10 Tips to Get Out of Debt Quickly

Some products in this article are from our partners. Read our Advertiser Discloser.

Wouldn’t be great if you could get out of debt quickly?

Imagine how much peace of mind you would have if you eliminated all of your debt. Imagine the places that you could go and the things that you could do.

Does it seem almost impossible, and no matter what you do, you just can’t seem to get ahead?

I am here to tell you that it is not impossible and I can prove it.

We were able to pay off $52,000 of debt in only 18 months and today I am going to share with you just how we did that and how you can to.

How to Get Rid of Debt Quickly

These steps will help you formulate a system that will allow you to get out of debt fast. Read them and put them in place for you. You deserve to be debt-free.

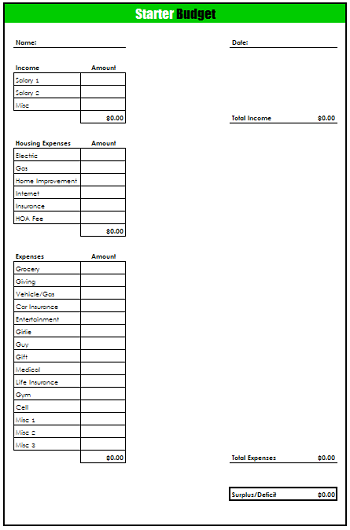

1. Develop a Starter Budget

Putting all your numbers on one piece of paper is the best way to get started when you want to get out of debt.

I created a Starter Budget to make the process even easier.

You should be able to create your initial budget in less than 10 minutes.

This form will help you figure out how much money you have to work with every month to pay down debt. It will also reveal to you areas where you can cut back to get more money with which you can tackle your debt.

Knowing what your monthly expenses are and what your monthly income is and having them written down is vital. These two pieces of information will help you find extra money to pay off debt.

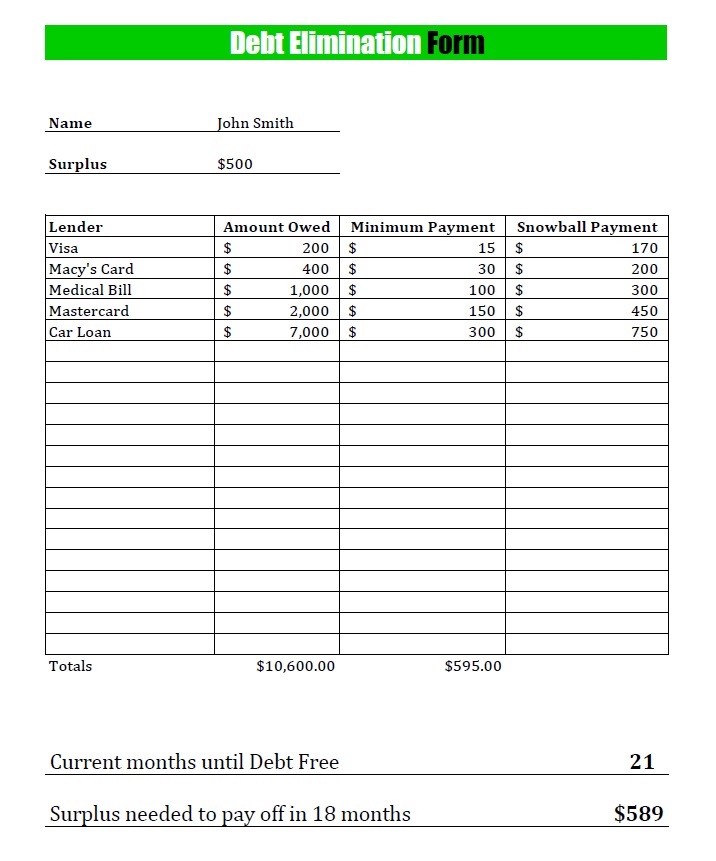

2. Organize Your Debt

If you want to pay off your debt quickly, then this next step is crucial. There are a few different ways you can organize your debt for a quick payoff plan.

My wife and I used the Debt Snowball method where we listed all of our debt on one piece of paper from smallest to largest. Then we started paying minimum payments on everything except the smallest debt.

If you were to use this method of debt organization, you’d take the surplus money you have after paying all your bills and throw that at your smallest debt.

For instance, if you have a $100 surplus and the minimum payment on the first debt is $25, now you will pay $125 per month until that debt is gone.

Examples of debts to include:

- Credit card debt

- Car loans

- Medical debt

- Personal loans

- Student loans

There are other methods of organizing your debt for payoff as well. You can pay it off in order of highest interest rate to the lowest interest rate. Or, you can pay it off in order of smallest monthly payment to largest monthly payment.

Everyone has a different opinion about which method of debt organization works best. Some choose the debt avalanche plan. This is the plan where you pay off the highest-interest loans and cards first.

The debt avalanche plan makes sense from a numbers standpoint. This is the plan that will help you pay the least amount in interest.

We chose the debt snowball simply because it allowed us to see some fast progress. We needed to see some fast progress to stay motivated.

Hint: If you would rather use an Excel spreadsheet rather than a piece of paper you can use this computerized Debt Snowball form.

We have also created our own online Debt Snowball calculator for your use.

See the example below for more details on how to fill it out.

Choose the method that works for you. Just be sure you’re organizing your debt list so you can pay down debts quickly.

3. Track Your Finances Monthly

Tracking your finances monthly is another crucial step to getting out of debt. To create a solid financial picture, you have to be intentional about your finances.

You can’t just spend money that is unaccounted for and then wonder at the end of the month where all of your money went. This (lack of a) “method” for tracking your money can cause big-time trouble and debt accumulation.

In addition, it’s hard to find extra money to pay toward debt when you don’t know where your money is going.

The best thing to do is to create a budget that tracks your income on the top and your expenses on the bottom. Some people think that tracking what you spend isn’t important as long as you’re paying the bills on time.

However, many people have found that tracking your expenditures can help you find nickel and dime purchases that add up to big money over the course of a month. You might be surprised at how much money you’re wasting on “little” expenses such as drive-thru runs.

Tracking your finances helps you find and eliminate those wasteful purchases.

How to Track Your Finances

I’d encourage you to start tracking your finances by writing down all of your projected income at the beginning of each month. Then write down your projected expenses. Be sure to include line items for fluctuating expenses such as groceries and miscellaneous spending.

I suggest using the envelope system for those fluctuating expenses so you don’t spend more than you’d budgeted for in those areas.

After you’ve calculated both projected income and projected expenses, subtract your total expenses from your total income.

This will show you if you have either a surplus or a deficit.

A surplus means that you have money left over to use to pay down your debt.

A deficit means that you are spending more than is coming in and that you need to make some drastic budget cuts if you want to get ahead.

Note: If you’re married, having regular meetings about your finances or doing your monthly or weekly budget together is important. Set aside some time each week to go over your money situation as a team.

Having regular money meetings that are productive can take some work at first. Working to pay off debt can be stressful. Don’t allow that stress to undermine your end goals. Stay positive, work together and focus on the long-term result instead of the short-term hurdles.

Value Based Spending

You might get nervous at the thought of budgeting and tracking your expenses. Know that there’s no wrong way to spend your money. However, it is important to practice value based spending.

Value based spending involves spending your money on things that are most important to you. It means stopping spending on things that aren’t important to you. If a certain purchase doesn’t bring you joy, stop spending on it.

Conversely, if a purchase brings you a lot of joy, keep it in your budget. Work to compare expenses to the joy you’ll feel when you’re debt free. This will help you figure out which expenses really matter to you.

Related Article: What Does the Bible Say About Debt?

4. Put All Extra Cash Toward Your Debt

This is one of the steps that can be very easily overlooked when you’re getting out of debt. Putting any extra cash or unexpected money toward debt will really speed up your debt payoff.

However, when you get a bonus or a tax refund, it can be tempting to want to go out and celebrate. If you’ve been on a tight budget for a while, it can be tempting to want to use the extra money to buy something nice or go on vacation.

However, if you are really serious about wanting to get out of debt and make progress toward your financial goals, you have to stay disciplined. And you’ll need to create the discipline of putting any extra cash that you get towards paying down your debt.

This is a major key to getting out of debt quickly. These windfalls of cash that you didn’t normally expect give you the progress you need to build some serious momentum.

They’ll ensure you reach your debt payoff goals much faster.

Some extra cash sources that you can put toward debt include:

- tax refunds

- bonuses from work

- overtime earnings from work

- second job earnings

- money from selling things

- monetary birthday or holiday gifts

- money you forgot you were owed that gets paid back

- cash back refunds from credit cards or purchases

- money from returning things you don’t need or want

There are many sources of extra, unexpected cash that can come your way. Commit to using them to get your debt paid off faster.

When you get extra money, think again about how you’ll feel when you no longer have the burden of debt. Imagine yourself debt free.

This will make it easier to avoid spending the money on whims.

5. Sell What You Don’t Need To Pay Down Debt

It’s likely you’ve got items in your house or apartment you don’t need or want. If you sell them, you can really pay off debt much faster. For instance, my wife and I both had newer cars when we got married.

To get out of debt fast, we decided to sell both cars and use the cash surplus (after we’d paid my car loan off) to get two cheaper vehicles. This wasn’t an easy choice. It’s fun to drive nice cars. However, it did allow us to put several thousand dollars extra toward our debt payoff goals.

Before we talk about what you can or should sell, we need to address the word “need.”

Example: You don’t need a $50,000 BMW, but perhaps you do need a vehicle to get you to and from work.

If you want to get out of debt bad enough, you need to make sacrifices now so that you will be better off in the long run.

That might mean selling the BMW and driving an older, reliable, used Toyota while you’re getting debt paid off.

Maybe you don’t have a BMW, and a car is not something that you have to sell. No worries; you can still probably find some stuff to sell to speed up debt payoff.

Go through every cabinet, closet, drawer, etc. and find items that you can sell on Craigslist, eBay, or Amazon to earn some extra cash.

For instance, my wife sold a lot of designer clothes and accessories to help pay off our debt. It wasn’t always easy for her to give up those things, but the thought of being debt free motivated her.

I sold my gaming system to help us pay off debt. That wasn’t fun. I liked playing video games, and my wife did too. But we wanted to be debt free more than we wanted to play video games.

The One Year Rule

When we started going through closets and drawers, I was shocked at how much stuff we had to sell.

Go through every area of your house and pull out everything you don’t need or don’t use. You might be surprised at just how big the pile of stuff you have to sell can get.

I used the One Year Rule to help determine what to sell. If I hadn’t used it in the past year, then I probably didn’t need it. Using this rule helped make it easier to sell things that we were having a hard time of letting go.

Make a point of selling things that you no longer need to get out of debt quickly. And remember, when you are debt free you can always buy it again if you find you actually do need or want it.

Use Craigslist and other sites like it to sell your stuff. eBay can be a good site to use too, although they do charge listing and selling fees.

You can send out emails to family and friends about things you have to sell too. Or, you could hold a garage sale. Just work to get rid of it quickly. This will help speed up your debt payoff and give you less time to fret over items you’re selling.

Note: Be wary of selling keepsakes, family mementos, or things with high sentimental value: once you sell them, you can’t get them back.

Related: Debt Anxiety Index

6. Scrutinize Your Expenses

Another key to paying off debt fast is to scrutinize every expense. Some people call this using the Challenge Everything Budget. Here’s how it works. Get your Financial Gameplan form or budget out.

Look at each line in your expense category and ask yourself, “How can I make this number smaller? Is there a way to reduce or eliminate this expense?”

We were able to decrease a lot of our expenses by simply doing this one thing. For instance, I called our cell phone company, insurance agency, and internet provider and was able to cut the monthly cost for each one.

We cut other expenses completely. As an example, we canceled our gym membership. We chose to work out at home and outside instead.

As another example, if you have satellite TV, consider replacing your cable with SlingTV which has plans as low as $40 per month.

Shop around for your insurance needs to see if you can get a better rate. Do whatever it takes to get your expenses as low as possible.

You can do the same thing with recurring expenses that might seem like necessities but really aren’t.

Some examples are:

- Going to a cheaper salon to get your hair cut or doing your nails at home

- Eliminating restaurant trips until your debt is gone

- Stopping newspaper and magazine subscriptions

- Finding and cutting out other recurring expenses

- Dropping your gym membership and working out at home by doing outdoor exercises such as jogging

A “Challenge Everything” mentality means taking a serious look at every single expense you have. If it’s not an absolute necessity, get rid of it.

You’ll likely be surprised at how much extra money you’ll gain each month from doing so. Then commit to putting that extra money toward debt payoff.

7. Consider Refinancing Your Debt

I do think that the Debt Snowball is the way to go when paying off debt. However, sometimes it makes sense to refinance your debt when you have multiple high-interest credit cards.

If you are paying over 15% in interest on your credit card debt, then refinancing to a much lower interest rate can make sense. It can help you save thousands of dollars over time.

I would much rather pay 5% than 15%, wouldn’t you? And paying less interest means more of your payment will go toward the principal balance. This will help you pay off debt faster.

8. Increase Your Income

This is one of the most important steps that many people overlook. While paying off debt, keep in mind that you’re not limited to your current income to do so.

Instead, find as many ways as possible to make extra money on the side so that you can pay off your debt quickly.

Apply for a second job at a pizza joint, serve at a restaurant, deliver papers, and do anything you can to bring in more income. I did this to help us pay off debt faster. It took me just eight days to find a second job as a pizza delivery driver.

But you don’t have to deliver pizzas. There are many other options for bringing in more cash to pay off your debt faster. You could sign up with DoorDash to deliver food for multiple restaurants.

Or, you could sign up to be a rideshare driver with Lyft. How about working an online customer service rep job from home?

U-Haul hires customer service reps as young as age 16 to work from home.

For more ideas see this post on 60+ Side Hustle Ideas to Make Extra Money. Whether you want to work from home, work for someone else or have your own business, there are always ways to make more money.

Hint: When you’re making a lot of extra cash you may want to increase your spending. Staying on a strict budget is hard.

When you’re bringing in hundreds of extra dollars a month from a side hustle you might want to play more. Go on vacation. Or buy something new.

Keep your debt payoff goals in the forefront of your mind. Remember that your strict budget is only temporary. Commit to using all of your extra income to get rid of debt super fast. Make your extra work worth it.

9. Be All-In

And the final – but perhaps most important – step is to commit to being all-in. Give this debt payoff thing all you got. Once you make a commitment and decision to become debt free, stick to it.

In poker, you go all-in if you are confident you have what it takes to win the hand. With debt payoff, your attitude has to be the same. You can’t have one foot in the “I want to buy new clothes” boat and the other in the “I want to become debt-free” boat.

It just won’t work. If you want to get out of debt fast, then you need to be all-in. Having this attitude will take some work. You may need to use motivational quotes or read inspiring books.

Read debt success stories or listen to debt payoff blogs on our site. Make charts or graphs to hang on your walls. Create a list of things you’ll do to celebrate when you’re debt free. Make a list of reasons why you want to get out of debt in the first place.

All of these actions will help you stay “all in”. Use them when you feel overwhelmed by the process or get discouraged.

10. Be Willing to Take Drastic Steps

Sometimes debt payoff requires drastic steps. If you’re house poor, you may need to sell your house and downsize to a cheaper payment. You might need to get a cheaper apartment. Or you may need to move to a more affordable area to live.

You might need to seek out a new job that pays more. Or, you might need to start walking or biking to work. What “drastic” means is up to you. For you, drastic might mean going to a cheaper salon. Or not buying designer clothes.

Everyone’s life experiences are different. The expenses we get use to having become a normal part of our lives. And it can be tough to change that. Drastic to me might mean no more $200 dinners out. However, that might be a silly, lavish expense to you.

There’s no right or wrong answers here because everyone is different. But I can tell you that getting drastic does work. It wasn’t easy for my wife to sell her jewelry and designer clothing. It wasn’t easy for me to give up my new, fancy car for an old, used car.

But I’m glad we did those things. Now we never worry about money. And we were able to pay our debt off super fast because we got drastic. Try getting drastic, even if it’s only for a short time. Set goals like “No going out to dinner for 30 days”.

You can always lighten up if you want to, but being drastic will help you reach your goals faster.

Remember that Focus is Key to Get Out of Debt Fast

When we were deep in debt, I felt like I was spinning my wheels for so many years. However, when my wife and I decided to focus intently on paying off the debt, the results were amazing.

It wasn’t easy to pay off $52,000 in debt in just 18 months, but it was worth it. Things will happen to try and get you off track. The car will break down. House repairs and other expenses will come up.

Another thing that will happen is that you’ll have opportunities to spend money. Friends will ask you to go to the movies or out to eat.

You may have opportunities for vacations. Or, an item you really want will go on sale. Temptations will come your way on a regular basis.

It is easy to get distracted by these types of temptations, so it is important to remind yourself why you are doing this.

Remind yourself that you want a better life for you and your family. Think about the things you want and why being debt free is so important to you.

You want to be able to put your kids through college. Or you want to be in a financial position where you can give to worthy causes. Use your list of “whys” and visualization to keep yourself on track.

For some people, positive visualization works best, such as imagining yourself financially secure and being able to buy whatever you want.

For others, negative visualization will work. You might get motivated by the thought of losing your house to foreclosure if you lose your job and can’t make the payments.

Find what works for you as far as motivation, and work it! Keep your “whys” in mind. Your “whys” are the reasons that make you do what you do to get out of debt. They’re the reasons you keep trying and sacrificing so you can make those big extra payments toward debt.

Whatever your “whys,” make sure you keep them at the top of your mind while you pay off your debt.

Related: 14 Best Debt Blogs to Help You Tackle Your Debt

Summary

If you want to get out of debt quickly, it is possible. If you use these tips above, you will be able to accelerate paying off your debt so that you can start putting you money toward other goals in life.

The faster you pay it off, the quicker you will have peace of mind when it comes to your finances.

Start you debt payoff plan today!

This is a great post! I liked how easy it was to understand the process. It makes it a lot simpler than people imagine it is!

I’m glad it helped!

Don’t forget the grocery bill. Believe it or not, I find great prices on every day items like almond milk and meal staples when I shop at Target. Sometimes the prices are lower than the Dollar Tree, which leaves me with more money for fresh fruits and veggies! Also, it’s ok to buy consignment or upscale second hand clothes. Big name companies donate items as tax right offs.

This is fantastic. How can I share this on my Pinterest board?

Thank you so much! I’ve been researching and putting a game plan into place and this form is just what I needed in order to get things going in the right direction. Let’s see how this goes! Wish me luck and I will keep you posted every so often.

Once again, thanks! This is a great motivator to my debt free success!!!!

Thanks a lot for sharing these ideas. It is really a must to get out of debt fast. And the information you shared will help in getting out of debt.

The one thing that I noticed, reading this blog, was that the couple doesn’t have any children in the picture. So, it would be very simple to pay off the debt they had that fast. Wait till they have children and see how much harder it is to pay off debt like they did. I have 2 teenagers and can tell you that it isn’t that easy. With kids playing sports, school activities, clothing, car insurance for a teen driver, etc., it isn’t that easy if you have a family with kids. But try this: 52k in 18 months with children and see how far you could get.

Hi, Ken. It is true that having kids can make it more challenging to get out of debt because of the increased expenses of having kids. However, I personally know several families that have become debt-free (except their home) that had multiple kids. They just put together a game plan, cut their expenses, increased their income, and before they knew it, the debt was paid off.

I agree with all of these. It is really not an easy task to get out of debt. I think the idea of having a game plan would really help. You should also know how to prioritize things. Thanks for sharing these tips.

This is great advice Deacon. Using a budget is totally the best way to make your money work for you – and to track your spending. The only way to true wealth is to become debt free! Congrats!

Thanks Greg!

Way to go! This is awesome advice to the readers. Getting out and staying out of debt is so important! Along with keeping on the budget you set.

Thanks Robin!

I agree with Robin! Deacon, I’m trying to follow your Debt Reduction Form. What is a Snowball Payment and how did you get it? Thank you for your great ideas. I just graduated from college last May, so I want to pay my student loans as soon as possible. Again, thank you!

Hi Lovette!

The Snowball payment = Surplus + minimum payment of the debt that you are working on paying off.

Ex.: If your smallest debt has a minimum payment of $20 and you have $150 of surplus then your Snowball payment would be $170. (Once you pay off that debt then you add the $170 to the next debt to get the snowball rolling.)

I hope that helps. If you have any other questions, please don’t hesitate to send them my way.

This is what Dave Ramsey has been teaching for years – it’s just copied from him. It’s good advice anyway.

Hi, Christine! Thanks for stopping by. Dave does have some great advice. We actually tend to have very similar views on money.

I think its a good way to get the message out, Christine, no matter who teaches it. I like it. Congrats on getting rid of that debt.