DiversyFund Review: Invest In Real Estate

Some products in this article are from our partners. Read our Advertiser Discloser.

Investing is an essential part of building wealth, but everyday investors often feel restricted in their investment options.

Real estate used to be one of the more exclusive investment vehicles. DiversyFund is a company that aims to make it easier for everyday people to invest in real estate offerings that were previously only available to wealthier investors.

Overall Rating

Summary

DiversyFund is a low-cost way to diversify your portfolio by adding real estate holdings for as little as $500 to start. However, the lack of liquidity means you need to be willing to commit for the long-term.

-

Limited investments

4

-

Ease of use

4.5

-

Start up fees

4

Pros

- Ease to use

- No fees

- Open to anyone

Cons

- Limited investment products

- No quarterly distributions

What is DiversyFund?

DiversfyFund is a crowdfunded real estate company that focuses on residential real estate. In particular, it focuses on multi-family homes, apartments and student housing.

How Does DiversyFund Work?

DiversyFund offers investors access to a privately-traded Real Estate Investment Trust (REIT), which it calls its Growth REIT.

REITs are companies that own and operate real estate that generates an income. This can include housing, commercial real estate, hotels, data centers or even land used for farming or timber.

REITs work much like mutual funds. Multiple investors can purchase shares in a REIT, and the REIT uses investor funds to buy and maintain its real estate holdings.

The investors receive dividends based on the REIT’s income and can sell their shares on the open market.

Because DiversyFund is a private REIT, investors cannot buy and sell shares on the open market. Instead, you have to purchase shares directly from DiversyFund.

Minimum Investment Period

You cannot sell shares until DiversyFund closes the fund and begins selling off its assets. The company aims to let investors withdraw their capital, plus earnings after five years.

This restriction means that you give up flexibility. However, it lets DiversyFund’s managers stay patient and look for opportunities to purchase properties at a low cost and to sell them for a significant profit.

The company hopes that this lets it offer higher returns than a traditional REIT.

How Does DiversyFund Choose Properties?

DiversyFund focuses on multi-family housing, such as apartment buildings or student housing. It avoids single-family homes and other real estate projects.

The company’s analysis shows that multi-family housing performs well, even when other real estate assets lose value or produce lower cash flows. It also aims to build lucrative connections and expertise by focusing on a single class of real estate.

DiversyFund has an extensive checklist that it uses to vet properties, working with experts and proprietary data technology to find undervalued properties in areas ripe for growth.

It looks explicitly for properties that currently produce cash flow and where it can add value.

The company adds value by streamlining the management of the property or improving it, such as by adding amenities.

This practice lets the fund earn cash flow from current renters while increasing the value of the property and growing the cash flow over time.

Unfortunately, you cannot invest in individual properties like some platforms offer.

Who Can Use DiversyFund?

Private investments like DiversyFund are usually for accredited investors. To qualify as an accredited investor, a single person must earn $200,000 per year or have a net worth exceeding $1 million.

Couples must have an annual income of $300,000 or a net worth exceeding $1 million.

However, DiversyFund is open to any investor in the United States because it has Regulation A approval from the Securities Exchange Commission.

This means the company undergoes regular vetting by regulators and must abide by reporting standards similar to those that public businesses follow.

For DiversyFund’s Growth REIT, the minimum investment amount is $500. This amount allows for beginner investors to invest in real estate.

If you have more than $500, you can invest more, with the average investor putting $2,500 into the fund. You can also make additional investments whenever you’d like.

Who is DiversyFund best for?

Whether it’s a good idea to invest in real estate through DiversyFund depends on many factors. You need to consider your risk tolerance, investing goals, timeline and how much money you can commit to the investment.

One perk of working with DiversyFund is that the investment is very passive.

Once you put your money into the fund, DiversyFund handles the rest, selecting properties, purchasing them, managing and improving them and finally selling them for (hopefully) a profit.

If you like the idea of hands-off investing, that’s a point in favor of investing through DiversyFund. However, if you prefer hand-on investing, you may want to look elsewhere.

Another benefit is that the company offers regular investors access to an asset class that many don’t have in their portfolio. Many investors hold a combination of stocks and bonds.

Adding real estate as a third class can increase diversification in your portfolio, which can reduce volatility and might increase your returns.

On the other hand, DiversyFund only invests in one type of asset: real estate. Further than that, it only invests in one class of real estate: multi-family housing. The fund holds multiple properties that offer some amount of diversification.

However, if some event causes multi-family housing as an asset class to lose value, your investment is at risk. That means that you probably won’t want to put all of your investable money into DiversyFund.

Instead, you could put just a portion of your assets in the fund.

Even the cash flow that the fund earns by collecting rents gets reinvested into the properties. Instead, you’ll get a chance to withdraw your money when DiversyFund liquidates its REIT.

When that happens, you’ll have the option to reinvest or to take your money out of DiversyFund.

Finally, many investors already have exposure to real estate, even if they aren’t aware of it. If you own your own home (or have a mortgage), you already have exposure to real estate, even if it isn’t in your investment portfolio.

How Much Are Diversyfunds Fees?

Here is a breakdown of the DiversyFund Growth Reit II investment fees:

- Minimum investment: $500

- Annual asset management fee: 2%

- Additional fees: Varies

There are also several miscellaneous fees that can be witheld from your investment to cover other fund expenses. These include acquisition fees and finance fees that occur when adding properties to the portfolio.

It’s also important to remember that a “hidden cost” is the multi-year investment period. You must invest for at least five years and cannot withdraw your funds early.

Pros and Cons

There are both pros and cons to investing with DiversyFund.

Open to anyone

Anyone can invest in DiversyFund’s private REIT. You don’t have to be a qualified investor, meeting restrictive net worth and income requirements. As long as you have $500 to meet the minimum investment, you can invest.

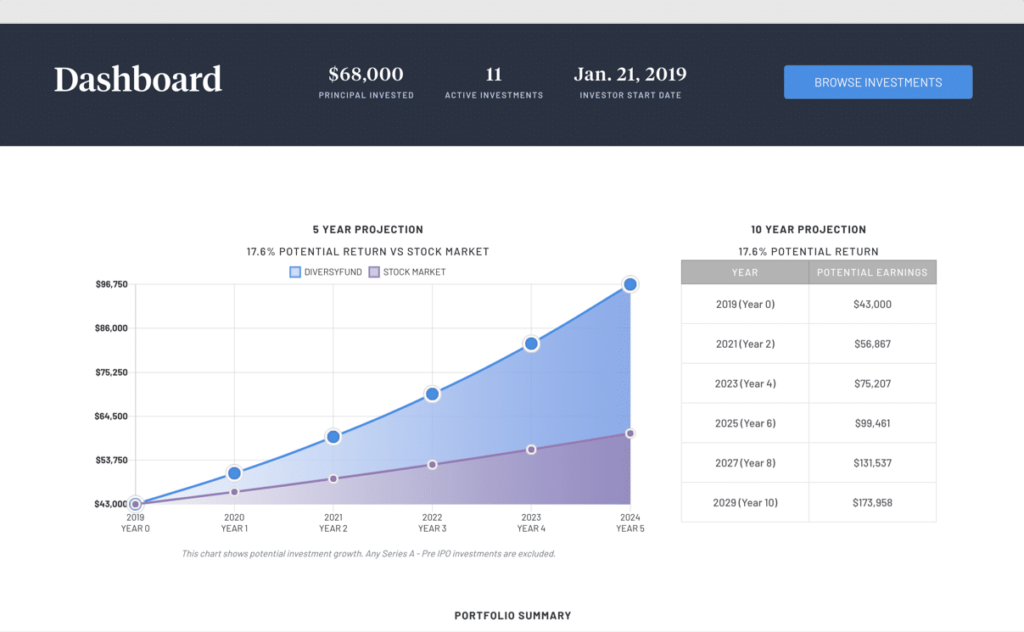

Potential for strong returns

While no investment is a sure thing, DiversyFund has a solid track record so far, producing annualized returns of 18% in 2017 and 17.3% in 2018.

Several Investment Fees

Traditional REITs charge management fees and expense ratios, and many brokerage companies add fees when you want to buy and sell shares. DiversyFund’s unique, vertically integrated structure lets can minimize the fees that investors pay.

Long-term commitment

A major drawback of DiversyFund is that you have to commit your money to the investment. You can’t make a withdrawal from the fund until DiversyFund liquidates it.

The firm says that its goal is to return money to investors five years after the fund closes, but there’s no set date where you’re certain to receive your investment and returns.

Only moderate diversification

When you invest in DiversyFund’s REIT, you’re investing in a portfolio of different properties. That offers diversification in the sense that one poorly-performing property won’t completely tank your investment.

However, the fund only focuses on a single class of real estate: multi-family homes. If that class of real estate performs poorly while others, like commercial real estate or single-family homes, do well, you’ll miss out on potential gains.

Customer Reviews

| Website | Rating | Number of Reviews |

| Trustpilot | 3.4 out of 5 | 522 |

| BBB | 3.54 out of 5 | 37 |

| Google Play Store | 3.5 out of 5 | 118 |

| Apple App Store | 3.4 out of 5 | 78 |

Here are several tidbits from DiversyFund investors:

“DiversyFund is great so far. I’ve been invested for almost 2 years now. The monthly dividend is slowly building but like what DiversyFund says, it’s a small part of you’r overall Investment. When they liquidate the properties… that’s when you’ll receive the big bucks.” — Thomas

“It would be nice if DiversyFund could show the appreciation the same way fundrise does. Right now all I see is the dividends I get each month. I guess I’ll have to wait the full 5 years to see that.” — Catherine S.

“That will not release your funds upon request. They are held until the property is sold.” — Larry L.

Note: Several customers reviews from early 2021 claim the platform is no longer issuing monthly dividends. This can be an issue of future focus and you may consider investing with a different platform.

Alternatives to DiversyFund

DiversyFund isn’t the only way for everyday investors to hold real estate in their portfolio.

Traditional REITs

REITs are companies that hold or finance real estate, whether it be commercial, residential or any other class of real estate.

Like other publicly traded companies, you can purchase shares in REITs on the open market and sell them whenever you wish.

The law requires that REITs pay 90% of their taxable income to investors, making them a great source of income for people who want an investment that produces cash flow.

Like any investment, you need to do your due diligence and research any REIT you want to invest in to learn about its investment strategy, strengths and weaknesses.

Some mutual funds and ETFs invest in a broad portfolio of REITs, letting you get easy diversification.

Fundrise

Fundrise is another company like DiversyFund that gives non-accredited investors access to private real estate investments. Its minimum investment is just $10.

The company offers three portfolios for investors to choose from providing supplemental income, long-term growth or a balance between the two.

With Fundrise, your initial investment is locked in the fund for a minimum of five years. Five years after you make your investment, you can begin making withdrawals, making it more flexible than DiversyFund.

You can make early withdrawals at a fee of up to 4%, and the company can suspend withdrawal during times of economic upheavals, such as during a pandemic.

The company charges a 1% management fee annually.

CrowdStreet

CrowdSteet gives you the flexibility to invest in funds that hold multiple properties or choose to invest in individual properties. While anyone can invest in one of the company’s funds, only accredited investors can invest in individual properties.

Like DiversyFund, CrowdStreet locks your money into your investment for years at a time, making it a poor choice for investors who need flexibility. The company also charges management fees ranging from .5% to 2.5%, which can eat into your returns.

Many investment opportunities have a minimum investment of tens or hundreds of thousands of dollars. So CrowdStreet can be a good choice for people with a lot of capital and the time to do due diligence on their investments.

RealtyMogul

RealtyMogul also offers the flexibility to invest in REITs or individual properties. But you must be an accredited investor to invest in individual properties.

The company has two REITs, each with a $5,000 minimum investment. You can make some withdrawals from your account one year after you make your initial investment.

However, you’ll pay a fee of 1% or 2% if you withdraw less than three years after your investment. You’re also limited to selling 25% of your investment each quarter.

Like DiversyFund, the goal of RealtyMogul is to liquidate its REITs in the future, returning all of your investment and returns to you and offering the chance to reinvest into a new fund.

FAQ

Here are some common questions about DiversyFund.

Investors can receive monthly dividends if the REIT earns a profit. However, the dividends reinvest and you cannot withdraw them until the fund liquidates.

It’s possible to lose money if the Growth REIT fails or sells properties for a loss. The platform had a positive performance in 2017 and 2018 but hasn’t released data for later years.

Like any investment, you should only invest what you’re willing to lose and don’t need access to for at least five years.

You can call DiversyFund and there is also an email and live chat option. An online FAQ database can also help answer several questions about opening an account or investing.

Summary

DiversyFund is an inexpensive way for everyday investors to invest in multi-family real estate. This opportunity can provide a unique chance to diversify your portfolio, and the company has historically offered strong returns.

However, the drawbacks are significant. Your investment is very illiquid, so you have to be able to commit the money you invest for the long term.

The funds also only invest in one class of real estate. This limitation offers less diversification than you could get from purchasing a mutual fund that tracks a diverse set of REITs.