Credit Karma Review: Is It Legit?

Some products in this article are from our partners. Read our Advertiser Discloser.

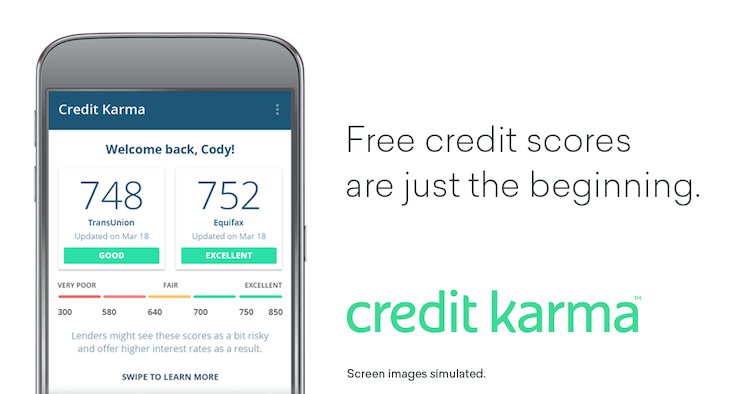

Credit Karma offers credit scores, credit monitoring and account monitoring that is actually free and they can do this because they make their money through advertising.

In this review, I will go over Credit Karma’s basic features, review its effectiveness as a service and deliver a verdict as to whether it will help you maintain a “well kept wallet”.

Overall Rating

Summary

Credit Karma delivers on its promise of being genuinely free. It combines a multitude of useful services and presents these in a natural, intuitive user interface.

-

Ease of Use

4.5

-

Accessibility

4.5

-

Detailed report

3

Pros

- Easy to use

- Free to use

- User interface

Cons

- Report details low

- Clarity of report

What is Credit Karma?

Credit Karma compiles data from TransUnion, supplying users with three different scores. These include the TransRisk New Account Score, VantageScore, an Auto Insurance Score and a Home Insurance Score (see details below).

In addition to offering credit monitoring and account monitoring, the site also provides users with a host of supplementary financial information about credit cards, bank accounts, bills and so on.

Members can read and write reviews of related products, such as credit cards, auto loans, home loans, and life insurance plans. Advertisements of such products are what allow for the service to remain free.

Credit Score details

There are a few different scores so let’s break those down so that you have a basic understanding when you see them.

TransUnion® New Account Score

This score ranges from 300 to 850. It’s calculated by TransUnion which is one of the three major credit bureaus.

The New Account Score is used by lenders to assess your creditworthiness, or the likelihood that you’ll repay your debts.

VantageScore

This score ranges from 501 to 990. The VantageScore model was created through a collaboration by the three major credit bureaus: Equifax, Experian® and TransUnion. It aims to make credit scoring more consistent and accurate across all the bureaus.

The VantageScore grades your creditworthiness on an easy A to F letter scale.

Auto Insurance Score

This score ranges from 150 to 950. It is calculated using data from your TransUnion credit report and is used primarily by auto insurance companies to help assess the likelihood that you’ll file an insurance claim.

It is worth noting that it is not based on your driving record.

Home Insurance Score

This score ranges from 150 to 950. It is calculated using data from your TransUnion credit report.

It is used primarily by home insurance companies to help assess the likelihood that you’ll file an insurance claim.

How does Credit Karma differ from other services?

The San Francisco-based company’s philosophy is to offer users the essential information about their credit score without the inclusion of extraneous details.

The result is a design that is comparatively minimalist. While such a style might do well for some, I personally found the lack of details left much to be desired.

The specific cause of one’s change in credit score isn’t readily apparent, and the report card feature – while intuitive – does not provide the level of detail which might be expected.

Nonetheless, its “simulator” feature, allowing users to experiment with how financial actions may impact their credit score, is highly valuable to say the least.

Is the credit score actually free?

I must, however, give credit where credit is due (apologies for the pun), and note that Credit Karma delivers on its promises.

As is affirmed all through its homepage, Credit Karma offers truly free credit scores, free credit and account monitoring and easy-to-access advice from fellow users of the service.

Additional tools unrelated to credit scores such as a debt repayment calculator, home affordability calculator and amortization calculator are among several other handy services that they offer.

Is Credit Karma easy to Use?

Credit Karma’s interface is natural to use and simply designed. And linking several services into a single UI (User Interface) saves enormous amounts of time in attempting to navigate the sheer number of areas surrounding one’s finances.

Positives and Negatives

To let you figure out if Credit Karma is right for you, here are the pros and the cons.

Pros

- Easy to use interface

- Three different scores in one location (TransUnion Credit Score, VantageScore, Auto Insurance Score, and Home Insurance Score)

- Variety of financial data and tools in one location

- (Actually) free

Cons

- Not as detailed as might be expected

- Cause(s) for changes in credit score not always apparent

Summary

Credit Karma delivers on its promise of being genuinely free. It combines a multitude of useful services and presents these in a natural, intuitive user interface.

Though it is not as comprehensive as one might expect, Credit Karma provides a nice, general overview of one’s financial state of affairs. Get your free credit score from Credit Karma today.

Hi there,

I’m gearing myself up to check on my credit score after 2 years of good payments. Do you know if Credit Karma works for Canadian credit checks?

Many thanks, if you have any info on this.

I believe that it only works for US citizens at this point, but if you find out differently, please let me know.

I used Credit Karma back a couple of years ago and for a free resource, I agree it is great. I obtained mine more out of curiosity than to use it for a future loan. I’m in the camp of not needing my FICO score for some time, but you never know.

I am in a similar situation where I don’t have a need for a FICO score, since I don’t intend to borrow money. One of the best benefits is the early detection of fraud. My wife has had fraud occur on her credit report and we would like to avoid that from happening ever again. Since Credit Karma emails us any time new accounts are opened, we should be able to address any fraud very quickly.

I absolutely love Credit Karma. It really is easy to use and it helps me ensure that nothing crazy is going on with my credit score or accounts.

I’m glad to hear that you are a fan of Credit Karma as well. It is a great way to keep a pulse on your credit, that is for sure.

It only monitors changes to one of the three CRA’s reports, so it’s no substitute for pulling your free reports once a year. Still, the always-on monitoring of TransUnion has proven extremely useful on multiple occasions for me.

I agree. That is a good thing to point out. If people want to get all 3 credit reports for free they can go to AnnualCreditReport.com. Thanks for mentioning that Mario.

I’ve been using Credit Karma for quite some time to monitor my credit score. I use it more as a “trivia” sort of piece of information since I don’t actually care what my credit score is. My philosophy is, if I take care of my bills like I should, then my credit score will take care of itself. But it is kind of interesting to see how the score is generally affected by different actions I take with my finances. I did hear, however, that what Credit Karma reports isn’t your FICO score…do you know if this is true? If not, what exactly is Credit Karma reporting?

I’m glad to hear that you have been using Credit Karma for a while. I use it very similarly in that it is more informative than anything. If I make good financial choices, I see the direct correlation within Credit Karma. As far as the score, you are correct, they do not provide a FICO score. They provide the TransUnion New Account Score which is also used by lenders to assess your creditworthiness. They are not one and the same. However, it is a good gauge to tell if you are moving in the right direction with respect to improving your credit.