7 Best Debit Cards to Build Credit

Some products in this article are from our partners. Read our Advertiser Discloser.

A good credit score is a useful tool for your personal finances that can unlock substantial savings when financing big purchases. For most people, credit cards are the main way they build or improve their scores.

But what if you don’t want to risk the temptation of a credit card? The good news is that there are now debit cards specifically designed to help you build credit.

If you want to improve your credit without the risks of a credit card, we’ve found the best debit cards to build credit.

Top Debit Cards to Build Credit

A debit card that can help you build credit is a relatively unique find. To streamline your research process, we’ve scoured the market for the top products that will show up on your credit report.

Each of the cards below offers a streamlined way to build your credit history while using a debit card. Plus, they come without the risk of a traditional credit card.

In alphabetical order, here’s a look at the best debit cards to build your credit.

1. Extra

Best Overall Debit Card

Unlike a traditional debit card, the Extra Debit Card allows you to improve your credit history by spending your own money that’s already in your bank account.

This platform regularly reports your payments to two of the three major credit bureaus. While it reports to Experian and Equifax, the service won’t report your payments to TransUnion. This differs from a regular credit card issuer.

When working with the Extra Debit Card, you won’t need to sign up for a separate bank account. Instead, the service connects to your existing financial institution. There are over 10,000 banks that are compatible with the platform.

As you spend your funds, Extra covers the cost. The next day, you’ll automatically pay Extra back.

These on-time payments will build a positive credit history. Since payment history represents 35% of your FICO score, having a record of on-time payments will push your score in the right direction.

As you build your credit, you’ll also earn points on your spending. Extra offers 1% in points on your purchases.

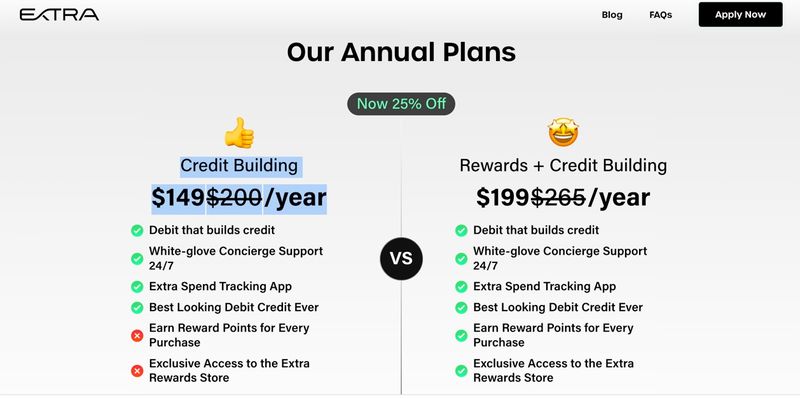

How Much Does Extra Cost?

Extra offers an affordable annual plan:

Even though this cost can add up, improving your credit score could be well worth the new line item in your budget.

Learn more: Extra Debit Card Review

Pros

- No credit check

- Earn 1% rewards

- No security deposit

Cons

- Doesn’t report to TransUnion

- Restricted reward redemption options

2. Grain

Best Debit Card For All Ages

Grain offers a credit building option through your debit card spending. The product is a virtual credit card that allows you to better your credit score without switching to a new checking account.

This virtual credit card operates similarly to a cash advance. When you start working with Grain, you’ll need to transfer a portion of your credit limit into your linked checking account.

Once you start spending the funds using your virtual credit card, you’ll receive a monthly statement of your spending.

Similar to normal credit cards, Grain will report your payment information to all three major credit bureaus each month. If you make on-time payments, this reporting should improve your credit score and show up positively on your credit report.

Every six months, Grain will evaluate your account for a credit line increase. If you receive a credit line increase, it could help improve your credit score by lowering your credit utilization rate.

How Much Does Grain Cost?

Grain might be a solution for credit building while spending from your debit card. However, there are some fees involved.

First, you’ll encounter a transfer fee. A 1% fee is charged each time you transfer funds from your line of credit to your bank account. There is an instant transfer option, but the fee is 1.5%.

Next, you’ll potentially face interest charges. If you make on-time monthly payments for the complete balance, you won’t need to worry about interest. But, if you don’t pay off the entire balance by the due date, you’ll face interest charges.

Pros

- Reports to credit bureaus

- No credit check

- Credit increases available

Cons

- Transfer fees

- Interest charges

Related article: 10 Best Apps Like Grain

3. Sequin

Best Debit Card For Women

The Sequin Card is specifically designed with women in mind. Women can use this card to get a better credit score while making debit card purchases.

That said, Sequin Card does note that all genders are welcome.

Unlike some of the other options on this list, the Sequin Card may require a change in your checking account. While a regular security deposit isn’t mandated, you’ll need to have a deposit account through Evolve Bank and Trust to use the card.

Similar to a credit card issuer, this service will front your funds. But, unlike a normal credit card, it will withdraw the same exact amount of money from your bank account the same day. This builds a record of on-time payments.

As you use Sequin Card, you won’t face any monthly fees or interest charges. Plus, you won’t need to agree to a credit check.

If you move forward with Sequin, you’ll enjoy a 1% cash back reward on every dollar spent on the card. Plus, you’ll be able to access other perks and discounts.

These additional benefits include:

- Access to credit events and workshops

- A $25 cash credit on Pink Tax categories

- Discounts on women-focused brands

It’s important to note that the Sequin Card requires you to sign up for a waitlist. There is no information on how long it may take to get access to the card.

How Much Does Sequin Cost?

Sequin’s website lists an $89 membership fee to use the card. However, the company says that this membership fee is well worth the perks and benefits since the value of those exceeds the card’s cost.

Pros

- Designed for women

- Reports to credit bureaus

- No monthly fee

- Rewards and perks

Cons

- Waitlist to join

- Deposit required

4. Sesame Cash

Best Debit Card With Free Option

Sesame Cash is a credit building opportunity provided by Credit Sesame. It’s a digital debit account with a Credit Builder feature built right in.

To get the card, you must start by opening a Sesame Cash account. Even without the credit building feature, this FDIC-insured account has plenty of features that make it worthwhile.

A few benefits include:

- No minimum balance requirement

- Zero monthly maintenance fees

- No foreign transaction fees

- Cash back on your purchases

The Credit Builder perk is one of the many features that the Sesame Cash account offers. To start building credit, you’ll need to request a Credit Builder account. Then, you’ll set aside a certain amount of money for credit building purposes.

Basically, you can think of these funds as a security that determines your credit limit.

From there, all you have to do is use your Sesame Cash debit card. As you make purchases, Sesame Credit Builder will report those transactions as on-time payments that show up on your credit report and improve your credit history.

Not only is this credit building option free, but you can actually earn money for working with Credit Sesame. If your credit score increases by 100 points in a 30-day cycle, you’ll receive $100.

How Much Does Sesame Cash Cost?

Sesame Cash offers a free way to help you when you are building credit. That said, you’ll need to have some funds to set aside as a sort of security deposit before you can get started.

Pros

- Cash back on purchases

- Free to use

- Rewards for improving credit

- Reports to credit bureaus

Cons

- Upfront deposit required

- Need a Credit Builder account

Learn more: Sesame Cash Review

Best Secured Credit Cards

The cards we’re sharing next function as secured cards, which means you have to put down a cash deposit which determines your credit limit.

However, they still offer you the ability to build or rebuild your credit score.

5. Chime

Best Card for a Tandem Checking Account Relationship

Chime is a banking fintech that offers a checking account, a debit card, and a Credit Builder account.

The Chime Credit Builder account is attached to your Chime checking account. The account comes with a secured card that you can choose the limit for.

The limit is based on how much money you’ve chosen to put in your Credit Builder account.

The Credit Builder account functions as a secured credit card is different from traditional secured credit cards because:

- There’s no credit check when you apply

- The Chime app shows you how much you have available to spend

- There are no annual fees

- You won’t pay interest

- There’s no minimum deposit amount for the account

You can put as little as you want in your Credit Builder account. Then use the Credit Builder card to spend money on things you’d normally buy such as groceries.

At the end of the month you can pay your Credit Builder card off. Your payments are reported to credit bureaus.

On-time payments help you build credit.

How Much Does Chime Cost?

Chime doesn’t charge anything for its Credit Builder account. It’s free. However, you will pay a fee when you use out-of-network ATMs.

That being said, Chime does offer more than 60,000 in-network ATMs to choose from. See our full Chime review here.

Pros

- No annual or monthly fee

- Choose your deposit amount

- No credit check

Cons

- Out-of-network ATM fee

6. Sable ONE Secured Card

Best “No Credit Check” Card

The Sable ONE secured card is also a secured credit card that partners with the Sable free checking account.

Sable offers a checking account with no monthly fees and no minimum balance requirement.

And you can get a free Sable debit card and a free Credit Builder card as well.

You choose the limit for your Credit Builder card, and the funds are transferred from your Sable checking account.

As you use and pay the card off each month, your activity is reported to major credit bureaus.

There is no credit check done when you apply for your Sable ONE Mastercard.

Bonus: Sable pays cash back rewards on purchases made with the card.

How Much Does Sable ONE Cost?

There are no annual or monthly fees for Sable ONE, or for the banking account or debit card.

You will pay interest on unpaid balances that carry over from month to month.

See our full Sable review here.

Pros

- No monthly fees

- Zero minimum balance requirement

- No minimum deposit for secured card

- No credit check performed

Cons

- Interest accrues on unpaid balances

7. Bank of America Customized Cash Rewards Card

Best Rewards Card for Building Credit

The Bank of America Customized Cash Rewards card offers two main benefits to those looking to build credit:

- You’ll earn rewards on every purchase

- You can choose a category in which you’ll get paid double the standard rewards

This is a secured card that allows you to choose your spending limit, anywhere from $200 to $5000.

You get 3% cash back in the category of your choice. And you’ll get 2% cash back at grocery stores and wholesale clubs.

All other purchases will earn 1% cash back. Also, this card allows you access to your monthly updated FICO score for free.

How Much Does the Bank of America Customized Card Cost?

There are no annual fees associated with the Bank of America Customized card.

You will pay interest on unpaid balances on the card.

Pros

- Cash back on all purchases

- Customizable rewards percentages

- Free monthly FICO score access

Cons

- Interest charges on unpaid balances

Frequently Asked Questions

If you are still on the fence about signing up for a debit card to get a better credit score, these answers to commonly asked questions can help you decide if this type of product is a good fit for you.

When using a debit card, there is no risk of going into debt. This is because your available funds typically determine your credit limit.

Without the higher credit line associated with most credit cards, you’ll need to stick to spending only money you have available in your checking account.

Plus, if you have a limited credit history, it can be hard to approved for a card from regular credit card companies. It’s much easier to get a debit card so you can improve your credit score.

The downside of using a debit card to improve your credit score is that not just any debit card will work. Most traditional debit cards won’t help you build credit.

Instead, you’ll need to use a debit card that is specifically designed to help you build credit. These cards will report your payments to the major credit bureaus.

It depends. If you want to build credit with a debit card, you’ll need the help of a specific card since a traditional debit card won’t report payments like credit cards do.

Debit cards that build credit will provide an opportunity to build credit while using their debit card.

Yes. Using a credit card to make purchases can help you build credit. However, it can also hurt your credit if you don’t use the card responsibly.

You’ll need to consistently make on-time payments and keep your balance to a minimum to build credit with a regular credit card.

Summary

Good credit is worth pursuing. For those who want to finance major purchases, good credit scores are a requirement. That said, an excellent credit score will help you save thousands over the loan term.

If you want to build or improve your credit, a credit-building debit card is a great solution. With the help of this spending tool, you can build credit by making everyday purchases since your payments are reported to the credit bureaus.

The best part is that you won’t need to face the risk of spiraling into credit card debt. This is a safe solution to help make sure your credit health is the best it can be.