10 Best YNAB Alternatives (Paid & Free Budgeting Apps)

Some products in this article are from our partners. Read our Advertiser Discloser.

Have you ever heard of You Need a Budget (YNAB)? YNAB is a budgeting tool created to help you have better control over your finances. It’s one of the most popular budgeting apps, but are there better YNAB alternatives?

Depending on your budgeting style, YNAB might not be a good fit. We’ll show you some similar software programs to help you decide which budgeting program is best for you.

There are many reasons why budgeting is important, and these tools will help you to do it better.

Why You Might Want A YNAB Alternative

You Need A Budget is a very popular budgeting app, however, it does have some drawbacks. First, it is $14.99 per month, which can be pricey since there are free and lower-cost budgeting apps.

Second, it does not have much regarding investment tracking or analysis. This is why Empower is our top pick since it is free and has robust investment tools.

Top You Need a Budget Alternatives

There are a few different options you may want to check out if you’re looking for an alternative to YNAB. Each helps you reach your financial goals better, but they all work differently.

Here are some details on the You Need a Budget alternatives we found.

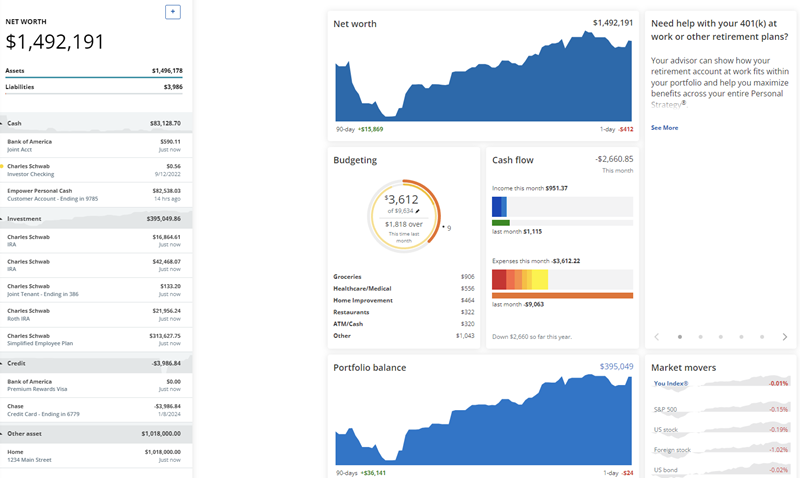

1. Empower

Empower will help you manage your money. However, it does so in a much more comprehensive way than YNAB as you get to see the long-term financial results.

It also has a budgeting tool that will automatically categorize your expenses. When you sign up with Empower, you start by linking your financial accounts. You’ll include checking, savings, credit card, loan, retirement, and investment accounts.

Now you have a complete picture of your financial situation in one place. The free financial tracking tools help you monitor your overall financial situation. It’s nice because you don’t have to check each account manually online.

Instead, you can pull up your Empower account and see a full picture of your net worth and financial picture.

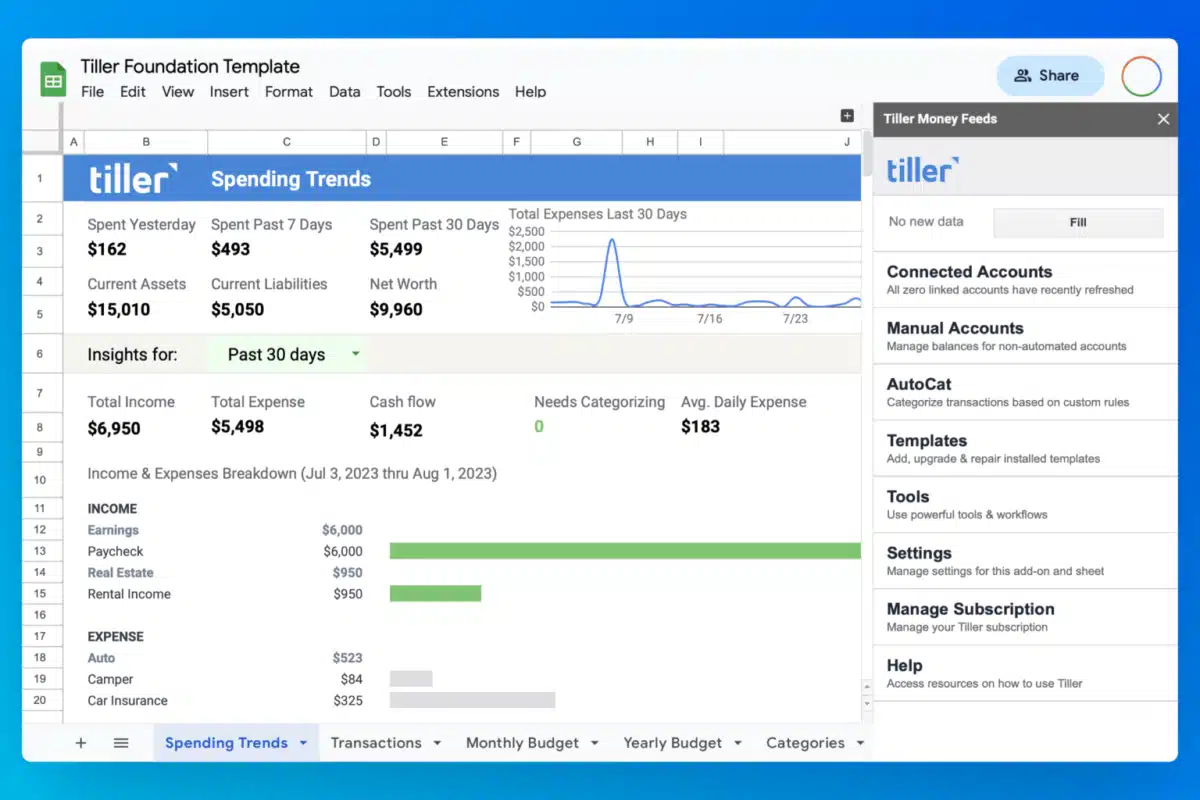

2. Tiller

Tiller Money is an awesome alternative to YNAB. It’s great for budgeting, expense tracking, and debt payoff.

The main difference between Tiller and the other options on this list is that it uses Excel and Google spreadsheets.

When you sign up with Tiller Money, you link up your accounts, just as you do with You Need A Budget. Next, you’ll create customized spreadsheets to help you manage your money.

Here are some examples:

- Monthly budget spreadsheet

- Debt snowball spreadsheet (yes, it’ll help you get debt-free using the debt snowball method)

- Net worth tracker

- Weekly expense tracker

The worksheets are attractively designed and super easy to view and use. In fact, I signed up for Tiller a while back and am loving it. It’s thorough but easy enough for tech novices like me to use.

And it’s affordable. Tiller Money costs $79 a year. That averages out to $6.58 per month.

3. Qube Money

Qube Money was founded by financial health coach Ryan Clark, who is passionate about helping people overcome spending and budgeting problems.

He calls Qube Money “envelope budgeting for the 21st century.” Using the Qube app, you set up Qubes for all your budget categories.

When you need to make a purchase, go to your Qube app and see how much money is left in the Qube for the coordinating category.

Enter the amount of your purchase, and Qube automatically transfers the money from your bank account, provided you have available money in that Qube.

With Qube, you can always see how much money you’ve left in each spending category. This helps ensure you stay on budget.

ⓘ Learn More: Qube Money Review

4. Mint

Mint.com was founded in 2006 and is currently owned by Intuit. It offers you a way to budget and track your money in one place. And it’s one of the most popular YNAB alternatives.

Like the other services listed here, Mint gives you easy access to your bank, credit card, investment, and loan accounts all in one place.

It’ll also send you alerts if your bank account is running low or you have payments due on loans or credit cards. This is a nice feature because it helps ensure you won’t accidentally forget to pay.

Late payments often result in late fees and raised interest rates. So, in that way, Mint can help you save money.

In addition, Mint will let you know how much you’re paying in ATM and other fees. And it’ll alert you if there are any large or unusual transactions on your accounts.

Lastly, Mint helps you keep track of your net worth. It’s displayed at the top of your account every time you sign in.

Related: YNAB Versus Mint: Which is Better?

5. CountAbout

CountAbout was founded to be a step up from Quicken. In fact, you can seamlessly migrate from Quicken to CountAbout.

The site will automatically sync your Quicken data into the CountAbout system. One nice feature of CountAbout is that you can rename spending categories.

CountAbout’s prices are also very reasonable. The basic budgeting plan costs $9.99 per year.

If you’re willing to upgrade to the premium plan, you’ll get an added benefit: automatic download of transactions. The premium plan is only $39.99 per year. That equates to a bit over $3 a month.

Along with budgeting tools, CountAbout also provides:

- Graphs to help you assess income and spending

- Ways to incorporate recurring transactions and split transactions

- Apps for Android and iOS

It’s a fairly thorough system that should meet the needs of most basic budgeters.

6. Simplifi

Simplifi by Quicken is a newer budgeting app that aims to be a step above the old Quicken budgeting system.

In fact, the New York Times Wirecutter voted Simplifi the best budgeting app two years in a row. Simplifi is similar to Empower in that it lets you view your financial accounts in one place.

Your Simplifi dashboard allows you to view bank accounts, investments, 401ks, credit cards, loans, and more.

At just $5.99 per month (or $47.88 annually), Simplifi is also cheaper than YNAB.

Read our the full Simplifi Review for more details.

ⓘ Learn More: Simplifi Vs Mint: Which is Better?

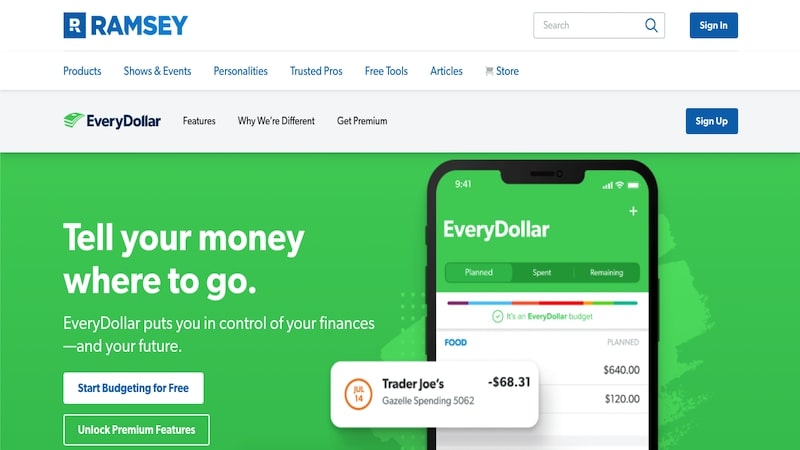

7. EveryDollar

EveryDollar is one of the most popular YNAB alternatives and is the budgeting brainchild of Dave Ramsey, the well-known personal finance expert.

The website says it’ll help you create your first budget in less than 10 minutes. It’s a simple program that’s fairly easy for people of almost any technical skill level.

EveryDollar is free and allows you to manually add income, spending, and budgeting information.

Consider upgrading to Ramsey+ if you want bank syncing, budget reports, and downloading transactions to a spreadsheet.

After a 14-day free trial, a Ramsey+ membership costs $9.99 for one month or $99.99 for one year.

ⓘ Learn More: EveryDollar Review

8. Goodbudget

Goodbudget is a budgeting app that helps you determine the “why” behind your expenditures. In other words, it helps you create a value-based spending plan.

It’s based on the cash envelope system and gives you electronic envelopes to put your spending money in when you create your budget.

You can also sync your device with your partner to work your budget together. The free version of Goodbudget includes ten digital envelopes and works with one account for up to two devices.

The Plus version ($7 per month/$60 annually) includes unlimited envelopes and accounts and lets you partner on five devices.

9. PocketSmith

PocketSmith has been helping people budget since 2008. It touts itself as a budgeting app with unique features for every budget need, including those with multiple income streams.

With PocketSmith, you can import transactions from your bank using multiple bank accounts if they’re from the same bank. You can track your income, expenses, net worth, and more.

You can make a cash flow forecast and work in multiple currencies. PocketSmith has a free plan allowing you to manually budget and import transactions.

The Premium plan from PocketSmith is $9.95 per month or $7.50 per month if paid annually. This is their most popular plan. It allows for automatic or manual transaction importation, a 10-year financial projection, and unlimited budgets.

Lastly, PocketSmith’s SuperPlan allows for 30 years’ projection of your financial picture and costs $19.95 per month or $14.16 per month if paid annually.

10. PocketGuard

PocketGuard’s big push is that it allows you to know how much money is in your pocket at all times. You can use it to make a budget, monitor your spending, and remind you when bills are due.

By knowing what’s left in your “pocket” for the day, week, or month, you can better make fluid spending decisions.

PocketGuard has a free version that allows you to import data from your bank and put the data into preset categories.

PocketGuard Plus costs $4.99 per month or $34.99 per year when you pay annually. With PocketGuard Plus, you get added features like customized categories, unlimited goals, and more.

How Do These Alternatives To YNAB Compare?

| Company | Cost | Best Feature |

| YNAB | $98.99/yr. | Zero-based budgeting |

| Tiller Money | $79/yr. | Customizable spreadsheets |

| Empower | Free | Comprehensive financial summary |

| Qube Money | $0 to $11.50/mo. | Individual and family plans |

| Mint | Free | Payment due date alerts |

| CountAbout | $9.99/yr.-$39.99/yr. | Supports small business invoicing |

| Simplifi | $5.99/mo.-$47.88/yr. | Intuitive spending plan |

| EveryDollar | $9.99/mo.-$99.99/yr. | Split transaction capabilities |

| Goodbudget | Free-$7/mo. | Partner syncing capabilities |

| PocketSmith | $9.95-$19.95/mo. | Cashflow forecasting feature |

| PocketGuard | $4.99/mo.-$34.99/yr. | Cost-effective zero-based plan |

Methodology

When we researched the best alternatives to YNAB, we looked at the following:

Pricing – We only included budgeting apps and services that were similar in pricing. We did include some free options with similar features to YNAB.

Functionality – We included apps and services that had similar budgeting functionality. Some apps may work differently, but all have budgeting at their core.

Customer reviews – We reviewed countless customer reviews of these products to ensure that they are legit and that people enjoy using them.

Summary

Using a budgeting program like the one we’ve mentioned here is important. It helps you avoid common budgeting mistakes that can impact your finances long-term.

As you can see, there are several YNAB alternatives if you find YNAB isn’t working for you. Depending on your needs, one of the budgeting programs here will be a better solution.

Actually, Ynab is not only available in USA, but everywhere.

I’m from Brazil and I’ve been using it for the last 3 years.

Hi, would it be possible for you to share some thoughts on money management tools that can actually be used outside the USA and Canada? I find some of the apps are only suitable for the American market, but not the rest of the world.

A large portion of our audience is in the USA and Canada. Of course, I recognize that not everyone is. Some other good ideas that might help are to seek out friends who do well budgeting and get their advice. You can also go to a library and look up books about budgeting or try the free tools available on our site as well as others. You can also search the internet for apps that are available where you live. I hope at least one of these ideas helps you out. Don’t give up on budgeting! 🙂