8 Best Net Worth Trackers To Grow Your Wealth

Some products in this article are from our partners. Read our Advertiser Discloser.

Tracking your net worth can even help you set financial goals for yourself or your family. It can also help you know when to change how you spend your money. Here are some of the best net worth trackers for monitoring your wealth.

How to Calculate Your Net Worth

What exactly makes up your “net worth”? It’s the actual value of the things you own. It is “net” because you need to deduct the amount you owe others.

Net Worth = Assets – Liabilities

Calculating your net worth is relatively easy. You can figure it out with these three easy steps.

- Make a list of all your assets. Add the value of your house if you’re a homeowner, any cars you own, retirement accounts, savings accounts, investment accounts, and items like boats and recreational vehicles.

- Make a list of all your liabilities. Next, you’ll list all of your liabilities (i.e., debts). Include your home mortgage, car or other personal loans, revolving, and other debt.

- Subtract your liabilities from your assets. Now it’s time to get your result. Subtract your liabilities from your assets. The answer you get is your net worth number.

If you want to use a net worth tracker, keep reading.

Top Net Worth Trackers

To help you track your net worth more easily, here are some of the most popular tools.

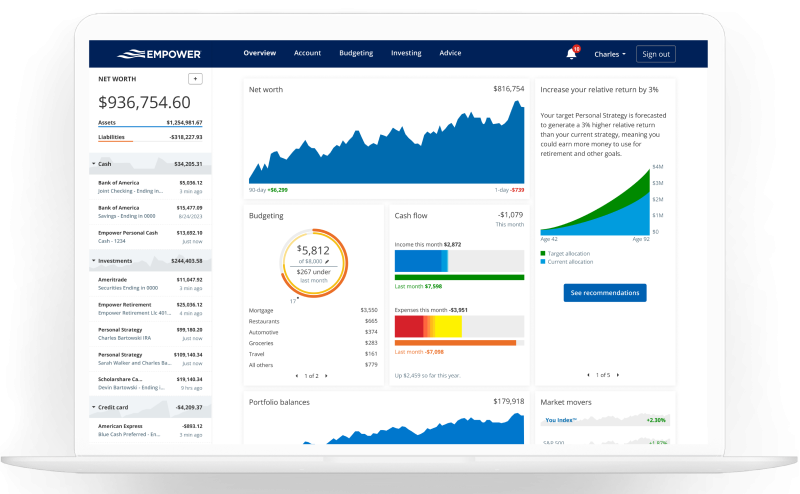

1. Empower

📱Apple 4.7 / Google Play 4.2

Empower is a free app that easily tracks your net worth.

With Empower, you can:

- Have access to all of your financial accounts in one place

- Plan for retirement

- Monitor your investments

- Uncover hidden fees

- View, manage, and categorize your expenses

They make it easy to link your financial accounts, and you can see your net worth in minutes.

Empower uses bank-level military-grade encryption. This ensures they always guard your account information with the utmost protection.

They can help you grow your net worth to achieve your financial goals faster.

Learn more: Empower App Review

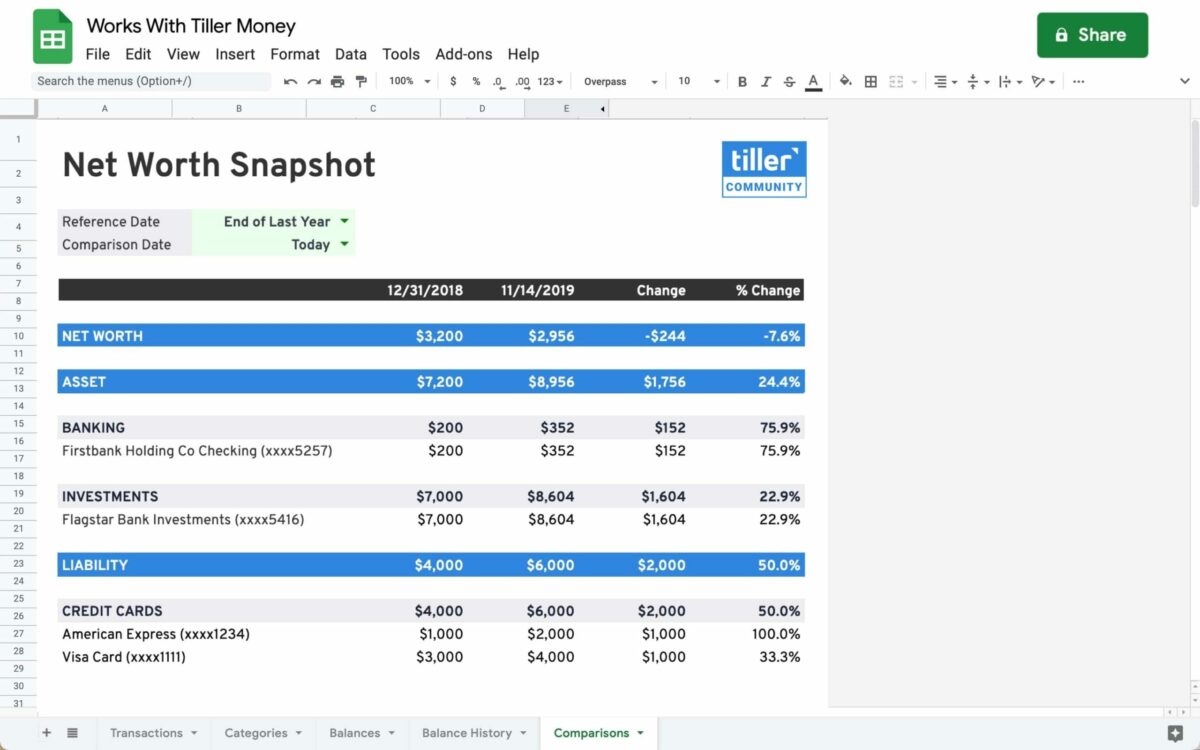

2. Tiller Money

Product Hunt Rating: 5 out of 5 with 15 reviews

Tiller Money is a tool for tracking your net worth by automating the data on your financial spreadsheets.

When you connect your financial accounts to your Tiller Money account, all data populates automatically. Tiller has free templates you can use to create your spreadsheets, and you can customize categories and more.

Tiller uses 256-bit AES encryption and promises not to share or sell your data to anyone. With Tiller Money, you can track your debt, create a budget, track expenses, and more.

Tiller Money offers a free 30-day trial. After that, you’ll pay $79 per year.

Here is what people are saying about Tiller on Reddit.

Learn More: Tiller Money Review

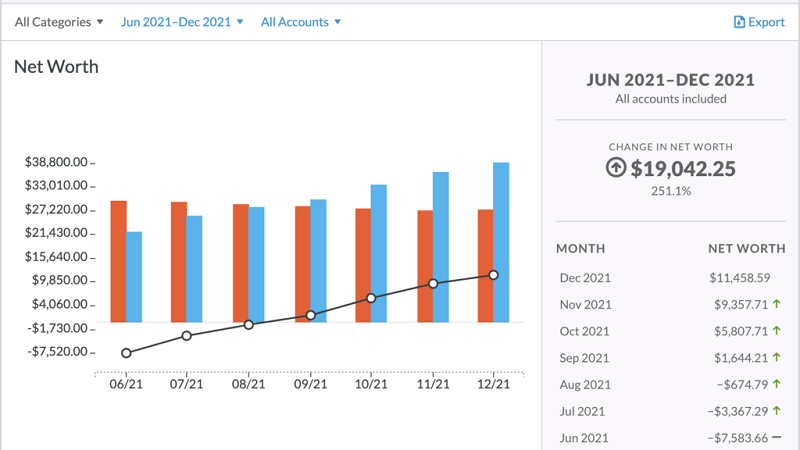

3. YNAB (You Need A Budget)

📱Apple 4.8 / Google Play 4.6

You Need a Budget (YNAB) is another popular site to track your net worth. However, its primary purpose is to help you budget.

It has a system in place that will help you with three financial goals:

- Stop living paycheck to paycheck

- Get out of debt

- Save more money

YNAB uses bank-level security to protect your information. The net worth tracker is a bonus since the budgeting app is meant to help you manage money better.

Unlike the other apps, YNAB is not free. You can try it for free for the first 34 days. However, after that, you’ll pay $14.99 monthly or $98.99 a year to keep the service.

Learn more: YNAB Review

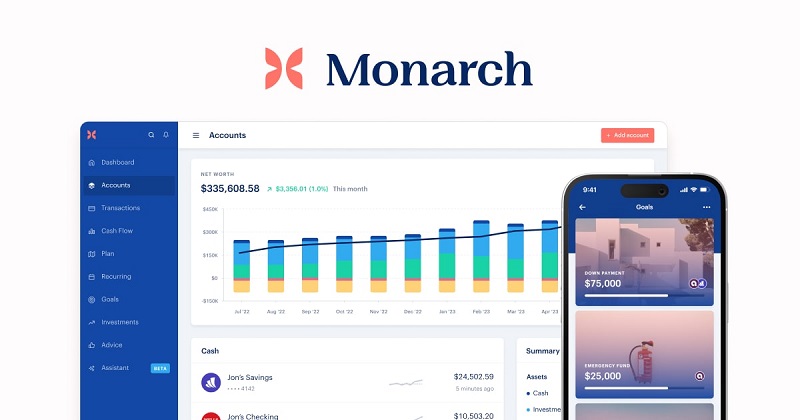

4. Monarch Money

📱Apple 4.8 / Google Play 4.7

Monarch Money is a money management platform that emphasizes reaching your financial goals. As you work toward short-term and long-term financial goals, Monarch Money makes tracking your net worth easy.

Specifically, Monarch Money offers net worth syncing. Instead of adding up your assets and liabilities, Monarch Money will run the numbers for you.

All you need to do is have your financial accounts linked to Monarch for seamless tracking.

If you have physical assets without an attached electronic account, you can manually add this value to your net worth. For real estate, the platform uses Zillow data to determine property values.

Monarch Money offers both a free and premium version.

Learn More: Monarch Money Review

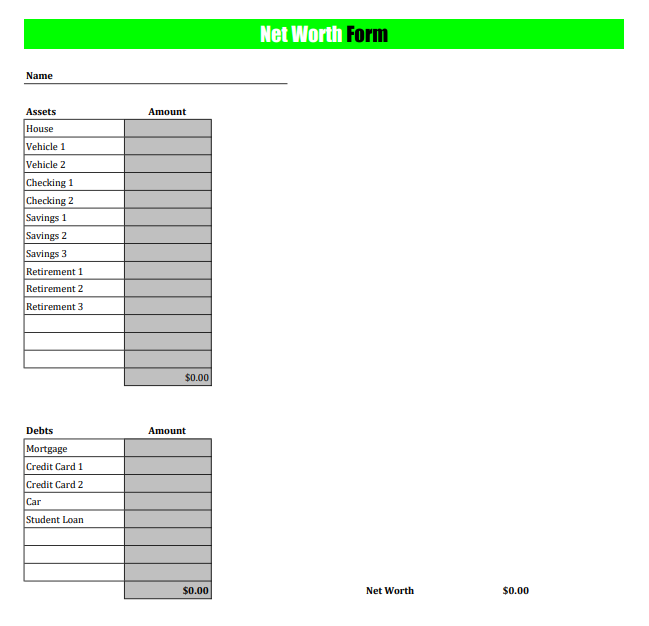

5. Net Worth Tracker Spreadsheet

Yes, the old Excel or Google spreadsheet. It may be tedious, but it is an option for tracking your net worth.

Using a spreadsheet isn’t the simplest way to track your net worth. You’ve got to enter all information manually regularly.

When you use a site like Empower, they enter the numbers for you. This saves you time, and time is money. But the spreadsheet option does work. Just create a system that works for you and update it regularly.

Having your net worth information on your computer is nice if the internet goes down because you can still access the data.

Download our free Net Worth Tracker.

6. Albert

📱Apple 4.6 / Google Play 4.1

Albert is a personal finance app that tracks your income, expenses, savings, and investing. You can link all personal accounts to Albert to track your net worth and make critical financial decisions.

While it’s not a banking app, the fintech company offers early access to your direct deposits if you set them up in Albert. They can also spot you up to $250 in an emergency between paydays.

What we love the most about Albert is it automatically sends money to savings that it determines is free based on your income, spending, and bills. You can also set up savings goals, and Albert will tell you how close you are to reaching them.

You can also build a portfolio with just $1 and uncover hidden savings opportunities.

Learn More: Albert App Review

7. Kubera

Reviews.io: 4.7 out of 5 with 693 reviews

Kubera allows users to monitor their net worth effortlessly, bringing all their financial data into one secure platform.

You can link multiple accounts, including investments, real estate, bank balances, and debts, providing a holistic view of your financial health.

Through powerful analytics and customizable reports, individuals can identify trends, set goals, and make informed decisions.

Find out what users are saying about Kubera on Reddit.

8. PocketSmith

📱Apple 3.4 / Google Play 3.4

PocketSmith is a personal finance software designed to help individuals track and manage their net worth. It provides a comprehensive platform where users can link their various financial accounts, including bank accounts, credit cards, investments, loans, and mortgages.

One key feature of PocketSmith is its ability to automatically categorize transactions, which allows users to easily understand their spending patterns and financial habits.

Additionally, it offers budgeting tools and forecasting capabilities, helping users set financial goals and plan for the future effectively.

Frequently Asked Questions

Here’s a look at additional questions users ask about tracking their net worth.

Are these apps safe to use?

Yes, these apps use bank-level security measures to protect your financial data. Always choose apps from trusted sources and read reviews to ensure security.

Are there free tracking apps?

Many apps offer both free and premium versions with additional features. Check their pricing structures to find the best fit for your needs.

Can I track my net worth manually on these apps?

Some apps offer the option to input data manually if you prefer not to link accounts.

Will these apps sync across multiple devices?

Yes, most apps allow syncing across smartphones, tablets, and desktops to conveniently access your net worth information.

How Do These Net Worth Trackers Compare?

| COMPANY | PRICE Per Year | APPLE RATING |

| Empower | Free | 4.7 |

| Tiller Money | $79 | N/A |

| YNAB | $98.99 | 4.8 |

| Monarch Money | Free | 4.8 |

| Net Worth Tracker | Free | NA |

| Albert | $96 | 4.6 |

| Kubera | $150 | N/A |

| PocketSmith | $108 | 3.4 |

Summary

Peter Drucker, a famous business consultant and author, has a great quote. It says, “If you can’t measure it, you can’t improve it.” In other words, those things that get measured can more easily be improved.

Tracking your net worth gives you a catalyst for increasing it. It helps you monitor expenses and debts and make changes where needed.

Besides, it helps motivate you as you see your numbers progress. For me, tracking with a free app like Empower makes it easy. However, the important part is that you’re tracking it – whatever method you choose.

I use a spreadsheet for budget/expense tracking, and another as a personal balance sheet.

Do you know of any software that JUST creates a balance sheet by going out to specified banks and brokerages, discovering all asset and debt accounts and then displaying them in a spreadsheet-like report?