, know how bills can creep up on us, especially when we’re waiting on client payments to come in. Toshl will ping you with reminders for when your bills are due.

6. Fiverr Workspace

If you’re looking to send out invoices to your clients without spending much time on the task, look no further than Fiverr Workspace, previously known as AND Co. It is one of the top apps for freelancers.

I haven’t run into any problems using Fiverr Workspace. The only downside is that there’s no ACH option. So your clients will need to pay you by check or credit card (fees apply).

Fiverr Workspace is a simple, no-frills way to send invoices to your clients, calculate taxes and track payments so you can see how much you get paid per month.

Other features a simple project management feature, where you can track time and send invoices per project and a basic template for proposals. However, if you need more robust project management features, another tool might be better.

You can also track your expenses by linking different accounts.

Ultimately, this is one of the best freelance apps for any independent contractor.

7. Expensify

While there are a slew of financial management apps for expense tracking, if you want an a la carte app solely to track expenses, Expensify does the trick.

This is a platform that allows freelancers to have an affordable way to monitor their spending.

The free version lets you log in your expenses and scan up to five receipts or invoices per month. It’s a great management tool if you don’t want to pay a set fee per month to keep track of your expenses.

8. Toggl

I personally track all my work-related tasks, even if I’m not billing by the hour. But if you want a simple way to track your tasks and handle project management, I highly recommend Toggl.

The basic version is free. With this free version, you get reports based on project, client or within a time period.

While a lot of other tools do offer time tracking, Toggl remains my go-to because it’s easy to use. When it comes to time management, this is a must-have app.

It also has an aesthetically pleasing interface and the reports help you gain insights on the time you’re actually spending on tasks.

9. FlexJobs

FlexJobs offers a quick way to find legitimate contract work as a freelancer. Instead of hunting around to make sure a job lead is real, FlexJobs handles that legwork for you.

Plus, it’s easy to filter out full-time jobs that would cramp your freelance style.

You’ll have to pay a membership fee to join. It offers no free plan. But that could quickly pay for itself if you land jobs through the platform.

Opportunities on this platform include anything from social media to writing to customer service and more.

Learn more: FlexJobs review

10. Upwork

Upwork is a platform that connects businesses with freelancers. It’s easily one of the top apps for freelancers.

You can sign up to be an available freelancer. Depending on your skill set, you might find yourself in high demand on Upwork.

You can sign up as a freelancer to get paid for everything from accounting to writing to social media. The multitude of clients seeking freelance work on this platform means it’s competitive.

That said, setting up a profile could help you land your next gig or connect with potential clients that allow working from home every day.

11. Canva

Every freelancer that does business online or in-person needs Canva.

This free app can help you create the most beautiful social media posts, business cards, flyers, Website Builder and other marketing material.

Don’t worry; you don’t have to start from scratch. Canva has an incredible library of templates you can customize to make your own. If you want more options, there is a paid version too. It’s $119.99 per year and includes access to all premium templates.

12. Grammarly

Most freelancers have to do some type of writing. Whether you create website content, blog posts, send emails, or any other written content, chances are you don’t have an editor watching over your shoulder.

With Grammarly, you can. I don’t know how I ever survived without this great app. It checks every document, from simple emails to long blog posts, helping me convey my point with proper grammar and flow.

You can use the free version or upgrade and gain access to more grammar checks and even a plagiarism checker, which is so important today with Google’s new algorithms and the crackdown on any plagiarized material, even if it’s not intentional.

13. Buffer

If you deal with social media, you need Buffer. Rather than wasting time posting the same thing on multiple platforms or forgetting to publish your post, Buffer can do it for you.

Buffer schedules, analyzes, and optimizes your posting schedule. Not only that, but you can see how your posts perform and plan content accordingly.

You can schedule posts months in advance and get tips on publishing certain posts to maximize your social media presence.

14. Calendly

If you’re tired of missing appointments or having tons of sticky notes on your desk, you need Calendly. It automatically schedules your meetings based on your availability.

Gone are the days of back-and-forth emails and trying to squeeze meetings in with everyone’s busy schedules.

Calendly simply highlights the times you’re free and sends them to the other people who need an appointment. It sends all parties a reminder and keeps everyone’s life much simpler and more productive.

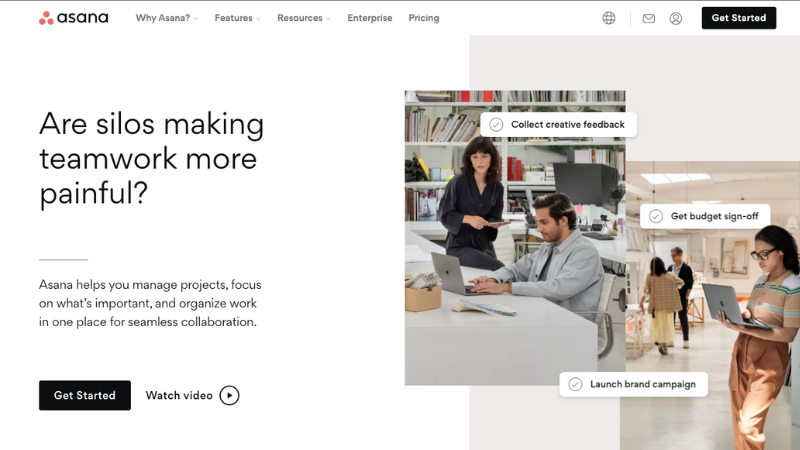

15. Asana

Asana is project management software. If you work with a team, especially remotely, Asana can keep everyone on the same page no matter how many miles are between you.

You can make your workspace as simple or as complicated as you want, setting up projects, subtasks, due dates, and more.

Everyone has the same information at their fingertips, so there’s less need for back-and-forth emails, lost work, or miscommunication.

Summary

Managing your finances and trying to make money when you are an independent contractor can be a tough thing to tackle.

Taking advantage of all the best apps for freelancers can help you avoid headaches, time and money.

What a great list! Finding the right freelance tools can be a bit of challenge. Thank you for sharing.

You’re right. For some it is a challenge to know which tools you should use to freelance. Thanks for your comments!