Is Seeking Alpha Premium Worth It?

Some products in this article are from our partners. Read our Advertiser Discloser.

Seeking Alpha is one of the most well-respected investment research platforms. It’s possible to receive coverage for stocks and ETFs plus discover different investing ideas.

If you regularly swing trade stocks or invest in individual stocks, high-quality research is essential to be a successful investor. It’s why I regularly use this service to learn more about potential investments and screen stocks.

While this online community offers a Basic free plan, you can upgrade to Seeking Alpha Premium, but is it worth it? Find out in this review.

Overall Rating

Summary

Seeking Alpha Premium gives investors unlimited access to its investment research articles and the Quant Rating system. Investors can quickly find reasons for other investors to buy or avoid a stock.

-

Ease of Use

5

-

Research

4

-

Cost

4

Pros

- Access to Investing Ideas articles

- Reviews most stocks and ETFs

- Can track your investment portfolio

Cons

- High monthly cost

- Information overload

- Not for technical traders

What is Seeking Alpha?

Seeking Alpha is an online community of investors that’s like Bogleheads but for investing in individual stocks. Further, there is additional coverage for ETFs.

You can get investing newsletters about different topics, including daily market headlines and analysis of individual tickers and market sectors.

When researching investing ideas or doing a portfolio checkup, you can read analysis articles that professional investors write covering specific stocks, funds, and asset classes.

Over 7,000 contributors write approximately 10,000 articles every month, according to Seeking Alpha.

Most companies have articles with bullish and bearish commentary, which helps you quickly estimate the positives and negatives of a stock’s potential performance. Personally, I enjoy following specific contributors and stocks.

You can also access the latest market news, read earnings call transcripts, and monitor your portfolio performance.

What Does Seeking Alpha Cost?

There are three subscription plans to choose from when using Seeking Alpha:

- Basic: Free

- Premium: $239 per year

- Pro: $499 annually and billed upfront after a 14-day free trial

Use This Link to take advantage of Seeking Alpha’s Summer Sale!Starting on June 28th – July 6th (end of day EST), Alpha Picks + 1 month FREE Premium will be priced at $449

Most investors will only need the Basic or Premium membership plan. You can try Seeking Alpha Pro with a 14-day free trial.

The most expensive membership plan, Seeking Alpha Pro, provides exclusive newsletters and more robust screening tools.

For instance, you can screen stocks by investing ideas or by shorting stocks. Plus, you will also have your own VIP Editorial Concierge.

Seeking Alpha Premium: In-Depth Review

You might already use the free version of Seeking Alpha but are tired of hitting the paywall to access exclusive content.

Upgrading to Seeking Alpha Premium gives you access to more advanced information, including rating tools and a stock screener.

This extended access can make researching and following investing ideas easier.

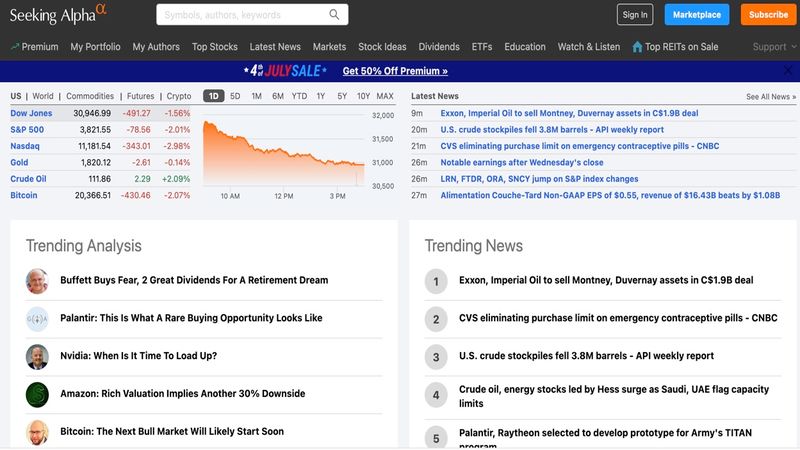

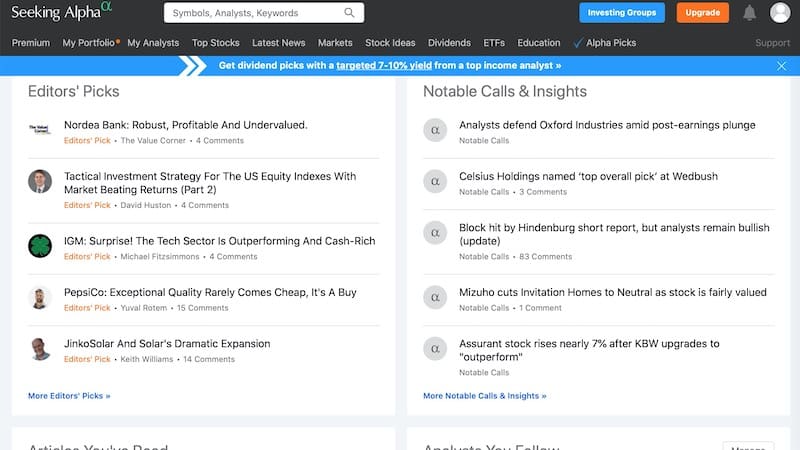

Find Investing Ideas

One of the best reasons to use Seeking Alpha is for its numerous investment ideas articles. They have more ideas than many of the best investment sites.

For example, you can scroll through these resources on the main page alone:

- Editor’s Picks for the top-rated articles

- Notable calls and insights

- Trending market news

- Top-rated stocks

Additionally, you can search for a specific stock or fund if you already have an idea. I enjoy being able to browse the headlines and stock ratings to learn about new companies and determine what’s trending and how my portfolio is affected.

Most investment ideas articles are available for free for the first ten days. However, Premium members get unlimited access to all investing ideas articles.

Contributors share their predictions in article format, and the Seeking Alpha editorial team screens the article for statistical accuracy.

Both Basic and Premium members can comment on whether they believe the author’s prediction is correct.

These articles present the bullish, bearish, and neutral case for a stock. Of course, each piece is a matter of opinion. You should read both the bull and bear case to perform thorough investment research.

Also, having unlimited access lets you read previous articles from the same author covering a stock that interests you.

If you’re looking into buying a new stock, the company’s investor relations page and Seeking Alpha can be two essential research sources. Of course, none of the content is personal investment advice, but it helps you complete your due diligence.

You might also use Seeking Alpha as a companion to Motley Fool Stock Advisor, which recommends two monthly stock picks.

Stock Ratings

Seeking Alpha Premium lets authors assign one of five ratings to a stock or ETF:

- Very Bullish

- Bullish

- Neutral

- Bearish

- Very Bearish

Both authors and the Seeking Alpha scoring tools follow this rating system. Basic members cannot see the author or Seeking Alpha ratings.

In addition to a general rating for a stock ticker, you can read a brief “Bulls and Bears Say” synopsis. This quick read lets you see why a stock is worth buying and why you might avoid or sell shares.

I particularly enjoy Seeking Alpha’s Quant Ratings, which score stocks by investment style. For instance, you can see a specific rating for factors including valuation, profitability and momentum.

Article Sidebar

Next to each article, Premium members can see an article sidebar.

This sidebar contains extra details:

- Author’s stock rating (i.e., bullish, neutral or bearish)

- Stock price chart

- Ratings from proprietary Seeking Alpha scoring models

With Seeking Alpha, the sidebar can help you quickly understand and compare the author’s sentiment of a specific stock. This tool can also help reduce your research time per article.

Discount online brokerages like Fidelity or Schwab may offer similar ratings using their proprietary formulas. What I appreciate about this platform is that you can view the consensus of the article authors, Wall Street analysts, and Seeking Alpha’s Quant Ratings to look for overlapping opinions and potential divergences.

Author Ratings

Premium subscribers can see the long-term track record of the contributors submitting investing ideas. This data can help you find contributors that make better long-term predictions.

In addition to the author’s rating history, you can see each contributor’s favorite stocks. Some contributors work for well-known investment firms.

As a result, you can get an inside look at their investment strategy while avoiding high advisor fees.

You can also access plenty of viewpoints with a flat subscription cost. It’s also easy to avoid the opinions of unmoderated investing groups, where you can easily receive stock tips from a total stranger that may have minimal investment experience.

Before digging too deeply into an author’s commentary, I take the time to view their rating history and read comments left by readers to determine their accuracy. No investor will be 100% accurate, but some are more consistent.

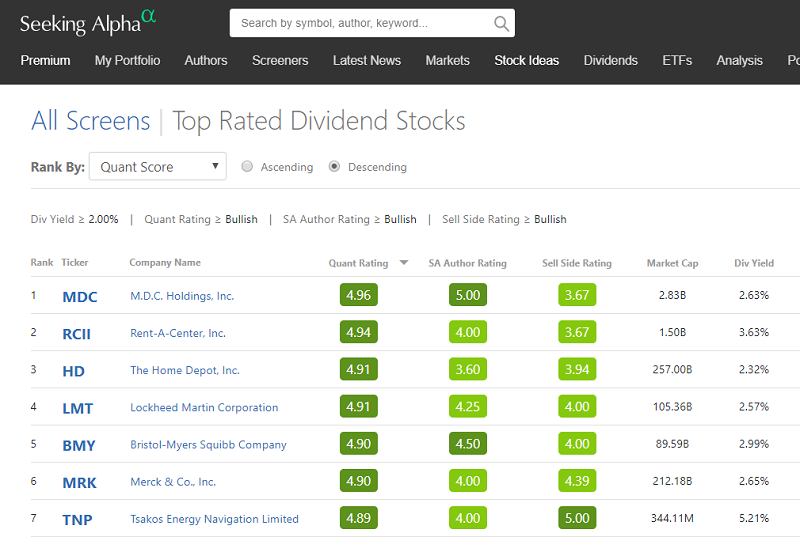

Stock Screening Tools

Premium members have access to in-depth stock screening tools.

Stock Screener

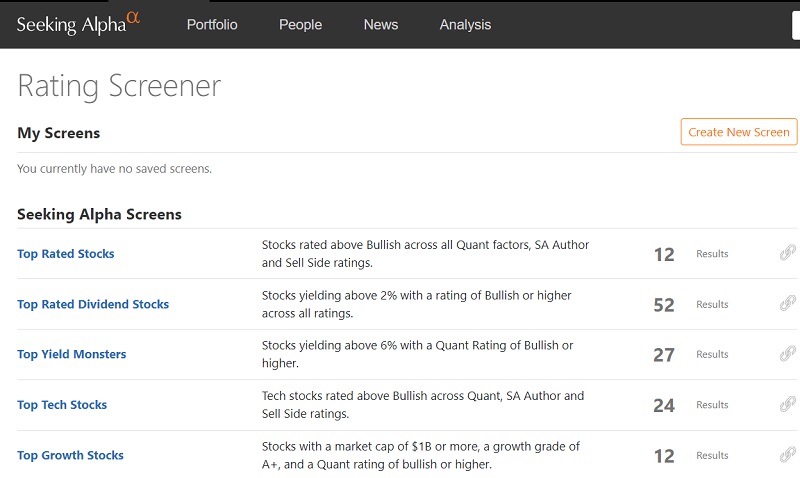

Like most online brokerages, Seeking Alpha has a stock screener to run your custom filter, including Seeking Alpha’s author ratings, market cap, or a fundamental rating like growth or momentum.

You can use a premade screen to find top-rated stocks and ETFs.

Here are some of the premade Seeking Alpha screens:

- Stocks with an above bullish rating across all rating factors

- Dividend stocks yielding at least 2% and with an above bullish rating

- Best growth stocks with a minimum $1 billion market cap

- Best value stocks with a minimum $1 billion market cap

You can also browse the best stocks by market sector, such as technology and consumer staples. These premade screens can be a quick way to find potential trades and fine-tune an investing idea.

Most investing apps don’t offer in-depth stock screeners so you need to rely more on investing newsletters to present stock ideas or you look for trending symbols. This tool makes it easier to personalize your watchlist and find stocks overlooked by others.

This screener is one of the most robust that I’ve used. It’s also easy to navigate and its color-coded ratings can help you identify the best investment ideas.

Quant Ratings

Technology is transforming investing from an art into a science, as computers can analyze lots of data in minimal time. Most professional investors use quantitative analysis to research stocks and manage their portfolios.

Seeking Alpha has a proprietary “Quant Ratings” system to help ordinary investors understand complex numbers.

The quant score derives from these factors:

- Value

- Growth

- Profitability

- EPS revisions

- Stock price momentum

Each stock undergoes a backtest to calculate its final quant rating.

While every person’s research process is different, my eyes gravitate to the Quant Ratings sooner instead of later. They make the initial research process a lot easier.

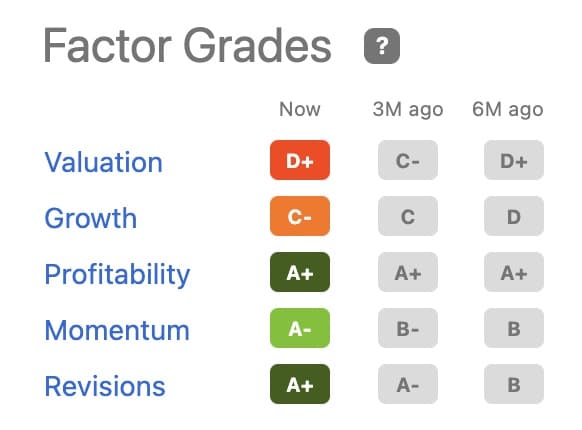

Factor Scorecard

In addition to screening stocks by quant score, you can analyze the underlying stock fundamentals. Seeking Alpha compiles a factor scorecard compiling the stock’s value, growth, profitability, momentum, and EPS revisions.

When grading real estate investment trusts (REITs), Seeking Alpha scores the Funds from Operations (FFO) and Adjusted Funds from Operation (AFFO) as well.

The scorecard ratings for these five factors range from “A+” to “F.” Like your school grades, an A+ is the best score a stock can receive for each item.

You can see why a stock receives the rating it does by clicking the letter grade. They also show you the underlying data to determine the score.

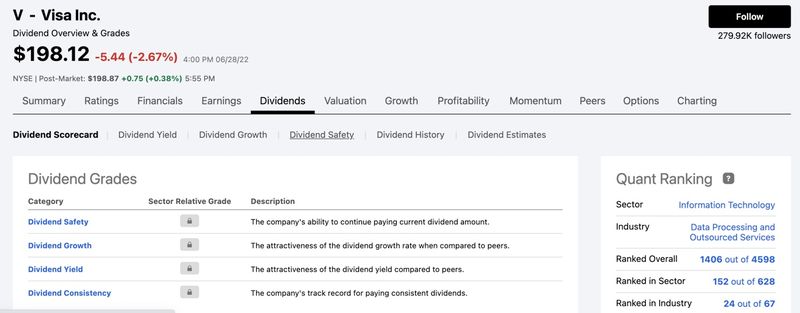

Dividend Stock Scorecard

Do you want to earn dividend income? For your long-term investing ideas, the dividend stock scorecard can help you avoid stocks with unsustainable yields.

Dividends are sometimes overlooked as people focus on share price growth. The scoring factors are essential for dividend investors who want reliable and sustainable yields.

For example, if an attractive dividend is one reason I’m considering a stock, the dividend helps you estimate if the current payout is safe and likely to grow. You can also compare it to the competition if you’re not loyal to a particular brand.

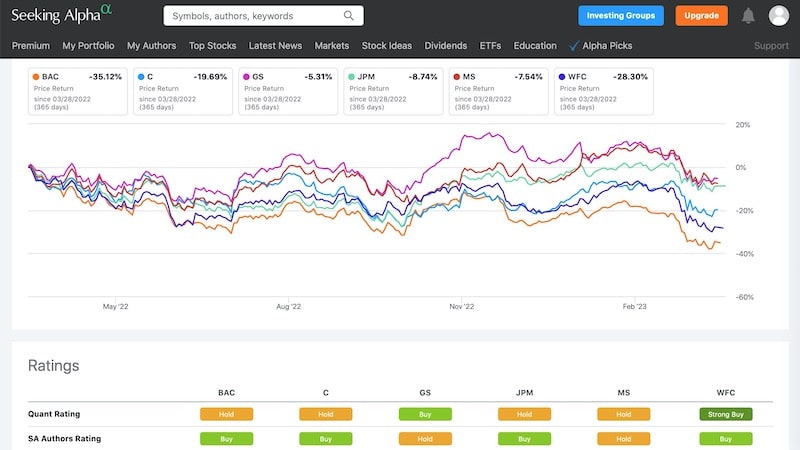

Stock Comparison Tool

You can compare multiple stocks by quant rating and factor with a single search screen. Many full-service online brokers offer this tool, but free investing apps most likely don’t.

The platform also lets you make peer comparisons to see how the metrics stack up between similar stocks and funds.

What makes this tool unique is the ability to compare up to 20 symbols at once. You can also get an in-depth look at the company fundamentals and Quant Ratings instead of just the price history and select metrics such as the PE ratio.

Earnings and Conference Call Transcripts

A premium subscription lets you listen to audio recordings of earnings and conference calls. You can also print and download the presentation slides and transcripts.

As a Basic member, Seeking Alpha only lets you read the transcripts online.

Premium members can also read up to 10 years of financial statements. However, Basic members can only access it for up to five years.

Having access to these resources can encourage you to complete the due diligence process. For example, I like breezing through the earnings transcripts as you can uncover details that the market headlines and commentary may overlook.

Earnings Forecasts

All Seeking Alpha members can see a stock ticker’s dividend payment schedule and company earnings. Premium membership lets you see extra factors, including earnings estimates and surprises.

Notable Calls

In addition to the Seeking Alpha scoring systems and the investing ideas articles, you can access “notable calls” that Wall Street professionals and fund managers make.

This feature is another source of finding investment ideas. You can also get a glimpse into how “smart money” is investing the cash of their wealthy clients.

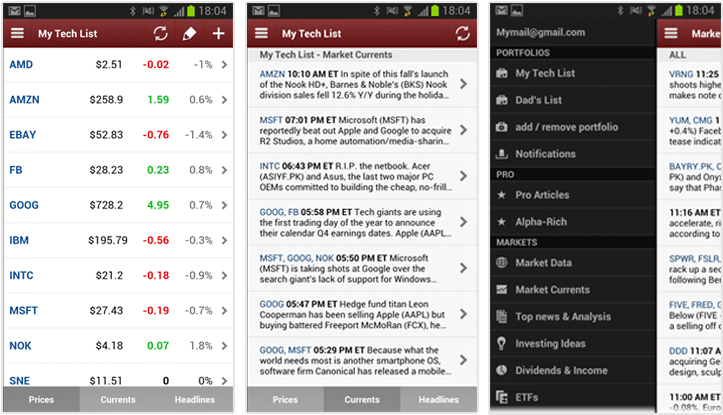

Portfolio Monitoring

You can monitor your portfolio performance in Seeking Alpha. Basic members can track their portfolio holdings and receive some alerts.

Premium members get more features that can help you be among the first to see news on positions you own.

Sync Brokerage Accounts

Premium subscribers can link most US brokerage accounts to Seeking Alpha. If you have multiple brokerage accounts, you can track all of your investments in one place.

Basic members must manually enter each stock they want to track.

Like many investors, I have multiple brokerage accounts, and logging into each app is time-consuming and easy to forget. The automatic syncing lets me effortlessly track the performance of each account and my total portfolio.

Anticipate receiving daily portfolio summaries with these details:

- Portfolio health score

- Dividend safety score

- Today’s gain

- Total performance

- Stock warnings (when at risk of performing badly)

- Relevant articles, news and transcripts

Personalized Alerts

You can receive breaking news, upgrade, and downgrade alerts for your portfolio holdings.

Premium members can read the full alert directly from their email inbox instead of visiting the Seeking Alpha website.

This personal service can make Seeking Alpha easier to use than your brokerage.

News Dashboard

Seeking Alpha members can use the platform to read market headlines and ticker-specific news. However, Premium members have enhanced in-article capabilities for further reading.

Upgrading also gives you a fully functional news dashboard. You can have articles for specific sectors and investment strategies appear first.

The news dashboard can be a good alternative to CNBC or an expensive subscription to The Wall Street Journal or Barron’s.

Earnings Calendar

You can view an earnings calendar that lists upcoming calls and reports from stocks in your portfolio. Premium members can also see EPS revision scores as the market adjusts to the latest company reports.

Monitor Portfolio by Valuation Metrics

In addition to tracking the stock price, you can view your position performance by specific valuation, fundamental, and author rating metrics.

If there are potential weaknesses, you can see which rating has a lagging score for your portfolio. You’re able to see the ratings for each individual stock, which can help you decide which positions to trim.

This portfolio review doesn’t evaluate stocks by position size like some checkup tools do but primarily considers the underlying quality of the investment. As a result, I primarily use this tool to see if my holdings are living up to their original potential or if the risk exceeds the potential reward currently.

Other Seeking Alpha Features

Seeking Alpha Premium may have all the features you need to research stocks and track your portfolio.

These features are available to all Seeking Alpha members and help you get more out of Seeking Alpha as your primary source for stock market research.

Marketplace

Several Seeking Alpha contributors offer a subscription service similar to an investing newsletter. This content gives in-depth analysis and model portfolios you won’t see in the free Investing Ideas articles.

Podcasts

Seeking Alpha hosts eight different investing podcasts. Some podcasts cover the daily market happenings, while others focus on specific themes like trading stocks or investing in ETFs.

You’ll receive fifteen free newsletters with different themes, including the morning market headlines and focused sectors. You can quickly find links to relevant articles in each issue. I have personally browsed Wall Street Breakfast for nearly a decade.

Stock Ideas

The Stock Ideas feed collects articles with investing themes. The Seeking Alpha homepage shows a list of pieces that people are reading the most. Visiting both places lets you find more articles that might interest you.

Some of the idea themes you can browse include:

- Long ideas

- IPO analysis

- Quick picks

- Fund letters

- Editors picks

- Stock ideas by sector

You might also see company releases in the Stock Ideas section as their news team periodically publishes articles.

Investing Strategy

The Investing Strategy section features articles that can help shape your overall portfolio investment strategy. Other write-ups are for financial advisors, but regular investors may also appreciate them.

Who Should Avoid Upgrading to Seeking Alpha Premium?

Investors using a robo-advisor or not investing in individual stocks or ETFs should avoid Seeking Alpha Premium.

New investors may stay with the basic version of Seeking Alpha and use the platform to read articles on investing ideas. However, you must upgrade to read articles at least ten days old and access the Seeking Alpha stock ratings.

Long-term Seeking Alpha users (such as myself) may also find upgrading worth it to have unlimited access as before when the platform was ad-supported. In addition to the article library and ratings, the portfolio monitoring tools are an all-in-one solution.

Unlike investing newsletters recommending one or two monthly stock picks, Seeking Alpha is a research tool that presents the buy and sell reasons for each stock. But you must decide what to invest in.

Also, if you prefer investing in mutual funds, Morningstar Premium can be a better fit.

Frequent traders who rely on technical analysis and charting are less likely to benefit from the Premium service as it primarily caters to fundamentals. The quant ratings can make it easier to find potential stocks and read about insights from other investors.

The capabilities can be good for casual traders and competitive with most brokerage services.

Alpha Picks

Seeking Alpha recently launched a service called Alpha Picks, where you can get two stock recommendations to buy and hold per month. Consider this option if you want a model portfolio and find the regular platform too open-ended.

Here is what else you get:

- A detailed explanation of why each stock is rated so highly

- An alert if we think you should sell one of the stocks in the service

- Regular updates on current ‘Buy’ recommendations

Normally $199, but right now you can get Alpha Picks for only $99.

Positives and Negatives

Pros

- Covers most stocks and ETFs

- Unlimited access to investing ideas articles

- Quant Ratings for most stocks

- Can track personal portfolio performance

- Listen and download company call transcripts and presentations

Cons

- Plan fees can be too high for casual investors

- Few technical analysis tools

- Doesn’t recommend stocks to buy

- Minimal coverage for mutual funds

Is Seeking Alpha Premium Worth It?

Yes, Seeking Alpha Premium is worth it if you hold several individual stocks and want to save time monitoring your portfolio. I like the recurring portfolio updates that raise awareness about asset allocation and stock-related news.

You might also choose Premium if you make several monthly trades and rely on the fundamental analysis from other investors.

It’s difficult to justify the monthly cost if you only invest small amounts of money. Having a brokerage with useful research tools and analyst reports also makes upgrading to Seeking Alpha Premium not worth the extra cost.

You should consider joining Seeking Alpha Premium in these instances:

- Hold at least five individual stocks

- You are a serious investor

- Like to research stocks and ETFs

- Want access to Seeking Alpha content older than ten days

Seeking Alpha Alternatives

If you are looking for another option other than Seeking Alpha, check out Zacks, which is currently offering a free report on 5 Stock Set to Double.

Motley Fool is another investing service that provides stock picks on a regular basis. With their Stock Advisor service, Motley Fool sends out a list of stock picks every month for as little as $79 for new members. Billed annually. Introductory price for the first year for new members only. The first year bills at $79 and renews at $199

Related article: Seeking Alpha Versus Motley Fool

Summary

Seeking Alpha Premium can be worth it for active investors who rely on research. Hopefully, this Seeking Alpha review showed you valuable insights that you won’t necessarily get from your brokerage research platform or free stock screening tools.

However, casual investors should consider sticking with the free version instead.