NewRetirement Review: A Great Retirement Planner Tool

Some products in this article are from our partners. Read our Advertiser Discloser.

It can be challenging to figure out how much to save for retirement. Starting to save as soon as possible improves the likelihood that you will achieve your retirement goals.

NewRetirement helps you build a customized retirement strategy for free. Premium tools are also available for in-depth planning and personalized support.

This NewRetirement review can help you decide if this is the retirement planning tool to improve your saving strategy. We’re trying out the features so you can get a firsthand look.

Overall Rating

Summary

NewRetirement offers free retirement planning tools that will satisfy most users. The premium plan and financial advisor packages provide personalized support.

-

Ease of use

4

-

Features

5

-

Reports

4

-

Cost

5

-

Customer support

4

Pros

- Mostly free

- Quick setup

- In-depth retirement tools

Cons

- Limited account syncing

- Basic monthly budget tools

- No mobile app

What is NewRetirement?

NewRetirement provides free and paid retirement planning tools that offer more insight than your broker’s retirement calculator.

Some of the NewRetirement features include:

- Customizable retirement planner

- Personalized coaching suggestions

- Detailed graphs and charts

- Net worth tracker

- Financial advisor packages

It takes less than ten minutes to complete a basic questionnaire to project your retirement progress. You can customize your responses after the initial review to fine-tune your plan.

The retirement planner is more like a budgeting app than an investment tracking app like Empower. However, NewRetirement doesn’t link to financial accounts unless you upgrade to the paid PlannerPlus version.

The one-on-one financial advisor sessions also require a purchase. That said, most of the platform is available with their “forever free” membership.

Who Should Use NewRetirement?

The free platform can be a good option for anyone unsure if they are saving enough for retirement. You should also consider this platform if you want a customizable retirement planner.

Upgrading to the NewRetirement PlannerPlus includes real-time net worth tracking and money simulators.

You can get personalized suggestions and hire an on-demand financial advisor for one-on-one planning sessions.

Is NewRetirement Safe?

NewRetirement protects your data with bank-level security. The company uses a third-party service (Plaid) to connect to bank and brokerage accounts without storing the information on its server.

You also won’t get annoying phone calls encouraging you to upgrade to the paid version like you will with other companies. If you only want to use the free version, you can do so hassle-free.

NewRetirement Pricing

NewRetirement offers four pricing options, ranging from free to $999 annually. Here’s a breakdown of each option.

Basic

Annual cost: $0

The default account option is the Basic level. This tier is free, and there isn’t an obligation to pay for any services unless you want access to additional features.

Free retirement planning tools include:

- Interactive retirement calculator

- Coaching suggestions

- Online Facebook group community

This plan doesn’t link to financial accounts or track your net worth in real time.

However, it lets you quickly project how much money you can have in retirement and what steps you can take to improve your odds of success. You can also update your financial metrics and see the potential impact.

All new members start with the free planner. You can see how much information this membership plan provides and decide if you want to upgrade for full functionality.

I personally think this plan is sufficient if you want a rough idea of your current progress. However, being unable to customize your assumptions for the various factors can be a mild frustration. For example, I own an investment property and need the paid version to record this.

PlannerPlus

Annual cost: $120

The PlannerPlus tier has a 14-day free trial and costs $120 per year.

Upgrading unlocks more interactive features, including:

- Links to bank and investment accounts

- Budgeting tool (over 75 categories)

- Create customizable scenarios

- Add optimistic and pessimistic assumptions

- State-specific tax calculators

- Medicare simulators

- Real estate tracker

- Roth conversion modeling

- Printable and downloadable reports

- “What if” scenarios

PlannerPlus doesn’t provide human financial advisor access. However, the advanced planning tools and simulators can answer most of your questions.

There are also live Q&A sessions to help you navigate the planning process. The webinar host can answer your questions as you improve your plan.

You should choose this plan to monitor your bank and financial accounts in real time. The service can track your net worth and account balances.

PlannerPlus Academy

Annual cost: $270

With PlannerPlus Academy, you get to access monthly personal finance classes and priority product support. These benefits are in addition to the digital retirement planner.

The in-depth classes cover topics including:

- Asset allocation strategies

- Budget and expense planning

- Building an income plan

- Medicare and Socail Security benefits

- Tax planning

Multiple classes are pre-recorded and you can watch them on demand. Academy members also have access to exclusive in-depth live Q&A sessions.

You may consider this membership tier when you want to improve your personal finance skills and hone your retirement planning knowledge at a self-guided pace. This level provides decent hands-on support but still doesn’t offer financial advisor access for advanced help.

Advisor

Annual cost: Varies ($1,500 average)

You get access to a Certified Financial Planner (CFP) with the Advisor tier.

The cost varies depending on the number of online planning sessions you request. On average, the typical user spends $1,500 per year in advisory services.

It’s possible to start with a free discovery session to to decide if this service is beneficial. If so, you pay a flat fee instead of a percentage as most advisors charge.

The plan includes:

- Discovery call: Free session to discuss your financial goals

- Plan overview: Initial consult to review to agree on your plan’s data points and assumptions

- Plan of action: The CFP creates a personalized financial plan

- Annual check-in meeting: A yearly review of the plan progress and to make changes

- Ongoing support: Unlimited advisor access for advice on different retirement topics

The service recommends this plan if you’re within five years of retirement or seeking advice on a pending financial decision. It’s the only pricing tier to offer personalized financial planning sessions.

What Features Does NewRetirement Offer?

Here are several of the virtual advisor tools the platform offers.

Retirement Planner

The customizable retirement planner tool is the cornerstone of NewRetirement. It covers multiple financial factors that impact your retirement strategy, regardless of if you plan to retire early or later in life.

It takes approximately ten minutes to make a basic plan. Then, you can add extra information on the “My Plan” menu.

You can add and modify your details later on as necessary. This flexibility is nice if you don’t have all the answers right now or discover overlooked areas during the setup process.

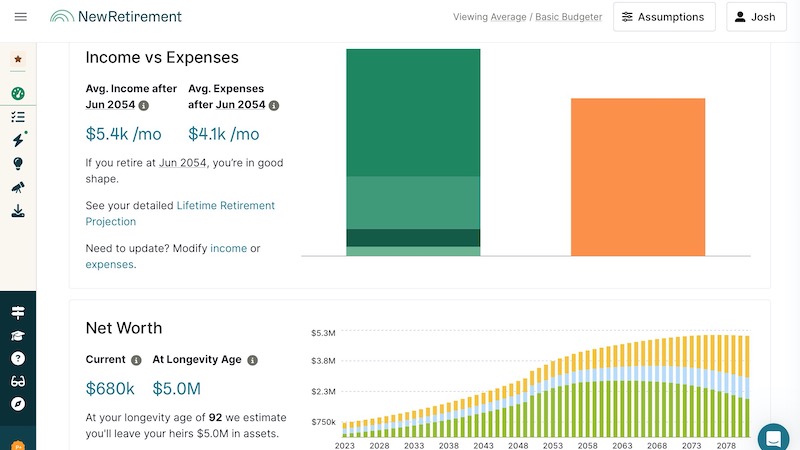

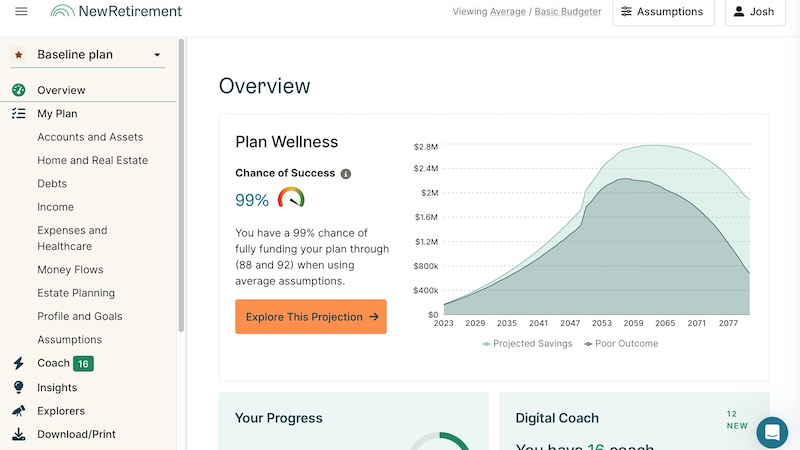

The projections are displayed as a chart on your account dashboard. This chart projects your savings progress during your working years and annual retirement drawdowns.

The planner requests information for these topics:

- Current age

- Income

- Expenses

- Savings balance

- Housing costs and home equity value

- Medical expenses

- Retirement benefits

- Estate planning

Overall, the planner is easy to use. Here is a look at the most influential factors.

Work and Other Income

This section calculates your annual earned income and passive income streams. The tool can also ask where you will store your excess earnings after paying your monthly bills.

Premium subscribers can project annual salary increases with an optimistic and pessimistic projection.

Expenses and Inflation

The free version only asks for your total monthly expenses, large one-time expenses and non-mortgage debts. This calculation quickly compares your income to expenses to project your cash flow and net worth.

PlannerPlus offers an in-depth budgeting tool, but you must manually input your expenses for the 75+ categories.

You will need to use a full-fledged budgeting app to track your actual spending against your monthly budget.

Paid subscribers can also use an inflation calculator to see how rising prices can potentially reduce their spending power in retirement. This tool can be especially helpful with the recent bout of generational high inflation.

There is a separate section for listing current debt payments. You can erase these as you get out of debt.

Savings and Assets

Users on the Planner tier can manually add the balance of their bank accounts and investment accounts, including IRAs and 401ks. They can also add the value of tangible assets like vehicles.

Paid subscribers can link to their financial accounts for effortless tracking.

NewRetirement uses this information to calculate your liquid net worth and project future tax situations.

Premium users can add these details as well:

- Estimated annual return per account

- Tax treatment of investment gains

- Roth conversion calculator

Listing your current savings balance and savings rate makes it easier to estimate the size of your future nest egg for liquid assets and alternative investments.

Social Security

You can calculate your Social Security benefits. PlannerPlus subscribers can also use a cost of living calculator.

The Social Security Explorer tool can run several scenarios to choose the best age to start drawing benefits. You can also see how this stipend plays into your overal strategy to afford expenses.

Annuities and Pension

Users can add annuity and pension details, including the benefit amount, cost-of-living adjustment, and survivor benefits.

The service can track monthly pensions and lump-sum pensions.

If you don’t have an annuity yet, NewRetirement offers a free consultation to determine if you’re an ideal candidate for this account.

Withdrawals

How much of your retirement savings you withdraw each year can be as important as saving for your golden years.

You can compare several withdrawal strategies based on:

- Spending needs

- Maximum spending

- Fixed percentage withdrawals

Only the spending needs strategy is available for free.

You might upgrade to access the fixed percentage withdrawal if you want to observe the 4% rule. PlannerPlus subscribers can also model transfers between accounts and see the impact on future withdrawals.

Home and Real Estate

Your housing costs are another critical factor in estimating retirement costs. One of the onboarding questions is whether you own or rent your primary residence and the current monthly payment.

You can also include your current home equity for your primary residence with the Basic plan. Upgrading is necessary to track second homes, investment properties and project future sales or acquistions.

PlannerPlus features include:

- Track multiple real estate properties

- Model future real estate purchases and sales

- Simulate mortgage refinancing or relocating

- Calculate property value appreciation

It’s possible to run “what if” scenarios to forecast buying, selling, and refinancing properties.

Medical

All users can enter current medical insurance premiums and projected medical and long-term care expenses in retirement.

Premium members can perform these functions:

- Estimate Medicare expenses

- Long-term care planning

- Project medical treatment price inflation

It can be challenging to pinpoint medical costs during your retirement years when it’s still several decades away. I appreciate the general assumptions and customizable scenarios to draft a realistic plan and progress assessment.

For example, free users can decide which Medicare plan they want to use. They can also choose how they plan on paying for long-term care, such as a specialty insurance policy or relying on a relative.

“What If” Scenarios

The “what if” simulator can be one of the most valuable tools as you can change many variables to estimate the potential impact on your retirement finances.

Some examples can include:

- Paying off debt or investing your extra income

- Early retirement vs. working until the standard age

- Estate planning

- The financial impact of relocating

- Switching asset allocation of investments

- Roth conversions

Considering several possibilities during the planning process can help you choose the best course of action. Running these scenarios can also identify potential weak spots that can hinder achieving your goals.

Insights

Inputting your information helps NewRetirement project your savings progress. The results are displayed in several colorful graphs and charts.

These charts measure these topics:

- Projected age when savings will run out

- Total savings needed per year

- Planned income and expenses

- Net worth forecast

- Retirement withdrawals by account type

The free charts make it easy to determine if you will likely outlive your savings. If the service projects a deficit, you may need to contribute more to a retirement account.

Premium subscribers can see advanced charts that analyze specific accounts and project estimated taxes using the PlannerPlus Inspector tool.

Monte Carlo Analysis

Paid users may enjoy the Monte Carlo simulator. This tool runs 1,000 scenarios using different investment, inflation, and earned income assumptions to find the probability of having enough money for retirement.

This analysis tool provides a more in-depth glimpse at the optimistic and pessimistic situations than the free insights.

Financial planners typically run this analysis when making your financial plan. With NewRetirement, you can gain similar insights at an affordable cost by yourself.

Improved Retirement Planning

Most retirement planning tools only calculate your current progress and recommend how much you should save each month to achieve your goals.

NewRetirement offers several virtual coaching options to provide personalized guidance.

Strengthen Your Plan

The Strengthen Your Plan tool is an online education center for different financial and retirement topics.

Some of the topics include:

- Increasing savings rate

- Maximizing Social Security benefits

- Minimizing tax liabilities

- Opening a health savings account

- Preparing for known and unknown risks

NewRetirement recommends relevant articles, strategies and calculators throughout the platform.

These topics can bolster your finances to avoid outliving your cash reserves and also to prepare for unknown expenses and risks.

Coach Suggestions

The automated coaching tool looks for gaps in your current strategy. You will see suggestions to add more details for the service to assess your actual financial situation.

After entering accurate information, the coaching tool may recommend additional steps. Paid subscribers will have access to more recommendations.

Your retirement score increases as you complete open suggestions and as your savings trajectory improves. This score is visible on the main dashboard and other pages.

Communities

All free and premium members can join the NewRetirement Facebook group. This online community lets users interact with one another to talk about the platform and general finance topics.

Expert Help

Users can order a one-on-one session with a planning coach make sure their plan is set up correctly. You pay $175 and this isn’t a substitute for financial planning but it can provide peace of mind and remove errors and omissions.

The live Q&A sessions for free and paid members are also helpful for receiving detailed insights to improve your plan and financial knowledge.

Customer Support

You can get technical support by email and live chat. It’s important to note that it can take several hours to receive a response by live chat.

NewRetirement offers an “Office Hours” video session on Thursdays where users can ask questions about navigating the platform.

The platform is easy to use. Several video tutorials are available that you can try before contacting customer support.

Users must purchase the Advisor package to get personalized financial advice.

Positives and Negatives

As with any financial service, you’ll want to be aware of the benefits and downsides before signing up. Here are the pros and cons of NewRetirement.

Pros

- Free retirement planner

- Customizable assumptions for over 250 inputs

- Multiple visual reports

- Financial advisor add-on packages

- No annoying phone solicitations

Cons

- Several simulators require a paid subscription

- Only PlannerPlus links to bank accounts

- The budgeting tool doesn’t track transactions

How to Join

Joining NewRetirement is easy and takes roughly eight minutes to make an in-depth plan or two minutes to complete a shorter registration process.

The following steps are for completing the in-depth registration. This option is more accurate and requires less effort later.

1. Enter Personal Information

After clicking “Create Free Account” on the NewRetirement homepage, you complete a profile survey.

Enter your name, age, and planned life expectancy. There is then a follow-up question about submitting the same details for your spouse.

2. Enter Current and Estimated Income

The next step is stating your current monthly income and estimated annual income until you reach retirement age.

You can fine-tune your active and passive income streams after completing the initial questionnaire. PlannerPlus members can define a specific annual percent change for a precise projection.

3. Project Social Security Benefits

The third section focuses on your estimated Social Security benefits. NewRetirement projects your monthly payment based on your age and income.

It’s possible to retrieve your information from the Social Security Administration website for a more accurate calculation.

4. Enter Savings

Enter your total current retirement savings and taxable savings balances. The service also asks for your monthly contribution amount.

You will see a graph showing your estimated savings before answering the remaining questions.

5. Include Pension Payments

Enter any pension payments you might receive in retirement.

6. List Current Housing Costs and Home Value

Enter your current housing situation and any home equity you have in your primary residence. You can also list your current monthly rent or mortgage payment.

7. Add Monthly Expenses

The final question asks for your monthly medical and household expenses.

8. Visit the Dashboard

You will go to the dashboard after completing the onboarding questions.

This page displays the following details:

- Plan wellness score

- Current net worth

- Estimated average monthly retirement income

- Estimated estate value

- Approximate age when savings will run out

It’s possible to increase your wellness score by completing coach suggestions and improving your financial situation to reach your goals.

The dashboard stats will update as you adjust the figures for the various topics.

While some effort is necessary to predict your retirement savings, this tool can quickly suggest if you’re on track and highlight areas needing improvement.

Summary

NewRetirement is a robust retirement planning tool. Its free features can quickly offer an in-depth look at your retirement strategy and recommend helpful changes.

These suggestions can be particularly helpful as you figure out when you can retire.

Upgrading to the PlannerPlus is affordable and can provide more peace of mind. Most people will appreciate this tier’s customizable assumptions and scenario simulator. The financial advisor packages are also handy when you need hands-on guidance.