Fundrise Review: Invest in Real Estate With $10

Some products in this article are from our partners. Read our Advertiser Discloser.

Many people turn to real estate investing to grow their wealth. When done well, this type of investing may produce attractive returns.

It also holds the possibility of being a regular income source over the long run.

There are several options for investing in real estate. You might purchase residential or commercial properties for investment purposes.

The goal is to rent the property and live off of the supplemental income.

The work involved and the money needed to get involved in traditional real estate investing can be overwhelming for many people.

Note: We will get a commission if you sign up through link for Fundrise. However, we only promote brands we believe are a good fit for our readers. All opinions are our own.

Overall Rating

Summary

Fundrise is an online investment platform where you can invest in real estate. This is open to everybody, not just accredited investors.

-

Ease of Use

4

-

Fees

4.5

-

Minimum to Invest

4.5

-

Customer Service

5

Pros

- Low minimum investment

- Low minimal fees

Cons

- Risk for loss in any investment

- Limited liquidity capabilities

What is Fundrise?

Fundrise is an online investment platform where you can invest in real estate.

As a company, Fundrise has been helping people invest in real estate ventures for around 10 years.

Fundrise’s management team worked for nearly a year with the Securities and Exchange Commission.

Their efforts to become an approved investment company paid off. Fundrise launched its first online public offering in 2012 and gained 175 investors.

Today, this real estate investment platform has over 300,000 members and has invested in over $7 billion worth of real estate investments.

How Does Fundrise Work?

It used to be that investing in private real estate assets was limited to those with hundreds of thousands of extra dollars lying around.

If you didn’t have big bucks, you weren’t allowed to play the game.

Fundrise has helped to change that by allowing investors of nearly all bank account sizes to participate in bigger real estate deals.

Overview of the Fundrise features:

- The minimum investment with Fundrise is just $10

- Non-accredited investors without a high net worth can invest

- 0.85% annual asset management fee

How to Start Investing with Fundrise

Here’s the process for getting started with investing in real estate through Fundrise.

As a new investor, you would open up an account with Fundrise by visiting the company’s website. It’s free to open an account with the company.

From there you would share your bank account information. Don’t worry: security is a top priority for Fundrise. The site boasts a 128-bit SSL encryption security system.

Making your minimum $10 deposit to your Fundrise account deems you to be eligible to begin investing.

Fundrise has several plan options to choose from. Portfolios within your plan are based primarily on your stated goals.

Investment Choices

After you open your account, you will choose from one of the five investment plans this real estate investment platform offers.

- Starter ($10 initial investment)

- Basic ($1,000 initial investment)

- Core ($5,000 initial investment)

- Advanced ($10,000 initial investment)

- Premium ($100,000 initial investment)

Each plan invests in portfolios that hold a combination of Fundrise’s eREITs. An eREIT is Fundrise’s version of a REIT. The Starter portfolio is the most accessible option.

What is a REIT?

A REIT is a security that invests in real estate through property or mortgages and often trades on major exchanges like a stock.

Fundrise offers a similar type of product, which they call an eREIT (Electronic Real Estate Investment Trust).

The company defines the product as “a professionally managed, diversified portfolio of commercial real estate assets such as apartments, hotels, shopping centers and office buildings.”

The Fundrise eREITS are non-traded, which means stock market ups and downs can have less of an impact on the performance of Fundrise investment offerings.

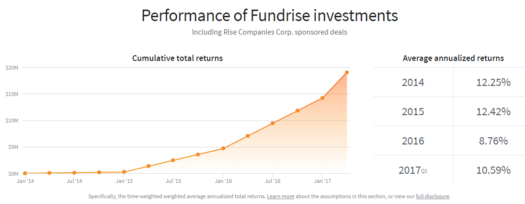

Speaking of performance, here’s a chart directly from the site that can give you an idea of their eREIT returns.

Fundrise investments implement a variety of four strategies for each account type offered.

As stated earlier, the strategy combination is based on the type of account you open and on your goals and is meant to help balance risk and reward accordingly.

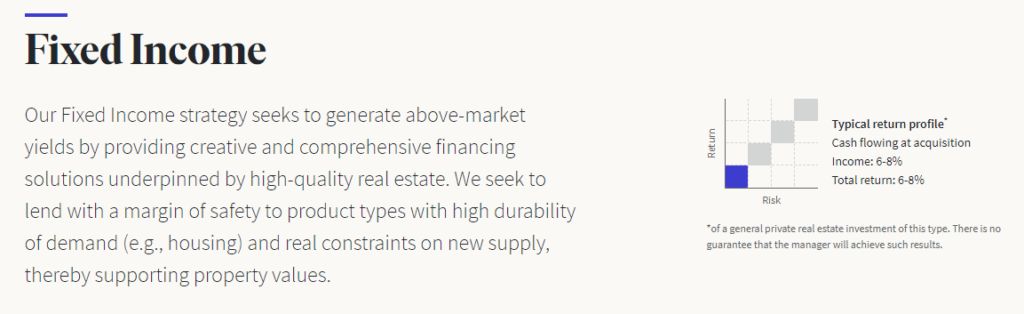

The Fixed Income Strategy

The goal of the fixed income strategy is to produce above-market yields while lending with a healthy safety margin in durable real estate products.

In this portfolio, you’ll primarily find housing and mixed use developments.

This portfolio is a relatively low to moderate risk portfolio that projects returns of 6% to 8% annually and income of 6% to 8% annually.

This portfolio purchases properties that are cash-flowing at acquisition. This investment strategy is meant for investors looking for a monthly income return.

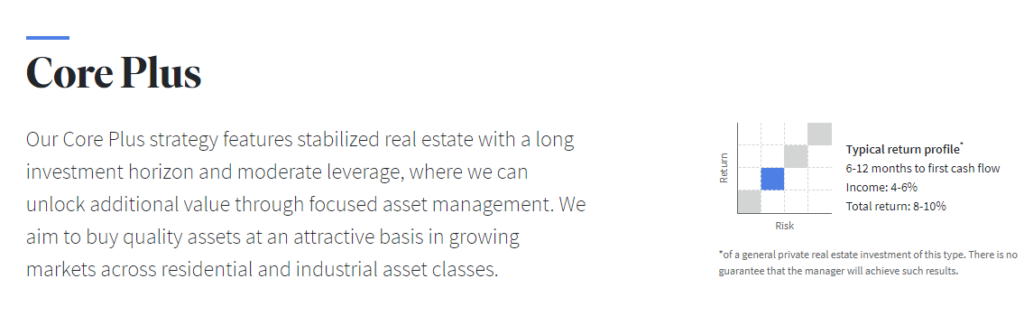

The Core Plus Strategy

Fundrise’s Core Plus Strategy focuses on stabilized properties with a long investment term.

In other words, this portfolio tends to hold funds that are a bit riskier than the Fixed Income Strategy, but that also means more possibility for growth.

This fund expects to produce a moderate current income yield.

You can expect annual returns of 6% to 8% and income of 4% to 6% annually. This portfolio’s investments can be expected to cash flow 6 to 12 months from acquisition.

You wouldn’t choose this strategy if you were looking for immediate and regular income returns.

Instead, this strategy could help you if you are looking for income returns in the near future.

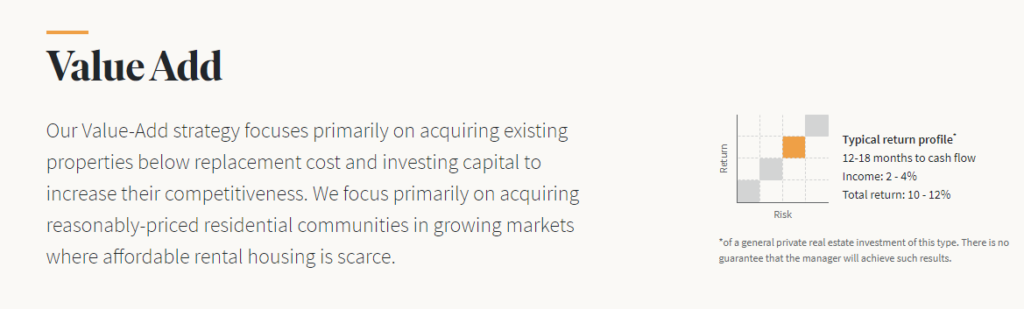

The Value Add Strategy

The company’s Value Add Strategy works to buy properties that are priced below replacement cost.

The goal then is to add capital to increase the property’s overall value. Fundrise works to maximize returns by focusing on purchases in affordable communities.

They look to buy in growing markets where housing is difficult to find.

Properties in this portfolio will generally not cash flow until 12-18 months after purchase.

Once they do start earning income, you can expect a 10% to 12% annual return and a 2% to 4% annual income.

Apartment communities, office buildings and mixed-use communities make up the primary holdings in this portfolio.

If you’re okay with higher risk and the potential of a higher return, along with income-producing assets that cash flow in a year or more, this could be the portfolio for you.

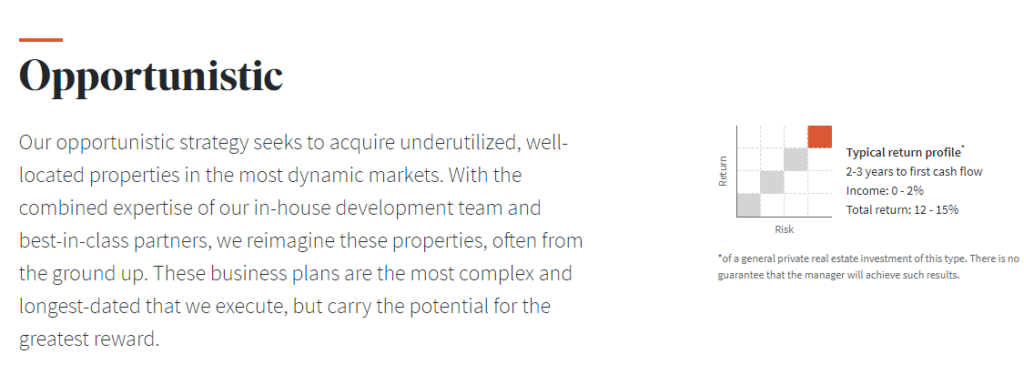

The Opportunistic Strategy

The fourth strategy Fundrise offers is called the Opportunistic Strategy. As you can guess from its name, this is the riskiest of strategies that Fundrise offers.

Properties in this portfolio are underutilized and in attractive markets with a large potential for growth.

You can expect to see returns of 10% to 12% in this portfolio. Income will range from 0% to 2% as returns are reinvested to promote maximum growth.

You’ll start earning supplemental income from this strategy at about the 2-3 year mark. This portfolio is for the investor who is interested in the highest potential returns.

Just keep in mind that a great risk of initial loss of investment is involved with this portfolio. It’s slightly less of a balanced investing strategy.

If you have a low-risk tolerance level, this is probably not the portfolio you want to have the majority of your money invested in.

That being said, it could be fun to put a minority of your investment capital into this fund and see what happens, especially if you’re age 50 or younger.

Broad Range Investment Choices

Fundrise invests in commercial real estate deals all over the United States, which can possibly lower the risk of default or losses.

Here’s why. Let’s say the commercial real estate market collapses in Atlanta. Fundrise will investors still have a stake in properties in Dallas or other major metropolitan areas in the United States.

Since the eREITs are made up of a variety of properties nationwide, one area’s market collapse won’t necessarily affect another area.

The broad diversification of Fundrise’s portfolio properties means investors have a lower potential risk for loss.

With their “eggs” divided up into many properties within each fund’s basket, the risk of loss is potentially reduced.

One of the reasons for the rising popularity of investing in Fundrise is that it takes away much of the work required to invest in real estate.

It also eliminates many of the other possible problems associated with being a traditional real estate investor.

When you invest in traditional real estate via rental properties or fix and flips, you’re in for some serious potential issues.

How Fundrise Simplifies Real Estate Investing

Investing via the traditional routes definitely has its benefits. Buying and renting homes and apartment buildings can produce a steady monthly income stream.

If you’re looking to increase cash flow or replace traditional job income as you head toward financial independence, an online investing platform can be more attractive than traditional investing opportunities.

The supplemental income you can get from real estate assets obtained via online investing platforms can be easier to get than through traditional real estate investment opportunities.

Doing the fix-and-flip thing can produce large amounts of cash in a relatively short period of time. Profits can increase if you are handy with home repair and improvement tasks and can do most or all of the work yourself.

However, as with any type of investing, there are some downsides to the traditional types of real estate projects.

Owning Rental Properties

With owning rental properties, you’re on the hook for finding and managing tenants. You’re also responsible for taking care of any home repair issues that might come up.

Also, not all tenants are responsible, respectful members of society who will value your property as much as you do.

Some tenants are careless and not concerned about being respectful of the property. Some won’t pay the rent on time – or at all.

Yes, there are safeguards you can put in place to increase your chance of getting a good tenant.

Performing credit checks, references and background checks are all good ways to increase your chances of getting a good tenant.

However, those safeguards all require the time and money of the property owner.

And even if you put all of the safeguards in place, and there’s still no guarantee you won’t end up taking your now former tenant to court for non-payment of rent.

Similarly, you could end up doing a major overhaul on the property due to damage inflicted by tenants.

Of course, you could hire a property management company to do all of the dirty work for you.

However, in doing so, you’re looking at giving away a slice of your monthly profit as well.

Fixing and Flipping Properties

Being a Fix and flip real estate investor can have its own set of problems. First, there’s the work involved in finding and then fixing up the property.

Then, as improvements progress, there is the risk of possibly finding more problems than you bargained for.

After the property is fixed (usually costing several thousands of dollars) you’ve got to sell it and pay realtor fees.

Oftentimes a bottom-line profit in the fix and flip world isn’t what an investor hoped it would be.

Also, fix and flips generally require quite a bit of time and effort on the part of the investor.

Large Down Payments Needed

On top of that, most mortgage lenders require that real estate investment deals have at least twenty to thirty percent down payment before they’ll fund the deal.

That can be an astronomical amount of cash for the typical investor.

A small residential home costing $200,000 would require a down payment of $40,000 to $60,000. And that’s not including closing costs and the money needed to perform any repairs or improvements.

This is not to say that traditional real estate projects aren’t for you. Only you can decide whether or not you want to own brick-and-mortar properties.

However it’s important to know upfront the cash needed and the work involved before you become a direct owner of rental properties or fix and flip properties.

Is Fundrise Legit?

Yes, Fundrise is a legitimate company. However, just as there are risks with traditional real estate projects as outlined above, there are also risks with an online investment platform.

Due Diligence Limitations – Banking on the Expertise of Others

With an online investment platform, investors are basically banking on the expertise of others.

Unless you have an in-depth knowledge of commercial real estate investing as a whole, you will be relying on the information you are being given by the online investment platform as to the possible profitability of a deal.

Similarly, if you are not familiar with loan risk analysis parameters, you may unknowingly choose an unwise investment to put your money in.

When investing in real estate, it’s good to know the answers to the following questions:

- What is an acceptable loan-to-value ratio?

- Should I invest in a property where the owner is only putting five percent down? Or should I look for deals with down payments in the twenty and thirty percent range like the bank does?

- Are the ROI projections for the deal realistic? Is the owner really going to make as much money on the deal as he or she thinks they are?

- What is the need in the area for the type of property the owner is promoting? Is the chance of gaining quality tenants high enough?

There are good and bad sides to an online investment platform. The bad side is that you are giving up a large amount of control as you are putting your money into the hands of others in hopes for a profit.

The good side is that reputable companies will commit to doing some serious due diligence on the deals they present to their members before they offer them.

Having an Expert Management Team Helps

Fundrise management staff does work to help minimize risk by only approving deals that have been thoroughly scrutinized.

That being said, it is important that investors understand that this intense examination doesn’t eliminate risk altogether.

Since the leadership team at Fundrise has had personal experience in commercial real estate investing, it means they have more experience than the typical investor at spotting a good deal versus a bad deal when commercial property managers come to them for a loan.

This truth can help to counter possible risks for investors who have little or no personal real estate investing experience.

But as with any investment, the risk for loss still exists, even on highly analyzed real estate opportunities.

Limited Liquidity

Online investment platforms do have limited liquidity capabilities too. In the case of Fundrise, there is a six-month holding period on all investments.

After that six-month period is up, investors have the option to cash out their investment, but that option is only offered once per quarter.

Potential Property Owner Failure

With any real estate deal, there is the chance that the owner of the property could end up losing the property or going bankrupt due to unforeseen costs.

This could leave investors in an online investing platform holding an empty bag.

The key to avoiding this type of scenario lies largely in making sure you are dealing with a company that has done due diligence on its investments.

You need to know the company has taken steps to be transparent about its inner workings.

Because Fundrise is a publicly offered investment, it lies under the scrutiny of the Securities Exchange Commission.

This helps you as an investor to be secure from a Bernie Madoff type of a situation.

The company also works to invest in the top commercial real estate markets and with the top real estate companies.

Being choosy about who they loan money to helps protect investors from potential property owner failure.

However, it’s important to know that risk still exists with any investment platform, whether in real estate or in the stock market.

Is Fundrise a Good Investment?

So, is investing with Fundrise a smart investment choice? Only you can answer that question.

Even with the online investment platform, some investors might be more comfortable building their real estate investment portfolio slowly by purchasing properties directly.

Knowing that you have full control over the buildings you own directly might be more appealing to you than owning pieces of a basket of buildings you’ll likely never see.

However, the upside of owning via an online investment platform is that you don’t have to spend time managing those buildings either.

Fundrise Reviews

Fundrise is rated a 3.4 out of 5 on Trustpilot. Out of the 319 reviews published on Trustpilot as of this writing, 84% of them are 5-star reviews.

Positive reviewers comment on stellar service and attractive returns they’ve earned.

Negative reviewers comment primarily on low returns, however, many of these reviewers withdrew their investments after only a few months.

Fundrise specifically states it offers a long-term investment strategy.

Fundrise is rated A+ by the Better Business Bureau. The BBB states that Fundrise has 21 closed complaints in the last three years.

Fundrise appears to work hard to respond to and address all BBB complaints.

Alternatives to Fundrise

Let’s review some alternatives to Fundrise.

Groundfloor

Groundfloor is like Fundrise, offering real estate investments with a minimum investment of just $10. You can download their new mobile app via the Apple App Store and Google Play listed on their site.

However, whereas Fundrise specializes in long-term investments, Groundfloor focuses on short-term investments for either a non-accredited or an accredited investor.

Groundfloor investments typically have a term of 18 months or less. These investments are short-term, high-yield investments that often earn 10% in a year or less.

You, as the investor, choose which properties you own shares in and how much you invest in each property.

In a way, Groundfloor helps you create your own REIT instead of investing in already-formed REITs.

Groundfloor does not charge any fees for investors. The company earns its money from borrowers.

Note that Groundfloor practices debt investing instead of pursuing equity investments. Money is earned from borrowers instead of from tenants.

Learn more by reading our GroundFloor Review.

DiversyFund

DiversyFund has a $500 minimum investment and invests your money primarily in residential rental properties such as apartment complexes.

They currently offer two REITs: The Growth REIT I and the Growth REIT II.

Both REITs purchase apartment complexes of 100 units or more, add value to them with specified renovations, and then work to hold and stabilize the properties.

Typical investment terms with DiversyFund are five years, after which the company sells value-added, stabilized properties to other investors.

Based on historical earnings, you can expect to earn between 5% and 18% with DiversyFund. However, the company cannot guarantee similar earnings in the future.

As with Fundrise, DiversyFund allows both a non-accredited and an accredited investor to join regardless of their net worth.

Fees for DiversyFund vary based on the offering, but you can expect to pay a 2% annual fee on your equity dollars each year.

See individual circular offerings for descriptions of additional fees.

CrowdStreet

CrowdSteet offers you the flexibility to invest in funds that hold multiple properties or individual properties. Anyone can invest in one of the company’s funds, but only an accredited investor with a high net worth can invest in individual properties.

This platform locks your money into your investment for years at a time, so you’ll need to be ok with not having access to these funds for an extended period of time.

The company also charges an annual asset management fee ranging from .5% to 2.5%. This can reduce your overall profits.

Many investment opportunities on this platform have a high minimum investment. Because of this, So CrowdStreet could be a better choice for people with a lot of money and the time to research their investments.

Note that all investments in real estate via online investment companies such as Fundrise come with a risk of loss of your initial investment. This is important to know as you decide which company you’ll invest with and how much money you’ll invest.

Frequently Asked Questions

Here are some answers to some frequently asked questions about Fundrise.

Fundrise investments are meant to be held for the long-term (i.e. five years or more). However, you can pull your investment funds early, although you should expect to pay a penalty fee to do so.

Yes, you can! However, it’s important to note that the more you have in your Fundrise account, the more investment opportunities you’ll have with the company.

Fundrise offers several types of accounts including individual accounts, joint accounts, Traditional IRAs, Roth IRAs and trusts.

Note that IRA investments are not available with the Starter account plan. You’ll want to consider your investment needs before getting this starter portfolio.

Yes, you can get business accounts with Fundrise including S-corp, C-corp, LLC, Single-person LLC and more.

Summary

Investing can be a well-known path to building wealth. A well-rounded investment portfolio includes a variety of investments.

It might contain some stock market investments, some real estate, and/or ownership interests in individual businesses.

At the end of the day, the goal of an investor is to weather the ups and downs of the different markets and come out ahead.

For short-term investors, the “end of the day” could mean anywhere from one to five years. For long-term investors, it could mean ten to forty years or more.

All investment markets have their highs and lows. It’s not the highs and lows that you necessarily need to worry about as an investor.

Instead, it’s whether your investment choice has the stability to weather those fluctuations and come out profitable over the long-term.

Do your research and choose your investment portfolio offerings wisely. Diversification is important. Investment education and management is important as well.

By managing your investments well and staying educated on the latest investment news, you’re creating a foundation that will provide financial security for years to come.

This is a testimonial in partnership with Fundrise. We earn a commission from partner links on Well Kept Wallet. All opinions are those of our writers and Well Kept Wallet.

Note: We will get a commission if you sign up through this endorsement of Fundrise. However, we only promote brands we believe are a good fit for our readers. All opinions are our own.

By investing through Fundrise, do you still get to participate in the tax advantages of owning rental property, like depreciation? I expect not, but I wanted to clarify.

It’s possible. But the best source to go to for the answer to that question is probably Fundrise itself.

Hi, I have a question. If I sign up for Fundrise how soon until I get my first payment?

Thank you.

Michael

You would need to check with Fundrise to find that out. You might be able to find out by looking at their website. But if you can’t find the information, you could always contact them directly and ask.