15 Free Google Sheets Budget Templates

Some products in this article are from our partners. Read our Advertiser Discloser.

Trying to figure out what tool is the best and easiest for creating a budget can be difficult.

Instead of giving up or jotting everything down on paper, a Google Sheets budgeting template makes it easy to pursue most budgeting strategies.

The best budgeting templates give you the ability to modify the template to fit your personal needs and money goals.

Top Free Budget Templates For Google Sheets

There are many excellent candidates for the best budget template, as there are so many budgeting strategies to try.

Most of these budget templates are free and let you try different budget styles. Investing in a premium sheet can sync with your bank accounts and make tracking your spending effortless.

1. Starter Budget

You may only need a basic budget template that lets you quickly compare your income and monthly expenses.

Advanced spreadsheets may require too much effort to update or can be confusing to navigate. These complex budgeting templates are “too smart.”

The simplest budget is writing your income and expenses on a piece of paper. The digital alternative is manually logging each transaction into your spreadsheet.

Building your own template can be effective, but it’s easy to overlook certain expenses.

Using Well Kept Wallet’s own Starter Budget is free and saves you time. You can open the Starter Budget in Microsoft Excel or Google Sheets.

The Starter Budget takes a monthly look at these categories:

- Income – You and your spouse’s (if applicable) monthly salary

- Housing expenses – Mortgage/rent, utilities, internet, insurance, etc.

- Expenses – Groceries, giving, “His” and “Her” spending, vehicle and gas, etc.

You can modify the income and expense categories to fit your personal spending plan.

Check out our Free Budget and Financial Planning Printables as well.

Want to make budgeting even easier? Check out Tiller which will automatically pull in the data from your bank!

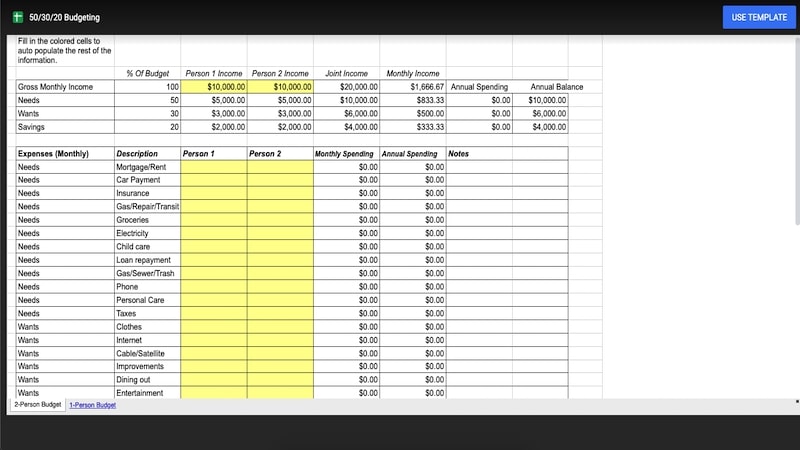

2. 50/30/20 Budget

Most budgeting templates are a zero-sum budget where you assign a budget category for each dollar you earn. The “50/30/20 rule” encourages you to only spend half of your monthly income on necessary expenses.

Only spending half of your income on needs means you’re not living paycheck to paycheck.

You’re also more likely to be able to afford a one-time financial surprise or temporary pay cut without going into debt.

The 50/30/20 rule divides your cash into one of three categories:

- Needs (50%)

- Wants (30%)

- Savings and extra debt payments (20%)

Examples of your “needs” include your minimum monthly loan payments, insurance and living expenses. Your “wants” might consist of streaming plans and date nights.

The remaining 20% for savings and extra debt payments should include saving for retirement and boosting your emergency fund.

Separating your necessary monthly expenses (needs) from your wants can be challenging at first. Thankfully, there are simple ways to save money when you don’t have free time to pursue a side hustle.

The 50/30/20 budgeting strategy can be easier to achieve if you live in a two-income household. This template has a tab for one person or two persons to compare each person’s income to their needs, wants and savings.

3. Google Sheets Budget Trackers

Did you know that Google Sheets offers two premade templates? Both are free and similar to the Microsoft Excel budget templates you may already use.

These barebones templates can help improve your spending habits without breaking the bank.

However, you must be willing to input each transaction manually to have correct figures.

These are the two default Google Sheets budgeting templates:

- Monthly budget – Log individual income and spending transactions. You can compare your planned and actual benefits by category.

- Annual budget tracker – List your monthly income and expenses by category to track your monthly progress.

Both sheets include basic how-to instructions to create your budget. It’s possible to customize each template, but your options are relatively slim versus a Tiller Money spreadsheet.

You may decide to use the monthly budget template to track your daily spending. At the end of each month, you can copy these figures to the annual budget tracker to keep quickly comparing your month-to-month habits.

If you continue using these sheets for multiple years, you can compare your 2021 and 2020 monthly spending.

You will find both templates in the Google Sheets template gallery at sheets.google.com. There are free templates for other tasks, including a to-do list, calendar and travel planner.

4. Budget Tracking Tool

Our friends at The Measure of a Plan have a Budget Tracking Tool for Excel and Google Sheets.

This template is one of the best free in-depth budgeting templates. You can quickly track your common monthly budget percentages.

You can manually input each expense and income transaction and then assign a category. This template also lets you assign a monthly spending target for each category.

In the “Budget Targets” tab, you can compare your actual spending to your target spending by percentage and dollar amount.

The “Dashboard” tab lets you view your budget activity for a specific month or custom period.

Download Here: https://themeasureofaplan.com/budget-tracking-tool/

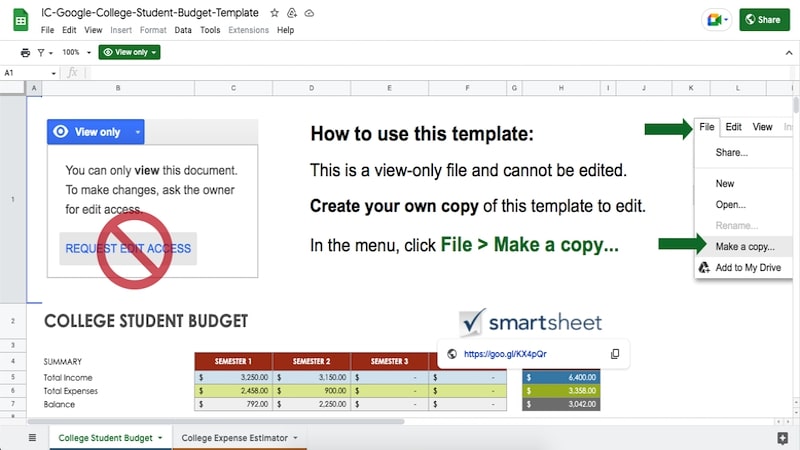

5. Smartsheet College Student Budget

The best time to learn how to budget is when you live at home or as a college student.

Your expenses are low as you’re not “adulting” yet (although you don’t want to squander your college side hustle income).

The Smartsheet College Student Budget helps you plan for these expenses:

- Tuition and fees

- Rent

- Food plan

- Transportation

- Laundry

- Entertainment

This template also has income slots for your earned income, student loans and financial aid.

Download Here https://docs.google.com/spreadsheets/d/1itveMRvT_Q-29PApvY3JgZZfNwHOSO7-MqK9HlCmwxM/edit#gid=28335603

6. Wedding Budget Spreadsheet

Weddings are an exciting “once in a lifetime” event. However, your special day can quickly turn into a budget-buster.

Renting a wedding dress can save money, but a wedding budget template can help you stay within your spending limit.

Your wedding budget should include these expenses:

- Ceremony

- Flowers

- Reception

- Entertainment

- Transport

- Fashion

- Hair and beauty

- Stationery

- Photography and videography services

- Gifts

Bridal Musings has one of the most in-depth templates for tracking the many expenses of your dream wedding.

Their template lists various expenses for each of the major categories in the above list. You will also be happy to hear this wedding budget template is free.

You can list the estimated cost, actual cost, supplier name and contact details for each expense.

Download Here: https://bridalmusings.com/free-wedding-budget-spreadsheet/

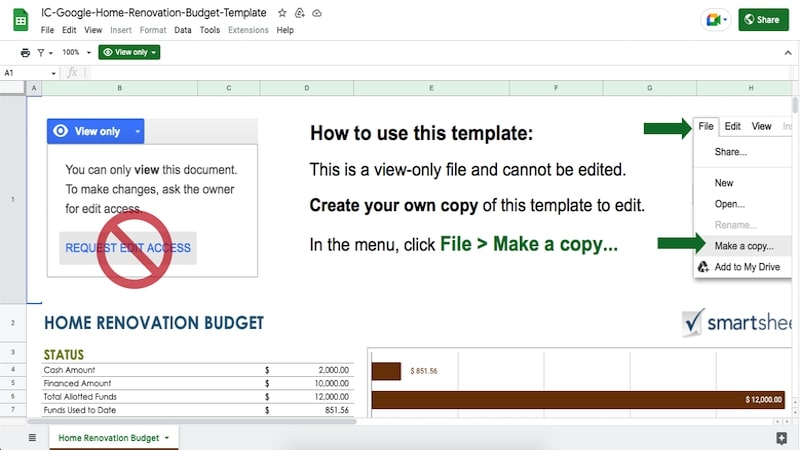

7. Smartsheet Home Renovation Budget

You may decide to remodel your home to increase its curb appeal or start a home business. Tracking project costs can be difficult if you forget to log multiple receipts.

Smartsheet’s “Home Renovation Budget” template is free. You can enter your total cash available. Each transaction you enter updates the remaining balance.

The template also lets you enter a target and actual spending amount for each expense.

Download Here: https://docs.google.com/spreadsheets/d/1pEPA_9_ABn0I03p8lk7VL71-oBcgpYHulGLohwBuzYc/edit#gid=261485834

8. Vertex42 Debt Reduction Calculator

You’re likely familiar with Dave Ramsey’s Baby Steps if you are striving to be debt-free. The second step is using the “Debt Snowball Method” to make extra debt payments.

This debt payoff strategy follows these steps:

- List your debts from the smallest to the largest remaining balance

- Continue making the minimum monthly payment on each debt

- Make extra monthly payments on the smallest debt balance

As you pay off your smallest debt balance, make extra payments for the next-smallest balance. If two loans have the same balance amount, make additional payments on the one with the higher interest rate first.

While there are debt payoff apps to make a payment plan, a template might be your preference.

Vertex42 has a debt reduction calculator. Your first ten creditor accounts are free. Buying the Extended license costs $9.95 and lets you enter up to 20 creditors in Google Sheets. The premium Microsoft Excel version allows up to 40 creditors.

The free and premium templates let you enter these creditor details:

- Creditor name

- Current balance

- Minimum monthly payment

- Interest rate

After entering the necessary loan details, you can enter your monthly snowball payment. The spreadsheet recommends which loan to pay off first. You will also see the estimated payoff debt and potential interest savings.

Download Here: https://www.vertex42.com/Calculators/debt-reduction-calculator.html

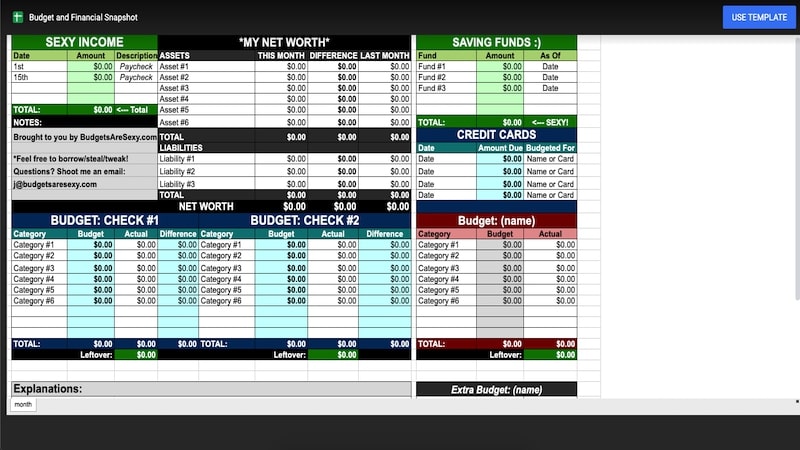

9. Financial Snapshot and Budget

Is it possible to see your budget summary and in-depth at the same time? The legendary J. Money of Budgets Are Sexy does this with his free Financial Snapshot and Budget template.

This customizable template shows these budget details on one tab:

- Net worth tracker

- This month’s pay dates

- Expenses your first month’s paycheck and second month’s paycheck pay

- Compare actual spending to planned spending for main budget categories

- Savings account balances

- Credit card balances

You may be hesitant to use a Google Sheets template as you must switch between multiple tabs to budget. This spreadsheet can be a good option if you want to see all of your vital money stats in one place.

However, you may need to use another template to log your daily expenses. Tracking each expense helps you accurately see how you spend each dollar.

You can also avoid common budgeting mistakes.

You may prefer the Financial Snapshot and Budget template if you want a biweekly budget. This method makes it easy to visualize how you spend and save each paycheck.

This spreadsheet is free and compatible with Google Sheets and Microsoft Excel.

Download Here: https://docs.google.com/spreadsheets/d/1fTfYTushmUK6F5uA7E9xVfwrr4H1mXR-0lT-WGfqnjA/template/preview?usp=drive_web&ouid=%7BuserId%7D

10. Zero-Based Budget

If you like giving every dollar you bring in a ‘job,’ the zero-based budget may be a good option. With this budget, you allocate every dollar you bring in to do something, so you have nothing left at the end of the month.

This doesn’t mean you spent all your money. Instead, you gave them jobs, such as debt payoff, savings, and paying bills.

For example, if you bring in $3,000 monthly and your bills are $1,500, you’d budget where the remaining $1,500 should go.

If you have debts, it’s a good idea to pay them down first, then allocate anything left for retirement, emergency, and specific goal savings.

Aspire Budgeting offers an excellent template for a zero-based budget.

Download Here: https://www.aspirebudget.com/

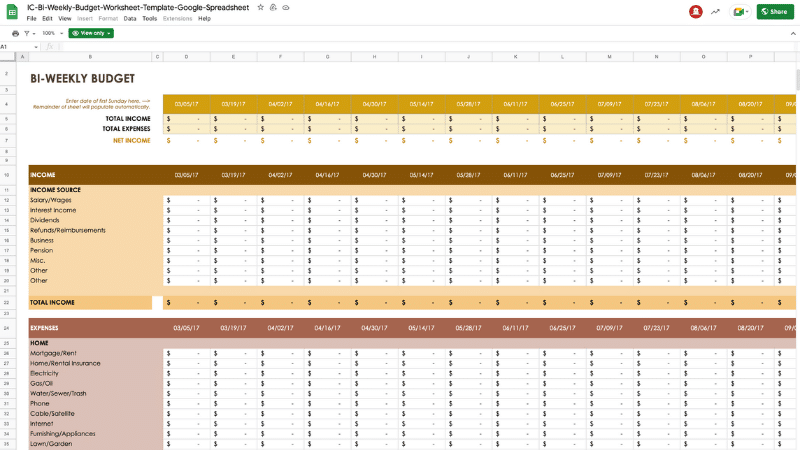

11. Smartsheet Bi-Weekly Budget

Smartsheet offers many budgeting templates, including a bi-weekly budget. This budget can help you manage your money well if you get paid every other week.

To use the budget effectively, match your bill due dates to one of the two paychecks you receive monthly to stay on track.

This budget tracks your net income as you go, so you can easily reallocate funds if you aren’t saving enough or discover you need funds for another purpose.

We like that the spreadsheet has various categories for income and expenses to make it easy to track what you bring in and spend.

Download Here: https://docs.google.com/spreadsheets/d/1xYhg_0mnxaks1HG5WZeoXFnVsLb_LOnP0C0kv7claE4/edit#gid=1363947942

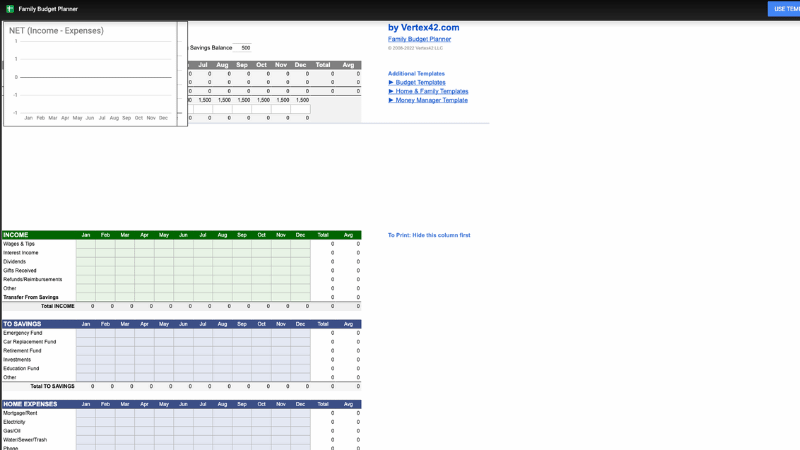

12. Family Budget Planner

The Family Budget Planner by Vertex42.com is your standard monthly budget, but it includes categories you can use by child. We all know raising kids is expensive, so budgeting for their expenses can help you stay on track.

The budget breaks down children’s expenses as follows:

- Medical

- Clothing

- School tuition

- School lunch

- School supplies

- Babysitting

- Toys/games

- Other

The budget template also has various categories to track your spending on almost anything, making it easy to see where and how much you spend at a glance.

Download Here: https://docs.google.com/spreadsheets/d/1h_iLnxWbGCnjvvtkQuS4aAd9-LkansaguwpQdgtglno/template/preview

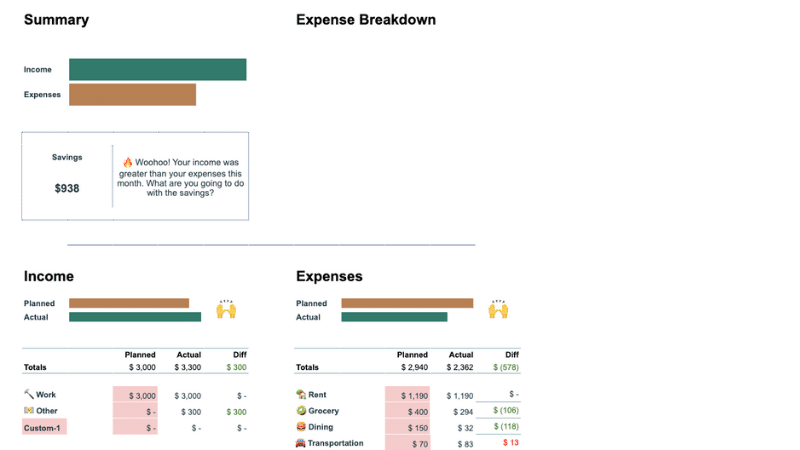

13. Budget and Transaction Tracking Budget

Greenshift offers a great free budget template that allows you to plan and track your actual expenses.

So, for example, say you budget $300 for groceries but spend $400 that week. You’ll have a record of how much you went over your budget.

You’ll see where you overspend and underspend and what changes you must make. It’s a budget for everyone because no one knows exactly how much you’ll spend.

Of course, you can give it your best guess, but the Budget and Transaction budget takes the guesswork out and allows you to make more informed budgeting decisions.

Download Here: https://docs.google.com/spreadsheets/d/1TAXeBDKJO1keYwKWjP0fdf8K2LdPd00hxdw_MifA4WQ/template/preview

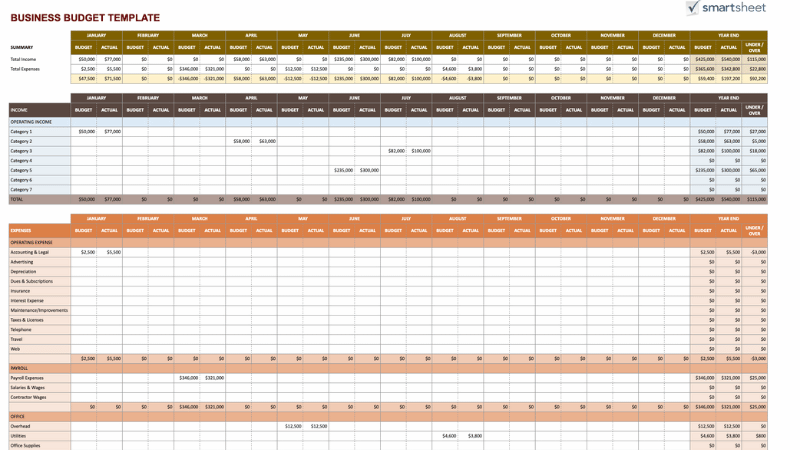

14. Business Budget

Your business needs a budget as well. If you’re looking for something simple that won’t overwhelm you, consider the Smartsheet Business Budget.

The free tool is simple and straightforward, and best for small business owners.

Of course, it’s not a replacement for working with a CPA or tax advisor, but it can help you keep your finances straight and make better business decisions.

Download Here: https://docs.google.com/spreadsheets/d/1SHe8qMT6da0BXuAWgGkHMKJnFhDPxtKUJOY2HXhvJOo/edit#gid=0

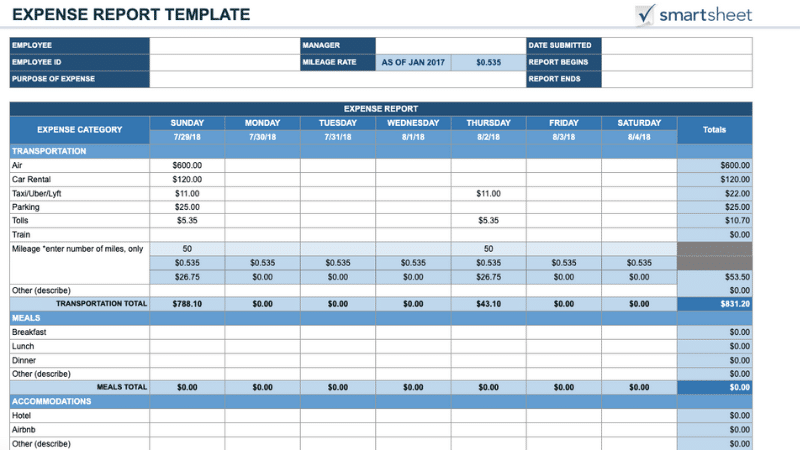

15. Expense Budget Report

If you work for a company that reimburses you for your business expenses or if you run a business, the Smartsheet Expense Budget Report can help you keep track of your expenses.

Even if you don’t get reimbursed, having a record of your spending can help you understand your budgeting and spending.

It can also come in handy if you can write any expenses off at tax time.

Download Here: https://docs.google.com/spreadsheets/d/1-QKikFjcy9jqwG5FE6-w0NAId0_DOCKJzl1fwSg-37U/edit#gid=0

Summary

Budget templates may require more effort than a budgeting app, but you have more flexibility.

If you like spreadsheets, finding one that caters to you may motivate you to improve your money skills.