9 Places to Cash a Check (Including Handwritten Checks)

Some products in this article are from our partners. Read our Advertiser Discloser.

Looking for the best places to cash a check? We’ve got you covered.

We don’t live in a cashless society yet. Direct deposit, PayPal and Venmo are becoming more popular by the day, but paper checks are still a thing.

Until that day arrives, you may still receive checks that need to be cashed. You’re probably here because you need to cash a check.

If you start a side hustle this year — local or online — you may have a client who pays you by paper check. Or grandma sent you birthday money.

Whatever the case may be, you need to cash that check.

Where To Cash a Personal Check

Here is a list of the top places to get your check cashed.

1. Your Local Bank or Credit Union

The best place to cash a check, including handwritten checks, is your personal bank or credit union. Free check cashing may be one of your account benefits. By visiting your local branch, you could have instant access to your cash.

That said, depending on your local bank options, you might be better off joining a credit union. Credit unions usually charge fewer fees than banks.

If you don’t need access to a national network of branches, credit unions are a great choice. A credit union might also have a lower minimum balance requirement to avoid monthly checking account fees.

Many credit unions only require a $5 minimum balance to keep your account open.

Pick a local credit union or bank that offers free checking and is convenient to access. If your bank doesn’t cash checks for free, you should look for a new checking account.

Looking for a new bank? Check out these banks that pay decent interest:

2. Visit the Issuing Bank

When you don’t have a bank account, the issuing bank is the best place to start. It can be the cheapest and quickest option, compared to some of the other options on this list.

Some larger banks might also have a higher cashing limit than some other options, too.

The issuing bank’s name is located in the bottom left corner of the check, above the memo line. Go to your local branch of that bank to cash the check.

For instance, If the check is issued by BB&T Bank, you can visit the local BB&T branch. The teller can then check the account balance to make sure there are sufficient funds to cover the check.

As with any of these check cashing locations, you will need to bring your ID to verify your identity.

Each bank has different cashing policies for non-customers. Don’t be surprised if you are charged a non-customer fee, but not all banks and credit unions charge a non-customer fee.

The best way to find out is to call the bank or visit their online website.

If you must pay a fee, banks usually charge one of the following fees:

- $0 for any check balance below $50

- $7-$10 for check balances above $50

- 10% of the check balance

- $7 per check regardless of the balance

Sometimes, non-customer bank fees can be more expensive than some of the other options mentioned here.

A few banks only offer non-customers prepaid debit cards for cashed checks. This practice is relatively uncommon. These prepaid cards can come with monthly maintenance fees and expiration dates. If you receive a prepaid debit card, read the terms and conditions.

Make sure to use the card as soon as possible to ensure your money doesn’t expire.

3. Walmart Check Cashing

Believe it or not, 90% of Americans live within 15 minutes of a Walmart store. It’s very likely you will drive by a Walmart before you pass the issuing bank.

And if you buy your groceries at Walmart, your cashed check can double as your weekly grocery money.

You can expect to pay the following fees for the Walmart Check Cashing services:

- $4 for each check, up to $1,000

- $8 for each check greater than $1,000

The daily cashing limit is $5,000. The limit increases to $7,500 between January and April for Christmas money and tax refund checks. But note that Walmart won’t cash any personal checks over $200.

Walmart cashes your check for cash or a Walmart MoneyCard. They waive the reload fee for the MoneyCard for select payroll companies and government checks.

Walmart cashes all of these kinds of checks:

- Pre-printed checks

- Payroll checks

- Government checks

- Tax checks

- Cashiers’ checks

- Insurance settlement checks

- 401 (k), retirement disbursement checks

- MoneyGram money orders

- Two-party personal checks (limit: $200)

4. Your Local Grocery Store

Grocery stores are hit-and-miss with check cashing services. You need to ask their customer service desk to find out. Some stores might only cash payroll checks, cashiers’ checks and money orders.

These checks are printed and not handwritten with a pen. Sadly, check fraud discourages many stores from cashing handwritten checks.

Very few grocers still cash handwritten personal checks, but there are some that do.

Here are four national grocers that still cash checks:

- Albertson’s

- Kmart

- Kroger

- Publix

- Safeway

The check cashing fees for grocery stores can be free, up to 2% of the balance or $6 per check. Each store has a different cashing policy.

Some grocers waive the check cashing fee if you choose store credit instead of cash. If you buy groceries at that particular supermarket, this is the better option.

5. Gas Station Travel Centers

Most gas stations no longer cash personal checks of any sort. It doesn’t matter if it’s handwritten, from your employer, or a government check.

The risk of check fraud is too much. You will have the most success at travel centers (truck stops) you find driving along the interstate.

A travel center accepts personal vehicles and has dedicated refueling lanes for semi-trucks.

Two full-service travel center brands to try are:

Only a select few of their locations cash checks so you will just have to try your luck or call the closest location to you ahead of time.

It’s possible to get free checking cashing when you buy fuel within two hours of cashing your check.

6. Transact by 7-Eleven

One of the few gas station chains that cashes checks is 7-Eleven. You must download the Transact by 7-Eleven app. This app lets you cash a check by taking a picture of the check with your phone.

Most checks clear within 48 hours and the balance is deposited onto your reloadable 7-Eleven prepaid card.

You can then use the card anywhere that Debit MasterCard is accepted, which is most online and retail stores.

7. Endorse Your Check to a Friend

You can also endorse your check to a friend who can cash it for free. After all, what are friends for?

Endorsed checks are sometimes called “third-party checks.”

Endorsing a check to a friend to cash is simple. On the back of the check, follow these steps:

- On the top line, write “Pay to the order of Friend’s Name”

- You sign the check underneath this endorsement

Every bank has different policies for cashing endorsed checks. To fight check fraud, you might have to accompany your friend to the bank branch to verify your identity too.

Some banks require you to complete a form. This form states your friend has permission to cash your check. Check online or call the bank before your friend goes alone to cash the check.

Certain banks including Ally Bank, Discover Bank and Regions do not accept third-party checks.

8. Cash Your Check Using an App

You can also cash your personal check online. Two apps that don’t require you to be a bank customer to cash a check are PayPal and Ingo Money.

Ingo Money

This might be the best online app for cashing personal checks. You can use Ingo Money to cash most kinds of checks, including hand-written personal checks. Once you download the app, you endorse the check and use the app to take a picture of its front and back. Then you decide where you’d like the money to go.

You might prefer Ingo Money because of the multiple redemption options:

- Prepaid debit card

- PayPal account

- Amazon gift card

- Online bill pay for retail credit cards

- Cash pickup at participating MoneyGram locations

With the first three options, the check balance will be deposited in a matter of minutes. When you want to use your check amount to pay a retail credit card, the bill payment posts the next business day. You can also split the balance between multiple redemption options.

Ingo lets you cash checks as small as $5 or as much as $5,000.

This flexibility does cost a small fee. Handwritten personal checks that are under $100 cost $5 to cash. Balances greater than $100 cost 5% of the balance.

Pre-printed payroll and government checks cost $5 to cash for balances under $250. You will pay 2% of the balance when the balance is greater than $250.

For both check types, you can avoid the cashing fees by waiting 10 days to receive the balance. But, in that case, you can only deposit the balance into one account.

You can use Ingo Money to deposit your check into a Chime account. Chime is a financial technology company that offers free ATM access. You may also receive your direct deposit funds up to two days earlier than if you’d used a traditional bank.

PayPal

PayPal is one of the largest payment processors in the world, and it also offers a way to cash a check. It’s partnered with First Century Bank and Ingo Money to provide this service.

As with Ingo Money, you’ll need to first endorse the check, then use the app to take a picture of the front and back. Once your check is approved, you’ll be prompted to write “VOID” across the front of the check.

You can then choose to pay a fee and have your money made available within minutes. The standard fee is 1% for payroll and government checks with a pre-printed signature and 5% for all other accepted checks, with a $5 minimum fee per check.

Or, you can choose to wait 10 days to receive the funds, in which case the transaction is free.

Checks must be a minimum of $5 and a maximum of $5,000. You can cash multiple checks up to $5,000 per day and $15,000 per month.

Once your balance is unlocked, there are multiple ways to access your PayPal funds. You can transfer it to another bank account in one day for free. Another option is transferring the balance to an eligible debit card or prepaid card in minutes.

Debit card transfers currently cost 1% of the transfer amount (up to $10).

Or, you can transfer it to a PayPal Debit Card, which you can then use at any ATM to get cash.

NetSpend

NetSpend offers online check cashing too. You can also find a local NetSpend partner to cash checks too. The check balance loads to a prepaid debit card.

Standard processing is free. But for expedited processing, you pay 2% ($5 minimum) for a preprinted government and payroll checks.

Handwritten checks have an expedited processing fees of 5% of the check balance with a $5 minimum fee.

It’s also possible to get $10 overdraft protection with their Premier Card Account feature.

Green Dot

Green Dot is another prepaid debit card option with in-app mobile check cashing. You can also cash checks at Walmart to reload your prepaid Green Dot debit card. It’s free to deposit checks with the mobile app if you can wait 10 days to access your funds.

Otherwise, you can access your funds in minutes by paying a 1% fee for government and payroll deposits. Handwritten checks have a 4% fee.

Green Dot has the following mobile check cashing limits:

- The minimum check balance must be $5

- Single check balance can’t exceed $2,500

- Can cash up to $5,000 in a single day

- Can only cash up to $10,000 every 30 days

If you need to write somebody a check, Green Dot will send you a book of paper checks. You don’t have to open a checking account as the balance comes off your debit card.

9. Check Cashing Stores

This suggestion should always be your option of last resort because of the high fees.

Most locations charge a percentage of the balance instead of a flat fee. For smaller check balances, this can be cheaper than other stores that charge a flat fee. But, fees for large balances are often lower at most other places, even if they charge a percentage of the check balance.

These check-cashing stores are easy to find in your local town. They will cash every type of personal check, including handwritten checks from family and friends. Sadly, this convenience comes at a high price. These stores charge the highest check cashing fees.

When you put the balance on their reloadable debit card, you must also pay a monthly maintenance fee. Expect to pay a reload fee each time, too. If possible, cash your checks at Walmart if you want a reloadable debit card.

FAQs About Cashing Checks

Before cashing a check, verify the check amount is written to you, has the correct dollar amount, is dated and has the signature of the person paying you.

If the check information is correct, you will need to sign your name on the back of the check. The check cashing service may also have you write additional text. You should wait and sign your check once you are ready to cash it.

It’s possible to cash a check for free at some local banks and stores. Digital money apps might also cash checks fee-free if you can wait up to 10 days to receive your funds.

To receive your funds within minutes using a check cashing app, your fee can be between 1% and 5% of the check balance. Each app may have a maximum fee limit such as $10.

The process for cashing a check can be simple. First, decide if you want to cash your check at a local store or use a phone app.

If cashing your check at a store, bring an official ID to verify your identity. Your ID name must match your name on the check. Next, sign the back of the check on the “Endorse Here” line.

For check cashing apps, you can sign the back of the check and follow the app instructions to take pictures of your check. Then, you can decide if you want free standard processing to receive your funds within 10 business days or pay an extra fee for expedited processing to access your cash in a few minutes.

Yes, you will need to bring an official government ID card to cash a check in person. This ID can be a driver’s license, military ID or a passport.

Check cashing apps will likely require you to verify your identity when creating your account and before cashing your first check. After that, you should be able to cash checks without presenting your ID first.

Local stores let you cash checks instantly. Apps like Ingo Money, PayPal and GreenDot offer instant check cashing too but your fee can be between 1% and 5% of the check amount.

Only bank customers can cash checks at ATM machines. Even then, the ATM must have that capability. These machines are usually located at the physical bank branches. Other bank ATMs accept remote deposits but have a three-day holding period.

Most banks now offer mobile check deposits. This feature is free and quicker than mailing your check to the bank or finding a local bank. If you’re making a mobile deposit, make sure you check the “Mobile Deposit” box on the back of the check. Most paper checks now include this box as an extra security measure. You should also write “VOID” across the check once you’re sure that your deposit has cleared.

What to Look For When Cashing a Check

Cashing a check is easier than writing a check. In most cases, you only have to sign the back to receive payment.

But, you should still verify several areas on the check front before you head to the bank. If any of the information below is incorrect, the teller won’t cash your check.

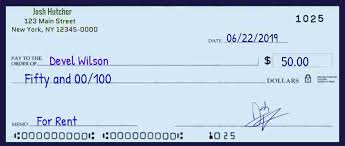

Pay to the Order Of

Make sure the check is written in the name that matches your legal ID. Only the person whose name is on the check can cash it. If you want your spouse to cash your check, you need to open a joint bank account.

The teller won’t necessarily reject your check if it doesn’t have your full legal name. For example, if the check says John Doe but your driver’s license says Jonathan, it’s acceptable.

Matching Dollar Amounts

Each check has two fields for the dollar amount. In one field, the issuer writes the check amount in numbers. This field is to the right of your name. On a $50 check, this box should read, $50.00.

The second check amount field is underneath the “Pay to the order of” field where your name goes. On a $50 check, this field reads Fifty and 00/100 Dollars.

The Check Issuer Signs the Check

Whoever writes the check must sign the check in the bottom right corner. Their signature verifies the check is active and legit.

Correct Date

Some places might only cash a check if it’s been issued within the last 180 days. Some checks even state to void the check if you don’t cash it within 180 days. If a check is issued on January 1, you have 180 days from that day to cash it. For this example, you have until June 30 to cash your check.

Incorrect dates are most common in the new year for handwritten checks. Some businesses might “future date” the check and give it to you early. If payday is on the 15th but you get the check on the 12th, you must wait three days before cashing.

Things to Remember When Cashing a Personal Check

There are a few things to remember the next time you cash a check:

- You always need to bring a photo ID

- Some locations won’t cash handwritten checks

- Certain stores and banks charge more to cash a check than others

- Most places have a daily redemption limit

For the most part, cashing a check in-person is extremely easy.

This is true when you have a pre-printed check from one of these issuers:

- Employers

- Government Agencies

- Your tax refund

All you need to do is sign your check and show a photo ID card. You instantly receive the balance minus any cashing fees.

Related: 15 Places to Get Cash for Coins

Summary

When you need money now, cashing a check is an easy option. There’s no shortage of options to cash a paper check locally. But, you will have to pay more at some places to cash your check.

Going to the issuing bank can be the cheapest option, but other places cash checks for free too.

Can I direct deposit my starter check from Well’s Fargo into a Bank of America ATM and get cash out right away

I’m trying to cash a personal handwritten check written for $100 from another state to me but I was wondering if a check cashing place is the easiest way to go

Since I am not a member there, the issuing bank’s check cashing fees are extremely high so I cashed the check at Walmart for a reasonable fee. I am getting out of banking and into cash and already I can see how the system is rigged to punish me for leaving it. I do have a prepaid card but it will only accept direct deposits from the government. I can still use it to pay bills on line and pull out cash when needed for no fees. Looks like the system has most of us by the throat now. Ha, ha, the “cashless society” is quickly becoming a stinking fact.

Very informative, thx. Wondering why Bank Of America & it’s check card (visa/chip/debit) wasn’t mentioned, and if you know anything about ZELLE? Oh & yes, I am aware some ppl hate BOA & besides the Merrill Lynch problem (I don’t use) I have absolutely no idea why…If you use another ATM they definitely penalize you w/1-2 other charges but this can easily be avoided by not using other atms, esp as there seems to be at least one BOA in every town.

A lot of this is about convenience & I’m surprised to hear most don’t live near their bank etc…I’ve had Bank Of America for about 20 yrs & I usually live w/in a couple miles of the bank or at least a BOA atm. As we know, they’re everywhere. Now basically the only time I go is to get cash, usually drive through. I don’t have a monthly fee bc I get direct deposit every month.

For the last couple yrs I’ve been using the mobile app to deposit checks & it gives me access to 1/2 the total that day, but if paying for something online, you then use the check card as credit & usually have access to the full amount. As far as cash obviously you’d have to go to their ATM & the same applies. I love it bc it’s so quick, convenient & happens in real time. Pretty sure the $ comes out of the other person/institutions account in less than 2 days. It doesn’t cost anything to get the BOA visa check card, or didn’t for me, but believe there’s a small fee if you don’t get direct deposit. Keep the change is a cool feature & the app can notify u of every charge, if it was a check that was just cashed or card was used online, & does so in real time, especially when you choose debit. Love the security features & also overdraft protection as well as all the offers to places we all go & w/services many of us use daily like 10% off, occasionally $50 back if you spend $250 etc w/Uber, Amazon, Starbucks, air bnb, Del Friscos, Chili’s, petsmart. xfinity, att etc

I look every week & click on the offer & if it’s on my card, ready to be used.

There’s also Zelle which is now part of the BOA app…I’ve never used it but ppl w/out a BOA account can download zelle to send or receive money from a BOA customer & obv anyone using zelle. Pretty sure it now works w/most institutions? Another thing that’s great is the ATM’s are open 24/7 & some are now offering a choice of denomination instead of just $20’s. ????

Very useful information on this post.

And judging by his picture, this Josh guy looks like a very happy and honest person.

Walmart will not cash a check if it doesn’t meet their 3rd party approval company Certegy approval requirements. Was declined trying to cash a personal check of 100.00 because of basically my credit score.

I have a personal out of state check made out to me. I don’t have a checking account, where can I cash it?

Check out some of the suggestion in the article for where you could cash it! Best of luck!

Check what bank they have and go to them

Where can I cash my personal check it’s handwritten for over 1,000$ besides a bank. Need cash now.

Check out some of the ideas and links in this article to help you get that check cashed!

Would anyone happen to know if I could load money from PayPal or a check on to a prepared digital debit card? I am in a tough spot today and I need to access my money asap without having to take the bus all over town looking for Walmart or a bank or whatever. If anyone can help me, that would be great. I’m hoping to just take my money from PayPal and put it on a prepaid debit card that I don’t have wait to get in the mail. I would love to know if there are any digital prepared cards so I can access my money right away. Thanks.

If you have a PayPal debit card you can do it. The best source to find out the answer to your question is probably to check with PayPal or ask your bank, since you mentioned you have checks.

You can go to a Walmart and withdraw from the PayPal app using a QR code the app generates.

So, a hand written business check, isn’t redeemable by Walmart, Safeway, or Fred Meyer. I’m pretty sure the federal fraud laws just got tighter for everyone. Thank stores for making me need a point.

I need to cash a 2 party check.

If you read the post, you can do it at #3. Good luck. 🙂

Chase bank no longer will give money out in Romeo Mi

I am a stay at home mom trying to make some money.

There are posts on our site about how to make money from home. There are lots of other ways you can make money. I wish you luck. 🙂

Whatever is free is the best way to cash a check for me. I also enjoy using mobile check deposit on my credit union’s mobile app.

Free is always good! 🙂

It’s hard to beat free!

Thanks for the shortlist. Now I can save some time and go cash my check at the grocery store rather than lining up at the bank. Thanks!

That’s true – especially if your bank is on the opposite side of town from your current location!