15 Best Investment Sites (For Research, Advice & News)

Some products in this article are from our partners. Read our Advertiser Discloser.

The best investment advice websites may help the average investor by providing suggestions about purchasing individual stocks and minimizing risk.

These stock market research websites offer expert-researched stock recommendations to help you reach your investing goals.

These stock picks can be less risky than investing by yourself and make researching investment ideas even easier.

Top Investment Sites

| INVESTMENT SITE | PROMOTION |

| Stock Advisor | Get 50% Off |

| Seeking Alpha | Get 25% Off |

| Stock Rover | 14 day Trial |

When you are just beginning to diversify your portfolio or want to own stocks that provide steady dividends, you only need to buy individual stocks that should outperform the market for the next three to five years.

Here are the best stock research websites to check out if you are looking for investment advice.

1. Motley Fool Stock Advisor

When you’re ready to buy individual stocks, consider Stock Advisor from The Motley Fool.

Stock Advisor is one of the best stock research websites for new and experienced investors since you’ll get access to several investing ideas as soon as you subscribe.

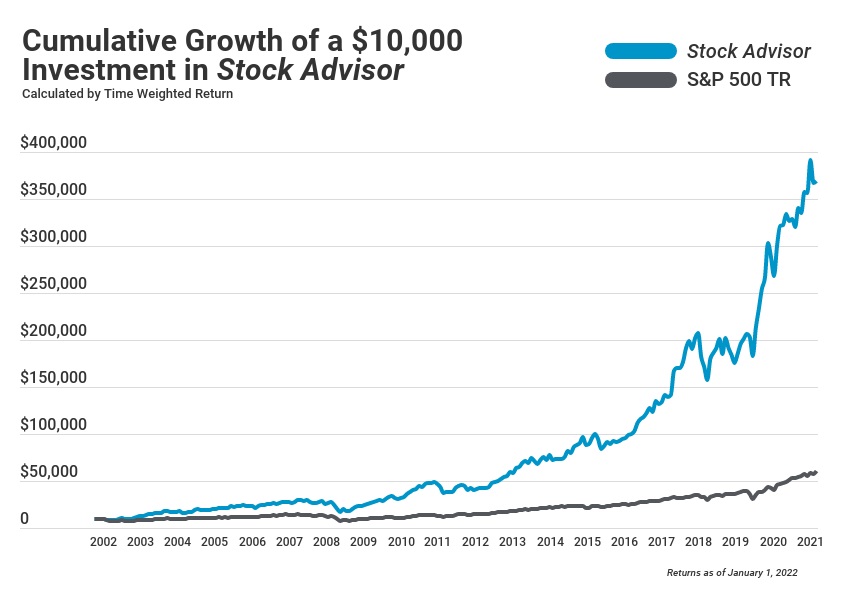

Since the service launched in 2002, brothers David and Tom Gardner have released two new monthly picks. David’s picks alone have outperformed the S&P 500 by 513.8%! Tom’s picks have outperformed the same benchmark by 88%.

While your S&P 500 index funds held during the same time period would have grown 93% by tracking the market performance, picking the right individual stocks can help you beat the market.

Each stock pick includes a short research report describing the company, reasons to invest in the stock now and why you might avoid the stock or sell your shares.

New investors may also appreciate the Starter Stocks list. This premade list recommends ten stocks that the Stock Advisor team believes fit most portfolios well. These stocks are for well-known companies.

Each starter stock can be less volatile than a monthly stock pick but has plenty of growth potential.

Stock Advisor recommends that investors buy at least three Starter Stocks before buying shares of the new monthly picks.

Before buying any stock recommendation, research separately from the investment site report. Take the time to understand how the company makes money and how it can lose or underperform the market.

How Much Does Stock Advisor Cost?

An annual subscription to Stock Advisor for new members is only $99 (normally $199). Billed annually. Introductory price for the first year for new members only. The first year bill is at $99 and renews at $199.

Stock Advisor is a bargain for the caliber of investment advice you receive. Similar newsletters only provide one monthly pick and don’t have a “starter stocks” list. It earned the top spot on our list of the best stock research websites.

Learn More: Motley Fool Stock Advisor Review or Stock Advisor Canada Review

2. Seeking Alpha

Seeking Alpha is arguably one of the best free investment sites. I personally subscribe to the daily Wall Street Breakfast email that includes a quick summary of the market’s top headlines.

This newsletter lets me quickly track any recent moves for my positions and stocks on my watchlist. You can also read articles to get investing ideas and review market commentary from Seeking Alpha contributors.

There are articles that list the bull case and bear case for a stock or ETF. I use these articles during the research phase to better understand an investment recommendation before deciding to buy or avoid it.

Investors who make several trades each month can benefit from Seeking Alpha Premium (Now $179 annually, normally $239).

Premium members also get access to a “Quant Ratings” system that can make screening stocks easier. Seeking Alpha recently launched its stock picking service called Alpha Picks, which allows you to get two stock picks to buy and hold per month.

It’s normally $199 per year, but you can get for only $99 with this link here, making it one of the best stock research website options.

Related: Seeking Alpha Vs Motley Fool: Which is Better?

Learn More: Seeking Alpha Review

3. Stock Rover

Stock Rover is one of the best stock research websites. They offer three plans: Essential, Premium, and Premium Plus. Each one offers levels of investment data, charts, ratings, margins of safety, and more.

Many investors think Stock Rover has one of the top stock screeners. In addition to evaluating potential investments using a specific metric, Stock Rover lets you find stocks using a “guru strategy.”

These custom screens model the methods that famous investors use to research stocks.

The Premium and Premium Plus plans will also monitor your portfolio. As your portfolio needs periodic rebalancing, Stock Rover will recommend potential trades.

This extra eye makes it one of the best stock research website options and can be helpful when you want advice for managing your portfolio.

Learn more: Stock Rover Review

4. Morningstar

One of the most widely respected investment rating sites is Morningstar. This is one of the best stock analysis websites for researching mutual funds and ETFs, but Morningstar analysts also research stocks.

Start a 7 day free trial today and save $50 on an annual Investor subscription with code WKW.

You may already be familiar with Morningstar because free investing apps use Morningstar ratings to help you screen prospective investments.

For example, a fund with a 5-star rating may have the top historical performance for its category.

As a disclaimer, excellent past performance doesn’t guarantee similar results in the future. That said, the ratings can help you find stocks and funds that you may choose to add to your investment portfolio.

Like other investment sites, you can access many free articles and video interviews to help you understand the markets and investing ideas.

These articles, a stock screener and portfolio tracker, come with a free Morningstar Basic membership. For in-depth analyst reports and a list of Morningstar’s favorite investments, you must purchase a premium subscription ($199 annually).

Morningstar Premium also includes additional stock screener and portfolio analyzer features.

Sign up for their 7-day free trial and get up to $50 off an annual membership with this link.

Cons

- High costs

- Clunky interface

Learn More: Morningstar Review

5. Zacks

Zacks is one of the best stock research sites and provides free commentary on potential investments. You can use Zacks investment research to find long-term and short-term investing ideas and learn more about the stock market.

To access the premade investment rank lists and in-depth analyst reports, you must join Zacks Premium. This is one of the more costly stock analysis websites, costing $249 per year after a 30-day free trial.

While any investor can benefit from Zacks Premium, it’s probably a better option if you follow a particular investment strategy.

The Zacks stock screener can filter by:

- Growth

- Value

- Earnings Surprises

- Best Industries

While Zacks has a robust stock screener, its “Rank Lists” can be an effective way to find stocks. There are lists for different industries and investing strategies.

Want to try Zacks out? Download their free report on 5 Stocks Set to Double.

Zacks investment research also assigns each potential investment a score. A higher score indicates the stock may have better investment performance.

In addition to the Zacks Rank Lists, you can read in-depth research reports for each stock. These research reports can describe the current pros and cons.

At $249 a year (after the 30-day free trial), you do get valuable research. Keep in mind you’ll have to invest more money so your investment returns can “pay” the annual subscription fee.

If you still need to buy your first stock, Zacks might not be the best option until you establish your investment strategy.

Learn More: Zacks Premium Review: Is It Worth It?

6. Investopedia

Investopedia is one of the best investment sites because of its educational database, market news articles, and investing simulator. It’s one of the best stock research sites.

New investors will appreciate the no-cost educational resources that many free investing apps don’t offer. You can learn about investing terms and strategies.

If you want to test investing ideas, you can make simulated investments with a $100,000 starting balance for free.

Before you invest your money with some investment suggestions, you can see how they play out with paper trades first.

You can also read market news articles that tell you what’s happening in the stock market and select industries. These articles may also list stocks benefiting or hurt by market events.

However, Investopedia never recommends which stocks to buy or sell.

7. AAII

You may have received envelopes in the mail from the American Association of Individual Investors (AAII). Many people regard AAII as a respected source for learning how to invest in stocks, ETFs, and more.

You can also use their model investment portfolios as an example to build your own investment portfolio. This feature makes it one of the best stock research websites.

An annual subscription only costs $49 a year. This makes AAII one of the best affordable stock research website options.

AAII offers other newsletters that focus on investing strategies like dividend investing. If you like the basic AAII membership, you may want to consider adding these subscriptions later.

Learn more: American Association Of Individual Investors (AAII) Review

8. Barron’s

Barron’s is a highly-respected investing publication that offers daily market insights and weekly stock market recommendations. You can subscribe digitally. A weekly print newspaper is also available.

Each week, Barron’s gives readers five new investment ideas from a team of individual stock pickers. Their recommendations represent different investing strategies.

Much like Stock Advisor by Motley Fool, these ideas focus on company fundamentals, so you don’t have to worry about short-term trades that require you to watch the stock market closely.

If you’ve read a copy of The Wall Street Journal, you will be familiar with Barron’s content format.

The same parent company owns both publications, but Barron’s focuses on stock investing, while the Journal is better for business news and current events.

Learn More: Barron’s Magazine Review

9. Kiplinger

Kiplinger is another great investment site known for its monthly personal finance magazine that offers investment recommendations and money management advice for every age, including millennials.

An annual subscription to the magazine costs $29.95.

Several columnists provide monthly investing ideas, plus each month features a special report of other stocks, bonds, ETFs, and mutual funds you might want to buy.

You can act on one of the new recommendations or follow one of their investing lists:

- Kip Dividend 15 (Best Dividend-Paying Stocks)

- Kip 25 Mutual Funds (Best 25 Mutual Funds to Own)

If you want to invest in individual stocks, I recommend James Glassman’s column. He mentions several stocks or ETFs to invest in and covers a different investing theme each month.

As always, research each pick before you buy to determine if it’s a good fit for you.

You won’t find the same level of deep stock market analysis as some of the other recommendations on this list, but Kiplinger ranks as one of the best financial magazines.

10. CNBC

CNBC is the most-watched investing news channel. To save time (and the cost of a cable TV subscription), you can visit their website to read their numerous articles for free. It’s one of the best stock research sites.

You’re going to find bullish and bearish sentiment like Seeking Alpha. Consequently, CNBC may be used as a stock research tool to understand the strengths and weaknesses of potential investments.

As you track your investment portfolio, the CNBC articles can help you quickly see if a stock remains a good investment.

Because CNBC is mostly news articles, read the bull and bear-side opinions for your potential investments.

Only reading bearish articles can cause you to panic sell. Likewise, only reading positive articles can cause you to buy stocks that might be too risky.

11. Benzinga Pro

Within Benzinga Pro, you’ll be able to screen stock tickers based on various metrics.

Plus, the trading platform delivers the latest stock market news and allows you to set up filters for your news so that you can easily stay up to date on what’s happening in the markets that matter to you most.

Depending on your needs, there are several membership levels. You can get started with a free version of the trading platform with limited functionality, like the stock market news articles, without any filtering options.

The next level up is the Basic package at $27 per month. But the most popular option is the Essential plan at $177 per month, with advanced newsfeed options, real-time scanners, signals, and more.

Plus, you can add a monitoring feature for unusual options activity for $27.97 per month. If you want more hands-on help building your portfolio, there’s even a mentorship opportunity focused on options. But it comes with a steep price tag of $347 per month.

Ultimately, you can use the stock research tools within Benzinga Pro to vet stocks before adding them to your portfolio. And the filtered newsfeed can come in handy if you are interested in a particular industry.

12. Trade Ideas

As a frequent trader, you’ll likely find much value in the stock screener features available through Trade Ideas.

While using the trading platform, you can simulate trading to understand how the AI systems interact with the stock market. Plus, explore stock news that aligns with your portfolio interests.

If you want to work with Trade Ideas, there are two paid subscriptions. You can either pay $118 per month for the Premium plan, or $59 per month for the Standard plan.

Of course, you’ll have access to more features if you opt for Premium. A few things that are for Premium members online include risk assessment tools, AI virtual trading analysis, and backtesting any ideas.

13. TradingView

Technical traders might find exactly what they are looking for in TradingView. With the paid plans, you can access extensive backtesting and chart customization options.

Free users will still find plenty of value with over 50 drawing tools, 100,000+ technical indicators, lengthy historical market data, and some chart customization options. The catch for free users is that you’ll face ads.

If you opt for a premium plan, the costs range from $14.95 to $59.95 per month. Those who pay annually tap into a discount. But if you aren’t sure whether or not it’s the right option, you can test it out with a free 30-day trial.

At any level, you’ll have access to the Community tied to TradingView. Within this community, you can see what other investors are saying or post thoughts of your own.

14. Yahoo! Finance

Yahoo! Finance has been a go-to source of market news for years, making it one of the best stock research sites.

As an investor, you can pursue the headlines to get a sense of what’s going on in the world of investments. But looking for opinions on both sides of the story is important. Otherwise, you could get drawn into a cycle of doom and gloom or unrealistic optimism.

The free version of Yahoo! Finance can be a bit distracting with all the ads. But plenty of information is available on a wide range of stocks.

If you want a more robust experience, you can opt for Yahoo! Finance+. Within this premium platform, you’ll find extra stock research tools and streamlined insights as you build your portfolio.

You can choose the Essential plan for $29.16 per month or the Lite option for $20.83. Either way, you’ll get an ad-free experience, trading ideas, customizable alerts, and more.

15. TradeStation Analytics

As one of the oldest online trading platforms, TradeStation Analytics earns a spot on this list of best stock research sites. In recent years, the platform has expanded from only looking at stocks to also providing tools for crypto investors through their ‘Crypto Universe.’

Active investors will find robust tools from this online broker to manage their platforms via desktop and mobile settings. The extensive selection of stock research tools can help you simulate strategies and look for opportunities.

The zero commission trading opportunities mean you won’t pay to make trades here. But newer investors or those looking to take a more passive approach to investing don’t necessarily need what TradeStation offers.

Are Investment Sites Worth It?

The best stock research sites may simplify buying individual stocks and sector ETFs. The top sites can highlight some of the best (and worst) potential investments.

Nonetheless, you will still need to perform your own research to decide if their recommendations fit your investment strategy before you start making trades through an online broker’s trading platform.

For example, investing in a fast-growing tech stock probably isn’t a good idea when you want a blue-chip dividend stock.

If the investment site charges a fee, you must decide if the quality of stock research is worth the cost. When the answer is “yes,” you must decide if you will buy enough stocks to justify the fee the best stock market websites charge.

The Right Way to Buy Individual Stocks

Many online brokers make it easy to buy stocks without fees. Unfortunately, online brokers won’t provide individual advice, so it can be easy to make a risky portfolio. These suggestions may help you as you start investing.

Diversify Your Portfolio

Buying stocks with the most exciting headlines or investing in brands you use can simplify things.

However, some online brokers and investing sites may recommend a model portfolio of domestic and international stock and bond sectors.

You can use this recommendation to find stocks and funds that fit the recommended sectors and asset allocation.

If you have yet to invest your first dollar, consider investing in index funds and target-date retirement funds through your online brokerage account.

These funds expose you to most publicly traded stocks and instant diversification with low fees. As a result, you can minimize your portfolio risk.

How Much Stock to Buy

When buying stocks, it’s important to pay attention to asset allocation. You don’t want one stock to be too large of a position in your portfolio.

For instance, if a single stock is 50% of your portfolio value and the share price goes to zero, you lose half of your money.

To limit your downside risk, you may consider only having a maximum 5% portfolio allocation for each stock you buy. If you have $10,000 in your brokerage account, each stock position might only be $500.

Other investors might invest as much as 15% of their portfolio in one stock. Make sure you are comfortable with the amount of stock you buy. With each purchase, make sure you maintain a diversified portfolio.

When you invest small amounts of money, you may assign a 1% or 2% allocation per stock. If the stock fails and it’s just a 2% allocation, you will only lose a small amount of cash.

Assigning a small allocation can also be good when you invest in risky stocks with a volatile share price.

Avoid Common Investing Mistakes

It’s common for new investors to have blunders when they first get started. Investment sites may help you minimize the number of missteps you make.

Using investment sites to purchase stocks can help you avoid these common mistakes:

- Investing in company stock just because you work there

- Only buying stock for brands you use

- Trading stocks on headlines

- Investing in stocks without understanding the company’s business model

- Having a single position that’s too large for your risk tolerance

- Not performing your own due diligence

Always remember that stock investing isn’t a “get rich quick” scheme.

Do Your Research

You have many options when it comes to investing. You can use robo-advisors, mobile apps, personal retirement accounts such as IRAs, or investment management companies such as Charles Schwab or Fidelity to manage your investments.

The best stock research sites help educate you on the best trading platforms, exchange-traded funds, cryptocurrency, and other investing platforms.

Although there are successful day traders and momentum traders, most successful investors follow the “buy and hold” approach and ignore the periodic share price dips.

This is why getting investment advice from a third-party resource is so important. Investing in stocks and ETFs can be easy if you use the proper resources and information to manage your investment accounts.

Comparison of Investment Sites

| Investment Site | Annual Base Price | Rating |

|---|---|---|

| Motley Fool Stock Advisor | $99 | 4.5 |

| Stock Rover | $79.99 | 4.0 |

| Investopedia | $0 | 4.0 |

| Zacks | $249 | 3.5 |

| Seeking Alpha | $359 | 4.0 |

| AAII | $49 | 4.0 |

| Barrons | $179 | 3.5 |

| Kiplinger | $29.95 | 4.0 |

| CNBC | $299.99 | 4.0 |

Summary

Professional investors rely on many of the best stock market websites mentioned above to research potential investments.

You can access the same information without paying hefty advisory fees or subscribing to an expensive investing newsletter.

When you’re ready to invest in stocks and ETFs as a DIY investor, these investment sites can help you with your research.

Investopedia has become the quasi-authority on definitions and understanding. Zacks has always been good and the free version of Morningstar I visit. What has been excellent is that while transaction free trading is on the rise, so is cost-free institutional level information that was once reserved for paying clients. I’m a Channelchek fan myself. They cover my sectors and I trust they aren’t trying to sell me anything.

Thanks for sharing!

What about Morningstar is anyone using it? Worth a try?

We have a review on our site you can search and check out!

Motley Fools recommended some very good stocks. I have my own strategy, but hearing it from them confirms my thought process.

This is the only paid subscription I’ve done. Highly recommend it for long term or short term investors.

Zack’s are so expensive and they have * one star ratings i am ultimate member paying them 2999.99 per year. Need some advice, thanks.

I feel Zack’s basic service is ok, but their higher paying (more expensive service offerings) get information earlier than other clients. By the time I am reading information to buy a stock, stock is already up by 5 to 15% !. That means somebody is ahead in this game! You did not mention Value line service which is one of the best service, little more expensive though.

Thanks for the feedback David. We will take a look at Value Line.

I am a Motley Fool subscriber and have been very happy with that for several years. I though feel the services are very much focused on the US markets, and I would like to diversify my portfolio towards EU and Asia. Anyone having some good recommendations for similar services covering those markets more?

What about SuperStockScreener.com? I’ve been subscribing for years and their picks have made me a lot of money.

Thanks for the suggestion!

I rarely see anyone recommend Investor’s Business Daily. I have subscribed since the 1980’s and it has proven to be invaluable to me. Whether you subscribe to the CANSLIM principle or not, it contains a wealth of information not found elsewhere.

Thank you for sharing your investing story with us!