Self Inc. Review: Build Credit

Some products in this article are from our partners. Read our Advertiser Discloser.

It sounds weird to admit this but I built my credit when I was in college thanks to credit cards that offered free stuff for signing up.

My card had a $500 limit and like the typical 18-year-old, I maxed it out pretty quickly. However, I had a part-time job and was able to pay off the card monthly.

By the time I graduated, my credit was established and I was able to open a second card from Bank of America with a heftier $2,000 credit limit.

I had two cards under my name and without even realizing it, I had built good credit for myself.

If you need to work on your credit score, then continue reading to learn more about Self Inc.

Overall Rating

Summary

Self Financial is a tool that you can use to help work on your credit history and savings at the same time.

-

Ease of use

4.5

-

Work on your credit

4

-

Fees

3.5

-

Interest rates

3

Pros

- Work on your credit

- Credit monitoring included

- Establish savings

Cons

- High interest rates

- Additional fees

What is Self?

Times have changed since I was in school. For example, credit card companies are banned from enticing students with freebies on college campuses.

And if recent data is accurate, not having a credit card seems to be a trend these days according to Bankate.

If you did not know, credit is sort of like a Catch-22. You need to have established credit in order to get more of it for larger purchases and loans.

But how do you get it in the first place? And what if you have bad credit?

This is where Self shines.

Credit Builder

The company helps you establish good credit by setting up a CD account for you using funds from a small loan that you take out. This is a credit builder that allows one to build credit and build savings.

You make payments each month to pay off the loan and access the funds in the CD. Then, payments are reported to the credit bureaus each month.

It’s free to sign up, but there are interest fees you’ll have to pay, which is worth it if you need to work on your credit.

In a nutshell:

- Self is a tool that you can use to help build your credit history and savings at the same time. However, keep in mind everyone’s credit situation is different and they don’t guarantee you’ll see an improved score.

- Self provides a path for consumers to open a small loan with one of their banking partners. The funds from the loan are placed in an FDIC insured CD in your name.

- Each month, you make a payment towards your loan. Once the loan period is completed, the funds placed in the CD become available.

- Monthly payments are reported to the credit bureaus by Self’s banking partners. Responsible monthly payments help you build credit history, which can impact your credit score.

How Does Self Work?

Self is a fintech company that helps you work on your score by providing a way for you to establish positive payment history.

They are essentially a free credit monitoring company that also offers a Credit Builder Account and a Self Visa Card. *

The Credit Builder account is a low-cost loan that you make to yourself. Yes, that’s right, to yourself.

You use it to funnel money into a CD each month.

You’re essentially being forced to make payments each month into a savings plan, and at the end of your term, you receive the money (minus interest and fees) in a lump sum to support credit score to boot.

The idea behind Self is awesome because is a credit builder that allows one to build credit and build savings.

And after you’ve established a positive history with Self via your Credit Builder Account, you may qualify for a Self secured Visa card.

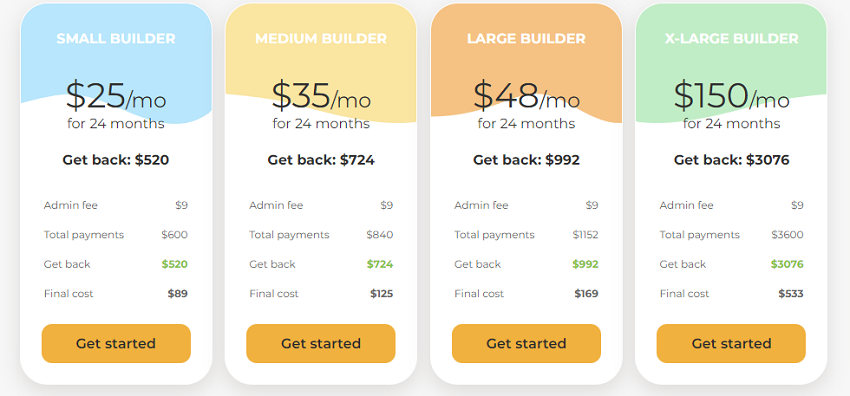

How Much Does Self Cost?

Self helps you bridge the gap between no or bad credit to good credit, so of course, this service isn’t free.

However, Self makes the numbers transparent, and it’s easy to see how much you’re paying vs. how much interest and fees you’re shelling out.

At the time of this writing, there is a non-refundable administration fee of $9. The interest rate you’d pay depends on the size of your loan.

However, you can expect to pay somewhere around 14% or more.

Self offers loan terms for 24 months. Check their site for the most current rates.

Here is an example of how much the lowest-tiered credit builder account costs:

- Monthly payment: $25

- How many months: 24

- Activation cost: $9

- Your cost total: $609

- What you get at the end of your term: $520

Key Features of Self

Self has several features that can help you work on your credit if you’ve got bad credit.

Work On Building Credit

Self has two main benefits: It helps work as a credit builder – that allows one to build credit and build savings.

Self reports each “payment” you make to yourself as an on-time payment to the three major credit bureaus.

As such, your credit reports get positive feedback each month, while at the same time you use a credit builder that allows one to build credit and build savings

Automated Payments

All Self Credit Builder accounts are set up with automatic payment from your bank account.

That way you never have to worry about forgetting about a payment or being late on a payment and further damaging your credit.

Note: If the money for your automated payment isn’t available in your account, you will incur a late fee that is equal to 5% of your monthly payment.

If after 30 days there is still no payment made, Self will report a late payment to your credit bureau.

Locked Savings

The payments you make to Self are locked in a Certificate of Deposit so that you can’t touch them until the term is completed.

This “forced” savings plan can be a great way for you to build an emergency savings fund.

When you’re done with your Credit Builder account term, you can then take that money and transfer it to a high-yield savings account for further growth.

Choose From Four Credit Builder Accounts

Self gives you four credit builder accounts to choose from so there’s something for every budget.

No Hard Credit Pull

Self does a soft credit pull, not a hard credit pull. This is a good thing because it means you don’t have to worry about your credit score dropping before it rises.

Self Secured Visa Credit Card

Self also offers a secured Visa credit card. As with the Credit Builder accounts, there is no hard pull when you apply for Self’s secured Visa credit card.

You have to make 3 on-time payments on a Credit Builder account before you can apply for a Self secured Visa credit card.

And your Credit Builder account has to be in good standing. See the Self website for rates and terms.

Self Customer Service

Self has a few different customer service options to choose from. You can call Self’s toll-free number at 1-877-883-0999.

You can also contact the company by email or by chat when you visit the Self website.

Lastly, there is a menu button on the Self credit building app that has an option for contacting Self’s customer service center.

What Others Are Saying About Self Inc.

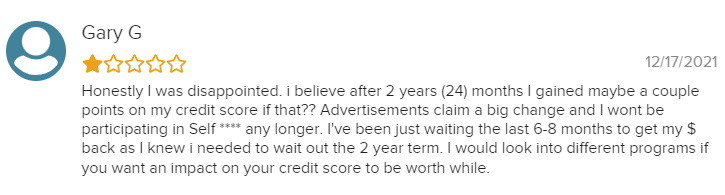

Self has a Trustpilot rating of 1.9, which is considered poor. 29% of Trustpilot reviews were marked as “excellent.” 13% of Trustpilot reviews were marked as “poor.”

There are only 26 reviews for Self on Trustpilot. Most of the negative reviews revolved around complaints about fees or unhappiness with credit scores.

The Better Business Bureau gives Self a “B” rating. There are hundreds of reviews about Self on the BBB website.

Most of the BBB complaints are closed and are similar in nature to those on Trustpilot.

It’s important to read reviews from authoritative sources such as Trustpilot and the BBB before you do business with a new company.

That way you can potentially find first-person opinions on the companies you’re considering doing business with.

Next, let’s talk about alternatives to Self.

Alternatives to Self

Our favorite alternative to Self is the Extra debit card. The Extra debit card works with your existing checking account to help you safely build credit.

It’s very easy to use. Just open the Extra debit card and link it to your main checking account.

Every time you want to make a purchase from your checking account, simply use the Extra debit card instead.

Extra will take the money from the purchase out of your checking account on the following business day.

It will also report all purchases made with the Extra card to Experian & Equifax, defining them as creditworthy purchases.

This positive reporting process can help you safely build your score or responsibly establish your credit score if you don’t yet have one.

Bonus: You will also earn up to 1% cash back on every purchase made with your Extra debit card.

Frequently Asked Questions

If you have bad credit and want to work on it, a Credit Builder Account may be your only option.

Self helps you work on your score if you’re dealing with bad credit because they don’t run a hard inquiry credit check.

However, Self does want to know if you have any checking accounts that may have gone to Chexsystems or were fraudulently shut down.

In order to get started you will need to have:

A bank account, debit card, or prepaid card

Email address

Phone number

Social security number

To open an account you must be:

At least 18 years old

Be a permanent U.S. resident with a valid address

Note: If you use a debit card, you will be charged a convenience fee of $0.30 + 2.99%. In order to avoid that fee, link your bank account.

The answer to that question depends on a few different factors.

First, it’s important to know that choosing a larger Credit Builder account won’t necessarily mean you can improve your credit faster.

Second, you’ll want to consider choosing a monthly payment that easily fits into your current budget.

Third, you’ll want to determine what your savings goals are and choose your Credit Builder account based on that and payment factors.

You can close your Self account early. Note that there fee up to $1 for an early closure of a Self account.

You will also still have to pay the agreed upon interest charges for the length of the time you had the loan.

Also, the $9 administrative fee you paid at the beginning of the loan is non-refundable.

Summary

Building good credit doesn’t happen immediately. It can take 6 to 12 months before you see a noticeable difference in your credit score.

Just know that if you’re responsible, make on-time payments, and keep your utilization low, your score will go up. If you want some extra help getting there, consider using Self.

If you are committed to keeping the payments you make to Self in your Self account for the entirety of the term commitment, you can help build your credit score.

However, if you feel there is a good chance that you’ll want to close the account early to get the funds you’ve saved, you may want to avoid using Self.

*Self Disclaimers: Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., SouthState Bank, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval. Self Visa® Credit Card issued by Lead Bank or SouthState Bank, N.A., each Member FDIC. See self.inc for details.

This is a great article with sound advice. There are points that I can utilize immediately!

I’m so glad to hear that. I wish you luck!

I love this information.

Thanks, Ronan. I’m glad you find it helpful!

This is a great article. Thank you.

Thank you for the compliment and also for dropping by!