Cash App Review: Is it a Safe App to Send and Receive Money?

Some products in this article are from our partners. Read our Advertiser Discloser.

Whether you are splitting a check with friends or getting rent money from a roommate, having an electronic way to transfer money like Cash App is extremely helpful

Not only does the app allow you to easily send and receive money, but it also offers other useful financial services.

Our Cash App review will help you determine if the app is right for you.

Overall Rating

Summary

Cash App makes it easy to send and receive money among friends while offering other financial services like banking and investing.

-

Ease of use

5

-

Fees

4.1

-

Investment options

2.6

-

Banking features

3.7

-

Customer satisfaction

4.6

Pros

- Free to send and receive money

- Stock and Bitcoin investing with no commission or fees

- Savings on purchases with Cash App Boost

Cons

- No FDIC insurance

- No fraud protection or ability to cancel payments

- Limited to sending and receiving $1,000 per 30 days

What is Cash App?

Cash App is a digital financial services company created by Square, Inc. Similar to services like Venmo, Cash App is designed as a peer-to-peer money transfer app that allows you to send and receive money.

Headquartered in San Francisco, the platform has grown considerably since its launch. It’s ranked #1 in the Apple App Store in the finance category and has received the Editors’ Choice award.

The service has more than 30 million active users, making it one of the most popular apps of its kind.

Who is Cash App For?

Cash App serves customers in both the United States and the United Kingdom. Thanks to its variety of services, it stands out among its competitors.

Not only does it offer the transfer services you’d expect from this type of company, but it also offers banking, a debit card and investing features.

Since it has so many different features, it is a great option for people who have many needs they want to meet with a single app.

Those who verify their identity with the company will get the most use out of the app, as it allows you to send and receive more money and use the company’s investing services.

However, Cash App isn’t ideal for people who don’t want to send or receive money from peers and only want to use the company’s banking or investing features.

If you fall into that category, you can likely find more suitable banks or investing apps.

Cash App Features

Whether you want to send money back and forth among friends, have your paycheck direct deposited or invest in your favorite companies, Cash App can help.

Here are Cash App’s most useful features.

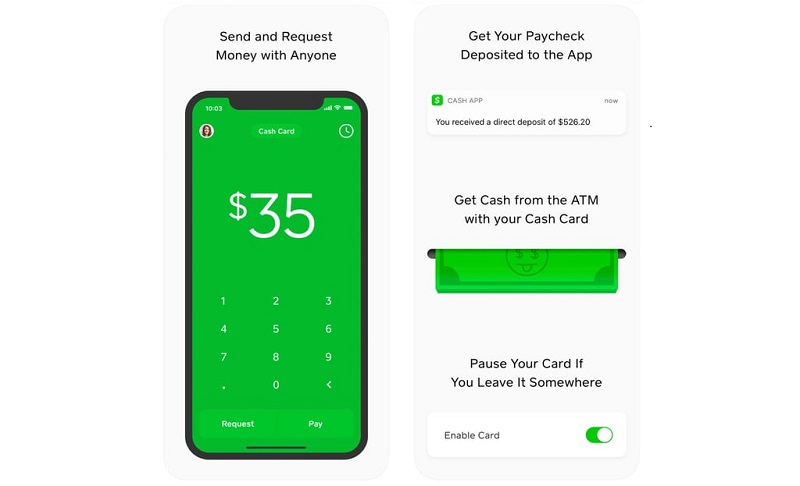

Sending Money

Sending money to another user is easy. To get started, open the app and enter the amount you want to send. Then click the “Pay” button.

Next, you have to enter the information for who you’re sending the money to. You can use their email address, phone number or $Cashtag.

Finally, you can simply type in what the payment is for and complete the transaction.

You can send money from your Cash App balance, a connected bank account or a credit card. If you send money from your bank account, there is no fee but you will pay a 3% fee if you transfer money with a credit card.

Additionally, Cash App only allows you to send up to $1,000 in a 30-day period by default. You can increase your limit by verifying your identity.

Receiving Money

Similar to how you can send money from your Cash App account, you can also receive money.

If someone sends you money using your email address, phone number or $Cashtag, it will automatically go into your balance.

You can then transfer it to a connected bank account or spend it using your Cash Card.

When you receive a payment, it will show up in your activity feed. You can review it by clicking on the Activity tab from your home screen and selecting the payment you want to review.

Keep in mind that you’re restricted on how much you can receive. You can only receive up to $1,000 in a 30-day period without verifying your identity.

Banking

Your Cash App account can serve as a bank account where you can receive direct deposits, spend with a debit card and more.

Like a bank account, a Cash App account has a routing number and account number to identify it and transfer money. It also allows you to receive direct deposits two days earlier than your regular bank.

While the platform has the features of a bank account, it’s not insured by the Federal Deposit Insurance Corporation (FDIC). FDIC insurance protects up to $250,000 per person per account at a normal bank.

Since this protection doesn’t exist for your Cash App balance, you may want to limit the amount you keep in your account.

Cash Card & Boost

When you open an account, you can also get a Cash Card. This is a debit card that can access your Cash App balance.

Just like any other debit card, you can use your Cash Card to make both online and in-person purchases. You can even use your Cash Card to withdraw money from an ATM.

While you won’t automatically receive a Cash Card when you sign up for an account, it’s easy to request one. Visit the Cash Card tab from your home screen and press the button that says “Get Cash Card.”

Once you complete the instructions, you’ll receive your card within 10 business days.

Cash Card also allows you to use Boost, which is a feature that helps you save money on your purchases at coffee shops, restaurants and other merchants.

There are various Boosts for different types of purchases, and you can learn the details of each program in the Boost hub. While you can only have one Boost open at a time, you can swap them out as often as you want.

To start saving with Boost, go to the Cash Card tab on ythe home screen. Then, select the button that says “Save with Boost.” You’ll see the available Boosts, and you can click on each option before choosing one.

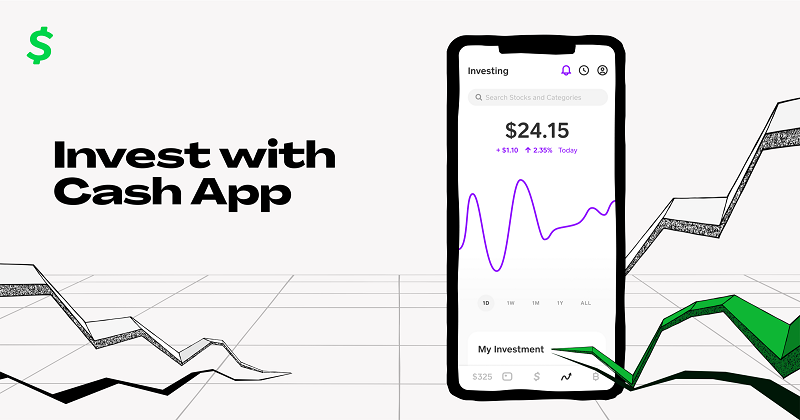

Investing

Cash App allows users to buy and sell stocks using its investing feature. With Cash App Investing, you can start trading for as little as $1.

Opening an investing account requires a bit more information than is needed for a normal account.

You’ll have to verify your identity, including your:

- Full name

- Date of birth

- Social Security number

- Address

- Employer information

Once your Cash App Investing account is set up, you can buy and sell stocks during trading hours.

It’s easy to get started. To buy a stock, simply go into the Investing tab on your home screen, search for the stock you want to purchase and press the “Buy” button.

You can purchase stocks with the funds from your Cash App balance or your linked bank account. The platform doesn’t charge any commission or fees.

Not only does Cash App Investing allow you to buy stocks, but you can also buy and sell Bitcoin using your Cash App balance.

Cash App Investing is a registered broker-dealer with FINRA, and your investments are protected by the Securities Investor Protection Corporation (SIPC).

While SIPC insurance doesn’t necessarily mean you can’t lose money in your account, it does mean that if Cash App Investing shuts down, you’ll get the current value of your investments back.

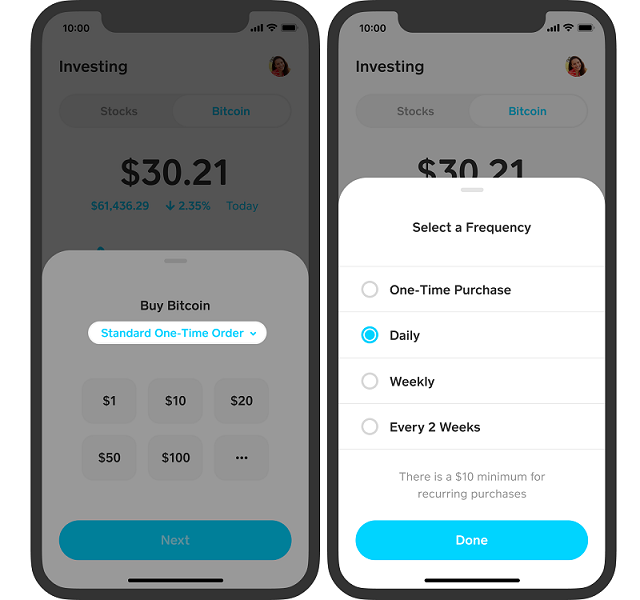

Invest in Crypto

Now you can also invest in Crypto using the Cash App. As of right now you can only invest in Bitcoin (BTC).

Does Cash App Charge Fees?

Cash App charges a 3% transaction fee if you send money using a credit card. Cash App also charges a 0.5% -1.75% fee (with a minimum fee of $0.25) on instant transfers.

The service also charges a $2 ATM fee to withdraw money from an ATM using your Cash Card.

Fortunately, Cash App will reimburse you for fees charged by the ATM operator if you get $300 or more direct deposited into your account each month.

Is Cash App Safe?

One of the most important considerations with any financial service it’s whether it’s safe to use. In the case of Cash App, the answer is yes, but with some caveats.

The company uses cutting-edge encryption and fraud detection technology. Cash App uses the same safety standards as its parent company, Square.

Despite the safety measures, there are also a few potential risks. For example, transactions are instant and can’t be undone. If you unintentionally send money to the wrong person, you’re unlikely to get it back.

Additionally, the service doesn’t offer any sort of fraud protection. If you’re defrauded and lose money, the platform won’t reimburse you.

Finally, the money in your Cash App account isn’t FDIC insured. As a result, if the service goes out of business, there’s no guarantee that you’ll recover your balance.

FAQs

Before signing up for the platform, here are some answers to frequently asked questions that may help you decide if the service is right for you.

Yes, Cash App is legit and safe to use. It has strong security features and is owned by Square, a well-known provider in the financial services industry.

As with any online financial service, it’s safe as long as you take the necessary precautions to protect your money.

Cash App currently allows you to send and receive up to $1,000 within any 30 day period.

It’s also possible to increase your send and receive limit by verifying your identity with your full name, date of birth and the last four digits of your Social Security number.

No, you don’t need a bank account to use Cash App. Cash App offers a Cash Card, which works like a debit card and allows you to make purchases or withdraw money from an ATM.

To send money without a bank account, you can either use a credit card or your existing Cash App balance.

Keep in mind that using Cash App without a bank account means you can’t transfer money out of the account. Also, to send money with a credit card rather than a bank account, you’ll pay a 3% transaction fee.

There are a couple of ways to withdraw money from your Cash App account. First, you can withdraw money by depositing it into your bank account.

Another option is to use your Cash Card at an ATM. Cash App charges a $2 fee for these withdrawals but will reimburse you for ATM fees if you get $300 or more deposited into your Cash App account each month.

Cash App Reviews

Cash App has a 4.7 out of 5 star rating on the Apple App Store and a 4.6 out of 5 star rating on Google Play. Here are a few reviews from app users.

“I love Cash App. I can be anywhere and send my children money instantly. They can go to any atm or use it as a credit card. Amazing.” – Rebecca M.

“It’s a really good app. But I do have to say the instant transfer fees are a bit high. Also You shouldn’t be charged on an instant transfer fee if your money is refunded to you. That just seems like robbery to me.” – Bruce M.

“This is the best app I have ever ever used. So easy, affordable, and quick. Love the coin jingle as my money arrives.” – Anne L.

“Never been a fan of the interface. Could use a remodel. No glitches, the app functions properly in terms of doing what it saids it does. Experience is meh at best.” – Jorge C.

Summary

Cash App is a great service for anyone who wants an easy way to send and receive money while enjoying other perks like banking and investing.

The app has a great variety of services and provides a simple all-in-one solution to some of your financial needs.

Despite its banking features, Cash App isn’t a suitable replacement for your current bank account. The money in your account isn’t FDIC insured and doesn’t have all the features you’d receive from a checking account.