8 Best Identity Theft Protection Companies

Some products in this article are from our partners. Read our Advertiser Discloser.

Can identity theft protection keep your personal information safe?

So much of our personal information is scattered across the Internet and the cloud. Monitoring your credit report is a great way to start spotting identity theft. However, you may not have the time to constantly monitor your other accounts for signs of theft.

The best identity theft protection companies monitor your sensitive information 24/7.

This monitoring can give you and your family extra peace of mind. And if you become an identity theft victim, a restoration team can help repair the damage.

Top ID Theft Protection Companies

The leading identity theft protection services offer monitoring and repair benefits. These companies can monitor your personal information, including your Social Security Number or social media accounts.

If your identity is stolen, the company’s repair benefits include step-by-step support. You might also get identity theft insurance benefits that offset qualifying legal costs and reimburse stolen funds.

Most companies also offer up to $1 million in identity theft insurance. This coverage can offset the costs associated with restoring your identity.

1. IdentityForce

IdentityForce offers two plans with in-depth monitoring. Both plans provide up to $1 million in identity theft insurance. As identity theft can happen at any time, each plan has 24/7 restoration support too.

It’s also possible to monitor your children’s identity. The ChildWatch add-on costs $2.75 monthly or $27.50 per year. You pay this fee for each child you enroll.

You also get complimentary Internet security software for your PC and mobile device. This software prevents hackers from tracking your keystrokes and installing malware.

UltraSecure

The UltraSecure plan costs $14.99 per month or $149.90 per year. Paying for the entire year upfront gives you two months for free. UltraSecure comes with a 14-day free trial.

This plan can be the best one for most people as you get the same identity monitoring benefits as the pricier UltraSecure+Credit plan. However, you may find the credit monitoring benefits.

IdentityForce monitoring includes:

- Court records

- Dark web

- Medical benefits

- Sex offender registries

- Social media accounts

- Social Security number

It’s possible to request a copy of your credit report, but you won’t be able to track your credit score.

UltraSecure+Credit

Your other plan option is UltraSecure+Credit. It costs $19.99 per month or $199.90 per year.

The best reason to choose this plan is for the daily three-bureau credit report monitoring.

You can also get instant access to your credit report and credit score. Other monitoring services may only offer credit updates monthly or less frequently.

When you’re cleaning up a bad credit history, you may appreciate the frequent updates. This plan also includes a credit score simulator and a month-to-month tracking tool.

Why We Like IdentityForce

- Extensive identity monitoring tools

- $1 million in identity theft insurance

- Can monitor your children’s identity with ChildWatch add-on

- Daily three-bureau credit report monitoring (UltraSecure+Credit plan only)

Consumer Affairs Rating: 3.9 out of 5

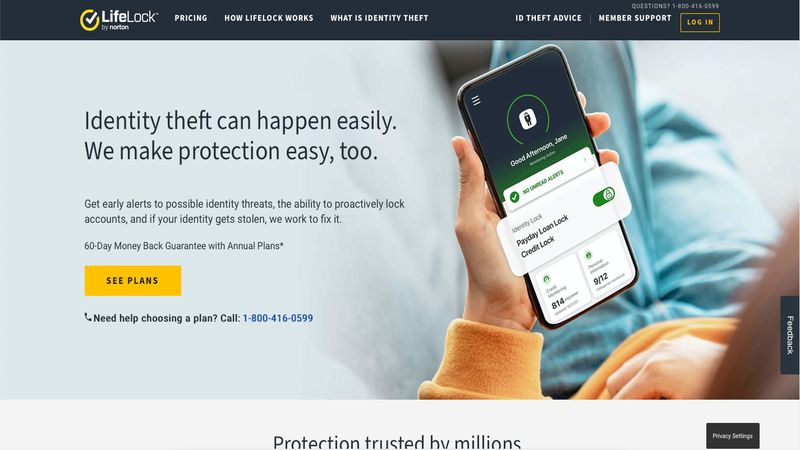

2. LifeLock

LifeLock is one of the first identity theft protection companies. You can choose from three different plans.

Each plan offers different layers of monitoring and repair benefits. LifeLock has a U.S.-based restoration team if someone steals your personal details.

All plans have LifeLock’s “Million Dollar Protection Package.” As you might guess, you get up to $1 million coverage for lawyers and expert legal fees. Each plan has differing coverage amounts for stolen funds reimbursement and personal expense compensation.

Standard

This entry-level plan costs $8.99 per month for the first year and then $11.99 per month.

The main features for this plan include:

- Identity and Social Security number alerts

- Experian® credit report monitoring

- Stolen funds reimbursement up to $25,000

- Personal expense compensation up to $25,000

- Dark web monitoring

- Data breach notifications

You might appreciate this plan if you only need basic identity theft protection. LifeLock will scan the “dark web” to see if someone is trying to sell your personal information.

If strange activity lands on your Experian credit report, LifeLock sends you an alert. It’s possible to approve or report the alert as fraudulent from your phone.

One downside to the Lifelock Standard plan is that you can’t view your credit score. You will need to use a free credit score website or upgrade to a pricier plan.

Advantage

The mid-tier Advantage plan costs $17.99 per month for the first year. You pay $22.99 per month after the introductory rate.

This plan includes the Standard benefits plus these benefits:

- Annual credit score and report viewing from Experian

- Bank and credit card activity alerts

- Alerts on crimes committed in your name

- Fictitious identity monitoring (i.e., someone is pretending to be you)

- Stolen funds reimbursement up to $100,000

- Personal expense compensation up to $100,000

The $100,000 identity insurance benefits can bring extra peace of mind. Also, searching the crime reports for false charges in your name can protect your reputation. Receiving an early warning can also prevent a larger legal headache.

Ultimate Plus

The premium Ultimate Plus plan costs $26.99 per month for the first year and then $34.99 per month. This plan can be your best option if you’re a previous identity theft victim. You might also go with this plan to get more peace of mind for the advanced monitoring features.

Benefits exclusive to this LifeLock plan include:

- Priority 24/7 live customer support

- Home title monitoring

- Checking and savings account application alerts

- Bank account takeover alerts

- 401k and investment account alerts

- File-sharing network searches

- Sex offender registry reports

- Stolen funds reimbursement up to $1 million

- Personal expense compensation up to $1 million

Investment account or bank account takeovers are relatively unlikely. If a thief drains an account that you rarely check, LifeLock can alert you to any unusual activity.

The file-sharing network search can scan cloud databases for information leaked during a data breach.

You also get monthly credit score updates from one bureau. Once a year, you can see your credit report and credit score from the three major bureaus.

Why We Like LifeLock

- $1 million in identity theft insurance

- 24/7 live support

- Credit report monitoring with all plans

Consumer Affairs Rating: 4 out of 5

Learn More: Is Lifelock Worth The Cost?

3. Credit Sesame

Credit Sesame offers free identity theft protection to all members. There’s also a paid option if you prefer advanced protection. At its core, Credit Sesame is still best for credit score tracking.

Free Identity Theft Protection

Admittedly, Credit Sesame’s free plan isn’t feature-packed, but it’s a good option when you can’t afford a premium plan. Plus, who doesn’t like finding free stuff online?

This plan monitors your credit report. Credit Sesame inspects your TransUnion credit report daily. You will receive alerts when unusual activity occurs.

If you become an identity theft victim, the free plan gives you $50,000 in identity theft insurance. You also get live support access to identity restoration specialists.

Platinum Protection

Credit Sesame offers three different paid plans. But only the highest-tier Platinum Protection plan offers full identity theft protection. The other two premium plans focus on providing three-bureau credit report monitoring.

You will pay $19.99 per month for the Platinum Protection plan. This price is competitive with other companies offering similar benefits.

Going Platinum also gives you up to $1 million in identity theft insurance benefits.

The Platinum Protection plan has these identity monitoring benefits:

- Dark web monitoring

- Public records monitoring

- Social Security number monitoring

- 24/7 lost wallet protection

You can also get a monthly update from all three bureaus for your credit score and credit report. If there’s a credit report error, Credit Sesame can help you file a dispute.

Why We Like Credit Sesame

- Free identity theft insurance up to $50,000

- $1 million identity insurance with Platinum Premium plan

- 24/7 identity restoration support

Consumer Affairs Rating: 4.4 out of 5

Learn More: Credit Sesame Review

4. Experian

Maybe you already use Experian® to track your credit score. You can see your industry-specific FICO scores, including your auto, home and bankcard score versions. This is a perk to consider if you’re buying a home soon.

Experian also offers identity theft protection with its IdentityWorks service.

You can get an individual plan. Family plans covering up to 10 children are also available. Experian might be the most affordable option for large families.

All plans come with a 30-day free trial, which is one of the longest free trial periods.

There are two different plan levels. The basic IdentityWorks Plus monitors your Experian credit report and barebones identity monitoring. For complete credit and identity monitoring, you should consider the IdentityWorks Premium plan.

IdentityWorks Plus

IdentityWork Plus can be a good fit if you want to spend less money on basic coverage. An individual plan either costs $9.99 per month or $99.99 per year.

A family plan can cost $19.99 per month or $199.99 each year.

Plan benefits include:

- $500,000 in identity theft insurance

- Dark web surveillance

- Social Security number monitoring

- Address change notifications

- Experian credit report alerts

- Daily FICO credit score updates

You will need to enroll in IdentityWorks Premium to get advanced identity monitoring tools.

IdentityWorks Premium

The IdentityWorks Premium plan is similar to what other theft protection companies offer. You get extensive identity monitoring and three-bureau credit monitoring.

A single adult plan costs $19.99 per month or $199.99 per year. Family coverage costs $29.99 per month or $299.99 each year.

Premium gives you up to $1 million in identity theft insurance. The Plus plan only offers up to $500,000 in insurance benefits.

Experian IdentityWorks monitors these activities:

- File-sharing networks

- Social media networks

- Court records

- Sex offender registries

- Financial accounts

Regarding credit monitoring, Experian checks your Equifax and TransUnion credit reports daily. You receive quarterly FICO credit score updates from these bureaus. Like the Plus plan, you can check your Experian credit report and credit score daily.

Why We Like Experian

- Up to $1 million in identity theft insurance

- Three-bureau credit monitoring with IdentityWorks Premium

- Family plans cover up to 10 children

- Access to industry-specific FICO credit scores

Consumer Affairs Rating: 3.6 out of 5

5. Identity Guard

Identity Guard uses IBM Watson technology to monitor your personal details. Both individual and family plans are available with three different plan levels.

All plans come with a browser extension and an anti-phishing mobile app. These tools can help make your devices more secure in case you visit an unsafe website.

Up to $1 million in identity theft insurance is standard with every plan. It’s also possible to receive reimbursement for stolen funds.

Value Plan

The Value Plan is one of the cheapest identity theft plans you will come across. Individual plans cost $8.99 per month or $90 per year.

You get dark web monitoring scouring the internet looking for illicit use of these personal details:

- Social Security number

- Health insurance information

- Credit card numbers

- Financial account numbers

Identity Guard assigns you a risk management score. Your score can increase when you follow Identity Guard’s suggestions to guard your privacy. This feature is common for other identity theft protection companies.

Total Plan

Choose the Total Plan if you also want three-bureau credit monitoring. You also get more extensive identity monitoring that tracks the latest online identity theft trends.

Individual plans cost $19.99 per month or $200 for an annual subscription.

You will receive alerts for these unusual events:

- Bank account takeover

- Checking and savings account applications

- Tax refunds

- Three-bureau credit report changes

Identity Guard updates your VantageScore 3.0 credit score monthly. This score comes from your TransUnion credit report.

While Total members can get credit report alerts, you cannot view your credit reports. That privilege is only for the top-tier Premier plan.

Premier Plan

Are you one to share most of your life on social media? Sharing life’s highlights can be exciting. But you might also open the door to identity theft.

The Premier Plan lets Identity Guard watch your Facebook timeline for questionable posts. You will get a social insight report with recommended actions to guard your privacy.

Individual plans cost $24.99 per month or $249.96 per year.

You get a monthly credit score and credit report updates from all three bureaus.

For the best credit and identity monitoring, this is one of the best plans. The pricing is also competitive with other companies.

Why We Like Identity Guard

- Competitive plan costs

- Family plans are available

- $1 million in identity theft insurance

Consumer Affairs Rating: 4.3 out of 5

6. ID Watchdog

ID Watchdog can be another favorite choice for parents wanting to protect their children. You can lock your child’s Equifax credit report directly from the ID Watchdog dashboard. Family plans let you enroll up to four children.

Single adult plans are available as well if you don’t need family coverage.

ID Watchdog offers two different plan choices. Both options provide up to $1 million in identity theft insurance and 24/7 customer support.

These identity monitoring benefits are standard with all ID Watchdog plans:

- Dark web monitoring

- Medical care records

- Bank account takeovers

- Public records

- Sex offender registries

- Social media accounts

- Payday loans (these loans won’t appear on your credit report)

- U.S. Postal Service change of address

The best ID Watchdog plan for you depends on what type of credit monitoring you desire. You can either get one bureau or three-bureau monitoring.

ID Watchdog Plus

ID Watchdog Plus provides credit report monitoring from Equifax. However, you won’t be able to see your credit score or credit report.

The monthly plan fee is $14.95, and the annual plan costs $164 per year for single adults. A family plan costs $25.95 monthly or $287 annually.

As other monitoring companies reserve their full identity monitoring suite for the most expensive plans, this plan can be an affordable alternative. The only “catch” is that you only get credit monitoring from one bureau.

ID Watchdog Platinum

Choosing the Platinum plan offers full-service credit monitoring. ID Watchdog monitors your three credit bureaus daily.

You can access your Equifax credit report and credit score daily. Your reports and scores from the Experian and TransUnion are accessible once a year.

In addition to the $1 million in identity theft insurance, you get up to $500,000 in stolen 401k and Health Savings Account (HSA) funds.

Individual plans cost $19.95 per month or $219 per year. Family plans cost $34.95 per month or $383 per year.

Why We Like ID Watchdog

- All plans have extensive identity monitoring

- Up to $1 million in identity theft insurance

- Can freeze credit reports for you or your children

Consumer Advocate Rating: 4.2 out of 5

7. Complete ID

Complete ID offers one of the most affordable identity theft plans, although there’s a catch.

You can only join Complete ID if you’re a Costco member.

Costco Executive members ($120 per year) pay $8.99 per person per month for coverage. All business and basic Gold Star members ($60 per year) pay $13.99 per person per month.

Complete ID will monitor up to five children for an extra fee. Executive members pay $2.99 per month per child. Gold Star and Business members pay $3.99 per month per child.

Regardless of your Costco membership level, you get the same identity and credit monitoring benefits.

All Complete ID members get these benefits:

- Dark web monitoring

- Social Security number monitoring

- Non-credit identity monitoring

- Criminal records monitoring

- Financial account takeovers

- $1 million in ID theft insurance

- 24/7 customer support

Complete ID monitors all three bureaus’ credit reports daily, yet you will only see your reports annually. You get monthly VantageScore 3.0 updates from Experian. However, your Equifax and TransUnion credit scores update annually.

Why We Like Complete ID

- Low-cost plans for Costco members

- Up to $1 million in identity theft insurance

- Daily three-bureau credit monitoring

Best Company Rating: 3.7 out 5

8. Zander Insurance

Fans of Dave Ramsey’s baby steps may like Zander Insurance for a couple of reasons. (Yes, Zander has Dave’s stamp of approval.)

The primary reason for the stamp of approval is that Zander has some of the cheapest identity theft plans. Individual plans are $6.75 per month or $75 for the year. Families pay $12.90 monthly or $145 yearly.

Up to 10 children under age 18 can be on your family plan. Most companies only let you enroll up to five children.

Zander also provides $1 million in identity theft insurance. This coverage limit also extends to stolen funds and personal expenses. Other low-cost plans are likely to have lower (or no coverage amounts) for these two expense types.

Identity monitoring benefits include:

- Dark web monitoring

- Court records

- Social Security number alerts

- Medical ID theft

- Tax refund fraud

Where Zander falls short is their alerting process and its lack of credit monitoring. You can only receive email alerts when Zander detects abnormal activity.

Zander doesn’t monitor your credit reports or provide you with credit score updates. The lack of credit monitoring is one reason why Zander costs less than most identity theft protection plans.

Despite these shortcomings, you still get restoration help and identity theft insurance if you become an ID theft victim.

Why We Like Zander Insurance

- One plan for all members

- Low-cost for identity monitoring

- Up to $1 million in identity theft insurance

Yelp rating: 4 out of 5

FAQs

Here are some of the most frequently asked questions about identity theft protection plans.

The best way to protect your identity for free is by monitoring your credit reports. Look for unusual activity, including new account openings or address changes.

For more peace of mind, you can freeze your credit report for free. You may have to file a separate request with each bureau. Some monitoring services let you freeze your credit from their dashboard. You will need to unfreeze your reports before authorizing a hard credit pull.

You should also use strong passwords, two-step verification and limit your public presence online. These steps can reduce the risk of having your account information compromised.

Most identity theft protection companies offer identity theft insurance coverage amounts up to $1 million.

These policies can cover these qualifying expenses:

– Lawyer and identity restoration expert fees

– Stolen funds from qualifying financial accounts

– Out-of-pocket personal expenses including unpaid time off of work

You will need to read the insurance policy terms and conditions. Each policy provider may have different coverage limits. You might get reimbursed up to $1 million in lawyer fees but only $500,000 in personal expenses, for instance.

Before your insurance benefits activate, you may need to notify the provider of the affected account. This institution may have to offer reimbursement first.

When you first detect identity theft, speak to your identity monitoring company’s restoration team. The team should provide step-by-step guidance to help repair the damage. They can also help you file an accurate claim for all qualifying expenses.-

Summary

Identity theft protection is becoming more critical each year. Daily monitoring helps you detect potential fraud early and gives you extra peace of mind.

Early detection can also make the restoration process less stressful. The best bet is to ensure it doesn’t happen before it happens.