Morningstar Investor Review: Is It Worth It?

Some products in this article are from our partners. Read our Advertiser Discloser.

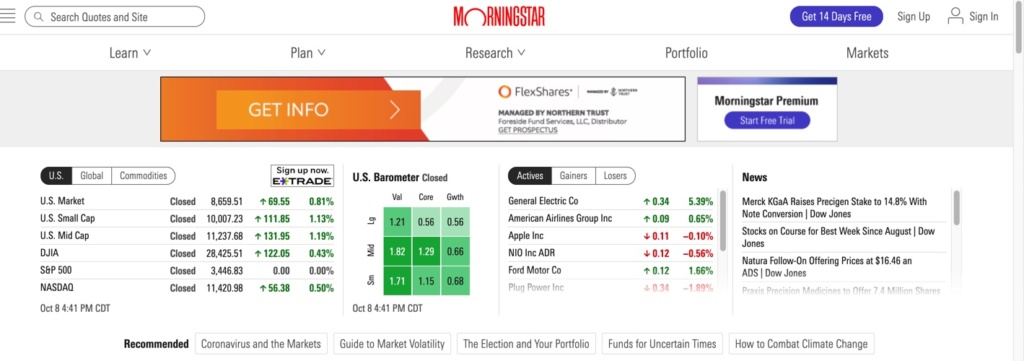

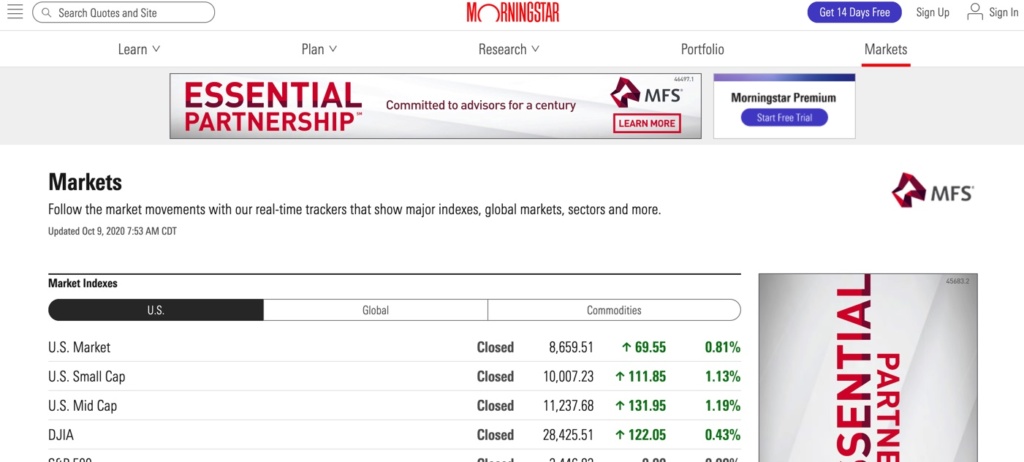

If you’ve researched stocks and mutual funds, you’ve likely come across Morningstar. It’s a well-respected company that offers analysis and insights about individual stocks’ investment performance, mutual funds and entire sectors.

While you can access basic information for stocks or funds for free, if you want to get detailed analytics, you need to sign up for Morningstar Investor.

This Morningstar review can help you decide if this in-depth information can help you improve your investment performance and make informed buying and selling decisions.

Start a 7 day free trial today and save $50 on an annual Investor subscription with code WKW.

Overall Rating

Summary

For the serious investor who likes delving into research and data, Morningstar Premium offers enough value that it may justify the high price tag. You get historical numbers, expert analysis and detailed information about stocks and mutual funds all in one place.

-

Free trial

4.5

-

User interface

4

-

Research depth

4.5

Pros

- Research depth

- Easy to use

- Free trial

Cons

- High costs

- Clunky interface

What is Morningstar?

Morningstar is a global investment research company with 35 years of history. The company started in Chicago in 1984, intending to empower investors’ success.

It’s responsible for $201 billion in assets under management and advisement as of March 31, 2018, and operates in 27 countries.

Morningstar prides itself on asking the tough questions to get the correct information to investors. They focus on comprehensive, high-quality data to offer the right research and analysis.

As a result, it’s one of the most well-respected investment research services. Several online stock brokerages offer their third-party analyst reports but a paid subscription provides additional research tools.

How Morningstar Investor Works

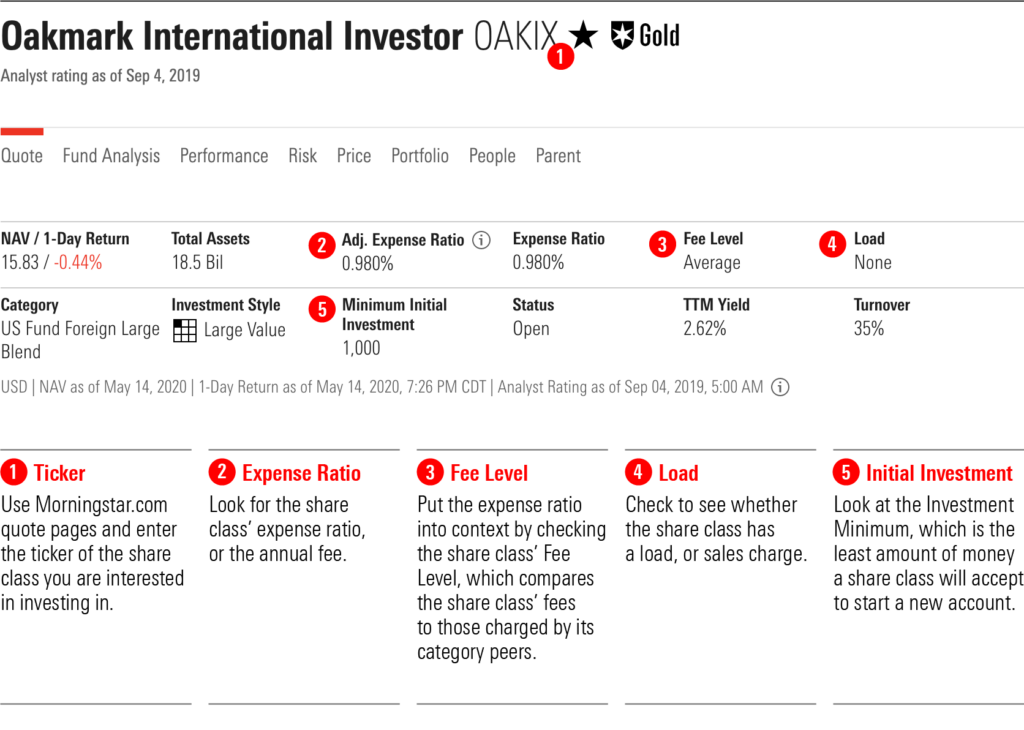

One of the key features that makes Morningstar stand out is how they break down complex information into easy-to-understand ideas.

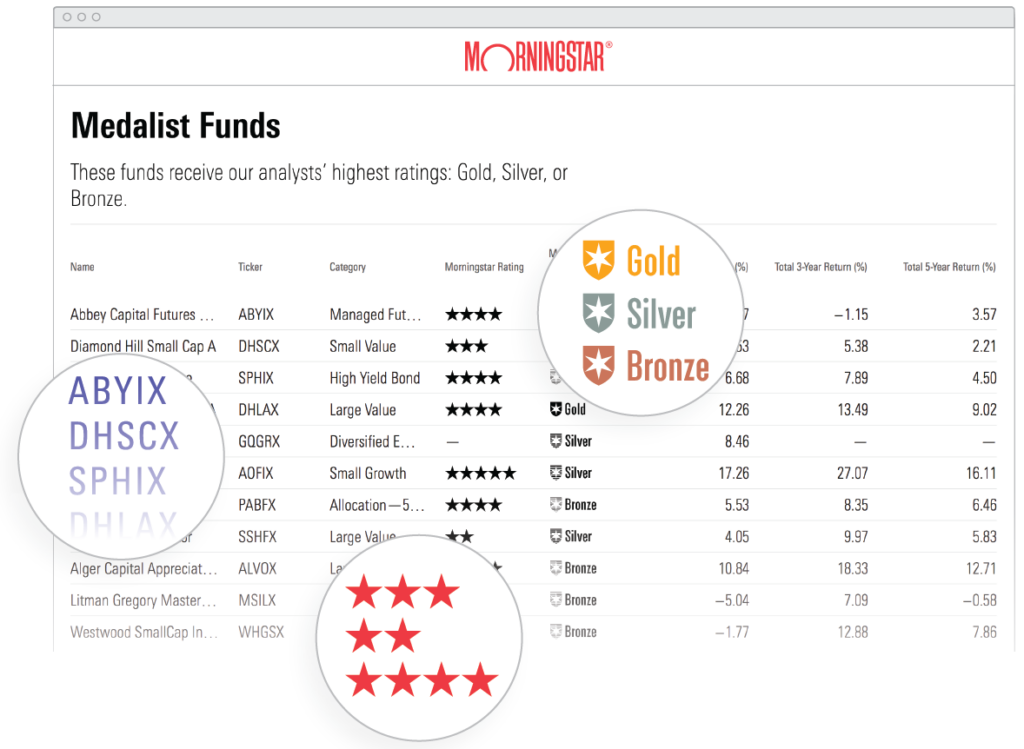

The company uses a five-star mutual fund rating system based on returns offered by each fund to make it easier for investors to evaluate different options.

You can access necessary information about stocks and funds through the Morningstar website. However, you will need to subscribe to Morningstar Investor for more in-depth research.

A subscription will give you access to full analysis for each fund or stock, and detailed research, news, and other data.

How Much Does Morningstar Investor Cost?

Morningstar Investor costs $249 for a one-year subscription which can be steep, but if you plan to use it, it can be a good value.

The monthly cost is $34.95. If you go with an annual vs. a monthly plan, you can save $270.

Two-year plans cost $399, which breaks down to $190.50 per year, and three-year plans are $499 (or $166.33 annually). If you’re not sure you will get value out of the service, there is no point in signing up for a longer plan just for the savings.

Key Features

You can get basic information for stocks, bonds, mutual funds and ETFs using Morningstar’s basic membership which is free. This membership includes full access to the article archives and limited access to fund screeners, Portfolio X-ray and Portfolio Manager.

But if you want full access to all the above features and tools, you will need to go with the premium version. Morningstar Investor offers complete access to analyst reports, top investment picks, Portfolio X-ray, fund screeners, Portfolio Manager and more.

These can be valuable tools for investors who plan and research before pulling the trigger. It can help them see the big-picture financials for individual funds or companies to decide if they are a good bet.

Here are some tools and features of a Morningstar Investor subscription.

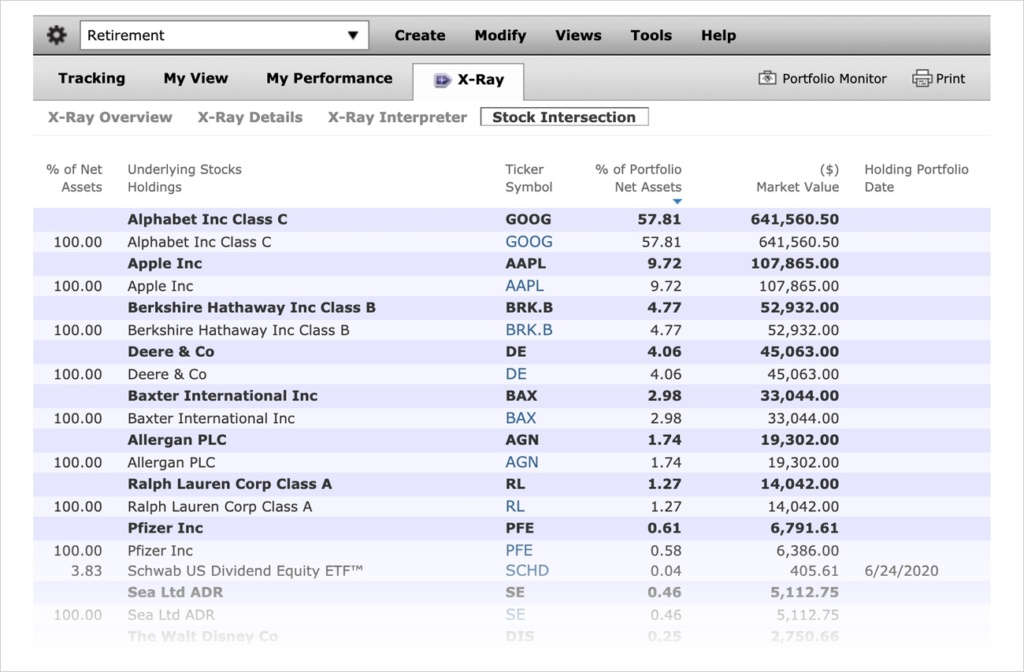

Portfolio X-ray

When you invest in many funds and stocks, it’s difficult to keep track of how each one balances out against the companies and sectors in your portfolio.

While funds summarize their allocation within the prospectus, it’s difficult to compare them against the rest of your holdings.

The Portfolio X-ray service from Morningstar Investor can help you create a balanced portfolio by addressing this challenge. Morningstar determines your true asset allocation using each mutual fund’s quarterly SEC reports.

With this type of analysis, you can see how your portfolio stacks up and pinpoint any areas where you are heavily weighted. Using this insight, you can course-correct and decrease your investment risk while increasing your returns.

Some of the factors this tool evaluates include:

- Asset allocation

- Stock style (i.e., growth, value, etc.)

- Stock sector

- World regions

- Fees and expenses

One disadvantage of Portfolio X-ray is the manual process. This task can be cumbersome and needs improvement to make it easier to use. However, if you use Quicken, you can import Quicken files.

And since Morningstar offers Portfolio X-ray as part of the service, Premium Quicken users can automatically link all of their investment accounts.

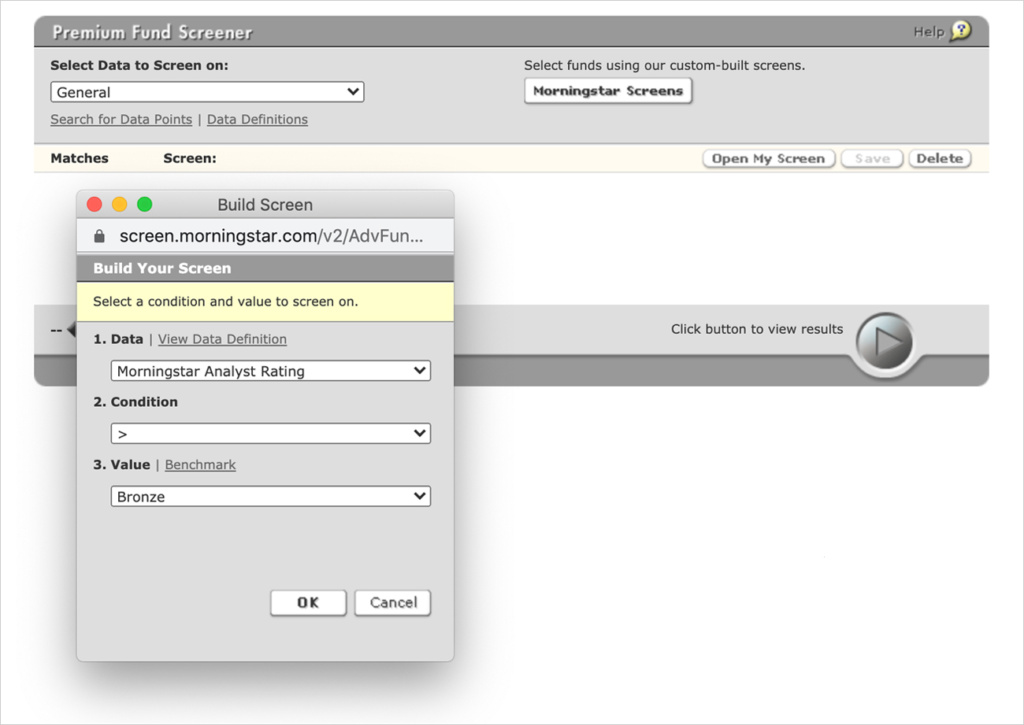

Fund screeners

If you like to research and compare funds, you will enjoy Morningstar’s fund screener tool. It allows you to search and filter mutual funds by performance, category and rating.

This makes it easy to find funds that fit your investment criteria and compare them.

With Morningstar’s Premium version, you can go beyond basic screening to filter funds by:

- Annual returns

- Risk

- Morningstar rating

- Yield

- Sustainability

You can also get an idea of the analyst grade ratings and use them to narrow down your choices further.

If you find a fund you are considering but want to see how it stacks up against other similar options, you can use the “Similar Funds” feature.

It allows you to find additional funds like the one you are considering so you can compare them before deciding where to invest.

The screener tool works beyond mutual funds. You can use the data to compare individual stocks and exchange-traded funds (ETFs).

This information can help you make informed decisions when buying a particular investment and building a balanced portfolio.

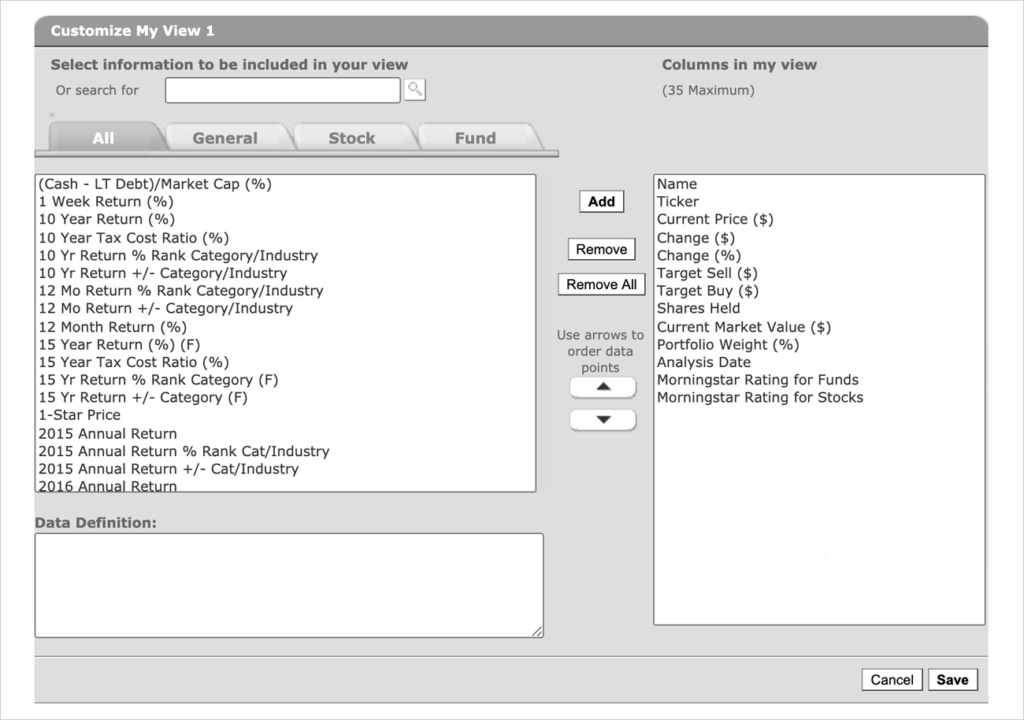

Portfolio Manager

Morningstar’s Portfolio Manager offers an at-a-glance look at your investments. It gives you an overview and helps you track your current investments.

You can use it to create a strategy, evaluate how your investments are doing and create watch lists of potential opportunities.

One of the useful features of the Portfolio Manager is that you have easy access to the corresponding Morningstar reports in the overview table.

This makes it simple to find the data to evaluate investment performance and decide on the next steps.

Investment Planning

For those who get lost in the weeds researching fund after fund, Morningstar’s Best Investments section can help.

It gives you a starting point with a list of the best funds for your portfolio based on the analysis of more than 200 independent analysts.

You can research and compare funds in a variety of categories such as:

- Stocks

- ETFs

- Mutual funds

- Index funds

- Bond funds

- Target-date funds

When viewing individual funds, you will get the analyst summary of the fund, how the fund has performed over time, the fund’s price and so on.

Also, it will give you an insight into the fund managers, which can help get a behind-the-scenes look.

If you are looking for bargain stocks, Morningstar has a list of five-star stocks, which are companies with shares priced at less than fair value.

Using this list can be an excellent way to evaluate and select a few companies to add to your investment portfolio without the hassle of pouring through SEC filings and quarterly reports.

iPhone and iPad Apps

If you have an iPhone or an iPad, you can download the Morningstar app for free. This will give you easy access to your investment portfolio overview, but you won’t get the same in-depth information available on the website.

The biggest advantage of having the app is for quick analysis of a stock or a fund. However, for most other needs, you are better off logging into the website so that you can access the full functionality.

Unfortunately, the Morningstar for Investors app currently isn’t available for Android users.

Empower integration

If you have assets over $100,000 in your investment portfolio, you will have a one-on-one financial review with a Empower advisor. This option comes up when you first sign up for the service.

You will also have access to free Empower tools to manage your investments and keep track of them. This bonus is only available for Morningstar service users, so you will have to sign up before you can set up your one-on-one meeting.

What do you get with Morningstar Investor?

When you sign up for Morningstar Investor, you get full access to analyst reports, top investment picks, Portfolio Manager, Portfolio X-ray, fund screeners and the article archive.

In contrast, the free basic membership gives you full access to the article archive and limited access to the fund screeners, Portfolio X-ray and Portfolio Manager.

You will not get access to the top investment picks or analyst reports.

Are Morningstar ratings reliable?

Morningstar is highly regarded for its investment research, but that doesn’t mean their ratings are always the most accurate.

Most people researching investments for their portfolio rely on third-party ratings as Morningstar offers for a simple way to compare investment options.

With that said, even Morningstar has a disclaimer that investors should take the company’s ratings with a grain of salt. Ratings are based on past fund and stock performance relative to other investments in the same field.

When researching investments, it’s always best to use a variety of resources to evaluate investment options rather than relying on a single company or rating system.

How to Get Morningstar Investor for Free

Who doesn’t enjoy getting things for free? With the high cost of a Morningstar Investor subscription, it would be nice to get it for free, so you can determine if it’s worth paying for the service.

The best way to determine if Morningstar Investor is worth the cost is to start with the free 7-day trial.

It will give you access to the premium services so you can evaluate your investments to decide whether you’re getting enough value to warrant a subscription.

Morningstar Trial & Promo Offers

If you want to try Morningstar Investor before committing to a monthly or an annual plan, you’re in luck.

Current Offer: Get a 7-day trial to try out the tool for free and see how it works with your portfolio. Plus right now they offer $50 off the full year price making it only $199.

The trial will give you access to the full set of features and tools you will get as a paying member.

Bonus for students: $25 annual rate for students which is a 90% discount

Morningstar Reviews

When looking for reviews for apps we found Morningstar for iPhone products have both iPad and iPhone options. Both are pretty much the same. The Google store only offered one app download option.

We found review responses from the developers to be courteous and timely.

| App | Rating | Number of Reviews |

| Apple App Store | 4.3 out of 5 | 6.2K |

| Google Play | 2.9 out of 5 | 55 |

Great App for viewing all of your investments at once! – Ken M.

I have a premium account, and while a new subscriber, I use Morningstar data extensively. The portfolio tracking feature is nice on the iPhone, and I especially like that I can also follow the same portfolio on my iPad (which you can’t do with Apple’s default Stocks app, because it doesn’t exist for the iPad). – Jeremy T

Morningstar Alternatives

While Morningstar is an effective investment research platform, you may prefer the features from these other investment sites.

Zacks

Zacks has many similarities to Morningstar Investor but it can be easier to find investment ideas with their Zacks Rank feature.

You can see stock and ETF rankings for free along with a limited research report.

Zacks Premium gives you full access to these features:

- Rank lists for stocks, funds and industries (short-term and long-term ideas)

- Focus List portfolio of 50 long-term investment ideas

- Analyst reports

- Stock screener with 45 predefined screens for value, growth, momentum and income factors

- Charting tools

- Portfolio tracker

You can try Zacks Premium for free for 30 days and then an annual subscription costs $249.

Motley Fool

Consider Motley Fool if you prefer receiving monthly buy recommendations for a specific investment strategy instead of having an abundance of research tools to find stock ideas.

Motley Fool Stock Advisor provides two new stock recommendations each month. The service also provides a list of ten “Starter Stocks” that can be a good fit for most portfolios and can be an attractive buy any time of the year.

As the platform has many active recommendations, you also receive weekly updates of the ten “Best Buys Now” highlighting companies with the best investment potential at the moment.

The investment strategy for each recommendation is a long-term holding period. The Fool recommends stocks they anticipate to outperform the stock market over a 3-5 year period and is willing to hold through bullish and bearish price swings when other newsletters may recommend selling.

While you will receive plenty of investment ideas and a brief write-up for each recommendation, this service lacks the in-depth analyst reports for stocks the newsletter doesn’t cover.

Special $79 Stock Advisor Introductory Offer for New Members

*Billed annually. Introductory price for the first year for new members only. First year bills at $79 and renews at $199.

Find out Motley Fool compares to Morningstar.

Summary

Morningstar Investor could be a worthwhile investment if you manage your investments and do in-depth research on mutual funds. However, their stock and ETF research can be valuable too.

You will have a variety of tools, research, and analysis from top analysts at your fingertips.