M1 Finance Review: Is This Free Investing App Worth It?

Some products in this article are from our partners. Read our Advertiser Discloser.

Stock investing apps offer a lot of account features and investment options that can make it easy to diversify your portfolio.

You might like M1 Finance as you can build your own portfolio, use automated investing funds and also access online banking tools.

This review looks over the pros and cons of M1 Finance and if the app is a good fit for your investing strategy.

Overall Rating

Summary

Given that M1 Finance is free, there is little risk to testing out the service, aside from the money you’re investing.

-

Investment options

3

-

Ease of use

4.5

-

Cost

5

Pros

- Free and easy to use

- Purchase fractional shares

- You choose

Cons

- No mutual funds

- No advisors

What is M1 Finance?

M1 is a simple and elegant service that can help many investors achieve their investing goals without paying any trade commissions.

M1 Finance is a fee-free investing app that lets new and experienced investors invest small amounts of money into stocks and ETFs trading on the US stock market.

The platform is a hybrid robo-advisor as you can build a self-directed portfolio and add automated portfolios in the same account.

Most online stock brokerages take an either/or approach. Your self-directed account and managed portfolios are in separate portfolios, usually.

With M1 Finance, you can:

- Open a taxable investment account or a tax-advantaged IRA

- Access more than 4,000 stocks and nearly 2,000 exchange-traded funds (ETFs)

- Invest in automated portfolios or you can build your own

- No trading fees

- Automatic portfolio rebalancing with new investments

- Buy fractional shares of any stock or ETF

- Online banking products

The best reason to consider this platform is for the investing features. However, the banking features and a premium membership can add additional value.

Opening an Account

Joining M1 Finance is quite simple. All you need to do is enter an email address and create a password, then enter some personal identifying information.

You will also be asked a series of questions about your financial situation and investment approach.

Requested information includes:

- Net worth

- Liquid net worth (how much cash you have on hand)

- Risk tolerance (low, medium or high)

- Investment time horizon

- Level of investment experience

After answering these questions, you now have an account. You can browse the platform and start building your portfolio before making an initial deposit.

Funding an Account

You can fund your taxable brokerage account or IRA by linking a checking account.

The platform lets you make one-time transfers or schedule requiring transfers.

The minimum initial deposit varies by investment account type:

- Taxable accounts: $100

- Retirement accounts: $500

After making a qualifying initial deposit to make your first trade, the investment minimum is $25 for taxable and retirement accounts.

You can transfer as little as $10 at a time. Most bank transfers take one business day to complete.

Types of Accounts

M1 Finance offers the following investment accounts:

- Taxable brokerage accounts (individual and joint accounts)

- Traditional IRAs

- Roth IRAs

- SEP IRAs

- Rollover IRAs

- Trusts

- Custodial accounts (M1 Plus members only)

The banking products available include:

- Checking account (M1 Spend)

- Line of credit (M1 Borrow)

- No annual fee credit card (Owner’s Rewards Card by M1)

All of these accounts are available for free to all members. However, upgrading to M1 Plus ($125/year) offers additional investing and banking features.

The M1 Finance Investing Platform

You can access your portfolios in two ways:

- Online website

- Mobile app (Android and iOS)

Either platform is easy to use and has a clean and clutter-free design.

All of your investments are viewable on a personal dashboard. It’s also possible to make buy or sell transactions plus research potential investments on either platform.

Creating “Pies”

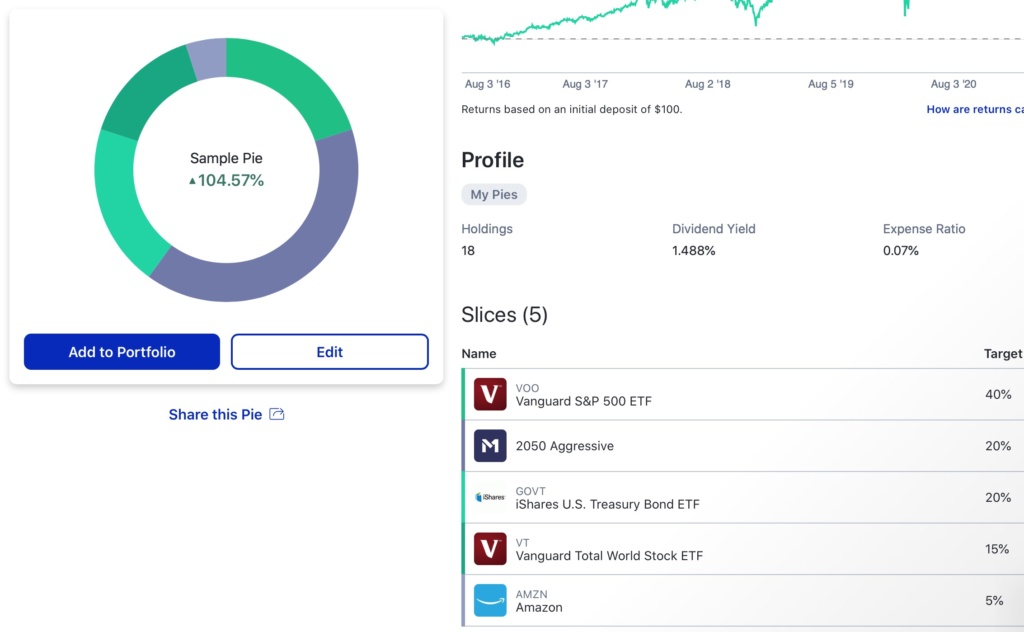

How you build a portfolio with M1 Finance is different than most investing apps. Instead of deciding how many dollars to invest in a stock, you assign a target percentage.

Then, the platform uses a dynamic rebalancing feature to buy more shares of positions below their target asset allocation. The app won’t sell any over allocated shares unless you request a manual rebalance.

Each pie can have dozens of “slices” consisting of these assets:

- Individual stocks

- ETFs

- Expert pies

The expert pies are premade portfolios that M1 Finance builds and rebalances. You simply decide which ones to add and assign a target allocation.

For example, you can create a pie and select “slices” as follows:

- Apple stock — 15%

- Google stock — 10%

- Walmart — 10%

- Vanguard Total Stock Market ETF — 50%

- 2050 Aggressive Pie (Target retirement expert pie) — 15%

It’s possible to add, subtract or adjust slices of your pie at any time. The platform executes your trading request at the next daily trading window (930am Eastern for most users).

Expert Pies

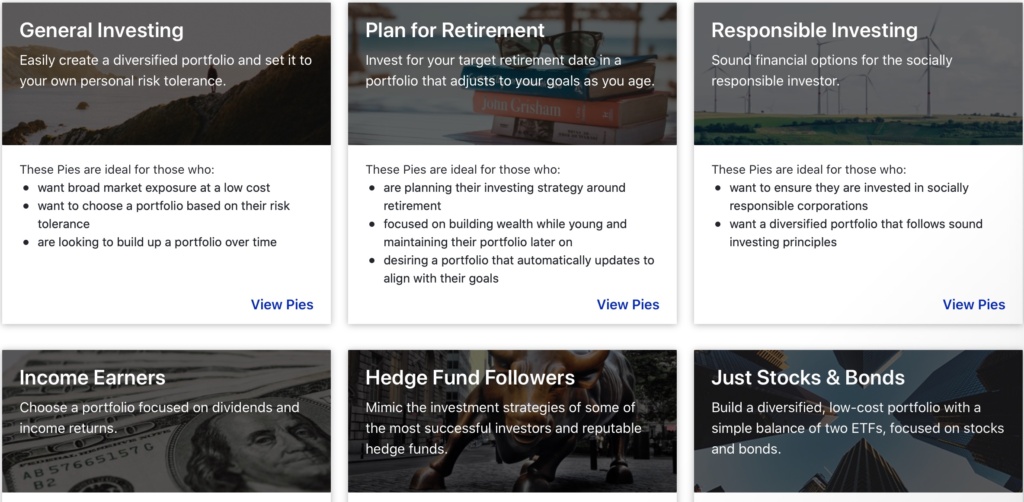

With an expert pie, you can select a pre-set mix of investments using on your risk tolerances and planned retirement date.

Other pies may invest in a specific industry, for example.

These pies copy the portfolios of many robo-advisors and you avoid their annual advisory fees.

- General investing offers pies based on general risk tolerances, ranging from ultra conservative to ultra aggressive. There are seven choices of pies, with between seven and 10 holdings (or “slices”) each.

- Plan for Retirement focuses on retirement, with target dates in mind. There are 26 pie choices, each with between 16 and 19 holdings.

- Responsible Investing is for the investor who wants to focus on companies or industries deemed socially responsible. There are two options. The domestic fund has five holdings and an internationally-focused pie has seven.

- Income Earners has a focus on dividend production and income. There are six pies to choose from in this category, each comprising three to five holdings.

- Hedge Fund Followers is designed to mirror the performance of some of the nation’s largest hedge funds, including Berkshire Hathaway and Icahn Capital. There are eight pies with seven to 33 holdings each.

- Industries and Sectors allows you to invest in specific groups of companies, such as aerospace, biotech, financials and real estate. There are 17 different pies to choose from, with five to 17 holdings each.

- Just Stocks and Bonds is a selection of nine pies, each with just two ETFs. One of the ETFs is focused on bonds, the other on stocks. Allocations for each range from 90 percent bonds and 10 percent stocks, to 10 percent bonds and 90 percent stocks.

- Other Strategies contains six additional pies that don’t fit into the above categories, including Domestic Growth, Dow Jones, and Global Value.

Stock and ETF Investment Options

Most of your investment options are for individual stocks and ETFs. As you can buy fractional shares, it’s easy to diversify or also buy stocks from investment newsletters.

Individual Stocks

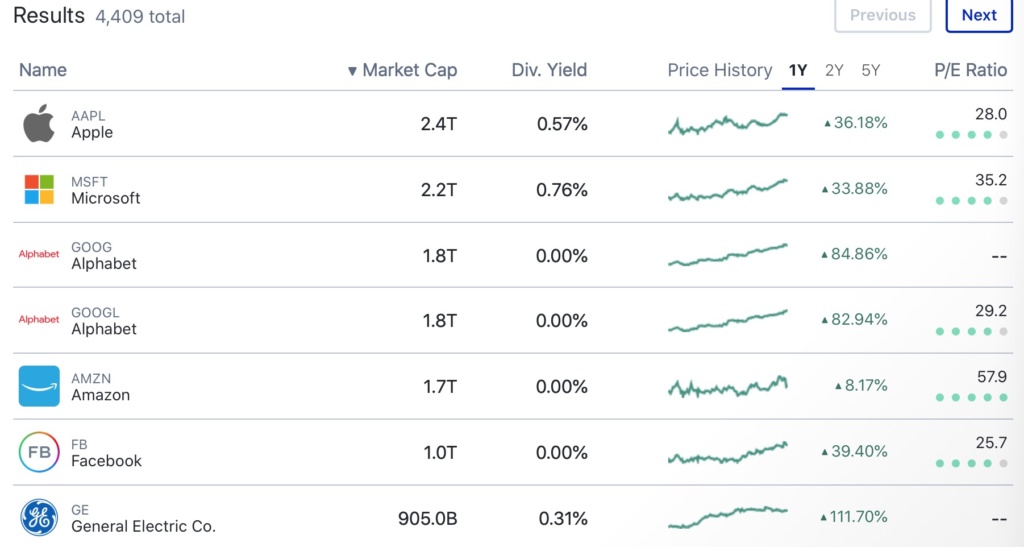

M1 offers access to over 4,400 stocks that trade on the major U.S. exchanges.

You may not be able to trade ADR and OTC stocks that have thin trading volumes or volatile share prices. These companies are usually international stocks with common shares trading on the Canadian, European or Asian exchanges.

The platform displays basic research details, such as:

- Historical share price performance

- Dividend yield

- Price-to-earnings ratio (PE ratio)

- Recent market headlines

You will need to use a stock screener for in-depth research tools to find the best stocks for your investing goals.

ETFs

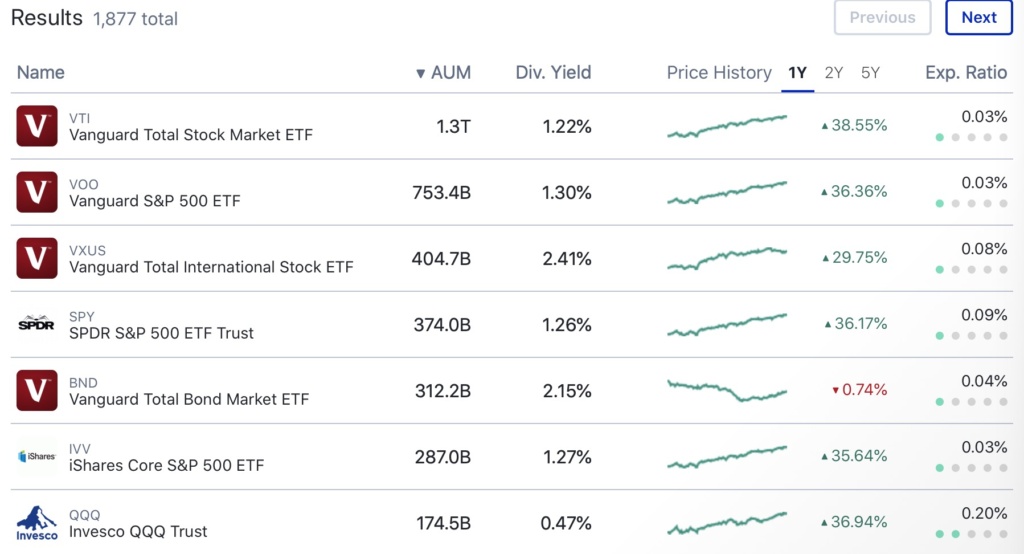

There are 1,877 ETF choices as of August 2, 2021 for active and passive investment strategies.

For example, you may invest in sector ETFs (i.e., banking or technology) and index funds.

The ETF selection includes these fund families:

- Vanguard

- iShares

- SPDR

- Charles Schwab

- Fidelity

You can research ETFs using these factors:

- Historical performance

- Expense ratio

- Dividend yield

- Market cap

- Sector

Unlike full-service online stock brokerages, you won’t get ETF report cards. Instead, you can use Morningstar Premium to see analyst reports for potential funds.

Like most micro-investing apps, you won’t be able to trade mutual funds that have similar investment strategies but usually have higher fund management fees.

Trading Windows

One potential downside of M1 Finance is not being able to trade on-demand during normal market hours.

Instead, you must place your trade request before the daily trading window.

There are currently two trading windows:

- 9:30 AM Eastern

- 3:00 PM Eastern

For most members, the only trading window available is at 9:30 AM.

If you’re an M1 Plus member, the platform will execute your trade request in the afternoon trading window. However, you must submit your trade request after the morning trading window opens.

You must have a minimum $25,000 account balance to trade during both windows and avoid the pattern day trader restrictions.

For each trade request, M1 fills the order at the current market price when the trading window opens. Most orders fill within a few minutes.

Reinvesting Dividends

Some of your stocks and funds may earn dividend income.

Unfortunately, you won’t be able to reinvest your dividends directly back into the same asset.

Instead, your dividends deposit into your cash balance and buy more shares of your underallocated positions with your next $25 minimum investment.

Other M1 Finance Features

Here are some of the banking features available to M1 Free and M1 Plus members. You may decide to upgrade to M1 Plus to get enhanced perks for some of these banking features.

M1 Borrow

With typical brokerage accounts, there’s no easy way to borrow against your invested money. One exception is a 401k loan which this feature is similar to.

It’s different with M1 Borrow as you can access a line of credit once your balance in a taxable account value reaches $5,000 or more.

You can borrow up to 35% of your portfolio value.

The interest rate as of August 2021 is:

- 3.5% for M1 Basic members

- 2% for M1 Plus members

This interest rate is lower than most personal loans and other debt refinancing products. However, you won’t earn investment income on your collateral amount.

There isn’t any loan application forms or credit check to qualify. You can repay the balance at any time without penalty.

There are some potential risks:

- Margin call: You may need to make a cash deposit or sell some investments to raise your collateral position if your portfolio value drops too much.

- Interest charges: While you pay a low interest rate, this isn’t free money. You will need to make interest payments to avoid selling stock to pay your monthly bill.

- No repayment period: You don’t have to repay your balance within a specific number of months. However, the longer you carry a balance, the more interest you pay and the less money you invest.

M1 Spend

An M1 Spend account is a free checking account that accepts direct deposit and provides a debit card. There is no minimum account balance to open or keep your account active.

M1 Basic members get one free ATM reimbursement per month. However, you won’t earn interest or debit card rewards.

However, you must upgrade to M1 Plus to enjoy these benefits:

- Earn 1% APY on your entire account balance

- 1% cash back on debit card purchases

- Up to 4 monthly ATM reimbursements

- Unlimited international fee reimbursements

- Can send checks

The 1% APY interest rate can be better than most high-yield savings accounts.

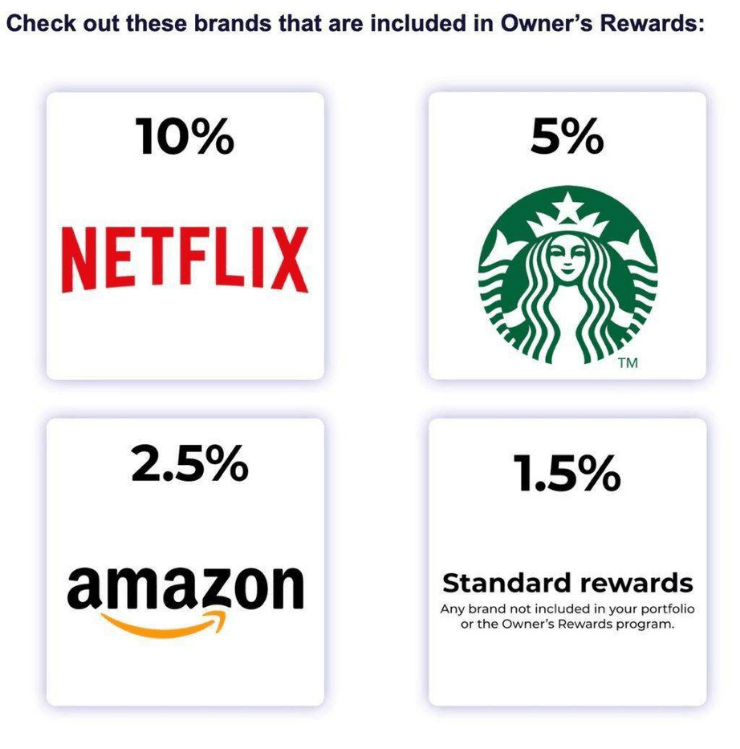

Owner’s Rewards Card by M1

The newest platform feature is the Owner’s Rewards Card by M1.

This is a rewards credit card with no annual fee only available to M1 Plus members. It can be an excellent option if you can pay your card balance in full every month to avoid interest charges.

Featured card benefits include:

- Up to 10% cash back at participating merchants

- Unlimited 1.5% back on non-bonus purchases

- Can invest your cash rewards

- Metal credit card

- Visa Signature benefits

While this card doesn’t have an annual fee, you must be comfortable paying $125 per year for an M1 Plus membership.

The company is waiving the annual membership cost for the first year for new M1 Plus members.

Taxes and Fees

Your gains and losses from selling stocks and earning dividends can be a taxable event. You may also pay platform fees to use M1 Finance.

Taxes

Like any brokerage account, securities you sell in a taxable account are subject to the appropriate capital gains taxes.

Dividend income in your brokerage account or checking account can also be taxable.

M1 works to minimize your tax liability through a lot allocation strategy to minimize your taxable gains.

- First: Losses that offset future gains.

- Second: Groups of shares that result in long-term gains.

- Third: Groups of shares that result in short-term gains.

The platform does not offer automatic tax-loss harvesting. With tax-loss harvesting, it’s possible to save on capital gains taxes by selling securities at a loss to offset those that were sold at a profit, then replacing them with similar securities.

At the end of the tax year, you will receive a Form 1099 tax form to report your taxable gains and losses.

Note: M1 Finance integrates directly with many popular tax software programs, such as TurboTax and H&R Block.

Fees

There are no trade commissions to buy or sell stocks and funds.

However, all ETFs have expense ratios, usually under 1 percent. You pay this fee regardless of the online broker you use.

Some of the other fees you might pay include:

- M1 Plus membership : $125 year

- Account inactivity fee: $20 (Balances of $20 or less and 90+ days of inactivity)

- Paper statements: $5

- IRA termination fee: $100

There are also small mandated expenses such as SEC transaction fees and trading activity fees. See the full schedule of fees.

How M1 Makes Money

You might ask yourself how M1 operates as a business if it is a free investing app.

The company makes money in a few ways:

- M1 Borrow interest payments

- Membership fees from M1 Plus subscriptions

- Interest income from uninvested cash

- Fees by routing stock market orders to “market makers”

These practices are similar to other investing apps that don’t charge trading commissions.

Limitations

M1 has a limit of 10 accounts per user. This can be any combination of taxable, individual retirement or trust accounts.

Security Features

When opening any kind of account online, there is always risk of personal data being stolen.

To protect against this, M1 encrypts all data when it is in transit and on the platform servers using military-grade, 4096-bit encryption.

The investing app doesn’t store any data on devices or computers.

You can also enroll in two-factor authentication (2FA). With this feature, you enter a one-time passcode from your linked email or phone number to login.

M1 will automatically log you out after a short period of inactivity.

It’s worth noting that you can’t immediately open an account if your credit is locked or frozen. I learned this because I keep my credit locked to protect against identity theft.

To proceed with opening an account, M1 requested that I send a copy of an identification card and a piece of current mail.

SIPC Insurance

Because M1 Financial is not a bank, money is not FDIC-insured. Instead, the Securities Investor Protection Corporation protects against the loss of cash and securities up to $500,000. (There’s a $250,000 limit for cash.)

However, the SIPC does not protect you for any decline in the value of securities.

FDIC Insurance

The M1 Spend online checking account can have up to $250,000 in FDIC insurance.

Customer Support and Advice

M1 has a comprehensive section with answers to frequently asked questions, and offers support via email and phone.

Customer service agents are available from 9 a.m. to 5 p.m. Eastern Time.

It’s important to note, however, that M1 does not offer investment advice. It’s up to you as an investor to determine how to best allocate your money.

Unlike other brokerages and robo-advisors, there is no algorithm or human advisor letting you know whether you are on track to meet your investing goals. Thus, the service is perhaps not ideal for investors with limited experience and knowledge.

M1 Finance Competitors

As we stated above, there are a number of robo-advisors that have come onto the investing scene in recent years. Many of them operate under similar principals but have some distinct differences.

Key competitors to in the robo-advisor space include:

Betterment

Betterment charges a 0.25 percent annual fee and builds customized portfolios based on your risk tolerances and investment goals.

It automates tax saving strategies, including tax-loss harvesting. However, you can make a self-directed portfolio.

The service also offers a variety of banking products including a cash management account.

See our full review of Betterment for more information.

Wealthfront

Wealthfront is one of the largest robo-advisors. It builds a diversified portfolio of low-cost index funds and uses tax-loss harvesting and other strategies.

You can also open a cash management account and a portfolio line of credit.

Empower

Empower isn’t technically a robo-advisor. Instead, it is a paid wealth management service that uses human portfolio managers aided by software.

The investment minimum is $100,000 to use the investing service.

Despite the high investment minimum, there are several free tools including:

- Net worth tracker

- Investment portfolio analyzer

- Retirement calculator

Read our Empower review to learn more.

Pros and Cons

Let’s break down in clear terms the key advantages and drawbacks of M1 Finance.

Pros

- It’s free. You will pay no commissions on trades for stocks and ETFs. The M1 Spend checking is also free.

- Simple and clean interface. It’s very easy to start investing with M1 with a mobile or web platform.

- Fractional shares. You can buy partial shares of stocks and ETFs when you don’t have enough cash to buy a whole share. It’s easy to diversify your portfolio.

- Many investment options. You can build your own investment portfolio, only choose automated expert pies or a combination of both.

- M1 Plus. The premium membership offers checking account rewards, a reduced M1 Borrow interest rate and a cash rewards credit card.

Cons

- No mutual funds or fixed income investment options. This platform is good if you only want to invest in stocks and ETFs. However, you must use an online brokerage to invest in mutual funds and fixed income products like bonds and CDs.

- Not good for active traders. Because M1 executes all trades at the same time once a day, it is not a good solution for those who like to trade more frequently (i.e., day traders).

- No investment advice. Traditional brokerages might offer financial advisor access. M1 doesn’t provide individual investment advice or in-depth research tools.

Summary

M1 Finance is a solid choice for anyone looking to invest using a robo-advisor service. Being able to customize your investment portfolio with self-managed and expert-managed funds is the best reason to consider this investing app.

The other banking features and M1 Plus benefits can add additional value for new and experienced investors. However, inexperienced investors will miss the lack of educational resources that traditional brokerages are more likely to provide.

You have many investment options for stocks and funds. However, you will need to use another platform to dabble in alternative investments.