Groundfloor Review: Is It Legit?

Some products in this article are from our partners. Read our Advertiser Discloser.

Real estate investing by crowdfunding is one way you can get a stake in real estate without having to purchase it directly.

We will show you some of the key points you need to know about investing and the debt side of real estate holdings.

If you’ve been thinking about investing in real estate but aren’t sure where to start, Groundfloor might be an option for you. With a low minimum investment amount (only $10) and no fees for investors, Groundfloor has made real estate investing more than affordable.

Overall Rating

Summary

Groundfloor offers fractional real estate investing with no fees and requires only $10 to start.

-

Minimum start up

4.5

-

Ease of use

4.5

-

LRO risks

3.5

Pros

- Minimum to start

- Non-accredited investors

- No fees

Cons

- Investment in LROs risks

- Deferred investments

- No liquidity

What is Groundfloor?

As mentioned earlier, Groundfloor is a crowdfunded real estate investing company. It was founded in 2013 by Brian Dally (co-founder of Republic Wireless) and Nick Bhargava.

Their goal was to help the average investor have the freedom to participate in an investment asset class that was typically only available to higher-end investors.

You’ve probably heard and read about other crowdfunded real estate investing companies such as Fundrise. The difference between Groundfloor and other real estate companies is that Groundfloor is open to everyone and offers no fees to invest.

In the words of CEO and founder Brian Dally, the company “helps investors automatically diversify into short-term, high-yield real estate loans.”

Other companies offer investments in real estate management companies instead. The Groundfloor website says that the client’s financial returns speak to the success of the company’s model.

Its debt-based investment platform has gained returns averaging a consistent 10%+ over the last 10+ years.

Is Groundfloor Legit?

Yes, Groundfloor is a legit company with over 250,000 users and over $1.3 billion transferred on Groundfloor’s investment platform.

They have a 3.9 out of 5 rating on Trustpilot and a B rating with the Better Business Bureau. They’ve also won several awards, including the Forbes Fintech 50.

As far as online security measures go, Groundfloor is secure. They use bank-level security when it comes to online investor interactions.

How Does Groundfloor Work?

The difference is that debt investments seek to earn a profit by offering loans to real estate investors.

In contrast, equity investments seek to profit from rental income paid by tenants or capital gains if the property sells for a profit.

Groundfloor mostly deals in debt investments. Most crowdfunded real estate loans managed by Groundfloor run for 12 to 18 months, offering more short-term liquidity.

Conversely, many other crowdfunded real estate companies have investment terms of three to five years in length.

When you invest with Groundfloor, your money is instantly allocated and diversified into dozens of real estate projects at once, so you’ll start to see repayments trickle in within as little as seven days.

Investors can then reinvest or cash out–whichever they prefer.

Here’s how the company sets up and manages its investments.

Groundfloor’s Investing Process

Groundfloor’s real estate investing process starts when a real estate investment borrower wishes to borrow funds for a real estate project.

Typically, the projects either involve refinancing for cash out on a short-term loan or purchase and rehab (e.g., fix and flip, new construction) properties.

The borrower submits an application, and Groundfloor’s underwriting team vets and approves (or denies) the project.

Once a project is approved, the loan is available in the pool of loans ready for investing investors. When you meet the $10 account minimum, you invest in all the projects where Groundfloor lends.

Groundfloor’s Auto Investor Account makes it easy and simple to invest in hundreds of loans at once. As soon as your funds transfer, they’ll be instantly and automatically invested across all available loans so you can start earning yields in as little as 7 days.

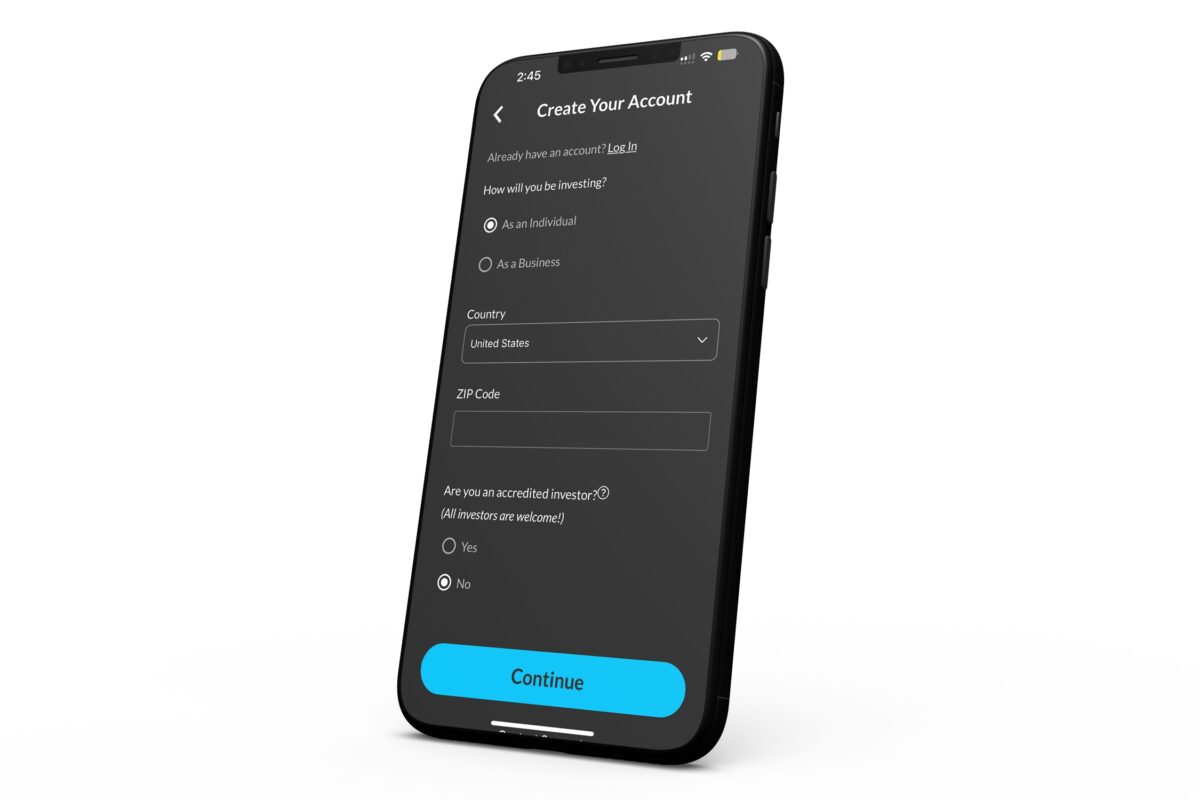

How Do I Get Started With Groundfloor?

The easiest way to get started is through the Groundfloor mobile app. You can easily sign up, connect your bank account through Plaid in seconds, and schedule a one-time or recurring transfer. Plaid is a Visa-owned company that helps consumers link their bank accounts with trustworthy financial partners.

To get started on the desktop, click “Get Started” at the top right of the Groundfloor homepage and begin opening a new account. You’ll start by sharing your name, address, and other personal information on Groundfloor’s secure site.

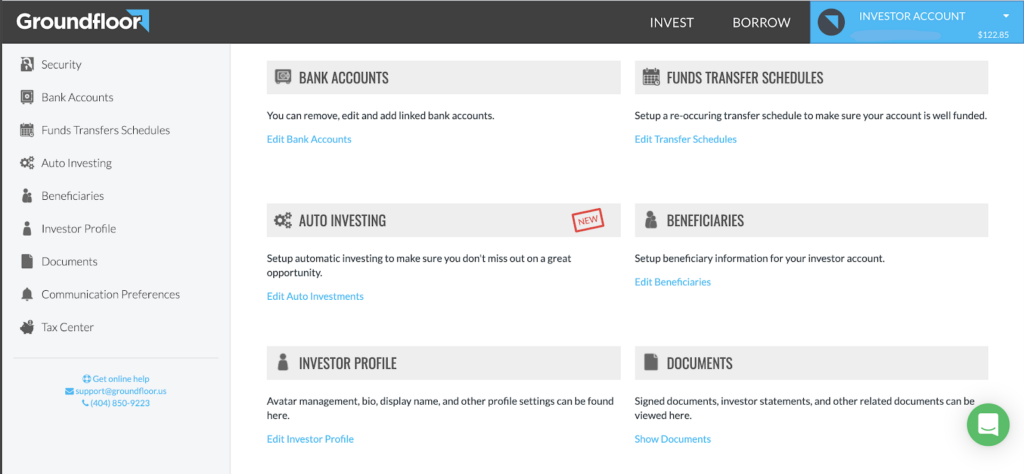

In either the mobile app or browser, you’ll add your bank account information.

After your bank account information is verified (Plaid uses multi-level security), you can transfer funds to your Groundfloor account, starting at minimum of $10 (although most investors start with $100). It can take a few days for the transfer to go through, but once it does, your funds are at work.

If you’d like, you can set up automatic transfers from your bank account to your Groundfloor account. That way, you’ll always have funds in your account if you want to make investment purchases. Groundfloor offers recurring transfers on a weekly, biweekly, monthly, and semimonthly basis.

How Does Groundfloor Work?

Groundfloor has a mobile-first approach, with an app that makes investing easy and accessible to every investor — though you can also invest from your desktop or mobile browser.

In the mobile app, you can see your accrued interest, total loans you’re invested in, annualized return, an estimate of your portfolio’s value ranging from one to 20 years, and more. If you’d like to get into the details of your returns, you can check the Repayments Breakdown, which shows your return of capital, interest received, and your average realized return.

The Groundfloor app is available on iOS and Android devices.

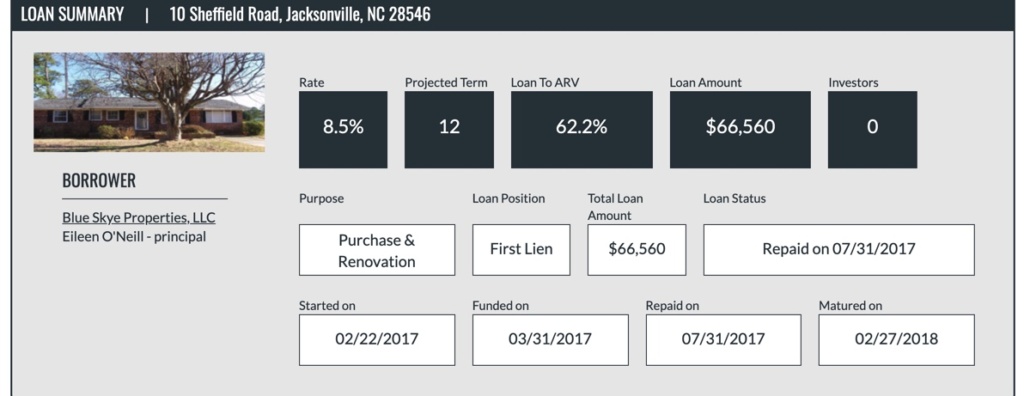

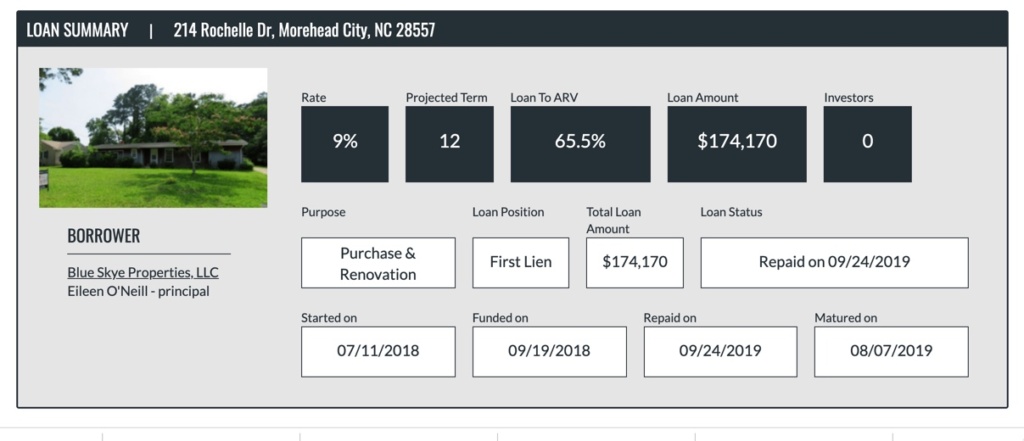

If you want more specific details on each loan, you can see information about each investment, such as:

- The expected rate of return it will pay

- The length of the investment

- Where the investment property is located

- The loan term

- The project’s loan-to-value (LTV for cash-out refinances) or after-repair value (ARV for rehab projects)

Additional Loan Information

Groundfloor’s full-page detailed information gives a comprehensive list of facts about a loan and the borrower behind it. For instance, you’ll be able to see data in a rating-like format that can help you assess your comfort with the loan.

Groundfloor rates the loan one through ten on factors such as:

- Loan to value

- The area of town the property is located in

- The borrower’s experience level

- Quality of valuation

And there’s more. For instance, one valuation grade is called “skin-in-the-game.” This grade gives you an idea of how much of the borrower’s own money is tied up in the project.

If the “skin-in-the-game” grade is a two out of ten, the borrower doesn’t have very much of their own cash committed to the project. In contrast, if the grade is an eight out of ten, they’ve got a lot of their own money applied to the project.

These types of additional details help you as an investor do a deep-level assessment of the project. That way, you can make a more informed decision about investing in the project.

Closely Monitored Investment Projects

One way that Groundfloor works to help protect the investment projects it approves is with close monitoring of each project. Groundfloor’s Asset Management Team works to obtain monthly status updates on projects directly from the borrower.

The company also agrees to a schedule for completion with each borrower. If regular draws to help complete the project are not being made, Groundfloor sends an independent inspector to the project to check on its progress.

These regular inspections help ensure the safety of the investment. Also, anytime a borrower requests a draw, they have to get a new independent inspection of work completed and give a project update report.

The project update reports are then shared with investors. Groundfloor also works with borrowers to ensure timely project completion and subsequent loan payoff.

All of these added steps help Groundfloor avoid potential problems with loan default.

What if the Loan Goes Into Default?

Whenever you’re investing in real estate loans, there’s a chance the loan could go unpaid. If it goes into default and funds cannot be collected, Groundfloor starts the foreclosure process. It’s almost always in first-lien position on its loans, which further mitigates against risk for all investors.

Foreclosure is a last-resort solution, however. Groundfloor first works to resolve the situation in a way that works with the property owner to get the loan paid back. Finding a resolution first is important to the company. In some cases, defaulted loans can even return a greater investment for the investors, although it may take longer to work out.

Groundfloor Features

There are several features that potential investors might appreciate.

Here are some of the company’s most prominent features.

- Groundfloor has a $10 minimum investment threshold

- Both accredited and non-accredited investors can participate

- The company works with residential properties only

- All loans are pre-vetted and pre-funded

- There are no fees for investors

- Each loan is qualified through the S.E.C., providing oversight and transparency

- Historical, annualized 10% returns on investment

Of course, the $10 minimum investment amount and the lack of fees for investors make for attractive features.

These features help ensure that investing with Groundfloor is affordable. That means people in almost every financial situation can start to build wealth.

Who Can Invest With Groundfloor?

Groundfloor is available to both accredited and non-accredited investors. So, basically, anyone can invest with Groundfloor. And the company’s $10 minimum investment threshold was set in place to encourage investors from every wealth level.

Is Groundfloor an REIT?

Groundfloor is not a REIT (Real Estate Investment Trust) and actually earns 10x higher yields than REITs. Instead, Groundfloor issues investment shares in LROs (Limited Recourse Obligations). An LRO is a debt security.

Groundfloor Holds a First Lien Position

Note that Groundfloor holds a first lien position on all loans it funds. Also, each loan is backed by its underlying real estate assets.

However, as with all investments, there is some risk of loss. For instance, Groundfloor holds the lien on the invested properties; investors do not. You are an unsecured creditor to Groundfloor.

Groundfloor does submit its LROs to the SEC (Securities Exchange Commission) for qualification. So, the loans are assessed by the SEC.

Nonetheless, there is some risk to you as the investor because you are investing in Groundfloor, and Groundfloor is investing in the properties.

So, if Groundfloor were to fail as a company, you would have no recourse to get your investment funds back.

Positives and Negatives

As with any investment, Groundfloor has its pros and cons. Here’s a brief summary of some of the pros and cons of investing with Groundfloor.

Pros

- A minimum investment of $10 makes Groundfloor accessible to almost all people

- No need to be an accredited investor

- A small minimum investment means a high potential for diversification

- Thorough vetting process for potential borrowers

- Easy-to-use investor platform

- No fees for investors

- Easy-to-use app

- Automated investing and instant diversification

- Won numerous awards, including the Forbes Fintech 50

Cons

- Investing through LRO’s can involve significant risk

- Borrowers can default on loans, which would affect investors negatively

Frequently Asked Questions

When understanding how to use Groundfloor, you may have some questions. Here’s a look at commonly asked questions.

Do You Have to Be a U.S. Resident to Invest with Groundfloor?

No, you don’t. International investors can invest with Groundfloor as well.

Can I Buy Stock Shares in Groundfloor?

Yes. Even though Groundfloor is a privately held company, it offers public stock sales from time to time.

You can buy your Groundfloor stock shares directly through Groundfloor or through the platform that is hosting the stock sale. There is usually a minimum purchase requirement of ten shares of Groundfloor stock.

Groundfloor is proudly 32% customer-owned.

What’s the Difference Between Groundfloor and a REIT?

When you invest with a traditional REIT, your “basket” of investments is chosen on your behalf. With Groundfloor, you are automatically invested and diversified into dozens of real estate loans at once.

In other words, you create your own REIT, but you don’t have to worry about fund management fees or not being able to access your funds for 3-5 years.

What Types of Projects Does Groundfloor Finance?

Groundfloor focuses on single-family real estate projects.

Note that Groundfloor does not finance commercial properties or mobile or modular homes. They do offer investing into land lots and other real estate, through their Groundfloor Labs, which is only available to accredited investors.

Can I Use Groundfloor for Retirement Investing?

Yes, you can open a self-directed IRA through Groundfloor. Groundfloor partners with the IRA Services Trust Company to help you get tax-advantaged investing options in real estate investing.

When you open an IRA account with Groundfloor, you can transfer funds directly from another IRA, do a rollover or make a contribution via a personal check.

Does Groundfloor have a Security Process?

As mentioned, Groundfloor uses bank-level security to protect investors’ bank accounts. The company uses what’s called multi-factor authentication and AES 256-bit security.

You must pass multiple security levels before you have access to transfer money from your bank account to your Groundfloor account.

Groundfloor’s one-time-use passwords help ensure that passwords cannot be re-used if you need to log in again. And you will need to re-authenticate every 30 days as well or set up two-factor authentication.

All of these security steps are in place to help make doubly sure your personal information stays safe within Groundfloor’s online system.

Can I Withdraw My Investment Early?

All Groundfloor loans are short-term in nature. As discussed earlier, 12 to 18 months is typical, and some loans are much shorter than that.

When you invest with Groundfloor, you cannot withdraw your funds early. You must wait until the loan is paid out before you can have access to your invested funds. But because you are instantly diversified across dozens of projects, you can start to see repayments trickle in within as little as seven days.

Does Groundfloor Have a Referral Program?

Yes, Groundfloor does offer a referral program. If you want to refer family and friends to open a Groundfloor account, the company will reward you for your efforts. After you’ve opened your account, you’ll get a referral link to send to family and friends.

When a family member or friend opens a Groundfloor account using the referral link you sent them, you are eligible for a cash bonus. You’ll get your bonus deposited into your Groundfloor account when your referred party transfers money into their Groundfloor account.

Bonus: There’s no limit to the amount of referral bonuses you can earn. The more people you refer, who open up and deposit into an account, the more cash you earn.

Does Groundfloor Have Investment Advisors?

Groundfloor does not offer investment advice. So you’ll be totally on your own when it comes to choosing your investments.

Although the loan details pages do provide much information about each investment, you should not construe those pages as investment advice.

Your best bet to help protect yourself from investment losses is to do your due diligence research. Read the loan details pages carefully.

Learn what your risk tolerance level is by taking a risk tolerance quiz. Then, decide on and manage your risk and invest accordingly.

Does Groundfloor have an App?

Yes, they have launched an app for both Apple and Android phones. Simply go to Groundfloor and get the app.

Summary

Many successful investors tout the benefits of real estate investing. But most people can’t own and manage real estate investment assets on their own. Groundfloor provides an affordable way for anyone to get involved in real estate investing.

However, be sure to use Groundfloor’s “loan details” page to screen loans before investing in them.