Credit Saint Review: Is it Worth The Cost?

Some products in this article are from our partners. Read our Advertiser Discloser.

As you may know, your credit score affects many areas of your life. Not only does it affect your ability to borrow money for things like mortgages, but it can also affect your ability to get a job.

Your credit score can impact how much you pay for insurance as well. Credit scores can be damaged for many reasons.

Perhaps you went through a rough patch in life and couldn’t pay the bills on time for a bit.

Or maybe there are errors on your credit report. Whatever the case, there are companies that can work to help you improve your credit score.

This review will tell you exactly how Credit Saint Credit Restoration company works.

It will also inform you about other relevant information on the company so you can decide if you want to work with them to improve your credit.

Overall Rating

Summary

Credit Saint has a 4.2 rating on Trustpilot and an A+ rating with the Better Business Bureau. The one downfall we see with Credit Saint is that it may be too expensive for some struggling individuals and families to be able to afford. But if you do have the money to afford their services, Credit Saint has a great program in place to help you improve your credit score.

-

Ease of use

4

-

Customer service

5

-

Availability

3.5

Pros

- Customer service

- Low fees

- Ease of use

Cons

- Limited availability

- Higher first-time work fee

What is Credit Saint?

Founded in 2004, Credit Saint is a New Jersey-based credit restoration company. They work with people throughout the United States to help them resolve credit report issues.

Many people have inaccurate, old or unproven marks on their credit reports. Those negative reports can hinder you from moving forward in life.

Credit Saint may be able to help you improve your credit record and credit score and ensure all of the information on your report is up to date.

Credit repair company review sites have given the company top ratings. Plus, it has an A+ rating with the Better Business Bureau.

Trustpilot Rating: 4.2 out of 5

How Does Credit Saint Work?

Credit Saint takes a multi-faceted approach in helping clients improve their credit. First, they start by educating clients on the credit rating process. The company has trained credit counselors with knowledge and experience in the credit repair industry.

During your first call with Credit Saint, you’ll get a free consultation. In this step, Credit Saint assesses your credit report. Then they highlight areas that need to be addressed.

Your Credit Saint advisor will show you how to understand the information contained in your credit report. And they’ll share what factors impact your credit score.

After that, you’ll choose from one of three plans the company offers. Each plan provides a different level of help when it comes to repairing your credit. We’ll talk more about that in a bit.

From there, your advisor will work with you to improve your credit score. You’ll use their online portal, Credit Saint Online, to monitor your progress.

The Credit Saint website says that most clients start seeing an improvement in their credit score within 45 days of working with the company.

And the company offers a 90-day 100% money-back guarantee if no negative credit report items can be removed within that first 90 days.

Is Credit Saint Secure?

Yes. Credit Saint has been in the credit restoration business for over 15 years. And they’ve worked hard to become one of the higher-rated credit restoration companies in the business.

Credit Saint also takes steps to verify your identity before they provide you with services. Once you’ve proven your identity, they can begin work on your credit report.

What Does Credit Saint Cost?

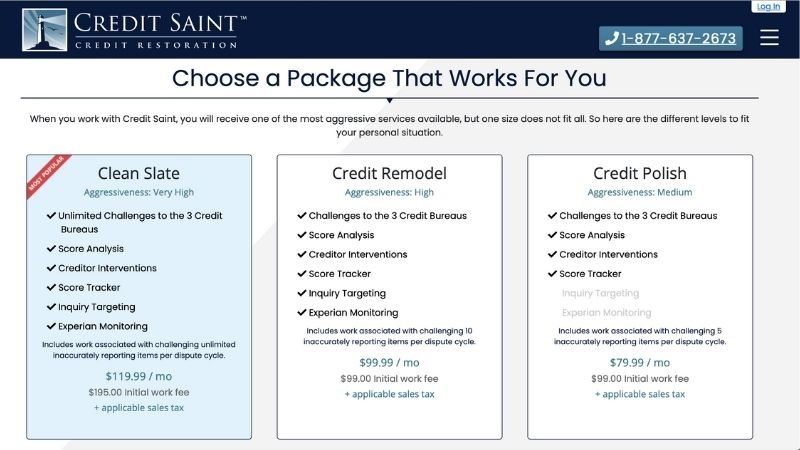

Credit Saint offers some of the lowest monthly fees in the credit restoration industry. Clients can choose from three different packages. Each package has what’s called a “First Work” fee, followed by a monthly fee.

The First Work fee covers the initial work of reaching out to creditors to help clean up your report.

The monthly fee covers the cost of monitoring your credit report, as well as working to get changes made to the report. This fee also covers the cost of your credit counselor’s time in communication with you.

Since the credit restoration process takes time, companies must charge a monthly fee to cover the work of your credit advocate.

Here’s an outline of each package, what it costs and what it has to offer.

Credit Saint Packages

Each of the credit clean up packages Credit Saint offers is designed for varying levels of help. Look at the different packages and see which one might be right for you.

Credit Polish Package

The Credit Polish package includes the following benefits:

- Full access to Credit Saint Online

- Toll-free phone support

And the following types of items challenged:

- Late payments

- Identity theft items

- Charge-offs

- Collection items

The Credit Polish package allows you to get up to five inaccurately reported items corrected or removed. This package can be right for those who just want basic help with minor credit report blemishes. Or for those on a tighter budget.

Cost: $99 First Work fee, $79 per month

Credit Remodel Package

Credit Saint’s Credit Remodel package is more comprehensive and offers some additional benefits over and above the Polish package.

- Full access to Credit Saint Online

- Toll-free phone support

- Escalated information requests

With the escalated information request feature, your Credit Saint counselor will go the extra mile to see if they can get any credit dispute rejection item removed.

They’ll draft more letters to the appropriate creditor, and document any intent you have to reach out to federal authorities regarding the matter.

The following types of items are challenged when you sign up for the Credit Remodel package:

- Late payments

- Identity theft items

- Charge-offs

- Collection items

- Bankruptcies

- Repossessions

When you sign up for this package, Credit Saint credit counselors can work to see if any of the information regarding past bankruptcies or repossessions can be removed or corrected too.

The Credit Remodel package allows you to get up to ten inaccurately reported items corrected or removed.

This package might be good for you if you have repossessions or bankruptcies in your past. Or it may be useful if you just want a more comprehensive clean up of your credit report.

Cost: $99 First Work fee, $99 per month

Clean Slate Package

Credit Saint’s Clean Slate package is the most comprehensive package the company offers. Included with the Clean Slate package are the following benefits:

- Full access to Credit Saint online

- Toll-free phone support

- Escalated information requests

- Dispute Avalanche

The Dispute Avalanche feature allows Credit Saint credit counselors to challenge all questionable negative items in your credit report at once. It’s kind of like an Escalated information request “plus.”

The following types of items can be challenged when you sign up for the Clean Slate package:

- Late payments

- Identity theft items

- Charge-offs

- Collection items

- Bankruptcies

- Repossessions

- Judgments

When you choose the Clean Slate package, the Credit Saint credit counselors can work on helping you clean up judgments as well.

This package is the most aggressive one Credit Saint has to help you clean up your credit.

The Clean Slate package allows you to get unlimited inaccurately reported items corrected or removed. It could be the right package for you if you have a lot of issues on your credit report. Or if you are interested in quick action on your report.

Track Your Progress, Learn Better Credit Management Techniques

Credit Saint keeps you up-to-date on the progress they’re making with your online account page. The online account page contains a timeline of actions the credit counselor takes, a progress report and a credit analysis piece as well.

You can check your account page at any time to see how things are going with your credit improvement plan.

Your credit counselor will also show you what you need to do to build new, more positive credit reporting. And you’ll get step-by-step instructions on how to do this.

Cancellation Policy

Note that all Credit Saint programs come with the ability to cancel any time. There are no contracts and no minimum amount of months you need to complete with the program.

However, if you want the 100% refund, you do need to cancel within 90 days of signing up. And remember that the refund comes with the caveat that they haven’t removed any negative remarks from your credit report.

Positives and Negatives

As with any company, there are both positive and negative aspects of Credit Saint. Here are a few pros and cons you may be interested in knowing.

Pros

Personal Advisory Team for All Clients

When you work with Credit Saint, you’ll be assigned a personal advisory team. Your team will know exactly where you are in terms of progress. That means you won’t have to explain your situation over and over again to different representatives.

Clearly Outlined Prices and Services

Credit Saint tells you upfront what they can do for you, and what it will cost. They describe their three available plans clearly and accurately.

90-Day Money-Back Guarantee

Many credit repair companies offer a money-back guarantee. However, most don’t offer their guarantees as far out as 90 days.

If Credit Saint doesn’t remove any negative items from your credit report within the first 90 days, you are entitled to a 100% money-back refund.

Comparatively Low Fees

Credit Saint’s monthly fees are among the lowest in the industry. That means you’ll be paying less for one of the highest-rated credit repair service plans in the country.

Highly Rated Customer Service

Credit Saint prides itself on providing good customer service. Their consultants are known to be friendly, helpful and understanding.

A+ Better Business Bureau Rating

Credit Saint has had an A+ rating with the Better Business Bureau for over twelve years straight. They’ve got a proven history of treating clients well.

Cons

Here are a couple of potential downsides about Credit Saint.

High “First Work” Prices

Credit Saint’s First Work prices are a bit high compared to other industry experts. But you might find that their lower monthly fees make up for the higher First Work prices.

Not Available in All States

Due to individual state laws, Credit Saint can’t work with clients in Georgia, South Carolina or Kansas. But if you live in one of the other 47 states, Credit Saint may be able to help you repair your credit.

FAQs

You might be wondering if it’s possible to improve your credit. Here are some things you should know about improving your credit score.

Can I Repair My Credit on My Own?

Yes, you are legally entitled to repair your credit on your own. The Fair Credit Reporting Act of 1970 made citizens legally entitled to certain rights regarding their credit. For this reason, you get access to information such as:

- The right to know what information is on your credit report

- The right to dispute incomplete or inaccurate information

- Access to information in your report that might have been used against you

- Access to your credit score (although you might have to pay to get your score)

- The right to get one free copy of your credit report each year through www.annualcreditreport.com

Also, consumer reporting agencies are required by law to repair inaccuracies, errors or unverifiable information on a person’s credit report.

The problem is that the reporting agencies often don’t know what’s inaccurate or in error until it’s brought to their attention.

Reputable credit repair company representatives can help you determine the validity of the information on your credit report.

Then they can help you with credit repair via the right legal processes, which they’re trained to know and understand.

Is it Legal to Take Bad Credit Information Off My Report?

As a consumer, it is your right to assure the accuracy of the information contained in your credit report. Sometimes the information on your credit report doesn’t reflect your behavior as a consumer.

If this is the case with your credit report, you have the right to request that questionable reports be removed from the report.

The Fair Credit Reporting Act, along with other similar acts, gives you the right to dispute potential inaccuracies on your credit report.

What if I Have Collection Items on My Credit Report? Can You Help?

It’s essential to be able to verify if collection items on your credit report are accurate. Even if they are correct, you may be able to get collection agencies to remove the items as a part of a goodwill request.

What if I Have More Serious Credit Issues Like Bankruptcy?

The Fair Credit Reporting Act includes limitations and rules for reporting bankruptcies on a credit report.

Credit Saint can work with you to ensure any bankruptcy information on your report is removed on time and according to the law.

Can I Continue to Use Credit While In Your Program?

You can and should continue to use credit while working with Credit Saint. We’ll show you how to manage your credit in a way that helps improve your credit.

Can I Apply for New Credit While in Your Program?

Your credit report belongs to you. So you have the freedom to apply for new credit while in a credit restoration program.

However, you should know that applying for new credit will result in a new credit inquiry on your credit report. Credit inquiries can result in lower credit scores for you.

What’s the Difference Between Credit Restoration and Debt Settlement?

Credit restoration and repair companies help you clean up inaccuracies on your credit report and work to improve your credit score.

You are still responsible for paying outstanding debt balances that accurately belong to you.

Debt settlement companies work with your creditors to get them to allow you to pay less than the balance owed and count it as full payment. They negotiate with creditors to help you pay less or get a lower interest rate.

In return, you’ll pay a fee for this service. One negative fact about debt settlement is that it could impact your credit score negatively.

For example, let’s say a debt settlement company negotiates one of your debts so that you don’t have to pay it all.

The creditor might report this as a debt settlement on your credit report. That makes it clear to potential creditors that you didn’t pay the balance in full.

That information might result in a lower credit score. For that reason, we suggest only using debt settlement as an option in extreme situations.

Summary

Having a good credit score is vital to getting loans like mortgage loans and student loans.

These days, your credit score can even affect whether you get a job you’ve applied for or how much you pay for insurance.

Reputable credit repair companies like Credit Saint can help you learn about credit management and repair a damaged credit score.

Once you know how to manage your credit score on your own, you’ll have the information you need to make sure it gets and stays in a healthy range.